Please email me at:

Or use the form below.

[contact-form 1 “Contact form 1”]

The no-pants guide to spending, saving, and thriving in the real world.

Today, I am continuing the series, Money Problems: 30 Days to Perfect Finances. The series will consist of 30 things you can do in one setting to perfect your finances. It’s not a system to magically make your debt disappear. Instead, it is a path to understanding where you are, where you want to be, and–most importantly–how to bridge the gap.

I’m not running the series in 30 consecutive days. That’s not my schedule. Also, I think that talking about the same thing for 30 days straight will bore both of us. Instead, it will run roughly once a week. To make sure you don’t miss a post, please take a moment to subscribe, either by email or rss.

On this, Day 7, we’re going to talk about paying off debt.

Until you pay off your debts, you are living with an anchor around your neck, keeping you from doing the things you love. Take a look at the amount you are paying to your debt-holders each month. How could you better use that money, now? A vacation, private school for your kids, a reliable car?

If you’ve got a ton of debt, the real cost is in missed opportunities. For example, with my son’s vision therapy being poorly covered by our insurance plan, we are planning a much smaller vacation this summer–a “staycation”–instead of a trip to the Black Hills. If we didn’t have a debt payment to worry about, we’d have a much larger savings and would have been able to absorb the cost without canceling other plans. The way it is, our poor planning and reliance on debt over the last 10 years have cost us the opportunity to go somewhere new.

The only way to regain the ability to take advantage of future opportunities is to get out of debt, which tends to be an intimidating thought. When we started on our journey out of debt, we were buried 6 figures deep, with a credit card balance that matched our mortgage. It looked like an impossible obstacle, but we’ve been making it happen. The secret is to make a plan and stick with it. Pick some kind of plan, and follow it until you are done. Don’t give up and don’t get discouraged.

What kind of plan should you pick? That’s a personal choice. What motivates you? Do you want to see quick progress or do you like seeing the effects of efficient, long-term planning? These are the most common options:

Popularized by Dave Ramsey, this is the plan with the greatest emotional effect. It’s bad math, but that doesn’t matter, if the people using it are motivated to keep at it long enough to get out of debt.

To prepare your debt snowball, take all of your debts–no matter how small–and arrange them in order of balance. Ignore the interest rate. You’re going to pay the minimum payment on each of your debts, except for the smallest balance. That one will get every spare cent you can throw at it. When the smallest debt is paid off, that payment and every spare cent you were throwing at it(your “snowball”) will go to the next smallest debt. As the smallest debts are paid off, your snowball will grow and each subsequent debt will be paid off faster that you will initially think possible. You will build up a momentum that will shrink your debts quickly.

This is the plan I am using.

A debt avalanche is the most efficient repayment plan. It is the plan that will, in the long-term, involve paying the least amount of interest. It’s a good thing. The downside is that it may not come with the “easy wins” that you get with the debt snowball. It is the best math; you’ll get out of debt fastest using this plan, but it’s not the most emotionally motivating.

To set this one up, you’ll take all of your bills–again–and line them up, but this time, you’ll do it strictly by interest rate. You’re going to make every minimum payment, then you’ll focus on paying the bill with the highest interest rate, first, with every available penny.

This is the plan promoted by David Bach. It stands for Done On Last Payment. With this plan, you’ll pay the minimum payment on each debt, except for bill that is scheduled to be paid off first. You calculate this by dividing the balance of each debt by the minimum payment. This gives you an estimate of the number of months it will take to pay off each debt.

This system is less efficient than the debt avalanche–by strict math–but is better than the snowball. It give you “quick wins” faster than the snowball, but will cost a bit more than the avalanche. It’s a compromise between the two, blending the emotional satisfaction of the snowball with the better math of the avalanche.

For each of these plans, you can give them a little steroid injection by snowflaking. Snowflaking is the art of making some extra cash, and throwing it straight at your debt. If you hold a yard sale, use the proceeds to make an extra debt payment. Sell some movies at the pawn shop? Make an extra car payment. Every little payment you make means fewer dollars wasted on interest.

Paying interest means you are paying for everything you buy…again. Do whatever it takes to make debt go away, and you will find yourself able to take advantage of more opportunities and spend more time doing the things you want to do. Life will be less stressful and rainbows will follow you through your day. Unicorns will guard your home and leprechauns will chase away evil-doers. The sun will always shine and stoplights will never show red. Getting out of debt is powerful stuff.

Your task today is to pick a debt plan, and get on it. Whichever plan works best for you is the right one. Organize your bills, pick one to focus on, and go to it.

Assuming you are in debt, how are you paying it off?

It’s that time of the year when people make public promises to themselves that last almost as long as the hangover most of them are going to earn tonight, otherwise known as New Year’s Resolutions.

Not a fan.

I am, however a fan of planning out some concrete goals and doing my best to meet them. I do this through a series of 30 day projects. I set a goal that can be reached in 30 days, and push for it. I tend to make my goals fairly aggressive, and I tend to meet them.

Here were my goals and results for 2010:

So I missed 4 months of projects. This year, I’m going to modify my overall plan and only do 6 projects, every other month. That will give me a month off to either relax or incorporate the goal into my ongoing habits without any stress.

Here are my goals:

That’s my plan for the new year. Six specific goals, each lasting 30 days. I could definitely use some help for September and November. Please give me some suggestions in the comments.

You should never be in the company of anyone with whom you would not want to die.

-Duncan Idaho, from God-Emperor of Dune

Some people suck the life out of everyone they encounter. Whether it be through lies, unreasonable demands, emotional abuse or manipulation, or just a vile personalty, the people they meet are worse off for the encounter. The people they interact with every day are screwed.

My time is too precious to waste any of it unnecessarily on people who remove value from it. I like being with people who enrich my life, instead.

Unfortunately, since I’m not an advocate for the use of hitmen, not every toxic person is easy to eliminate from your life.

Toxic people come in 3 basic varieties: professional, personal, and family. There is some overlap between the categories.

The personal category is easiest to deal with. These people aren’t relatives or coworkers, so you won’t see them at family gatherings or at work. I’ve dealt with these people in two ways.

First, there is the direct approach. One former friend, who was really only a friend when it was convenient for him(a pure leech), got told that he wasn’t invited to one of our parties because I was inviting his ex-wife, instead. That was the last time he called me.

The second option is far more passive. I set up a contact group in my phone called “Life’s too short”. At first, I set it up with a fairly insulting ring tone, but I later switched it to no ring at all. I don’t know they’ve called until I check my voicemail. It’s far less direct, but also far easier than the direct approach.

Dealing with the toxic people in your family is more complicated. You’ll see them at holiday gatherings, or hear about them during unrelated visits. You probably have a lot of memories growing up with them, and may feel some level of obligation–deserved or not–to maintain contact. It’s hard to break a tie that you’ve had your entire life.

Can you fix their behavior? It’s worth trying to have a frank discussion about how they are treating you, or the things they are doing. If the problem is that they are constantly bringing over their methhead boyfriends, banning the drug addicts from your home, while still welcoming the relative may be an acceptable fix. If the problem is a constant need to belittle you, demanding they stop may work. If the problem is a lifetime of emotional abuse, it probably isn’t fixable.

Is banishment an option? Can you put that creepy cousin on the Life’s Too Short list? You’ll still have to deal with him at family gatherings, but you can always leave the room when he comes in, right? Don’t engage, don’t participate in any conversation beyond a polite greeting, and don’t offer any encouragement towards regular contact.

It’s possible that it won’t be possible to fix their behavior and that you won’t want to banish the offender. If, for example, the offender is your mother (Not you, Mom!), you may feel a sense of obligation to maintain contact, or even be a primary caregiver at times. This is a line nobody else can draw for you. At some point, the current bad behavior could overwhelm the past obligations. When that happens are you prepared for it? That can be a traumatic break.

The other option, as cold as it sounds, is to wait it out. Nature will take its course, eventually. Can you wait that long, while maintaining your sanity and emotional equilibrium?

Professional toxic people include customers, vendors, and coworkers, none of whom are easy to get rid of.

If you own the business, you can fire your problem customers if the hassle outweighs the benefits you get from the relationship. You can find a new vendor, and you can fire the problem employees.

What happens if you are an employee?

If the problem is your boss, your options are to suck it up, talk to his boss, or find a new job. If the first is intolerable, and the second is impossible, it’s time to polish your resume.

If the problem is a vendor, you’ve got some options. Document the problems, first. Does he make inappropriate jokes, or badmouth you to your customers? Then, research the alternatives. Does one of his competitors offer an equivalent product or service? Take the documentation and research to your boss, or whoever makes that decision, and see if you can get your company to make the switch. The other option, is to request someone new to deal with at the vendor’s company, but that may not always be possible.

Finally, we come to the problem of toxic coworkers.

Some coworkers have the same problems as a toxic boss. Is the company vice-president the boss’s baby brother? You’re probably not going to find a win there. You’ll have to suck it up or move on.

Is the problem person working in an unrelated department doing unrelated tasks? It may be possible to start taking breaks at different times and leave him where he belongs: in the past.

Is the difficult individual sharing an office with you, demanding everything be done his way, and throwing daily tantrums? This is the one that has to be dealt with. He’s the one sucking the life out of you every single day.

First, start making use of a voice recorder. If you’ve got a smartphone, you’ve probably already got one. Otherwise, drop the $20 to buy one. This lets you document the evil. When his behavior goes hinky, record it.

Second, stand up for yourself. If he’s making unreasonable demands, tell him it’s inappropriate. He’s a bully, and bullies tend to back down when they are confronted.

Third, make sure the boss knows about the behavior. Yes, this is tattling. Get over it. If he wasn’t acting like he was a spoiled 4 year old, you wouldn’t have to tell the boss that he was. If the boss doesn’t know there’s a problem, he can’t deal with it.

Fourth, for any problem that isn’t directly aimed at you, ignore it. If he makes a habit of throwing a tantrum because somebody emptied the coffee pot, or because the company switched health plans, let him. Only get in the way if it’s directed at you. Over time, the tantrums will get more noticeable and out of hand, forcing the boss to deal with it, preferably by handing him a pink slip.

Your goal is documentation, awareness, and avoidance. Make the worst of it go elsewhere so you can be as productive as possible, document what you can, and let the boss become aware of the situation and how bad it has become. And be patient. This isn’t an overnight fix.

How do you deal with the toxic people in your life?

Welcome to the Totally Money Carnival #5, the Superbowl Edition. It’s my privilege to be the first outside host for this carnival.

I don’t watch the Superbowl. I’ve never been into spectator sports unless I have some skin in the game. If I’m playing, or have some money riding on the outcome, I’m watching. Other than that, I’ll usually pass. Yesterday, a bunch of grown men in tights earning envy-inducing amounts of money ran around for a few hours in front of people, some of whom paid 5 figures for the privilege of watching. Yay!

http://www.youtube.com/watch?v=hpjaOUjUPUc

Mike Piper presents Protecting Your Private Files posted at Oblivious Investor, “How can you keep your sensitive documents (scanned tax returns, for instance) both backed up and protected in the event of computer theft?” Ed. I love this solution, and I use it. All of my tax returns, online receipts, and documents I don’t want to lose get treated this way.

Suzanne K. presents The Psychology of Why You Can’t Budget—And Five Tips to Help You Do It posted at PsychologyDegree.net. Ed. I’ve always been a fan of trying to understand what makes people tick.

Silicon Valley Blogger presents Prepare Your Tax Return: Tax Products vs Tax Pros posted at The Digerati Life, saying “If you don’t enjoy preparing your taxes, you’re not alone. There are various ways to get your tax returns done. How do you go about preparing your taxes: DIY or with the help of a pro?” Ed. Tax time sucks. If we abolished payroll deductions and made everybody in the country write a check to the IRS every year, there would be a revolt on the next April 15th.

Kevin McKee presents How To Know if Your Job is Expendable posted at Thousandaire, saying “When businesses start doing poorly, some people are at risk of losing their job, while others are safe. Find out which category you fall in with these simple questions.” Ed: I was given a demonstration that defines expendability in the workplace. Fill a glass with water and place it on the counter in front of you. Stick your finger in the glass. Now, pull it out. See the impression you’ve made? I’ve done the rockstar bit, and I’ve been in positions that were necessary for the profitability of larger divisions of large companies. It doesn’t matter. Corporate loyalty is a joke.

35% of people who attend the game write it off as a corporate expense. (source)

Miss T presents 5 Ways to Lower Your Monthly Bills | Prairie EcoThrifter.com posted at Prairie Eco-Thrifter, saying “Believe it or not, there are lots of ways to save money, no matter how much of it you have- or don’t have.”

http://www.youtube.com/watch?v=jRYLhkOV2so

Tim Chen presents Pentagon Federal Offers Best Gas & Airfare Credit Card Rewards, Period. posted at NerdWallet Blog – Credit Card Watch, saying “There is only one credit card in America that offers no strings attached 5% cash back at any gas stations (excluding the likes of Costco) – the Pentagon Federal Platinum CashBack. It also gets you 2% back at grocery stores.”

Miranda presents Accelerate Your Credit Card Debt Pay Down posted at CreditScore.net, saying “Use these techniques to pay down your credit card debt faster.”

Buck Inspire presents Moving Up and On From Prepaid Debit Cards posted at Buck Inspire.

Ryan Hudson presents How I Got a Credit Card Late Fee Waived posted at Best Credit Cards IQ, saying “Don’t take accidental late fees laying down. Do something about it. Here’s how I got rid of my late fee.”

No network footage exists of Super Bowl I. It was taped over, supposedly for a soap opera.(source)

John presents Get Out of Debt Fast – How to Speed Up the Process posted at Passive Family Income, saying “There are quite a few people today that are beginning to dig their way out of debt. They have monitored their spending, created a budget, and have done the best that they can to stick with it. But, as many of you have experienced, the excitement of becoming debt-free gets pretty old after a while.”

http://www.youtube.com/watch?v=VRDx18GYITw

Mike Collins presents Defined Benefit vs Defined Contribution posted at Saving Money Today, saying “Understanding the different types of retirement plans.”

Boomer presents 10 Ways For Women To Obtain Financial Empowerment posted at Boomer & Echo, “It’s not that difficult to get your financial life under control (your control). Remember, a man is not a financial plan.”

The Super Bowl is measured in Roman numerals because a football season runs the span over two calendar years. This year the season began in 2010 and ends in 2011. (source)

Madison DuPaix presents Substitute, Improvise, and Make Do With What You Have posted at My Dollar Plan, saying “So often, when we run out of things we need, we run to buy something or spend money when we don’t have to. Find out how you can avoid this trap.”

Money Beagle presents The Power Of The Free Calendar posted at Money Beagle.

Amanda L Grossman presents Homemade Diversion Safes: Save Money by Making Your Own posted at Frugal Confessions – Frugal Living, saying “You can purchase your own home security money safes (diversion safes), but I thought it would be more frugal and fun to think of ones to make on your own. See what I can do with a used deodorant!”

http://www.youtube.com/watch?v=KQkK1UCH1EU

MoneyNing presents What Would You Do with a Million Dollars? posted at Money Ning, saying “I know what I would do with a million dollars. How about you?”

More drivers are involved in alcohol-related accidents on Super Bowl Sunday than any other day of the year (except St. Patrick’s Day), according to the Insurance Information Institute. (source)

Joe Morgan presents Is Gen Y Irresponsible, Or Is It A Matter Of Perspective? posted at Simple Debt-Free Finance, saying “Generation Y has a reputation for having a sense of entitlement, but here’s one reason it may just be a matter or perspective.”

http://www.youtube.com/watch?v=_78ylMLa0JQ

Ryan @ MFN presents Roth IRA Qualifications posted at The Military Wallet, saying “Are you qualified to open a Roth IRA? Find out income and contribution requirements to see if you are eligible!”

Brian @ BeBetterNow presents Money’s Golden Rule: Spend Less Than You Earn posted at Be Better Now, “In the end, most personal finance advice boils down to spending less than you earn. Here’s another article to reinforce that.”

http://www.youtube.com/watch?v=g364TG_8Qmw

Barb Friedberg presents Wealth in Life: 25 Cheap Ideas for Fun posted at Barbara Friedberg Personal Finance, “Join in to build a massive list of low cost fun!”

http://www.youtube.com/watch?v=R55e-uHQna0

PT presents Tax on Unemployment Compensation posted at PT Money, saying “A detailed look at what taxes are due on your unemployment compensation.”

Ken presents Important Tax Update for 2010 You Don’t Want To Miss posted at Spruce Up Your Finances, saying “A few of the tax provisions applicable to tax year 2010 such as the extension of tax filing date, expanded tax benefits, phase out on some limitations, etc.”

Fanny presents Top 10 Tax Deductions for Parents posted at Living Richly on a Budget, “Being a parent is one of the most important roles in life. Why not take advantage of all the deductions you qualify for?”

Thank you all for participating! Next week’s host is Saving Money Today, so be sure to submit your posts.

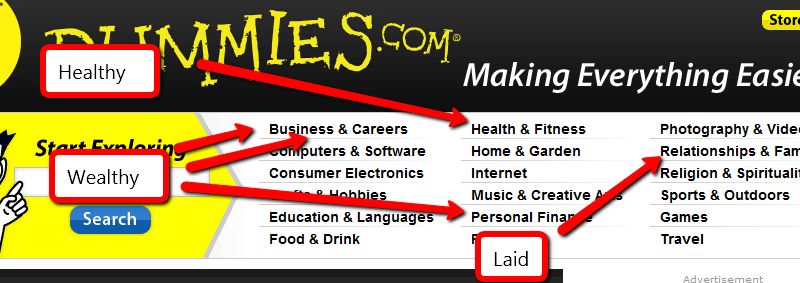

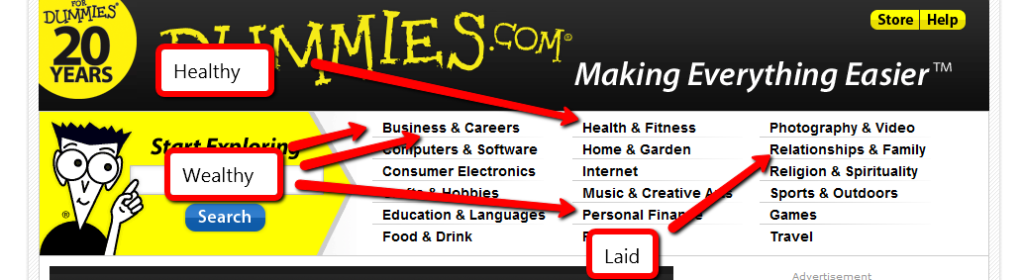

If you want to make money, help someone get healthy, wealthy or laid.

This section was quick.

Seriously, those three topics have been making people rich since the invention of rich. Knowing that isn’t enough. If you want to make some money in the health niche, are you going to help people lose weight, add muscle, relieve stress, or reduce the symptoms of some unpleasant medical condition? Those are called “sub-niches”. (Side question: Viagra is a sub-niche of which topic?)

Still not enough.

If you’re going to offer a product to help lose weight, does it revolve around diet, exercise, or both? For medical conditions, is it a way to soothe eczema, instructions for a diabetic diet, a cure for boils, or help with acne? Those are micro-niches.

That’s where you want to be. The “make money” niche is far too broad for anyone to effectively compete. The “make money online” sub-niche is still crazy. When you get to the “make money buying and selling websites” micro-niche, you’re in a territory that leaves room for competition, without costing thousands of dollars to get involved.

Remember that: The more narrowly you define your niche market, the easier it is to compete. You can take that too far. The “lose weight by eating nothing but onions, alfalfa, and imitation caramel sauce” micro-niche is probably too narrowly defined to have a market worth pursuing. You need a micro-niche with buyers, preferably a lot of them.

Now the hard part.

How do you find a niche with a lot of potential customers? Big companies pay millions of dollars every year to do that kind of market research.

Naturally, I recommend you spend millions of dollars on market research.

No?

Here’s the part where I make this entire series worth every penny you’ve paid. Times 10.

Steal the research.

My favorite source of niche market research to steal is http://www.dummies.com/. Click the link and notice all of the wonderful niches at the top of the page. Jon Wiley & Sons, Inc. spends millions of dollars to know what topics will be good sellers. They’ve been doing this a long time. Trust their work.

You don’t have to concentrate on the topics I’ve helpfully highlighted, but they will make it easier for you. Other niches can be profitable, too.

Golf is a great example. Golfers spend money to play the game. You don’t become a golfer without having some discretionary money to spend on it. I’d recommend against consumer electronics. There is a lot of competition for anything popular, and most of that is available for free. If you choose to promote some high-end gear using your Amazon affiliate link, you’re still only looking at a 3% commission.

I like to stick to topics that people “need” an answer for, and can find that answer in ebook form, since I will be promoting a specific product.

With that in mind, pick a topic, then click one of the links to the actual titles for sale. The “best selling titles” links are a gold mine. You can jump straight to the dummies store, if you’d like.

Of the topics above, here’s how I would narrow it down:

1. Business and Careers. The bestsellers here are Quickbooks and home buying. I’m not interested in either topic, so I’ll go into “More titles”. Here, the “urgent” niches look like job hunting and dealing with horrible coworkers. I’m also going to throw “writing copy” into the list because it’s something I have a hard time with.

2. Health and Fitness. My first thought was to do a site on diabetic cooking, but the cooking niche is too competitive. Childhood obesity, detox diets and back pain remedies strike me as worth pursuing. I’m leaning towards back pain, because I have a bad back. When you’ve thrown your back out, you’ve got nothing to do but lie on the couch and look for ways to make the pain stop. That’s urgency.

3. Personal Finance. The topics that look like good bets are foreclosures and bankruptcies. These are topics that can cost thousands of dollars if you get them wrong. I hate to promote a bankruptcy, but some people are out of choices. Foreclosure defense seems like a good choice. Losing your home comes with a sense of urgency, and helping people stay in their home makes me feel good.

4. Relationships and Family. Of these topics, divorce is probably a good seller. Dating advice definitely is. I’m not going to detail either one of those niches here. Divorce is depressing and sex, while fun, isn’t a topic I’m going to get into here. I try to be family friendly, most of the time. Weddings are great topic. Brides are planning to spend money and there’s no shortage of resources to promote.

So, the niches I’ve chosen are:

I won’t be building 9 niche sites in this series. From here, I’m going to explore effective keywords/search terms and good products to support. There’s no guarantee I’ll find a good product with an affiliate program for a niche I’ve chosen that has keywords that are both highly searched and low competition, so I’m giving myself alternatives.

For those of you following along at home, take some time to find 5-10 niches you’d be willing to promote.

The important things to consider are:

1. Does it make me feel dirty to promote it?

2. Will there be customers willing to spend money on it?

3. Will those customers have an urgent need to solve a problem?

I’ve built sites that ignore #3, and they don’t perform nearly as well as those that consider it. When I do niche sites, I promote a specific product. It’s pure affiliate marketing, so customers willing to spend money are necessarily my target audience.