What would your future-you have to say to you?

The no-pants guide to spending, saving, and thriving in the real world.

What would your future-you have to say to you?

Life is all about trade-offs. You trade your time for a paycheck. Your trade your paycheck for food, rent, and security. Don’t get so obsessed with saving and security that you forget to live your life. There are many good reasons to put your savings on hold in order to really live. Here are five of them:

1. You have an adequate emergency fund. You will never hear me advise against an emergency fund. If you don’t have one, stop reading this and get one. Go. Without an emergency fund, your budget is a financial crisis waiting to happen. With an emergency fund, you can weather life’s speed-bumps without watching them become total train-wrecks.

2. Your retirement is on autopilot. You are not allowed to stop saving and investing for retirement. Ever. Assuming you have a traditionally scheduled career that involves you working until you hit 65 and deferring a huge chunk of living until then, your income will cease when you retire. Do you know how long you will live? Do you want to spend your retirement broke and bored? Are you relying on the responsible financial management of the federal government to make sure you will still get your Social Security? Invest in your retirement and get this investment on autopilot so you can stop worrying about it.

3. Your income is set. I don’t believe in the fairy tale of a company being loyal to its employees. The aren’t. However, if you have a stable-ish job, an in-demand career, and some side-income coming from alternate sources, your emergency fund can be enough to carry you through the low times. That’s what it’s there for.

4. You have dreams. If you’ve always wanted to travel the world, follow a band on your, volunteer extensively, or anything else, it’s time to do it. Don’t postpone your passion.

5. Deathbed regrets suck. Very few people lie on their deathbed lamenting the things they did. Regrets tend to be focused on opportunities missed, skipped, or indefinitely postponed. Do the things that are important to you before it’s too late to do them. Don’t abandon your future in favor of current pleasures, but don’t forget to live, now.

Do you have any other reasons to stop saving?

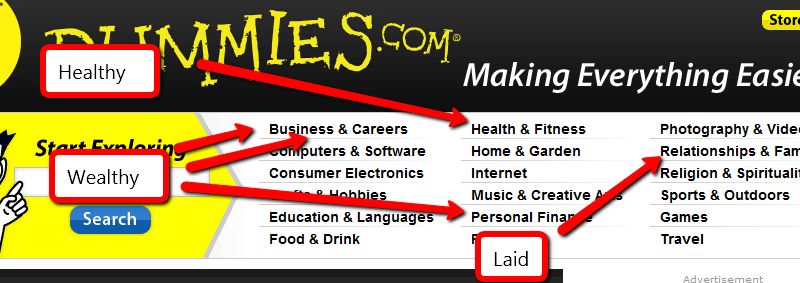

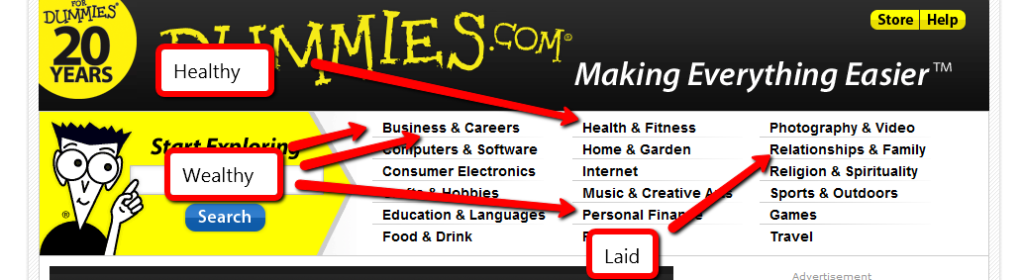

If you want to make money, help someone get healthy, wealthy or laid.

This section was quick.

Seriously, those three topics have been making people rich since the invention of rich. Knowing that isn’t enough. If you want to make some money in the health niche, are you going to help people lose weight, add muscle, relieve stress, or reduce the symptoms of some unpleasant medical condition? Those are called “sub-niches”. (Side question: Viagra is a sub-niche of which topic?)

Still not enough.

If you’re going to offer a product to help lose weight, does it revolve around diet, exercise, or both? For medical conditions, is it a way to soothe eczema, instructions for a diabetic diet, a cure for boils, or help with acne? Those are micro-niches.

That’s where you want to be. The “make money” niche is far too broad for anyone to effectively compete. The “make money online” sub-niche is still crazy. When you get to the “make money buying and selling websites” micro-niche, you’re in a territory that leaves room for competition, without costing thousands of dollars to get involved.

Remember that: The more narrowly you define your niche market, the easier it is to compete. You can take that too far. The “lose weight by eating nothing but onions, alfalfa, and imitation caramel sauce” micro-niche is probably too narrowly defined to have a market worth pursuing. You need a micro-niche with buyers, preferably a lot of them.

Now the hard part.

How do you find a niche with a lot of potential customers? Big companies pay millions of dollars every year to do that kind of market research.

Naturally, I recommend you spend millions of dollars on market research.

No?

Here’s the part where I make this entire series worth every penny you’ve paid. Times 10.

Steal the research.

My favorite source of niche market research to steal is http://www.dummies.com/. Click the link and notice all of the wonderful niches at the top of the page. Jon Wiley & Sons, Inc. spends millions of dollars to know what topics will be good sellers. They’ve been doing this a long time. Trust their work.

You don’t have to concentrate on the topics I’ve helpfully highlighted, but they will make it easier for you. Other niches can be profitable, too.

Golf is a great example. Golfers spend money to play the game. You don’t become a golfer without having some discretionary money to spend on it. I’d recommend against consumer electronics. There is a lot of competition for anything popular, and most of that is available for free. If you choose to promote some high-end gear using your Amazon affiliate link, you’re still only looking at a 3% commission.

I like to stick to topics that people “need” an answer for, and can find that answer in ebook form, since I will be promoting a specific product.

With that in mind, pick a topic, then click one of the links to the actual titles for sale. The “best selling titles” links are a gold mine. You can jump straight to the dummies store, if you’d like.

Of the topics above, here’s how I would narrow it down:

1. Business and Careers. The bestsellers here are Quickbooks and home buying. I’m not interested in either topic, so I’ll go into “More titles”. Here, the “urgent” niches look like job hunting and dealing with horrible coworkers. I’m also going to throw “writing copy” into the list because it’s something I have a hard time with.

2. Health and Fitness. My first thought was to do a site on diabetic cooking, but the cooking niche is too competitive. Childhood obesity, detox diets and back pain remedies strike me as worth pursuing. I’m leaning towards back pain, because I have a bad back. When you’ve thrown your back out, you’ve got nothing to do but lie on the couch and look for ways to make the pain stop. That’s urgency.

3. Personal Finance. The topics that look like good bets are foreclosures and bankruptcies. These are topics that can cost thousands of dollars if you get them wrong. I hate to promote a bankruptcy, but some people are out of choices. Foreclosure defense seems like a good choice. Losing your home comes with a sense of urgency, and helping people stay in their home makes me feel good.

4. Relationships and Family. Of these topics, divorce is probably a good seller. Dating advice definitely is. I’m not going to detail either one of those niches here. Divorce is depressing and sex, while fun, isn’t a topic I’m going to get into here. I try to be family friendly, most of the time. Weddings are great topic. Brides are planning to spend money and there’s no shortage of resources to promote.

So, the niches I’ve chosen are:

I won’t be building 9 niche sites in this series. From here, I’m going to explore effective keywords/search terms and good products to support. There’s no guarantee I’ll find a good product with an affiliate program for a niche I’ve chosen that has keywords that are both highly searched and low competition, so I’m giving myself alternatives.

For those of you following along at home, take some time to find 5-10 niches you’d be willing to promote.

The important things to consider are:

1. Does it make me feel dirty to promote it?

2. Will there be customers willing to spend money on it?

3. Will those customers have an urgent need to solve a problem?

I’ve built sites that ignore #3, and they don’t perform nearly as well as those that consider it. When I do niche sites, I promote a specific product. It’s pure affiliate marketing, so customers willing to spend money are necessarily my target audience.

Today, I am continuing the series, Money Problems: 30 Days to Perfect Finances. The series will consist of 30 things you can do in one setting to perfect your finances. It’s not a system to magically make your debt disappear. Instead, it is a path to understanding where you are, where you want to be, and–most importantly–how to bridge the gap.

I’m not running the series in 30 consecutive days. That’s not my schedule. Also, I think that talking about the same thing for 30 days straight will bore both of us. Instead, it will run roughly once a week. To make sure you don’t miss a post, please take a moment to subscribe, either by email or rss.

On this, Day 11, we’re going to talk about one method of paying for college.

I have a secret to share. Are you listening? Lean in close: College is expensive.

You’re shocked, I can tell.

The fact is, college prices are rising entirely out of proportion to operation costs, salaries, or inflation. The only thing college prices seem to be pegged to is demand. Demand has gotten thoroughly out of whack. The government forces down the interest rates on student loans, then adds some ridiculous forgiveness as long as you make payments for some arbitrary number of years, creating an artificial demand that wouldn’t be there if the iron fist of government weren’t forcing it into place.

Somebody in Washington has decided that the American dream consists of home ownership and a college education. Everything is a failure. He’s an idiot.

College isn’t for everybody.

Read that again. Not everyone should go to college. Not everyone can thrive in college.

Fewer than half of students who start college graduate. The greater-than-half who drop out still have to repay their loans. Do you think college was a good choice for them?

Then you get the people who major in art history and minor in philosophy. Do you know what that degree qualifies you for? Burger flipping.

Yes, I know. Just having a degree qualifies you for a number of jobs. It’s not because the degree matters, it’s because HR departments set a series of fairly arbitrary requirements just to filter a 6 foot stack of resumes. The only thing they care about is that having a degree proves that you were able to stick college out for 4 years. That HR requirement matters less as time goes on and you develop relevant work experience.

A liberal arts education also—properly done—trains your mind in the skill of learning. First, not everyone is capable of learning new things. Second, not everyone is willing to learn new things. Third, a passion for learning can be fed without college. If you don’t have that passion, college won’t create it. Most of the most learned people throughout history managed without college, or even formal education. Even if you want to feed that passion in a formal classroom, you’re assuming the professors are interested in training your mind instead of indoctrinating it with their views.

Now there are some pursuits that outright require a college education. The sciences like engineering, physics, astronomy, and psychiatry all require college. You know what doesn’t require college? Managing a cube farm. Data entry. Sales. I’m not saying those are bad professions, but they can certainly be done without dropping $50,000 on college.

Some careers require an education, but don’t require a 4 year degree, like nursing(in most states), computer programming(it’s not required, but it makes it a lot easier to break into) and others. Do you need to hit a 4 year school and get a Bachelor’s degree, or can you hold yourself to a 2 year program at a technical college and save yourself 40,000 or more?

That should be an easy choice. Don’t go to college just because you think you should or because somebody said you should, or to get really drunk. College isn’t for everybody and it’s possible it’s not for you.

Today, it is my please to host the 287th Festival of Frugality, the Independence Day Edition. Yesterday, was Independence Day in the US. It’s the day we celebrate throwing off the yolk of high-tax, no-rights tyranny and blowing stuff up.

That’s not what this Festival is about. As much as I love this country and enjoyed celebrating, today, the theme is the Independence Day movie.

Coolest ID4 fact, ever: A promotional piece that aired in Spain for this film set off a “War of the Worlds” type of wide spread panic. The promo featured a popular Spanish news anchor and the piece ran as if there really WAS an alien attack to occur on July 4.

The explosion of the Welcome Wagon Helicopters was actually footage of a pyrotechnics accident on set.

Miss T. gives us Seven Reasons to Avoid Penny Auction Sites. She does a great job of explaining the evil that is Penny Auctions, from outright fraud to the rip-off that is the basic business model. Some of these sites make $5000 or more on an iPad auction. They don’t even have to carry an inventory before running an auction.

Independence Day holds the record for most miniature model-work. It beat the previous record by double.

Philip submits Turn Wasted Extra Money Into a Debt Payment. I have a friend who is positive he can’t reduce his monthly expenses at all, while eating out almost every day.

The alien ship “miniature” was 65 feet across.

Boomer presents Financial Support For Your Adult Children. I love my parents. A lot. I couldn’t imagine moving back in with them, and I’m pretty sure they’d feel the same way soon enough. Although, Mom, if you’re reading this, can I have an allowance again?

This was the highest grossing film in 1996.

Suba presents Why you should not use 401k. I’ve never questioned the wisdom of maxing out a 401k. It’s good to see those assumptions challenged and the numbers crunched.

President Whitmore: Good morning. In less than an hour, aircraft from here will join others from around the world. And you will be launching the largest aerial battle in the history of mankind. Mankind, that word should have new meaning to all of us. We cannot be consumed by our petty differences anymore. Perhaps it is fate that today is the fourth of July, and we will once again be fighting for our freedom. But not for freedom from tyrrany or oppression or persecution. We’re fighting for our right to live, to exist. And should we win the day, the Fourth of July will no longer be known as an American holiday, but as the day when the world stood up and declared in one voice that we will not go quietly into the night! We will not vanish without a fight! We’re going to live on! We’re going to survive! Today we celebrate our Independence Day!

FMF presents Save Money on Groceries by Shopping on Wednesday posted at Free Money Finance.

Harri Pierce presents Have a second hand summer posted at TotallyMoney.

Daniel presents Top 10 Reasons to Shop Online vs. Shopping In-Store posted at Sweating The Big Stuff.

President Whitmore: It’s a fine line between standing behind a principle and hiding behind one.

Philip Taylor presents The Best Time to Buy posted at PT Money Personal Finance.

Outlaw presents Pay Yourself First and Have Money in the Bank posted at Outlaw Finance.

Crystal presents Frugal Tips for the Pet Dog posted at Budgeting in the Fun Stuff.

Matt presents The Price of Water posted at Stupid Cents.

That’s right! That’s what you get! Look at you! Ship all banged up! Who’s the man? Who’s the man?! Wait until I get another plane! I am going to line up all your friends right beside you! ~ Captain Steven Hiller

Alan presents The Cost of Online Gaming: Free to Play posted at Canadian Finance Blog.

Paula @ AffordAnything.org presents Diets and Debt: Managing Money and Your Weight posted at AffordAnything.org.

Kay Lynn presents Summer Fun for the Frugal Family posted at Bucksome Boomer.

Jacob @ My Personal Finance Journey presents Top 10 Money Saving Tips posted at My Personal Finance Journey.

Glen Craig presents The Cost of Clutter on Your Finances and Life posted at Free From Broke.

Eddie presents 55 Suggestions To Save $1000 posted at Finance Fox.

Darwin presents Are You Better Off Than Your Parents? posted at Darwin’s Money.

Sustainable PF presents Sustainability Tip #179: Loose Cap Lose Gas posted at Sustainable Personal Finance.

WHOOOOO!!!!!!!!! Elvis has left the building! ~ Captain Steven Hiller

I hope you enjoyed the carnival. Please take a moment to subscribe to Live Real, Now.

In the past, I’ve gone through a detailed series of budget lessons demonstrating how to make a budget and showing my personal budget spreadsheet template. If you weren’t here to see them develop, you probably haven’t seen them at all. I’ve never built an actual index for those posts.

This is the master index of my budget planning resources. As I develop more, this will grow.

Budget Lesson #1 – In this lesson, I go over how we handle discretionary income and I explain our modified envelope system. The discretionary budget contains things like our grocery bill, or the clothes we buy. We have near-total discretion over what is purchased, hence the name.

Budget Lesson #2 – Lesson #2 contains the details of our monthly bills. These are the ones that are consistent, predictable, and actually due each month. Most people take these for granted as the bills they have to pay, but it’s not true. You can get almost all of your regular bills reduced just by asking. You would also be surprised what you can do without, when properly motivated.

Budget Lesson #3 – This is where I explain how we deal with the non-monthly bills. That is, the bills that have to be paid, but are not due on a monthly basis. I also share the personal budget spreadsheet template I developed. I am working on a few sample templates to match various imaginary scenarios. If you’d like to be an anonymous case study, and get free help setting up a budget, let me know, please.

Budget Lesson #4 – In this lesson, I describe our “set-aside” funds for things that will need to be paid eventually, but not on a set schedule. Sometimes, they are never actually due. We set aside money for the parties we throw, for car repairs and for a number of other things. A few of these items are outright optional, but they are part of what makes life fun. You can’t make a budget without including some of the extras.

Budget Lesson #5 – This is the companion piece to lesson 2. Learn how I’ve reduced–or attempted to reduce–each of these bills. For the better part of two years, I called Dish Network every few months to ask for a discount. For almost 2 years, it was granted. Then one, day, they told me they were putting a note on our account to keep us from getting any more discounts, so I canceled. 100% discounts help us save more.

Budget Lesson #6 – This is the reduction companion to lesson 3. These bills are harder to reduce. Have you ever successfully gotten your property taxes lowered?

Budget Lesson #7 – This is the reduction companion to lesson 4. Notice a pattern, yet?

Budget Lesson #8 – Here, completely out of order, is the reduction companion to lesson 1. Watch as I magically reduce–or rationalize–our discretionary budget.

So, dear readers, what part of budgeting should I address next?