- RT @bargainr: Life in North Korea is absolutely dreadful http://nyti.ms/dAcL26 #

- RT @bitfs: Weekly Favorites and Gratitude!: My Favorite Posts this Week Jeff at Deliver Away Debt threw together the .. http://bit.ly/9J0gGo #

- @LiveRealNow is giving away a copy of Delivering Happiness(@dhbook). Follow and RT to enter. http://bit.ly/czd31X # #

- Baseless claims, biased assumptions, poor understanding of history. Don't bother. #AnimalSpirits #KeynesianCult #

- RT @zappos: Super exciting! "Delivering Happiness" hit #1 on NY Times Bestseller list! Thanks everyone! Details: http://bit.ly/96vEfF #

- @ericabiz Funny, we found a kitten in a box last week. Unfortunately, it was abandoned there, not playing. Now, we have a 5th cat. in reply to ericabiz #

The $10 College Fund

I recently started a college fund for my kids. With my oldest getting ready to turn 10, this was a late start. However, when he was born, we were in no position to set aside anything extra.

I recently started a college fund for my kids. With my oldest getting ready to turn 10, this was a late start. However, when he was born, we were in no position to set aside anything extra.

At least, we didn’t realize we were at the time.

When our oldest son was born, I was 20 years old. I was working in a factory and hadn’t gone to college myself, yet. That’s a situation that makes it hard to justify a college fund. Financial planning and responsibility was to come at a later date.

So, how much do we have in this shiny new college fund? [Read more…] about The $10 College Fund

Budget, updates, and the future

I have recently reworked our budget, including a new spreadsheet, sorted by categories. It’s a Google Doc template available here. I will dive into each section in detail in coming weeks.

My wife and I had a long conversation about what has worked and what has failed miserably regarding our debt and repayment plan. The results of that conversation will be the subject of a few posts over the next couple of weeks.

Our destination hasn’t changed. Our map hasn’t changed. We are making some changes to the route we take, to allow better for our strengths and weaknesses, both as a couple and as individuals.

Credit Peril

When my mother-in-law died, we went through all of her accounts and paid off anything she owed.

The Discover card she’d carried since the 80s–a card that had my wife listed as an authorized user–had a balance of about $700. We paid that off with the money in her savings account. They cashed out the accumulated points as gift cards and closed the account.

A few months ago, we decided it was time to buy an SUV, to fit our family’s needs. We financed it, to give us a chance to take advantage of a killer deal while waiting for the state to process the title transfer on an inherited car we have since sold.

Getting good terms was never a worry. Both of us had scores bordering on 800. Since our plan was to pay off the entire loan within a few months, we asked for whatever term came with the lowest interest rate.

Then the credit department came back and said that my wife’s credit was poor. I chalked it up to a temporary blip caused by closing the oldest account on her credit report and financed without her. No big deal.

Since we decided to rent our my mother-in-law’s house, we’ve discussed picking up more rental properties. That’s a post for another time, but last week, we went to get pre-approved for a mortgage. During the process, the mortgage officer asked me if my wife had any outstanding debt that could be ignored if we financed without her.

Weird.

A few days ago, we got the credit check letter from the bank. Her credit score? 668.

What the heck?

I immediately pulled her free annual credit report from annualcreditreport.com, which is something I usually do 2-3 times per year, but had neglected for 2012.

There are currently two negatives on her report.

One is a 30 day late payment on a store card in 2007. That’s not a 120 point hit.

The other is an $8 charge-off to Discover. As an authorized user. On an account that was paid.

Crap.

We called Discover to get them to correct the reporting and got told they don’t have it listed as a charge-off. They did agree to send a letter to us saying that, but said they couldn’t fix anything with the credit bureaus.

Once we get that letter, it’s dispute time.

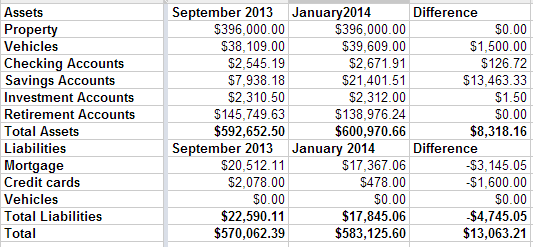

Net Worth Update – January 2014

This may be the most boring type of post I write, but it’s important to me to track my net worth so I can see my progress. We are sliding smoothly from debt payoff mode to wealth building mode.

Our highlights right now are nothing to speak of. We did let our credit card grow a little bit over the last couple of months, but paid it off completely at the end of December. It grew mostly as a matter of not paying attention while we were doing our holiday shopping and dealing with some car repairs.

That’s it. We haven’t remodeled our bathrooms yet, but we have the money sitting in a savings account, waiting for the contractor. We haven’t bought a pony yet, but we did decide that a hobby farm wouldn’t be the right move for us. We’ll be boarding the pony instead of moving, at least for the foreseeable future.

Our net worth is up $13,000 since September. Our savings are up and our retirement accounts are down because there are two inherited IRAs that we need to slowly cash out and convert to regular IRAs.

Family Bed: How to Make It Stop

baby on the cheek.” width=”300″ height=”199″ />

baby on the cheek.” width=”300″ height=”199″ />For years, my kids shared my bed.

When my oldest was a baby, I was working a graveyard shift, so my wife was alone with the baby at night. It was easy to keep a couple of bottles in a cooler by the bed and not have to get out of bed to take care of him when he woke up once an hour to drink a full bottle.

Then he got older. And bigger. And bigger.

We tried to move him to his own bed a few times, but it never worked well. He’d scream if we put him in a crib, so we got him a bed at 9 months old. That just meant he was free to join us whenever he woke up. Brat.

We finally got him to voluntarily move to his own bed after his sister was born. Shortly after she was born, I woke up to see him using her as a pillow. To paint the proper picture, this kid is 5’9″ and wears size 12 shoes. At 11. When I woke him up to tell him what he was doing, he decided to sleep in his own bed.

Method #1 to get your kids in their own bed: Have kid 1 try to crush kid 2 and feel bad about it.

Method #1 isn’t a great solution.

Soon, baby #3 showed up and we had 2 monsters in bed with us again. Once they started getting bigger, it became difficult for the 4 of us to sleep. We tried to get them into their own beds. Unfortunately, even as toddlers, my kids had a stubborn streak almost as big as my own. Nothing worked.

Eventually, they got big enough that I was crowded right out of the bed. At least we had a comfortable couch.

Sleeping on a couch gets old.

When the girls got old enough to reason with, we had a choice: We either had to find a way to convince them they wanted to sleep in their own room, or we had to have a fourth brat for them to attempt to crush at night.

We went with bribery. Outright, blatant bribery.

We put a chart on the wall with each of their names and 7 boxes. Every night they slept in their own beds, they got to check a box. When all of the boxes were checked, they got $5 and a trip to the toy store.

It took 10 days to empty our bed and it’s been peaceful sleeping since. That’s $5 well-spent.

Have you done a family bed? How did it work? How long did it last?