- RT @ramseyshow: RT @E_C_S_T_E_R_I_: "Stupid has a gravitational pull." -D Ramsey as heard n NPR. I know many who have not escaped its orbit. #

- @BudgetsAreSexy KISS is playing the MINUTE state fair in August. in reply to BudgetsAreSexy #

- 3 year old is "reading" to her sister: Goldilocks, complete with the voices I use. #

- RT @marcandangel: 40 Useful Sites To Learn New Skills http://bit.ly/b1tseW #

- Babies bounce! https://liverealnow.net/hKmc #

- While trying to pay for dinner recently, I was asked if other businesses accepted my $2 bills. #

- Lol RT @zappos: Art. on front page of USA Today is titled "Twitter Power". I diligently read the first 140 characters. http://bit.ly/9csCIG #

- Sweet! I am the number 1 hit on Ask.com for "I hate birthday parties" #

- RT @FinEngr: Money Hackers Carnival #117 Wedding & Marriage Edition http://bit.ly/cTO4FU #

- Nobody, but nobody walks sexy wearing flipflops. #

- @MonroeOnABudget Sandals are ok. Flipflops ruin a good sway. 🙂 in reply to MonroeOnABudget #

- RT @untemplater: RT @zappos: "Do one thing every day that scares you." -Eleanor Roosevelt #

You’re not alone: Help with Bankruptcy & Debt

Frequently regarded as an indication of personal failure, bankruptcy is still today widely considered a highly sensitive topic. Many will even feel uneasy speaking about their debt problems with close relatives and friends. If you, too, are facing serious debt issues and are in need of help, rest assured you are not the only one afraid of sliding into bankruptcy. In fact, thousands of households in the UK are threateningly close to insolvency and most are experiencing the exact same feelings of shame and despair. This perfectly understandable reaction has, meanwhile, unfortunately overshadowed the fact that there are hands-on practical steps especially designed to help you resolve your debt situation.

Frequently regarded as an indication of personal failure, bankruptcy is still today widely considered a highly sensitive topic. Many will even feel uneasy speaking about their debt problems with close relatives and friends. If you, too, are facing serious debt issues and are in need of help, rest assured you are not the only one afraid of sliding into bankruptcy. In fact, thousands of households in the UK are threateningly close to insolvency and most are experiencing the exact same feelings of shame and despair. This perfectly understandable reaction has, meanwhile, unfortunately overshadowed the fact that there are hands-on practical steps especially designed to help you resolve your debt situation.

There is a good reason why addressing the issue of bankruptcy has an urgent ring to it. Recent statistics indicate a steady rise of individual company insolvencies in the UK, particularly since the 1990s. According to the British Insolvency Service, the rate of bankruptcy on an individual level has risen from a total of 24,441 in 1997 to staggering 106,645 in 2007 in England and Wales. Alarmingly, the peak doesn’t seem to have been reached yet. As respected online-service ‘This is Money’ reports, ‘record numbers of people were declared insolvent in England and Wales’ in 2010, further noting that ‘an all-time high of 135,089 people were declared insolvent in 2010—0.7% up on the total for 2009.’ As you can gather from these numbers, you are certainly not alone with your debt problems: Around 140,000 adults are facing bankruptcy as a direct consequence of mishandling their debt issues, which translates to 385 new cases per day. It has already been pointed out that ‘the number of victims will be enough to fill both the London 2012 Olympic stadium and the Emirates Stadium.’

So, if you’re facing bankruptcy, there’s no need to feel ashamed. By taking an active stance and addressing your debt issues, you may even be able to avert insolvency altogether. With years of experience and several distinctions to our credit, the Debt Advisory Line have established themselves as leading experts in the field of debt management. We’ve already helped thousands of individuals and households who thought bankruptcy was their only option. Settling debt issues is our forte – and you shouldn’t settle with anything less.

This post brought to you by Debt Advisory Line.

How to Prioritize Your Spending

Don’t buy that.

At least take a few moments to decide if it’s really worth buying.

Too often, people go on auto-pilot and buy whatever catches their attention for a few moments. The end-caps at the store? Oh, boy, that’s impossible to resist. Everybody needs a 1000 pack of ShamWow’s, right? Who could live without a extra pair of kevlar boxer shorts?

Before you put the new tchotke in your cart, ask yourself some questions to see if it’s worth getting.

1. Is it a need or a want? Is this something you could live without? Some things are necessary. Soap, shampoo, and food are essentials. You have to buy those. Other things, like movies, most of the clothes people buy, or electronic gadgets are almost always optional. If you don’t need it, it may be a good idea to leave it in the store.

2. Does it serve a purpose? I bought a vase once that I thought was pretty and could hold candy or something, but it’s done nothing but collect dust in the meantime. It’s purpose is nothing more than hiding part of a flat surface. Useless.

3. Will you actually use it? A few years ago, my wife an cleaned out her mother’s house. She’s a hoarder. We found at least 50 shopping bags full of clothes with the tags still attached. I know, you’re thinking that you’d never do that, because you’re not a hoarder, but people do it all the time. Have you ever bought a book that you haven’t gotten around to reading, or a movie that went on the shelf, still wrapped in plastic? Do you own a treadmill that’s only being used to hang clothes, or a home liposuction machine that is not being used to make soap?

3. Is it a fad? Beanie babies, iPads, BetaMax, and bike helmets. All garbage that takes the world by storm for a few years then fades, leaving the distributors rich and the customers embarrassed.

4. Is it something you’re considering just to keep up with the Joneses? If you’re only buying it to compete with your neighbors, don’t buy it. You don’t need a Lexus, a Rolex, or that replacement kidney. Just put it back on the shelf and go home with your money. Chances are, your neighbors are only buying stuff so they can compete with you. It’s a vicious cycle. Break it.

5. Do you really, really want it? Sometimes, no matter how worthless something might be, whether it’s a fad, or a dust-collecting knick-knack, or an outfit you’ll never wear, you just want it more than you want your next breath of air. That’s ok. A bit disturbing, but ok. If you are meeting all of your other needs, it’s fine to indulge yourself on occasion.

How do you prioritize spending if you’re thinking about buying something questionable?

Vacation, Shmaycation, Staycation?

Last week was our family vacation. This year, we decided to keep it cheap, since we raided our savings a few months ago to cover my son’s vision therapy.

Here’s what we did:

Friday (Yes, I started vacation on a Friday): My wife worked a half day, then we drove to visit my parents, roughly 120 miles north of our house. $110 for gas, round-trip, and $10 for drive-through lunch. $120 total.

Saturday: We went to the county fair and Dairy Queen. $18 for admission. $30 for ride tickets. $35 for food and ice cream. The ride tickets were totally worth it. My son and I discovered that he can handle the fun rides, which thrills me. $83 total.

Sunday: We had a picnic at the bottom of Inspiration Peak, the third highest point in Minnesota, followed by a hike to the top. That evening, my brother, his wife, my wife, and I tricked my parents into babysitting and escaped for several hours of adult time. After a couple of overpriced drinks at a crap restaurant, we went somewhere nicer and cheaper. A nice dinner, a few drinks, and a round of drunken go-karts later, we spent $90 for the evening.

Monday: Back to the go-kart park for the afternoon, and the return drive home in the evening. The go-kart park included 3 rounds of go-karts, mini-golf, and a round of bumper boats. $40.

Tuesday: A hands-on kids museum, a natural history museum that was hosting a portable planetarium, and a teppenyaki restaurant. We used museum passes for the museums, so this cost a total of $160. By far, the most expensive part was the restaurant. The museums cost a combined $30.

Wednesday: We spent the day at the Monster Mall’s indoor theme park, Nickelodean Universe, where we tested my son’s ability to handle the fun rides for $70. Then we ate at the Rainforest Cafe for $116, and we got my wife’s anniversary present, a family portrait at an “old time” photo studio. We chose a 1920s theme. I must say, I look dashing in a zoot suit. $260 total.

Thursday: My wife had to work on Thursday because she was short of vacation time, so I had the brats to myself. We went to a pick-your-own apple orchard where we picked a large bag of apples, a bottle of real, locally-made maple syrup and 3 cookies-on-a-stick. Afterwards, Brat #1 and I went to a Chinese buffet and the comic book store while the women-folk went to a saddle-club meeting. $60 total.

Friday: We had a fried chicken picnic at the largest playground in the area, and otherwise took it easy. $12.

Saturday: On Saturday, my girls rode in a horse show for the saddle club while my wife put in her volunteer work hours. Registration and the food for the potluck ran $40.

Sunday: I had to teach a gun class, so I made money, instead of spending it. My wife and kids played around the house.

Total, our vacation cost us $865, for 10 days of memories. If we would have skipped the restaurants, it would have cost $465, but we wanted those experiences, too. Our vacation fund has $906 in it, so we did all right.

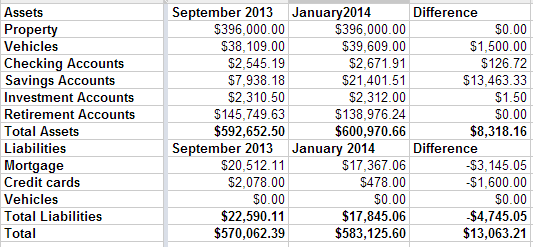

Net Worth Update – January 2014

This may be the most boring type of post I write, but it’s important to me to track my net worth so I can see my progress. We are sliding smoothly from debt payoff mode to wealth building mode.

Our highlights right now are nothing to speak of. We did let our credit card grow a little bit over the last couple of months, but paid it off completely at the end of December. It grew mostly as a matter of not paying attention while we were doing our holiday shopping and dealing with some car repairs.

That’s it. We haven’t remodeled our bathrooms yet, but we have the money sitting in a savings account, waiting for the contractor. We haven’t bought a pony yet, but we did decide that a hobby farm wouldn’t be the right move for us. We’ll be boarding the pony instead of moving, at least for the foreseeable future.

Our net worth is up $13,000 since September. Our savings are up and our retirement accounts are down because there are two inherited IRAs that we need to slowly cash out and convert to regular IRAs.

Healthcare.gov: Is this failure a warning of what’s to come?

The official launch of online registration for government healthcare has been rife with disastrous glitches from the very beginning. This cataclysmic failure has spurred severe service outages across the country, and this chronically dysfunctional interface serves as foreshadowing for an epidemic of systematic organizational deficiencies. Healthcare.gov is only the first in a series of planned bureaucratic catastrophes.

The Internet Errors

The requirement of preemptive registration resulted in a complete system crash. The ability to input health data was also starkly limited. Security issues also seemed evident as certificates failed to show updated validations, and there was no indication of where confidential information would be stored.

Lack of Foresight and Oversight

The decision to mandate initial registration was a hastily made last-minute change that failed to consider the magnitude of public interest. This unfortunately coincided with a government shutdown, which left limited federal resources available to respond to claims of malfunctioning servers. The biggest mistake made by the Department of Health and Human Services was underestimating the massive influx of uninsured applicants.

To further complicate woes, a chief contractor behind the layout of healthcare.gov is expected to testify that additional time and money could not have salvaged the doomed enlistment effort. His official testimony will shed light on administrative laziness, and the legislative committee is expected to issue serious reprimands, but nothing will recompense the thousands of individuals deprived access to healthcare registration on the date promised to them years in advance. These problems were completely avoidable, but the team in place refused to promptly pay attention.

Proposed Solutions

The Obama Administration has conveniently remained mum on the topic of minor adjustments to the healthcare law, but Congressional Democrats have proposed implementing small delays to the overall roll-out. The dates for enforcing the individual mandate have become a focal point of discussions to modify Obamacare. Because citizens were not given feasible access to the online enrollment system, it would be unconstitutional to levy fines for their lack of registration.

The Foreboding Warning

If politicians cannot even tackle basic website programming, then they should not be trusted to manage the well-being of millions of Americans. Partisan divisions have made two factions that are fully noncoalescent, which means all future fixes will be the result of an incomplete compromise between two warring parties. Real health concerns have been forgotten by the incessant squabbling of politicians in their ivory towers. This means that every new initiative will only cause further societal strife and struggle. Members of Congress have expanded the breadth of their authority without grasping the technological realm. As a consequence, these politicians will continue overextending the limits of their power, and the public will be left to pick up the pieces.