There comes a time when it’s too late to tell people how you feel.

There will come a day when the person you mean to talk to won’t be there. Don’t wait for that day.

“There’s always tomorrow” isn’t always true.

The no-pants guide to spending, saving, and thriving in the real world.

How much would you pay for a kiss from the world’s sexiest celebrity?

That was the focus of a recent study that I can’t find today. There is no celebrity waiting in the wings to deliver the drool, and the study doesn’t name which celebrity it is. That’s an exercise for the reader.

This was a study into how we value nice things.

The fascinating part of the study is that people would be willing to pay more to get the kiss in 3 days than they would to get the tongue slipped immediately.

Anticipation adds value.

Instant gratification actually causes us to devalue the object of our desire.

This goes well beyond “Will you respect me in the morning?”

The last time I talked about delayed gratification, it was in the context of my kids. That still holds true. Kids don’t value the things that are handed to them.

The surprising–and disturbing–bit is that adults don’t, either. If I run out to the store to buy an iPad the first day I see one, I won’t care about it nearly as much as if I spend a week or two agonizing over the decision.

The delay alone adds to the perceived value. The agony turns the perceived value into gold.

If I spend a month searching for the perfect car, the thrill of the successful hunt adds less value than the time it took to do the hunting.

Here’s my frugal tip for today: Delay your purchases. While it may not actually save you any money, you will feel like you got a much better deal if you wait a few days for something you really want.

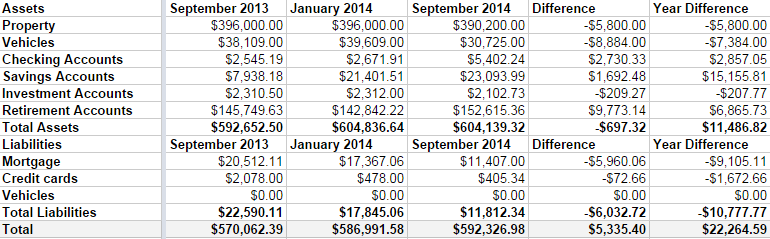

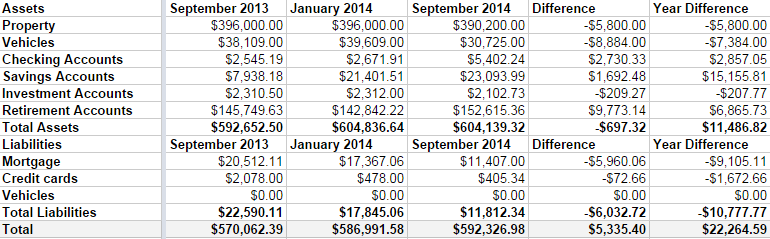

It’s time for my irregular-but-usually-quarterly net worth update. It’s boring, but I like to keep track of how we’re doing. Frankly, I was a bit worried when I started this because we’ve been overspending this summer and Linda was off work for the season.

But, all in all, we didn’t do too bad.

Some highlights:

I can’t say I’m upset with our progress. We’ve paid down $6000 in debt in 2014, including 3 months with 1 income. We aren’t maxing our retirement accounts, yet, but I’d like to be completely debt free before I do that. It’s bad math, but having all of my debt gone will give me such a warm fuzzy feeling, I can’t not do it.

My immediate goal is to hit a $600,000 net worth by my next update in January. I’m only about $7000 off.

Time to hit the casino. Err, I mean, time to up my 401k contribution from 5% to 7%.

In an effort to make sure that both of my readers can’t possibly miss the things I think are important, I’m going to start doing a weekly roundup of the best of the internet. Judged solely, and arbitrarily, by me.

On topic:

These, naturally, are the posts that fit the theme of this site.

How To Check Your Federal IRS Tax Refund Status. When I checked a couple of days ago, they were about 2 weeks out.

TurboTax has screwed up the property tax refund form for Minnesota. Thankfully, I haven’t filed this, yet, but I did verify the problem.

Where do you want to be in 5 years? Start taking those steps, now, or you will never get there. Find something, no matter how small, and do it.

Deficit Neutrality doesn’t count, if a massive initial purchase is offset by future intentions to cut spending.

Off topic:

This is just some of the random crap I think is worth sharing.

If you’re going to argue on the internet, make sure you have your sources right. Primary sources are better than secondary.

Bring back dueling to ensure good manners.

Here’s a guide to saving water-damaged books.

I am a shameless geek and reformed DnD player, so this room was exciting to see.