If you don’t know why you are hear, please read about the 21 Day Happiness Training Challenge.

Why I chose a prepaid credit card

This is a guest post.

You can’t get credit without a credit card, and you can’t get a credit card without good credit. This is a dilemma that many people find themselves facing, whether they are trying to re-establish their credit or build credit for the first time. In fact, this is the dilemma that I found myself in. My solution was to get a prepaid card, and here’s why.

The Real Deal with Prepaid

Prepaid credit cards have earned a mixed reputation over the years. While it’s true that they usually have more fees than a regular credit card, they also offer a financial solution for people who don’t have good credit. And you should also keep in mind that they don’t charge interest because the cash that you are using is yours to begin with. The important thing to remember about prepaid cards is that they are a means to an end; once you rebuild your credit, you’ll find it much easier to apply for a card with better rates and fewer fees.

In addition, prepaid cards offer several advantages. The most important one for me was the convenience of having a card that I could use to make purchases. Prepaid cards look and work exactly like regular credit cards (you don’t have to enter a personal identification number to use them), so the only one who knows it is prepaid is me. And while I use cash for everyday purchases, there’s no avoiding the need for a card when you have to shop online or pay for gasoline at the pump, for example. Most digital merchants only accept payments from cards linked to large financial brands like Mastercard and Visa, and my card gives me a way to buy what I need from whoever has it in stock. In addition, my prepaid card offers me a way to keep track of all of my purchases electronically, which is helpful since I am trying to keep a closer eye on my budget.

Prepaid cards also offer security. Cash can easily be lost or stolen, but if you lose a prepaid card, you can easily get a replacement. More importantly, your balance is protected by a replacement guarantee from your bank, which comes in handy if you ever have to dispute fraudulent charges.

Perhaps the most convenient factor of a prepaid card, though, is how easy it is to get one. You don’t have to have a bank account in your name to receive a prepaid card. However, if you do have an account, you can easily link it to your prepaid card.

Changing my spending habits and getting out of debt hasn’t been easy for me, but one way for me to show creditors that I am getting better at managing finances is to build my credit with my prepaid card. It’s also a way for me to eventually be able to make big purchases that are necessary, such as a car, and hopefully one day, a home. Prepaid isn’t for everyone, but if you find yourself considering this option, it’s worth a second look.

Garage & Yard Sale Manual

After months of research and planning I recently had a successful garage. Here’s my how-to yard sale manual.

Step 1: Preparation. You can never be too prepared. I detail advertising, setup, planning and more.

Step 1.5: Marketing. Here is the text of the ads I placed.

Step 2: Management. Pricing, haggling, staffing, and other “Day Of” issues.

Step 3: Wrap-up. It’s done. What now?

Finally, we’ve got a Page of Tips. This is sure to grow over time.

Budget, updates, and the future

I have recently reworked our budget, including a new spreadsheet, sorted by categories. It’s a Google Doc template available here. I will dive into each section in detail in coming weeks.

My wife and I had a long conversation about what has worked and what has failed miserably regarding our debt and repayment plan. The results of that conversation will be the subject of a few posts over the next couple of weeks.

Our destination hasn’t changed. Our map hasn’t changed. We are making some changes to the route we take, to allow better for our strengths and weaknesses, both as a couple and as individuals.

Dolly Parton’s Car Crash and the Importance of Insurance

America’s country sweetheart, Dolly Parton, was in a car accident recently. Although she was only a passenger in this minor fender-bender, she still suffered some injuries requiring a quick hospital visit and rest. The offending driver did not stop as he was supposed to and struck Parton’s vehicle. Parton surely has auto insurance, and hopefully the offending driver has coverage as well.

Every month, you pay a premium toward your coverage balance. Coverage varies by state, from hospital bills to repairing damaged street items, like guard rails. People with expensive cars pay higher premiums while inexpensive cars have lower amounts. Some buyers only purchase the bare minimum of coverage, called comprehensive. This coverage does not help in the Parton crash because it typically covers vehicle damage from objects, like flying rocks, rather than a collision situation.

How Much Does That Part Cost?

Repairing a vehicle after a car crash can lead to astronomical figures. A simple dent in the bumper may warrant an entire part replacement costing thousands of dollars. The offending driver in Parton’s accident is at fault. His insurance should cover Parton’s insurance deductible and any other expenses that arise. If he is not covered, she could technically sue him for damages, although there may not be many funds to pay out.

Those Medical Bills

Coupled with a car repair, Parton and her driver also went to the hospital. The offending driver uses his auto insurance to cover their medical bills. Any bills generated from the driver or passenger’s injuries goes directly to the offending driver’s insurance. If he is not properly covered with this policy feature, he must pay for the bills out-of-pocket. With medical bills costing thousand of dollars, he probably called his insurance agent right away to see if his policy has that coverage.

Luckily, Parton’s accident was not severe, but ongoing injuries can slowly siphon funds out of the offending driver’s account. If Parton has whiplash, for example, she may need multiple visits to a chiropractor or other specialty doctor. Each visit should be covered by the offending driver’s insurance. Because she has good insurance coverage does not mean that her policy should pay out. The party at-fault always pays for both car repairs and medical bills. With treatment that takes several weeks to a few months, the offending driver’s insurance rates will typically jump next policy year.

Someone Has To Pay For It

Depending on the insurance company, an accident on your record causes your premiums to rise. You are now considered a risk to the company. It is possible that you will cause another accident incurring more cost. Insurance companies must weigh their risky customers with their good drivers. Hopefully Parton recuperates quickly so the offending driver’s rates do not remain high for several years.

You may not think of auto insurance as a top priority, but the reality of Parton’s fender-bender shows everyone that accidents happen at any time. Even celebrities must cover their vehicles with good insurance to protect their assets.

What is a Mechanic’s Lien?

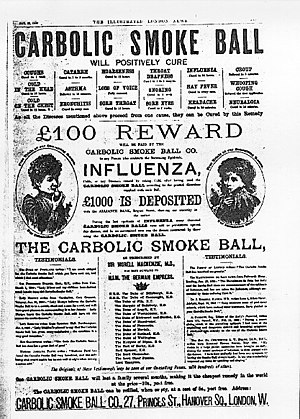

- Image via Wikipedia

When you hire someone to work on your property or provide material to build or improve it, they are entitled to get paid. A mechanic’s lien is the method of enforcing that payment.

Here is what you need to know about mechanic’s liens.

A contractor must usually give you written notice of intent to file a lien if the contract isn’t paid. He needs to do this within a short time of beginning the work. The notice will include text to the effect that subcontractors also have the right to file a lien if they are not paid. This notice gives you two methods of defense: You can pay the subcontractors directly and withhold that amount from the payment to the contractor, or you can withhold the final payment until you have received a lien waiver from each of the subcontractors.

If the notice isn’t given correctly, the contractor forfeits his right to file a lien. Also, in most places, if a contractor is supposed to be licensed to do the work, but isn’t, he’s not able to file a lien.

Subcontractors must also provide notice on intent within about 45 days–depending on the state–of the time they first provide services or material, or the lien is not enforceable.

Protecting Yourself

First, you only have to pay once. If you pay the contractor in full before getting the notice of intent from the subcontractors, you can’t be forced to pay again.

Next, make the contractor provide a list of all subcontractors and keep track of any notices of intent you get. Get lien waivers from everyone involved before you make the final payment to the contractor.

Finally, you have the rights defined in the notice of intent to file a lien. You can either pay the subcontractors directly, or you can withhold the final payment until you receive lien waivers from each subcontractor.

Resolution

The lien holder has 120 days to file the lien and 1 year to enforce it. Enforcing simply means that it a suit has been filed. Once that happens, you can either pay the contractor, attempt to settle with the contractor, or you can take the contractor to court to determine the “adverse claims” on your property. There aren’t too many choices at this point.

Do yourself a favor and get lien waivers before you make the final payment on any work done on your property.