Am I the only one who just noticed that it’s Wednesday? The holiday week with the free day is completely screwing me up.

Just to make this a relevant post:

Spend less!

Save more!

Invest!

Wee!

The no-pants guide to spending, saving, and thriving in the real world.

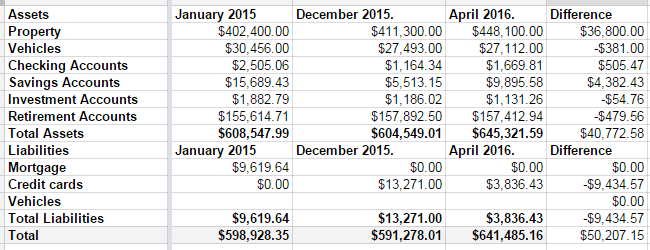

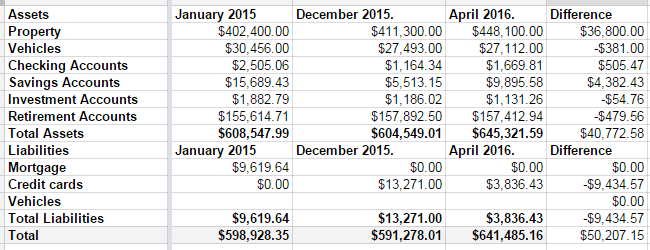

Last year wasn’t a good year for my net worth. It came with a $7000 drop.

Q1 2016, however, was a great quarter.

In December, we had $13,271 in credit card debt. At the time I took this screenshot, it was down to $3836.43. As of this moment, it’s down to $2640.91. If things go as expected this week, I should wake up on Friday to a paid-off credit card. I had to raid some of our savings accounts to make it happen, but it’s happening. Some of it was a tax refund, some of it was the fact that my mortgage payment went away in December.

That’s seven years of hard work, almost to the day. Seven years ago, I was researching bankruptcy, and stumbled across Dave Ramsey. Seven years ago, we were drowning in debt.

Next week, we’re free. No more debt, hanging over our heads. We’re free to take vacations. We’re free to finally save for college, when my son is 16, and stand a chance of being able to pay for it for him. We’re free to do…whatever we want to do. Our monthly nut after the debt is paid–only in fall/winter/spring when my wife is working–is roughly 1/3 of our take-home pay.

That’s how hard we’ve cut to make sure we can pay our bills and make debt die. We do have some things that would be considered extravagant. We’re not savages. But my car is 10 years old. My wife’s is 7. My motorcycles are 35 and 30; one of them was purchased before we cared about our debt.

Back to the net worth….

The biggest change came from our property values, which sucks. That was $36,000 of the difference, which comes with the painful tax bump to go with it. A large chunk of the savings increase was the money we set aside every month to cover the property tax bill, and that will go away next month.

Still, $641,000 dollars is a long way from nothing. I’m pretty happy.

In an effort to promote the crap out of the Yakezie Beta Chapter, I’ve created a search specific to us. This will make it easy to find Beta Challengers to promote.

The current list in the search is:

Live Real, Now

http://www.YourSmartMoneyMoves.com

http://meinmillions.blogspot.com/

http://www.rentingoutrooms.com

http://www.yesiamcheap.com

http://SimpleVesting.com

http://untildebtdouspart.blogspot.com/

http://www.blondeandbalanced.com

http://jamesfowlkes.com/

http://www.mightybargainhunter.com

http://www.beatingtheindex.com

http://www.thepassiveincomeearner.com

http://www.prairieecothrifter.com

http://sustainablepersonalfinance.com/

http://www.toddswanderings.com

More will be added as I have time to dig through the forums. If you’re a Beta Challenger and don’t see your name, leave a comment below and I’ll get you added ASAP.

Today, I discovered our AOL billing information. Turns out we’ve been paying for dial-up via automatic bill paying that we thought we cancelled in 2000. $1,800 later, we called to cancel. Customer service congratulated us on being loyal members for over 13 years. FML -Jay

I am a huge fan of automating my finances. My paycheck is direct-deposited. My savings are automatically transferred from my checking account to my savings account. Almost every bill I receive regularly is set up as an automatic payment in my bank’s bill-pay system. I even have my debt snowball automated.

The only question left is whether it’s possible to automate too far. Can you automate past the point of benefit, straight into detriment? The primary benefit of automation is knowing that you can’t forget a payment. The other benefit is freeing up your attention. You don’t have to give any focus to paying your bills, freeing you to worry about other things.

The problem with the second benefit is the same as the benefit. If you don’t give your bills any attention, how do you know if there is a problem? If something changes–an extra fee or a mis-keyed payment–you won’t notice because you haven’t been giving the bills any focus.

Sometimes, this means you are paying an extra fee without noticing it. Sometimes, if your due date changes, it can mean late fees. Even if nothing goes wrong, you are missing the opportunity to review what you are paying to ensure your needs are being met as efficiently as possible.

What can you do about it? I put a reminder on my Life Calendar to check my bills each month. I pick one bill each month and try to find a way to save money on it. I review the services to make sure they are what I need and if that doesn’t help, I call and ask for a lower price. If it’s a credit card, I ask for a lower interest rate. For the cable company, I ask if they will match whatever deal they have for new customers.

Every company can do something to keep a loyal customer happy. All you have to do is ask.

Do you automate anything? How do you keep track of it all?

What’s the difference between a bribe and a reward? It’s a question that has been heavily on my mind lately. As a father of three–1, 3 and 10–motivating children occupies a lot of my thoughts. Is it possible to motivate a child and reward good behavior without resorting to a bribe?

First, let’s look at the definitions:

bribe n.

1. Something, such as money or a favor, offered or given to a person in a position of trust to influence that person’s views or conduct.

2. Something serving to influence or persuade.

re·ward n.

1. Something given or received in recompense for worthy behavior or in retribution for evil acts.

2. Money offered or given for some special service, such as the return of a lost article or the capture of a criminal.

3. A satisfying return or result; profit.

4. Psychology: The return for performance of a desired behavior; positive reinforcement.

In my mind, a reward is given either as a goal for planned activity or a surprise for good behavior. When used for surprises, it should never be common enough to be expected. If a child is only behaving because she is expecting a reward, it is bribed behavior. She should always be surprised to get the reward.

Using a reward for goal setting is no different than collecting a paycheck. Is my company bribing me to do the work I do every day? They plan to reward or compensate me for the work I plan to do for them. While that my be blurring the line between compensation and rewards, it is valid. My future paycheck is the motivation for my current work.

Bribes, on the other hand, are reward for bad behavior. If my three-year-old is throwing a tantrum in the grocery store and I promise her candy to stop, I have just taught her that the “reward” for a public tantrum is candy. This is reinforcing negative behavior, which will only escalate in the future. If a temper tantrum earns a candy bar, what will she get for hitting Mommy with a frying pan?

The line is further blurred by preemptive bribes. If I tell my children there will be candy when we get home if they behave in the store, it’s still a bribe. Promising dessert if my son cleans his room is a bribe.

So what is the difference?

Bribes reward negative behavior. Whether that is actual behavior or anticipated behavior, bribes provide a reward for it. If you use a treat to end or preempt bad actions, you are bribing your child.

Rewards celebrate positive behavior. A promised treat for going beyond expectations or a surprise for excellent behavior is a reward. It should never become common, or the child will discover that withholding the positive behavior will generate promises of larger rewards. The goal is to reinforce the good to encourage positive behaviors even when there is no likelihood for reward.

For example, my son’s school is part of a reading contest. Over a two month period, if the students read 500 pages outside of school, they will get tickets to a basketball game. If they are in the top three for pages read, they will get personalize jerseys and on-court recognition. My son did the math and was reading enough to surpass the 500 page goal, but not enough to get into the top three. I offered a prize if he made it to 2500 pages. In my opinion, that’s a reward. He was already going beyond the requirement. I have provided motivation to push himself beyond what he thinks he can do. That’s positive reinforcement of good behavior.

On the other hand, when my eight-year-old was refusing to eat dinner, we offered a cookie for dessert if she ate well. That’s reinforcing negative behavior by giving a reward for misbehaving. A bribe.

Rewards are positive responses to positive behavior to motivate future good behavior. Bribes are rewards for negative behavior, real or anticipated, that only serve to encourage more bad behavior in the future.