- RT @ramseyshow: RT @E_C_S_T_E_R_I_: "Stupid has a gravitational pull." -D Ramsey as heard n NPR. I know many who have not escaped its orbit. #

- @BudgetsAreSexy KISS is playing the MINUTE state fair in August. in reply to BudgetsAreSexy #

- 3 year old is "reading" to her sister: Goldilocks, complete with the voices I use. #

- RT @marcandangel: 40 Useful Sites To Learn New Skills http://bit.ly/b1tseW #

- Babies bounce! https://liverealnow.net/hKmc #

- While trying to pay for dinner recently, I was asked if other businesses accepted my $2 bills. #

- Lol RT @zappos: Art. on front page of USA Today is titled "Twitter Power". I diligently read the first 140 characters. http://bit.ly/9csCIG #

- Sweet! I am the number 1 hit on Ask.com for "I hate birthday parties" #

- RT @FinEngr: Money Hackers Carnival #117 Wedding & Marriage Edition http://bit.ly/cTO4FU #

- Nobody, but nobody walks sexy wearing flipflops. #

- @MonroeOnABudget Sandals are ok. Flipflops ruin a good sway. 🙂 in reply to MonroeOnABudget #

- RT @untemplater: RT @zappos: "Do one thing every day that scares you." -Eleanor Roosevelt #

My Net Worth

While I find it fascinating to read about other people’s net worth, I’ve never bothered to figure out my own. With the start of the new year, I thought it would be fun to do. This is me, upping my personal transparency bar.

Assets

- House: $255,400. Estimated market value according to the county tax assessor.

- Cars: $23,445. Kelly Blue Book suggested retail value for both of our vehicles and my motorcycle.

- Checking accounts: $2,974. I have accounts spread across three banks.

- Savings accounts: $4,779. I have savings accounts spread across a few banks. This does not include my kids’ accounts, even though they are in my name. This includes every savings goal I have at the moment.

- CDs: $1,095. I consider this a part of my emergency fund.

- IRAs: $11,172 (Do you know your IRA contribution limits? Do you have a Roth IRA?)

- Total: $298,865

Liabilities

- Mortgage: $33,978

- Car loan: $1,226. This will be paid off this month.

- Credit card: $23,524. This is the next target of my debt snowball.

- Total: $58,728

Overall: $240,137

Update: I wrote and scheduled this before I paid off my car loan.

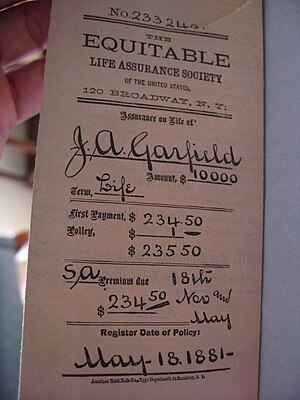

A Problem With Life Insurance

It’s pretty common for someone to buy a life insurance policy and make a minor child or grandchild the beneficiary.

Bad idea.

The reasoning is usually something along the lines of making sure the money goes with the kid, no matter where he ends up, but that money is mostly worthless until the kids grows up. With the UGMA/UTMA (Universal Gift/Transfer to Minors Act) laws, depending on your state, it can be nearly impossible to access that money or use it for the support of the child.

- For example, in Minnesota, I would have to go through the following steps:

- Complete a Petition for Appointment of Guardian and Conservator with a $322 filing fee and request it be reviewed without a hearing.

- Notify any interested parties.

- Consent to and pay for a background study.

- Establish a custodial account at the bank and maintain separate accounting for the money.

That’s just to access the money. As a conservator, I’d be able to use the money for “support, maintenance, and education”, but that does not include investing in a 529 college fund. I could theoretically invest in ultra-conservative growth funds, but if the investments shrink, I could be on the hook for the difference. I’d be a “conservator”, charged with conserving the asset.

After all of that, when the kid turns 18 (or 21 depending on the setup), the money is his to do with as he pleases.

Have you ever met an 18 year old who made really good decisions about money? I had a friend who had a settlement trust pay her a lump sum at 18, 21, and 25. Each time, she bought a new car and partied with her friends for a month before the money was gone. That was nearly $100,000 down the drain.

It’s a much better idea to visit an attorney and set up a trust. Make the trust the beneficiary of your life insurance policies. Then, define who will be the trustee under what circumstances. That way, you can make sure your kids and grandkids can actually be supported by your money.

WWE: Money in the Bank, or all Hype?

Most people will never realize what it’s like to lose $350 million in a single day, but if you’re Vince McMahon you know the feeling all too well. However, before you start collecting money to give to the WWE CEO, let’s remember that despite that setback he’s still worth a cool $750 million. So while he got knocked out of the billionaire’s club, he’s still a full-fledged member of the multi-millionaire’s club.

However, despite the rough financial spot in the road, don’t think the WWE is ready to tap out anytime soon. The WWE Network, an on-demand streaming service launched by the company earlier this year, is already approaching one million subscribers. Despite what will probably be an initial loss of $50 million for the fledgling network, McMahon and other WWE executives believe the network will eventually become a money-maker for the company.

So while Triple H, the Rock and John Cena have helped make the WWE what it is today, there are many other superstars who are helping take the company to even greater heights. In recent years, perhaps none are more well-known and liked than the company’s Divas. Whoever said sex sells sure knew what they were talking about, because it seems the wrestling fans simply can’t get enough of the beauties who fight it out every week for glory and gold. With the show Total Divas on the E! Network for the next several years, fans will continue to get their weekly dose of the ring beauties there as well as on the other shows in the WWE camp.

So while it’s not money in the bank that all of the company’s ventures will pan out as hoped, it’s a good bet Mr. McMahon and those associated with the WWE will continue to figure out what fans are wanting and deliver it to them on a regular basis. And whether or not you are a wrestling fan, you’ve got to admit the WWE is a captivating experience in sports entertainment that keeps fans coming back for more each and every week.

Related articles

Playing For Blood

Kris at Every Tips and Thoughts wrote a post about games and letting her kids win feeling bad about winning. I disagree. This post is an expansion of my comment there.

When we play games in my house, we play for blood. I’ve never let my kids win and they know it. From the first time the kids attempt Memory, they know they’ve got to earn a win against Mom and Dad. They know if they lose, they must do so gracefully. If they pout or cry, they lose game privileges for a while. I demand good sportsmanship, win or lose.

To be clear, my kids are 3, 4, and 11 and they are all held to the same standards of sportsmanship. Win or lose, they will do so gracefully. There will be no temper tantrums when they are Sorry’d and no pouting when the Queen is captured.

It took my son almost 3 years to beat me at chess. When it finally happened, he was almost as proud as I was and still talks about it 5 years later.

It’s not much fun playing games with his friends. They were coddled and expect to win everything. I have to take away game privileges just like I do for my 3 year old. They hate that because we have the coolest board games. Nobody else has games that involve zombies or disembodied brains.

What has the result been?

My kids love playing games. This week, my oldest has been teaching his sisters how to play Life. When he visits his friends, he’s as likely to bring a board game as an electronic game. He’s got a good mind for strategy, and I can’t remember the last time he pouted when I tromped him.

My 4 year old hasn’t mastered gamesmanship yet, but she will. When I threaten to put the game away, she wipes her eyes, and keeps playing, even if her jaw is chattering. She knows what is expected and works to live up to it.

Both of the older kids are competitive. They’ve never had a win handed to them, and they have each had wins they had to work for, and they know how it feels to win and earn it.

The youngest doesn’t care if she wins, she’s just happy to play. In my experience, the competitive gameplay gene doesn’t activate until 4.

In my mind, the real world won’t hand them any wins, so I might as well start teaching them how to work for it now.

How about you? Do you let your kids win, or do you teach them that all games are bloodsports?

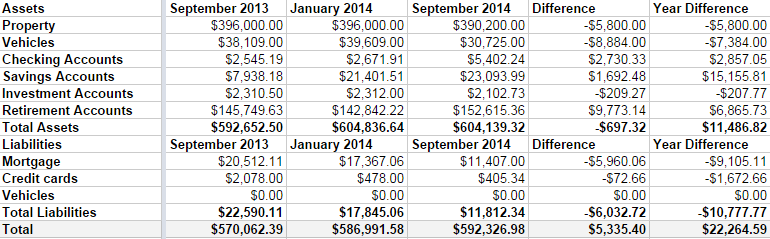

Net Worth Update – September 2014

It’s time for my irregular-but-usually-quarterly net worth update. It’s boring, but I like to keep track of how we’re doing. Frankly, I was a bit worried when I started this because we’ve been overspending this summer and Linda was off work for the season.

But, all in all, we didn’t do too bad.

Some highlights:

- Both of our properties lost around $3000 in value. I’m not worried, because we are keeping them both for the long haul. The rental is basically on auto-pilot, so that’s free money every month.

- We sold a boat that appraised for much less I had estimated in the last few updates. I had it listed for $5000, but it was worth $2000.

- I do have a credit card balance at the moment, but that goes away as soon as my expense check clears the bank, which will be in a day or two.

- We’re in the home stretch with the mortgage. There is $11,407 left to go, and we’ve paid down $9105 in the last year. By this time next year, I want that gone, gone, gone.

I can’t say I’m upset with our progress. We’ve paid down $6000 in debt in 2014, including 3 months with 1 income. We aren’t maxing our retirement accounts, yet, but I’d like to be completely debt free before I do that. It’s bad math, but having all of my debt gone will give me such a warm fuzzy feeling, I can’t not do it.

My immediate goal is to hit a $600,000 net worth by my next update in January. I’m only about $7000 off.

Time to hit the casino. Err, I mean, time to up my 401k contribution from 5% to 7%.