What would your future-you have to say to you?

The no-pants guide to spending, saving, and thriving in the real world.

What would your future-you have to say to you?

If you are looking to get out of debt, or you are currently debt-free and want to stay that way, then it is important that you get a grip of your financial situation and live within your means.

A good way to do this is to create a budget as this gives you a clear indication of how much money is coming in, how much is going out and also highlights any areas where you may need to make cut backs should you be falling short each month.

Once you have sorted out the figures and made necessary amendments, for example paying bills by direct debit in order to make savings or cutting existing debts by carrying out a balance transfer to a lower rate credit card, it is time to start focussing on the lifestyle changes.

As you will find, it is one thing to create a budget and quite another to stick to it, but by adhering to the following steps and exercising a certain amount of will power, you should be able to ensure that you live within your means and resist the urge to reach for that credit card.

Keep focussed

Before you start to look at how you can stick to your budget you need to clarify why you need to stick to your budget!

A budget can initially seem like something that has been devised with the sole intention of stopping you having fun and buying or doing the things that you want. So it is important to remember that, though some cutbacks may be necessary in the short term, a budget is a long-term strategy that will allow you to take control of your finances and, all being well, live a happy life that is free from the worry of excessive debt.

Change your habits

Unfortunately, a successful budget can require a change in lifestyle and this can be one of the most difficult things to adhere to.

For example, if you have previously enjoyed eating out regularly then you may have to make cut backs in this area to ensure that you are living within your means. But, instead of seeing this as a negative, try to focus on the positives and remember the reasons why you are budgeting.

And a change in habits doesn’t necessarily mean that you have to cut back on your enjoyment of life and it may actually open your eyes to other pursuits you may not have previously considered.

For example, instead of eating out try preparing a meal at home and turn your dining room into a restaurant. This means that you can still have the fine dining experience but at a fraction of the price and without the worry of making a reservation!

Shop smarter

Lists figure heavily when creating a personal budget and list-making is a habit that you should get used to when trying to stick to your budget.

When budgeting it is vitally important to avoid impulse buying and a great way to do this is to always make a list of things you need before you go shopping.

This means that you will have a clear idea of what you need and you will be less inclined to make random purchases that may just turn out to be an unnecessary drain on your finances. It’s also worth mentioning at this point that you should always differentiate and prioritise the things you need over the things you simply want.

If you are unsure how to make the distinction then put off making the purchase for a couple of days and then reconsider if you actually need it. This cooling off period will often convince you that you can do without it and save you money.

In addition, savings can be made on your shopping by simply swapping big name brands for supermarket own varieties, using discount coupons and looking for any special offers.

Overall, it is important to be fully focussed and committed to your budget plan and to be aware that a change in finances may require a change in lifestyle. But a few short term changes may well add up to better finances in the long term.

Article written by Les Roberts, budget reporter at Moneysupermarket.com.

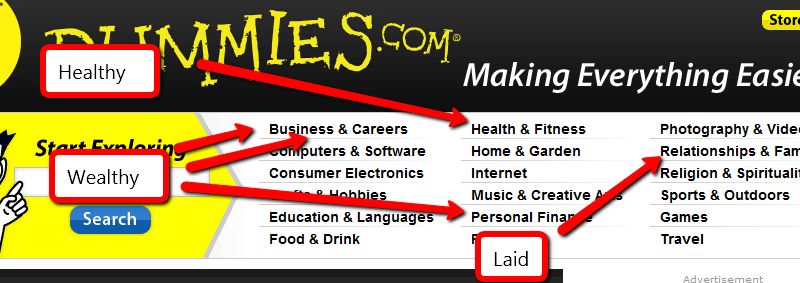

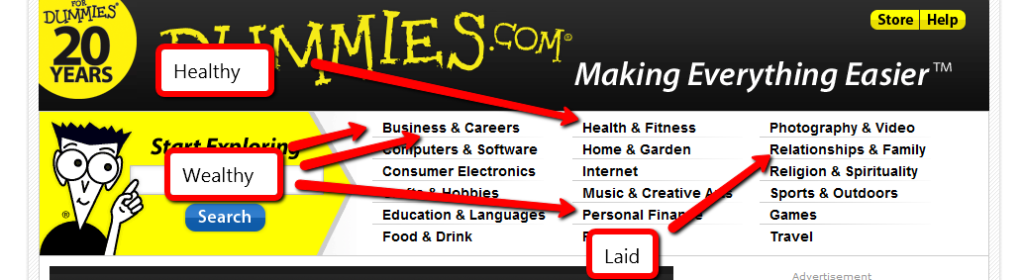

If you want to make money, help someone get healthy, wealthy or laid.

This section was quick.

Seriously, those three topics have been making people rich since the invention of rich. Knowing that isn’t enough. If you want to make some money in the health niche, are you going to help people lose weight, add muscle, relieve stress, or reduce the symptoms of some unpleasant medical condition? Those are called “sub-niches”. (Side question: Viagra is a sub-niche of which topic?)

Still not enough.

If you’re going to offer a product to help lose weight, does it revolve around diet, exercise, or both? For medical conditions, is it a way to soothe eczema, instructions for a diabetic diet, a cure for boils, or help with acne? Those are micro-niches.

That’s where you want to be. The “make money” niche is far too broad for anyone to effectively compete. The “make money online” sub-niche is still crazy. When you get to the “make money buying and selling websites” micro-niche, you’re in a territory that leaves room for competition, without costing thousands of dollars to get involved.

Remember that: The more narrowly you define your niche market, the easier it is to compete. You can take that too far. The “lose weight by eating nothing but onions, alfalfa, and imitation caramel sauce” micro-niche is probably too narrowly defined to have a market worth pursuing. You need a micro-niche with buyers, preferably a lot of them.

Now the hard part.

How do you find a niche with a lot of potential customers? Big companies pay millions of dollars every year to do that kind of market research.

Naturally, I recommend you spend millions of dollars on market research.

No?

Here’s the part where I make this entire series worth every penny you’ve paid. Times 10.

Steal the research.

My favorite source of niche market research to steal is http://www.dummies.com/. Click the link and notice all of the wonderful niches at the top of the page. Jon Wiley & Sons, Inc. spends millions of dollars to know what topics will be good sellers. They’ve been doing this a long time. Trust their work.

You don’t have to concentrate on the topics I’ve helpfully highlighted, but they will make it easier for you. Other niches can be profitable, too.

Golf is a great example. Golfers spend money to play the game. You don’t become a golfer without having some discretionary money to spend on it. I’d recommend against consumer electronics. There is a lot of competition for anything popular, and most of that is available for free. If you choose to promote some high-end gear using your Amazon affiliate link, you’re still only looking at a 3% commission.

I like to stick to topics that people “need” an answer for, and can find that answer in ebook form, since I will be promoting a specific product.

With that in mind, pick a topic, then click one of the links to the actual titles for sale. The “best selling titles” links are a gold mine. You can jump straight to the dummies store, if you’d like.

Of the topics above, here’s how I would narrow it down:

1. Business and Careers. The bestsellers here are Quickbooks and home buying. I’m not interested in either topic, so I’ll go into “More titles”. Here, the “urgent” niches look like job hunting and dealing with horrible coworkers. I’m also going to throw “writing copy” into the list because it’s something I have a hard time with.

2. Health and Fitness. My first thought was to do a site on diabetic cooking, but the cooking niche is too competitive. Childhood obesity, detox diets and back pain remedies strike me as worth pursuing. I’m leaning towards back pain, because I have a bad back. When you’ve thrown your back out, you’ve got nothing to do but lie on the couch and look for ways to make the pain stop. That’s urgency.

3. Personal Finance. The topics that look like good bets are foreclosures and bankruptcies. These are topics that can cost thousands of dollars if you get them wrong. I hate to promote a bankruptcy, but some people are out of choices. Foreclosure defense seems like a good choice. Losing your home comes with a sense of urgency, and helping people stay in their home makes me feel good.

4. Relationships and Family. Of these topics, divorce is probably a good seller. Dating advice definitely is. I’m not going to detail either one of those niches here. Divorce is depressing and sex, while fun, isn’t a topic I’m going to get into here. I try to be family friendly, most of the time. Weddings are great topic. Brides are planning to spend money and there’s no shortage of resources to promote.

So, the niches I’ve chosen are:

I won’t be building 9 niche sites in this series. From here, I’m going to explore effective keywords/search terms and good products to support. There’s no guarantee I’ll find a good product with an affiliate program for a niche I’ve chosen that has keywords that are both highly searched and low competition, so I’m giving myself alternatives.

For those of you following along at home, take some time to find 5-10 niches you’d be willing to promote.

The important things to consider are:

1. Does it make me feel dirty to promote it?

2. Will there be customers willing to spend money on it?

3. Will those customers have an urgent need to solve a problem?

I’ve built sites that ignore #3, and they don’t perform nearly as well as those that consider it. When I do niche sites, I promote a specific product. It’s pure affiliate marketing, so customers willing to spend money are necessarily my target audience.

You should never be in the company of anyone with whom you would not want to die.

-Duncan Idaho, from God-Emperor of Dune

Some people suck the life out of everyone they encounter. Whether it be through lies, unreasonable demands, emotional abuse or manipulation, or just a vile personalty, the people they meet are worse off for the encounter. The people they interact with every day are screwed.

My time is too precious to waste any of it unnecessarily on people who remove value from it. I like being with people who enrich my life, instead.

Unfortunately, since I’m not an advocate for the use of hitmen, not every toxic person is easy to eliminate from your life.

Toxic people come in 3 basic varieties: professional, personal, and family. There is some overlap between the categories.

The personal category is easiest to deal with. These people aren’t relatives or coworkers, so you won’t see them at family gatherings or at work. I’ve dealt with these people in two ways.

First, there is the direct approach. One former friend, who was really only a friend when it was convenient for him(a pure leech), got told that he wasn’t invited to one of our parties because I was inviting his ex-wife, instead. That was the last time he called me.

The second option is far more passive. I set up a contact group in my phone called “Life’s too short”. At first, I set it up with a fairly insulting ring tone, but I later switched it to no ring at all. I don’t know they’ve called until I check my voicemail. It’s far less direct, but also far easier than the direct approach.

Dealing with the toxic people in your family is more complicated. You’ll see them at holiday gatherings, or hear about them during unrelated visits. You probably have a lot of memories growing up with them, and may feel some level of obligation–deserved or not–to maintain contact. It’s hard to break a tie that you’ve had your entire life.

Can you fix their behavior? It’s worth trying to have a frank discussion about how they are treating you, or the things they are doing. If the problem is that they are constantly bringing over their methhead boyfriends, banning the drug addicts from your home, while still welcoming the relative may be an acceptable fix. If the problem is a constant need to belittle you, demanding they stop may work. If the problem is a lifetime of emotional abuse, it probably isn’t fixable.

Is banishment an option? Can you put that creepy cousin on the Life’s Too Short list? You’ll still have to deal with him at family gatherings, but you can always leave the room when he comes in, right? Don’t engage, don’t participate in any conversation beyond a polite greeting, and don’t offer any encouragement towards regular contact.

It’s possible that it won’t be possible to fix their behavior and that you won’t want to banish the offender. If, for example, the offender is your mother (Not you, Mom!), you may feel a sense of obligation to maintain contact, or even be a primary caregiver at times. This is a line nobody else can draw for you. At some point, the current bad behavior could overwhelm the past obligations. When that happens are you prepared for it? That can be a traumatic break.

The other option, as cold as it sounds, is to wait it out. Nature will take its course, eventually. Can you wait that long, while maintaining your sanity and emotional equilibrium?

Professional toxic people include customers, vendors, and coworkers, none of whom are easy to get rid of.

If you own the business, you can fire your problem customers if the hassle outweighs the benefits you get from the relationship. You can find a new vendor, and you can fire the problem employees.

What happens if you are an employee?

If the problem is your boss, your options are to suck it up, talk to his boss, or find a new job. If the first is intolerable, and the second is impossible, it’s time to polish your resume.

If the problem is a vendor, you’ve got some options. Document the problems, first. Does he make inappropriate jokes, or badmouth you to your customers? Then, research the alternatives. Does one of his competitors offer an equivalent product or service? Take the documentation and research to your boss, or whoever makes that decision, and see if you can get your company to make the switch. The other option, is to request someone new to deal with at the vendor’s company, but that may not always be possible.

Finally, we come to the problem of toxic coworkers.

Some coworkers have the same problems as a toxic boss. Is the company vice-president the boss’s baby brother? You’re probably not going to find a win there. You’ll have to suck it up or move on.

Is the problem person working in an unrelated department doing unrelated tasks? It may be possible to start taking breaks at different times and leave him where he belongs: in the past.

Is the difficult individual sharing an office with you, demanding everything be done his way, and throwing daily tantrums? This is the one that has to be dealt with. He’s the one sucking the life out of you every single day.

First, start making use of a voice recorder. If you’ve got a smartphone, you’ve probably already got one. Otherwise, drop the $20 to buy one. This lets you document the evil. When his behavior goes hinky, record it.

Second, stand up for yourself. If he’s making unreasonable demands, tell him it’s inappropriate. He’s a bully, and bullies tend to back down when they are confronted.

Third, make sure the boss knows about the behavior. Yes, this is tattling. Get over it. If he wasn’t acting like he was a spoiled 4 year old, you wouldn’t have to tell the boss that he was. If the boss doesn’t know there’s a problem, he can’t deal with it.

Fourth, for any problem that isn’t directly aimed at you, ignore it. If he makes a habit of throwing a tantrum because somebody emptied the coffee pot, or because the company switched health plans, let him. Only get in the way if it’s directed at you. Over time, the tantrums will get more noticeable and out of hand, forcing the boss to deal with it, preferably by handing him a pink slip.

Your goal is documentation, awareness, and avoidance. Make the worst of it go elsewhere so you can be as productive as possible, document what you can, and let the boss become aware of the situation and how bad it has become. And be patient. This isn’t an overnight fix.

How do you deal with the toxic people in your life?

In the past, I’ve gone through a detailed series of budget lessons demonstrating how to make a budget and showing my personal budget spreadsheet template. If you weren’t here to see them develop, you probably haven’t seen them at all. I’ve never built an actual index for those posts.

This is the master index of my budget planning resources. As I develop more, this will grow.

Budget Lesson #1 – In this lesson, I go over how we handle discretionary income and I explain our modified envelope system. The discretionary budget contains things like our grocery bill, or the clothes we buy. We have near-total discretion over what is purchased, hence the name.

Budget Lesson #2 – Lesson #2 contains the details of our monthly bills. These are the ones that are consistent, predictable, and actually due each month. Most people take these for granted as the bills they have to pay, but it’s not true. You can get almost all of your regular bills reduced just by asking. You would also be surprised what you can do without, when properly motivated.

Budget Lesson #3 – This is where I explain how we deal with the non-monthly bills. That is, the bills that have to be paid, but are not due on a monthly basis. I also share the personal budget spreadsheet template I developed. I am working on a few sample templates to match various imaginary scenarios. If you’d like to be an anonymous case study, and get free help setting up a budget, let me know, please.

Budget Lesson #4 – In this lesson, I describe our “set-aside” funds for things that will need to be paid eventually, but not on a set schedule. Sometimes, they are never actually due. We set aside money for the parties we throw, for car repairs and for a number of other things. A few of these items are outright optional, but they are part of what makes life fun. You can’t make a budget without including some of the extras.

Budget Lesson #5 – This is the companion piece to lesson 2. Learn how I’ve reduced–or attempted to reduce–each of these bills. For the better part of two years, I called Dish Network every few months to ask for a discount. For almost 2 years, it was granted. Then one, day, they told me they were putting a note on our account to keep us from getting any more discounts, so I canceled. 100% discounts help us save more.

Budget Lesson #6 – This is the reduction companion to lesson 3. These bills are harder to reduce. Have you ever successfully gotten your property taxes lowered?

Budget Lesson #7 – This is the reduction companion to lesson 4. Notice a pattern, yet?

Budget Lesson #8 – Here, completely out of order, is the reduction companion to lesson 1. Watch as I magically reduce–or rationalize–our discretionary budget.

So, dear readers, what part of budgeting should I address next?

This is a guest post written by Andreas Nicolaides, a financial author for UK based MoneySupermarket.com.

Whether your aim is to save money for a special occasion or you just want to make sure you don’t have to struggle financially when it comes to the end of the month, a budget can be a saving grace. Budgets help us quickly and easily identify our total income and all our expenditure, allowing us to plan for the best and prepare for the worst financial situations.

Set yourself a target

If you have decided to set up a budget, then there must be a reason. Are you looking to save for an upcoming event? Or maybe you have realised that you are struggling to make your payments every month and you would like to feel more financially secure. Based on what you would like to get out of your budget, you should set yourself a specific, measurable objective.

My first objective I set for myself was to save $100 every month for a year. This sort of objective is easy to manage and easy to monitor and this is what we are trying to achieve. One important thing I would mention here is to ensure your objective is achievable; don’t set yourself a target that is too far out of your reach, being realistic is extremely important.

How do you set up your budget?

The main key thing when you start to put your budget together is to make sure you’re as honest as possible. Get yourself a pen and some paper and on one page detail all of your income. Include the obvious and also remember to include any benefits you are entitled too. Then grab another piece of paper and detail all of your monthly outgoings, remember to be honest and thorough and try not to forget anything. Once you have both figures, deduct your expenditure from your monthly income that will give you your monthly figure.

You have some extra cash?

If when you have your figure you realise that there is some cash left over, you can then decide what you want to do with it. My advice here depends on your own personal circumstances, for example if you have high levels of debt, your main aim should be tackle your high interest debt aggressively and as often as possible.

If you have some money left over and your aim is to save, then set up an interest bearing bank account. If you are based in the US then you could look to set up an LSA or lifetime savers account. In the UK we have the equivalent, that is called a cash ISA saving account.

No money left over?

If after working out your budget you find you have no money left over, then you need to do something about it. Debt is one of those things that won’t just disappear overnight; it’s something that takes time and commitment, but not giving up is paramount.

How to cut down your expenditures?

One of the main things you can do when you realise you are in a bad situation is to try and cut down on your expenditure. Here’s a couple of quick ways:

A budget is used by many just to monitor what they spend month to month, but I hope I have detailed how it can be a helpful financial tool that can help you reach your financial goals. I hope my tips to budget successfully will help you get started on your way to financial freedom.