Please email me at:

Or use the form below.

[contact-form 1 “Contact form 1”]

The no-pants guide to spending, saving, and thriving in the real world.

Hayden Panettiere has formally announced her engagement! The starlet will be marrying Vladimir Klitschko, who is a world renowned boxer that has won an Olympic gold medal. The unexpected public revelation has sparked rumor trails regarding glitzy wedding plans. While no date has been set, and nothing has been confirmed, there is widespread speculation that the event is going to be glamorously over-the-top.

Although Panettiere’s fiance is 13 years older than her, it is the first marriage for both partners. This may instill extra incentive for the couple to make their officiation an extremely flashy occasion. Because Klitschko is a famous Ukrainian athlete, he will also be anticipating a magnificently choreographed wedding. Both individuals could invest fortunes in perfecting their walk down the aisle together.

Of course, one of the biggest decisions that Panettiere faces is the selection of her gown. All eyes will be on the fabric that she chooses for this special day. If they go through with a public wedding, the dress will be permanently immortalized in global media. She is going to want to show off flawless class, glimmering austerity and sizzling sultriness. Fashion critics are eagerly anticipating her selection. The high-end designer that she picks will receive a tremendous boost in popularity, especially if she pulls off a beautiful presentation.

A crazy wedding would be completely in character for the young television star. Her most known role was a bubbly cheerleader on the long-running series, “Heroes.” With vivacious charm, she became a sex symbol across the country. Explosiveness is simply a part of her personality, so a bombastic celebration is to be expected. Furthermore, Ukrainian wedding parties have a tendency to be more raucous than American traditions. If they follow any of the groom’s cultural practices, the event could become out of control.

The massive ring on Panettiere’s finger indicates no desire for privacy regarding this affair. In fact, it was an invitation for the mainstream media to cover the entire ordeal. This hints that the couple might be planning a gigantic wedding event. They can easily afford it, and the public celebrations will rapidly enhance the star’s critical acclaim.

In contrast, a private exchange of vows would disappoint her legions of fans. Furthermore, paparazzi could still infiltrate the wedding to snap pictures. To avoid any uninvited intrusions, the couple should be open to media coverage during their nupital arrangements. This will let them control the event, and allow them to recoup some of the expenses through lucrative network contracts. Regardless of how they conduct the wedding, it is certain that the whole world will be diligently watching with admiration, and perhaps a slight tinge of jealousy.

Today, I am continuing the series, Money Problems: 30 Days to Perfect Finances. The series will consist of 30 things you can do in one setting to perfect your finances. It’s not a system to magically make your debt disappear. Instead, it is a path to understanding where you are, where you want to be, and–most importantly–how to bridge the gap.

I’m not running the series in 30 consecutive days. That’s not my schedule. Also, I think that talking about the same thing for 30 days straight will bore both of us. Instead, it will run roughly once a week. To make sure you don’t miss a post, please take a moment to subscribe, either by email or rss.

On this, Day 8, we’re going to talk about insurance.

What is insurance? Insurance is, quite simply a bet with your insurance company. You give them money on the assumption that something bad is going to happen to whatever you are insuring. After all, if you pay $10,000 for a life insurance policy and fail to die, the insurance company wins.

A more traditional definition would be something along the line of giving money to your insurance company so they will pay for any bad things that happen to your stuff. How do they make money paying to fix or replace anything that breaks, dies, or spontaneously combusts? Actuary tables. Huh? The insurance company sets a price for to insure—for example—your car. That price is based on the statistical likelihood of you mucking it up, based on your age, your gender, your driving history, and even the type of car you are insuring. What happens if a meteor falls on your car? That would shoot the actuary table to bits, but it doesn’t matter. They spread the risk across all of their customers and—statistically—the price is right.

What kinds of insurance should you get?

For most people, their home is, by far, the largest single purchase they will ever make. If your home is destroyed, by fire, tornado, or angry leprechauns, it’s gone, unless you have it insured. Without insurance, that $100, or 200, or 500 thousand dollars will be lost, and that’s not even counting the contents of your home.

Homeowner’s insurance can be expensive. One way to keep the cost down is to raise your deductible. If you’ve got a $1500 emergency fund, you can afford to have a $1000 deductible. That’s the part of your claim that the insurance company won’t cover. It also means that if you have less than $1000 worth of damage, the insurance company won’t pay anything.

You can get optional riders on your homeowner’s insurance, if you have special circumstances. You can get additional coverage for jewelry, firearms, computer equipment, furs, among other things. You base policy will cover some of this, but if you have a lot of any of that, you should look into the extra coverage.

Car insurance is required in most states. That’s because the kind caretakers in our governments, don’t want anyone able to hit you car without being able to pay for the damage they caused. To my mind, I think it would be more effective to just make whacking someone’s car without paying for it a felony. If someone is a careful driver or has the money to self-insure, more power to them.

Auto insurance comes with options like separate glass coverage, collision, total coverage (comprehensive), or just liability. Liability insurance is what you put on cheap, crappy cars. It will only pay for the damage you do to someone else.

I’ve never had rental insurance. The last time I rented, I could fit everything I owned in the back of a pickup truck with a small trailer, and it could all be replaced for $100. Heck, I had the couch I was conceived on. Err. Ignore that bit.

Almost everything you can get homeowner’s insurance to cover will also cover renter’s insurance, except for the building. It’s not your building, so it’s not your job to replace it.

If you care about your family, you need life insurance. This is the money that will be used to replace your income if you die. I am insured to about 5 times my annual salary. If that money gets used to pay off the last of the debt, it will be enough to supplement my wife’s income and support my family almost until the kids are in college. You should be sure to have enough to cover any family debt, and bridge the gap between your surviving family’s income and their expenses. At a minimum. Better, you’ll have enough to pay for college and a comfortable living.

Life insurance comes in two varieties: whole and term. Whole life…sucks. It’s expensive and overrated. The sales-weasels pushing it will tell you that it builds value over time, but it’s usually only about 2%. It’s a lousy investment. You’re far better off to get a term life policy and sock the price difference in a mutual fund that’s earning a 5-6% return.

Term life is insurance that is only good for 5, 10, or 20 years, then the policy evaporates. If you live, the money was wasted at the end of the term. The fact that it’s a bad bet makes it far more affordable than whole life. It doesn’t pretend to be an investment; it’s just insurance. Pure and simple

An umbrella policy is lawsuit insurance. If someone trips and hurts themselves in your yard, and decides to sue, this will pay your legal bills. If you get sued for almost anything that was not deliberate(by you!) or business related, this policy can be used to cover the bill.

If you call your insurance company to get an umbrella policy, they will force you to raise the limits on your homeowner’s and auto insurance. Generally, those limits will be raised to $500,000, and the umbrella coverage will be there to pick up any costs beyond the new limit.

A little-known secret about umbrella policies: They set the practical limit of a lawsuit against you. Most ambulance chasers know better than to sue you for 10 million dollars if you only have a policy to cover 1 million. They will never see the other 9 million, so why bother? They’ll go for what they know they can get.

The flipside to that is that you should not talk about your umbrella policy. Having a million dollars in insurance is a sign of “deep pockets”. It’s a sign that it’s worthwhile to sue you. You don’t want to look extra sue-able, so keep it quiet.

Insurance is a great way to protect yourself if something bad happens. Today, you should take a look at your policies and see where you may have gaps in coverage, or where you may be paying too much.

Today, I am continuing the series, Money Problems: 30 Days to Perfect Finances. The series will consist of 30 things you can do in one setting to perfect your finances. It’s not a system to magically make your debt disappear. Instead, it is a path to understanding where you are, where you want to be, and–most importantly–how to bridge the gap.

I’m not running the series in 30 consecutive days. That’s not my schedule. Also, I think that talking about the same thing for 30 days straight will bore both of us. Instead, it will run roughly once a week. To make sure you don’t miss a post, please take a moment to subscribe, either by email or rss.

On this, Day 9, we’re going to talk about health insurance.

The first thing to understand is that there is a difference between health care and health insurance. Health care is what the doctors do. Health insurance is when the insurance companies pay for it. Or don’t. They are not the same thing. I won’t be addressing who should get care or who should be paying for insurance. That’s political and I try to avoid that here.

I won’t spend much time discussing health care as a “right”. It’s not. If a right requires somebody to actively do something for you, it’s not a right. It can’t be. The logical conclusion of requiring somebody to provide you care gets to be a intellectual exercise to be completed elsewhere. That, too, is political.

What I will discuss are the components of a health insurance plan is the U.S. and what to watch out for when planning your insurance coverage.

This is the amount you pay for your health insurance. For people with employer-sponsored insurance, this is usually paid out of each paycheck, deducted pre-tax. For those with an individual plan, it’s almost always a monthly payment. There generally isn’t much you can do to lower this much. Most employers offer, at most, 2-3 options, ranging from a good plan for a high premium to “we’ll mail you leeches if we think you’re dying” for a much smaller price.

This is a flat fee paid out of pocket when you get medical care. Depending on your plan and the type of visit, this could be $10-50 or higher. For example, with a plan I participated in recently, the copay was $15 for an office visit, $25 for urgent care, and $100 for an emergency room visit. The office visit and urgent care visit were billed the same amount to the insurance company, so the price difference was entirely arbitrary. Currently, all health insurance plans are required to pay preventative care visits at 100%, meaning there is no copay.

This is the payment split between the insurance company and the insured. 80/20 is a common split for plans with coinsurance. That means the insurance company will pay just 80% of the bill, until the insured has paid the entire out-of-pocket maximum. After that, the coverage is 100%.

This is the amount that an insurance company won’t pay. It has to be covered by the insured before the insurance company does anything. For example, if you have an insurance plan with a $25 copay, 80/20 coinsurance and a $100 deductible, and paying for an office visit costing $600 would look something like this: $25 for the copay, followed by $75 to max out the copay, leaving $500 to be split 80/20 or $400 paid by the insurance company and $100 paid by the insured. That office visit would cost $200 out-of-pocket. The next identical visit would be cheaper because the deductible is annual and doesn’t get paid per incident. That one would cost $115 out of pocket.

Health Savings Account. For people with a high-deductible plan–that is, a plan with a deductible of at least $1200 in 2011–they are eligible to open an HSA. This is a savings account dedicated to paying medical expenses, excluding OTC medication. It can be used for vision, dental, or medical care. Payroll contributions are taken pre-tax, which makes it a more affordable way to afford major medical expenses. Unfortunately, there are annual contribution limits. Currently $3050 for an individual account and $6150 for a family account. HSAs do not expire, so you can contribute now, and save the money for medical expenses after retirement.

Flexible Spending Account. This is similar to an HSA, but the contributed funds evaporate at the end of the year. It’s “use it or you’re screwed” plan.

If you’re not getting health insurance through your employer or another group, you are on an individual plan. These cost more because they A) don’t benefit from the economy of scale presented by getting 50 or 100 or 1000 people on the same plan, and B) you don’t have an employer subsidizing your premium.

If your employer provides health insurance, you have an employer-sponsored plan. Possibly the fastest way to correct problems with the health insurance industry would be to make individual plan premiums tax-deductible, while eliminating that deduction for employers and letting insurance companies work across state lines. That would eliminate the mutated pseudo-market we have right now, and force the insurance companies to compete for your business. Honest competition is the most sure way to increase efficiency and service while reducing costs. It beats “one payer” or “socialized” care which add overhead to the process and hide the premiums in increased taxes.

Most employer-sponsored plans only allow you to make changes at a specific time of the year, unless you have a “life changing event”, like marriage, divorce, death, or children.

After you use your health insurance, the company will send an EOB, showing you what was billed, what they paid, and what you’ll be responsible for. It’s fascinating to see the difference between what gets billed by the doctor and what the insurance company is willing to pay, by contract. You should read this, to at least understand what you are consuming and how much is getting paid for you.

If your insured care cost more than your maximum dollar limit, or maximum annual limit, the insurance company stops paying. this was supposed to be going away under the Patient Protection and Affordable Care Fraud Act. Unfortunately, if an insurance company offers a crap plan, they have been allowed to apply for waivers based on the fact that they offer a crap plan. The deciding factor in whether the waiver is granted seems to be the amount of the political contributions the insurance company has made to the correct political entities, but maybe I’m just bitter.

This is the most you will have to pay directly with coinsurance. After you pay this amount, the insurance company will cover 100% of expenses, subject to the maximum limit.

The Consolidated Omnibus Budget Reconciliation Act of 1985 is, in short, an opportunity to continue your employer-sponsored health plan–minus the subsidy–after you have left the employer. It’s expensive, but it keeps you covered, and will eliminate issue with pre-existing conditions when you get a new plan.

This is an extremely-high-deductible plan, typically $10,000 or more. For the people who can’t afford coverage, this is insurance-treated-as-insurance. It’s coverage when you absolutely need it, not when you feel a bit ill. $10,000 isn’t a bankruptcy-level bill, while $100,000 usually is. This plan prevent medical bankruptcy for a small monthly fee. For the people who got screwed by a PPAACFA waiver, it bridges the gap between a plan that’s useful for minor things and protection when something goes really wrong.

Now that we’ve looked at the terms you need to understand, we’re going to talk about some things to check before deciding what coverage is right for you.

Do you need coverage for yourself, or yourself and your family? If you and your spouse are both working, make sure to run the math for every possible combination that will cover everyone. Is it cheaper to have one of you cover yourself and the kids, while the other just gets an individual plan?

It’s really easy to blow through a $3000 annual maximum. If you’ve got a low annual max, look into a supplemental catastrophic plan.

For years, my wife paid for insurance that covered herself and the kids, while I covered myself. When we were expecting brat #3, I added her to my insurance plan, without having her cancel hers. When the bill came, my insurance plan covered the coinsurance and deductible, which saved us thousands of dollars when the baby was born.

If you’ve got a pre-existing condition, it can be difficult to get insurance if you don’t already have coverage. This makes sense. It prevents someone from corrupting the idea of insurance by waiting until something goes really wrong before getting a plan. Without this, all of the insurance companies would be bankrupt in a year. This is one of the biggest benefits of COBRA. It’s a short-term bridge plan that eliminates the idea of a pre-exisiting condition deadbeat. If you’ve got insurance, you can transfer to a different plan. If you don’t, you can’t.

Your homework today is to get a copy of the details of your health insurance and look up all of the above terms and situations. How well are you covered? Did anything surprise you?

You should never be in the company of anyone with whom you would not want to die.

-Duncan Idaho, from God-Emperor of Dune

Some people suck the life out of everyone they encounter. Whether it be through lies, unreasonable demands, emotional abuse or manipulation, or just a vile personalty, the people they meet are worse off for the encounter. The people they interact with every day are screwed.

My time is too precious to waste any of it unnecessarily on people who remove value from it. I like being with people who enrich my life, instead.

Unfortunately, since I’m not an advocate for the use of hitmen, not every toxic person is easy to eliminate from your life.

Toxic people come in 3 basic varieties: professional, personal, and family. There is some overlap between the categories.

The personal category is easiest to deal with. These people aren’t relatives or coworkers, so you won’t see them at family gatherings or at work. I’ve dealt with these people in two ways.

First, there is the direct approach. One former friend, who was really only a friend when it was convenient for him(a pure leech), got told that he wasn’t invited to one of our parties because I was inviting his ex-wife, instead. That was the last time he called me.

The second option is far more passive. I set up a contact group in my phone called “Life’s too short”. At first, I set it up with a fairly insulting ring tone, but I later switched it to no ring at all. I don’t know they’ve called until I check my voicemail. It’s far less direct, but also far easier than the direct approach.

Dealing with the toxic people in your family is more complicated. You’ll see them at holiday gatherings, or hear about them during unrelated visits. You probably have a lot of memories growing up with them, and may feel some level of obligation–deserved or not–to maintain contact. It’s hard to break a tie that you’ve had your entire life.

Can you fix their behavior? It’s worth trying to have a frank discussion about how they are treating you, or the things they are doing. If the problem is that they are constantly bringing over their methhead boyfriends, banning the drug addicts from your home, while still welcoming the relative may be an acceptable fix. If the problem is a constant need to belittle you, demanding they stop may work. If the problem is a lifetime of emotional abuse, it probably isn’t fixable.

Is banishment an option? Can you put that creepy cousin on the Life’s Too Short list? You’ll still have to deal with him at family gatherings, but you can always leave the room when he comes in, right? Don’t engage, don’t participate in any conversation beyond a polite greeting, and don’t offer any encouragement towards regular contact.

It’s possible that it won’t be possible to fix their behavior and that you won’t want to banish the offender. If, for example, the offender is your mother (Not you, Mom!), you may feel a sense of obligation to maintain contact, or even be a primary caregiver at times. This is a line nobody else can draw for you. At some point, the current bad behavior could overwhelm the past obligations. When that happens are you prepared for it? That can be a traumatic break.

The other option, as cold as it sounds, is to wait it out. Nature will take its course, eventually. Can you wait that long, while maintaining your sanity and emotional equilibrium?

Professional toxic people include customers, vendors, and coworkers, none of whom are easy to get rid of.

If you own the business, you can fire your problem customers if the hassle outweighs the benefits you get from the relationship. You can find a new vendor, and you can fire the problem employees.

What happens if you are an employee?

If the problem is your boss, your options are to suck it up, talk to his boss, or find a new job. If the first is intolerable, and the second is impossible, it’s time to polish your resume.

If the problem is a vendor, you’ve got some options. Document the problems, first. Does he make inappropriate jokes, or badmouth you to your customers? Then, research the alternatives. Does one of his competitors offer an equivalent product or service? Take the documentation and research to your boss, or whoever makes that decision, and see if you can get your company to make the switch. The other option, is to request someone new to deal with at the vendor’s company, but that may not always be possible.

Finally, we come to the problem of toxic coworkers.

Some coworkers have the same problems as a toxic boss. Is the company vice-president the boss’s baby brother? You’re probably not going to find a win there. You’ll have to suck it up or move on.

Is the problem person working in an unrelated department doing unrelated tasks? It may be possible to start taking breaks at different times and leave him where he belongs: in the past.

Is the difficult individual sharing an office with you, demanding everything be done his way, and throwing daily tantrums? This is the one that has to be dealt with. He’s the one sucking the life out of you every single day.

First, start making use of a voice recorder. If you’ve got a smartphone, you’ve probably already got one. Otherwise, drop the $20 to buy one. This lets you document the evil. When his behavior goes hinky, record it.

Second, stand up for yourself. If he’s making unreasonable demands, tell him it’s inappropriate. He’s a bully, and bullies tend to back down when they are confronted.

Third, make sure the boss knows about the behavior. Yes, this is tattling. Get over it. If he wasn’t acting like he was a spoiled 4 year old, you wouldn’t have to tell the boss that he was. If the boss doesn’t know there’s a problem, he can’t deal with it.

Fourth, for any problem that isn’t directly aimed at you, ignore it. If he makes a habit of throwing a tantrum because somebody emptied the coffee pot, or because the company switched health plans, let him. Only get in the way if it’s directed at you. Over time, the tantrums will get more noticeable and out of hand, forcing the boss to deal with it, preferably by handing him a pink slip.

Your goal is documentation, awareness, and avoidance. Make the worst of it go elsewhere so you can be as productive as possible, document what you can, and let the boss become aware of the situation and how bad it has become. And be patient. This isn’t an overnight fix.

How do you deal with the toxic people in your life?

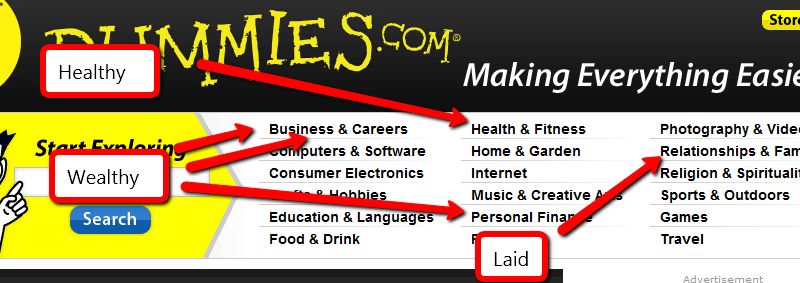

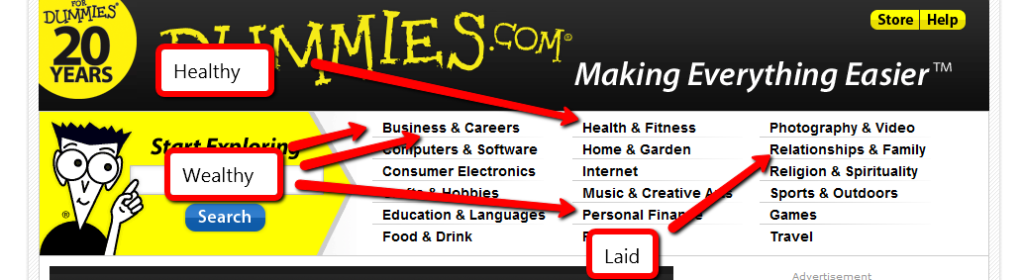

If you want to make money, help someone get healthy, wealthy or laid.

This section was quick.

Seriously, those three topics have been making people rich since the invention of rich. Knowing that isn’t enough. If you want to make some money in the health niche, are you going to help people lose weight, add muscle, relieve stress, or reduce the symptoms of some unpleasant medical condition? Those are called “sub-niches”. (Side question: Viagra is a sub-niche of which topic?)

Still not enough.

If you’re going to offer a product to help lose weight, does it revolve around diet, exercise, or both? For medical conditions, is it a way to soothe eczema, instructions for a diabetic diet, a cure for boils, or help with acne? Those are micro-niches.

That’s where you want to be. The “make money” niche is far too broad for anyone to effectively compete. The “make money online” sub-niche is still crazy. When you get to the “make money buying and selling websites” micro-niche, you’re in a territory that leaves room for competition, without costing thousands of dollars to get involved.

Remember that: The more narrowly you define your niche market, the easier it is to compete. You can take that too far. The “lose weight by eating nothing but onions, alfalfa, and imitation caramel sauce” micro-niche is probably too narrowly defined to have a market worth pursuing. You need a micro-niche with buyers, preferably a lot of them.

Now the hard part.

How do you find a niche with a lot of potential customers? Big companies pay millions of dollars every year to do that kind of market research.

Naturally, I recommend you spend millions of dollars on market research.

No?

Here’s the part where I make this entire series worth every penny you’ve paid. Times 10.

Steal the research.

My favorite source of niche market research to steal is http://www.dummies.com/. Click the link and notice all of the wonderful niches at the top of the page. Jon Wiley & Sons, Inc. spends millions of dollars to know what topics will be good sellers. They’ve been doing this a long time. Trust their work.

You don’t have to concentrate on the topics I’ve helpfully highlighted, but they will make it easier for you. Other niches can be profitable, too.

Golf is a great example. Golfers spend money to play the game. You don’t become a golfer without having some discretionary money to spend on it. I’d recommend against consumer electronics. There is a lot of competition for anything popular, and most of that is available for free. If you choose to promote some high-end gear using your Amazon affiliate link, you’re still only looking at a 3% commission.

I like to stick to topics that people “need” an answer for, and can find that answer in ebook form, since I will be promoting a specific product.

With that in mind, pick a topic, then click one of the links to the actual titles for sale. The “best selling titles” links are a gold mine. You can jump straight to the dummies store, if you’d like.

Of the topics above, here’s how I would narrow it down:

1. Business and Careers. The bestsellers here are Quickbooks and home buying. I’m not interested in either topic, so I’ll go into “More titles”. Here, the “urgent” niches look like job hunting and dealing with horrible coworkers. I’m also going to throw “writing copy” into the list because it’s something I have a hard time with.

2. Health and Fitness. My first thought was to do a site on diabetic cooking, but the cooking niche is too competitive. Childhood obesity, detox diets and back pain remedies strike me as worth pursuing. I’m leaning towards back pain, because I have a bad back. When you’ve thrown your back out, you’ve got nothing to do but lie on the couch and look for ways to make the pain stop. That’s urgency.

3. Personal Finance. The topics that look like good bets are foreclosures and bankruptcies. These are topics that can cost thousands of dollars if you get them wrong. I hate to promote a bankruptcy, but some people are out of choices. Foreclosure defense seems like a good choice. Losing your home comes with a sense of urgency, and helping people stay in their home makes me feel good.

4. Relationships and Family. Of these topics, divorce is probably a good seller. Dating advice definitely is. I’m not going to detail either one of those niches here. Divorce is depressing and sex, while fun, isn’t a topic I’m going to get into here. I try to be family friendly, most of the time. Weddings are great topic. Brides are planning to spend money and there’s no shortage of resources to promote.

So, the niches I’ve chosen are:

I won’t be building 9 niche sites in this series. From here, I’m going to explore effective keywords/search terms and good products to support. There’s no guarantee I’ll find a good product with an affiliate program for a niche I’ve chosen that has keywords that are both highly searched and low competition, so I’m giving myself alternatives.

For those of you following along at home, take some time to find 5-10 niches you’d be willing to promote.

The important things to consider are:

1. Does it make me feel dirty to promote it?

2. Will there be customers willing to spend money on it?

3. Will those customers have an urgent need to solve a problem?

I’ve built sites that ignore #3, and they don’t perform nearly as well as those that consider it. When I do niche sites, I promote a specific product. It’s pure affiliate marketing, so customers willing to spend money are necessarily my target audience.