Please email me at:

Or use the form below.

[contact-form 1 “Contact form 1”]

The no-pants guide to spending, saving, and thriving in the real world.

In the past, I’ve gone through a detailed series of budget lessons demonstrating how to make a budget and showing my personal budget spreadsheet template. If you weren’t here to see them develop, you probably haven’t seen them at all. I’ve never built an actual index for those posts.

This is the master index of my budget planning resources. As I develop more, this will grow.

Budget Lesson #1 – In this lesson, I go over how we handle discretionary income and I explain our modified envelope system. The discretionary budget contains things like our grocery bill, or the clothes we buy. We have near-total discretion over what is purchased, hence the name.

Budget Lesson #2 – Lesson #2 contains the details of our monthly bills. These are the ones that are consistent, predictable, and actually due each month. Most people take these for granted as the bills they have to pay, but it’s not true. You can get almost all of your regular bills reduced just by asking. You would also be surprised what you can do without, when properly motivated.

Budget Lesson #3 – This is where I explain how we deal with the non-monthly bills. That is, the bills that have to be paid, but are not due on a monthly basis. I also share the personal budget spreadsheet template I developed. I am working on a few sample templates to match various imaginary scenarios. If you’d like to be an anonymous case study, and get free help setting up a budget, let me know, please.

Budget Lesson #4 – In this lesson, I describe our “set-aside” funds for things that will need to be paid eventually, but not on a set schedule. Sometimes, they are never actually due. We set aside money for the parties we throw, for car repairs and for a number of other things. A few of these items are outright optional, but they are part of what makes life fun. You can’t make a budget without including some of the extras.

Budget Lesson #5 – This is the companion piece to lesson 2. Learn how I’ve reduced–or attempted to reduce–each of these bills. For the better part of two years, I called Dish Network every few months to ask for a discount. For almost 2 years, it was granted. Then one, day, they told me they were putting a note on our account to keep us from getting any more discounts, so I canceled. 100% discounts help us save more.

Budget Lesson #6 – This is the reduction companion to lesson 3. These bills are harder to reduce. Have you ever successfully gotten your property taxes lowered?

Budget Lesson #7 – This is the reduction companion to lesson 4. Notice a pattern, yet?

Budget Lesson #8 – Here, completely out of order, is the reduction companion to lesson 1. Watch as I magically reduce–or rationalize–our discretionary budget.

So, dear readers, what part of budgeting should I address next?

Today, I am continuing the series, Money Problems: 30 Days to Perfect Finances. The series will consist of 30 things you can do in one setting to perfect your finances. It’s not a system to magically make your debt disappear. Instead, it is a path to understanding where you are, where you want to be, and–most importantly–how to bridge the gap.

I’m not running the series in 30 consecutive days. That’s not my schedule. Also, I think that talking about the same thing for 30 days straight will bore both of us. Instead, it will run roughly once a week. To make sure you don’t miss a post, please take a moment to subscribe, either by email or rss.

On this, Day 11, we’re going to talk about extended warranties.

You’ve been there. You walk into a big box electronics store to buy a $10 cable for your DVD player and the boy in blue at the register tries to pressure you into spending $4 on an extended warranty in case the cable dies due to too much adult video…or something.

The same nameless blue and yellow store is currently selling a laptop for $349 with a 2 year extended warranty for $89. The sales pitch usually goes something along the line of “These things have a tendency to break. You need a warranty to make it worth purchasing.” Thanks, jerk. You just sent me to a competitor since your sales pitch involves telling me you’re selling garbage.

Seriously, getting an extended warranty on electronics is almost always a bad deal. Yes, almost 30% of laptops fail within three years. Most of those fail in the 3rd year. What’s a 2 year warranty going to do for you then? New laptops generally come with a 1 year warranty from the factory. That leaves you volunteering for a 25% markup in exchange for protecting your device for a year that is not statistically likely to include a laptop failure.

A much better idea is to create a warranty/repair fund. When you buy something and have a warranty offered, turn it down and put that money in a special savings account. That money will get set aside to repair your stuff when it breaks. If you do that with everything you buy, you’ll soon have a fund that can pay for most repairs, without stressing your budget. I’ve got $25 going into my repair fund every month, so I’ll never have to worry about an extended warranty again.

It’s called a self-warranty.

But what about a car warranty you ask?

This is where I differ from most people. I’m a fan of extended warranties on cars, with 2 caveats.

1. Use it. If you car has started shaking, knocking, or almost anything else, bring it in. You have a warranty, so get your dang car fixed. When you’re getting close to the end of your warranty, make up an excuse and get that car into the dealer. “My car’s making an intermittent knocking sound. Can you fix it? While you’re at it, please do your 90,000 point inspection and fix whatever you find.” There’s no reason that you can’t get your car running like new when it kicks over the 70,000 mile mark.

2. Negotiate it. The charge you see is typically twice the dealer’s cost. Let them make some profit, since that’s what makes the world go round, but don’t let them take advantage of you. If they offer you a warranty for $2000, counter with $1200.

If you can get a decent price and are willing to make sure you use the auto warranty, get it.

How do you feel about extended warranties? Please leave a comment below and let me know.

This is a guest post written by Andreas Nicolaides, a financial author for UK based MoneySupermarket.com.

Whether your aim is to save money for a special occasion or you just want to make sure you don’t have to struggle financially when it comes to the end of the month, a budget can be a saving grace. Budgets help us quickly and easily identify our total income and all our expenditure, allowing us to plan for the best and prepare for the worst financial situations.

Set yourself a target

If you have decided to set up a budget, then there must be a reason. Are you looking to save for an upcoming event? Or maybe you have realised that you are struggling to make your payments every month and you would like to feel more financially secure. Based on what you would like to get out of your budget, you should set yourself a specific, measurable objective.

My first objective I set for myself was to save $100 every month for a year. This sort of objective is easy to manage and easy to monitor and this is what we are trying to achieve. One important thing I would mention here is to ensure your objective is achievable; don’t set yourself a target that is too far out of your reach, being realistic is extremely important.

How do you set up your budget?

The main key thing when you start to put your budget together is to make sure you’re as honest as possible. Get yourself a pen and some paper and on one page detail all of your income. Include the obvious and also remember to include any benefits you are entitled too. Then grab another piece of paper and detail all of your monthly outgoings, remember to be honest and thorough and try not to forget anything. Once you have both figures, deduct your expenditure from your monthly income that will give you your monthly figure.

You have some extra cash?

If when you have your figure you realise that there is some cash left over, you can then decide what you want to do with it. My advice here depends on your own personal circumstances, for example if you have high levels of debt, your main aim should be tackle your high interest debt aggressively and as often as possible.

If you have some money left over and your aim is to save, then set up an interest bearing bank account. If you are based in the US then you could look to set up an LSA or lifetime savers account. In the UK we have the equivalent, that is called a cash ISA saving account.

No money left over?

If after working out your budget you find you have no money left over, then you need to do something about it. Debt is one of those things that won’t just disappear overnight; it’s something that takes time and commitment, but not giving up is paramount.

How to cut down your expenditures?

One of the main things you can do when you realise you are in a bad situation is to try and cut down on your expenditure. Here’s a couple of quick ways:

A budget is used by many just to monitor what they spend month to month, but I hope I have detailed how it can be a helpful financial tool that can help you reach your financial goals. I hope my tips to budget successfully will help you get started on your way to financial freedom.

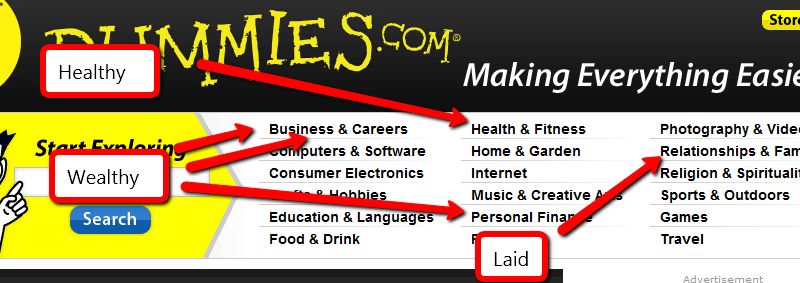

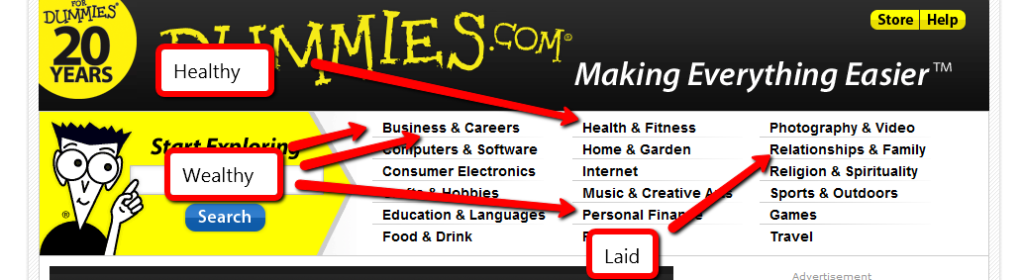

If you want to make money, help someone get healthy, wealthy or laid.

This section was quick.

Seriously, those three topics have been making people rich since the invention of rich. Knowing that isn’t enough. If you want to make some money in the health niche, are you going to help people lose weight, add muscle, relieve stress, or reduce the symptoms of some unpleasant medical condition? Those are called “sub-niches”. (Side question: Viagra is a sub-niche of which topic?)

Still not enough.

If you’re going to offer a product to help lose weight, does it revolve around diet, exercise, or both? For medical conditions, is it a way to soothe eczema, instructions for a diabetic diet, a cure for boils, or help with acne? Those are micro-niches.

That’s where you want to be. The “make money” niche is far too broad for anyone to effectively compete. The “make money online” sub-niche is still crazy. When you get to the “make money buying and selling websites” micro-niche, you’re in a territory that leaves room for competition, without costing thousands of dollars to get involved.

Remember that: The more narrowly you define your niche market, the easier it is to compete. You can take that too far. The “lose weight by eating nothing but onions, alfalfa, and imitation caramel sauce” micro-niche is probably too narrowly defined to have a market worth pursuing. You need a micro-niche with buyers, preferably a lot of them.

Now the hard part.

How do you find a niche with a lot of potential customers? Big companies pay millions of dollars every year to do that kind of market research.

Naturally, I recommend you spend millions of dollars on market research.

No?

Here’s the part where I make this entire series worth every penny you’ve paid. Times 10.

Steal the research.

My favorite source of niche market research to steal is http://www.dummies.com/. Click the link and notice all of the wonderful niches at the top of the page. Jon Wiley & Sons, Inc. spends millions of dollars to know what topics will be good sellers. They’ve been doing this a long time. Trust their work.

You don’t have to concentrate on the topics I’ve helpfully highlighted, but they will make it easier for you. Other niches can be profitable, too.

Golf is a great example. Golfers spend money to play the game. You don’t become a golfer without having some discretionary money to spend on it. I’d recommend against consumer electronics. There is a lot of competition for anything popular, and most of that is available for free. If you choose to promote some high-end gear using your Amazon affiliate link, you’re still only looking at a 3% commission.

I like to stick to topics that people “need” an answer for, and can find that answer in ebook form, since I will be promoting a specific product.

With that in mind, pick a topic, then click one of the links to the actual titles for sale. The “best selling titles” links are a gold mine. You can jump straight to the dummies store, if you’d like.

Of the topics above, here’s how I would narrow it down:

1. Business and Careers. The bestsellers here are Quickbooks and home buying. I’m not interested in either topic, so I’ll go into “More titles”. Here, the “urgent” niches look like job hunting and dealing with horrible coworkers. I’m also going to throw “writing copy” into the list because it’s something I have a hard time with.

2. Health and Fitness. My first thought was to do a site on diabetic cooking, but the cooking niche is too competitive. Childhood obesity, detox diets and back pain remedies strike me as worth pursuing. I’m leaning towards back pain, because I have a bad back. When you’ve thrown your back out, you’ve got nothing to do but lie on the couch and look for ways to make the pain stop. That’s urgency.

3. Personal Finance. The topics that look like good bets are foreclosures and bankruptcies. These are topics that can cost thousands of dollars if you get them wrong. I hate to promote a bankruptcy, but some people are out of choices. Foreclosure defense seems like a good choice. Losing your home comes with a sense of urgency, and helping people stay in their home makes me feel good.

4. Relationships and Family. Of these topics, divorce is probably a good seller. Dating advice definitely is. I’m not going to detail either one of those niches here. Divorce is depressing and sex, while fun, isn’t a topic I’m going to get into here. I try to be family friendly, most of the time. Weddings are great topic. Brides are planning to spend money and there’s no shortage of resources to promote.

So, the niches I’ve chosen are:

I won’t be building 9 niche sites in this series. From here, I’m going to explore effective keywords/search terms and good products to support. There’s no guarantee I’ll find a good product with an affiliate program for a niche I’ve chosen that has keywords that are both highly searched and low competition, so I’m giving myself alternatives.

For those of you following along at home, take some time to find 5-10 niches you’d be willing to promote.

The important things to consider are:

1. Does it make me feel dirty to promote it?

2. Will there be customers willing to spend money on it?

3. Will those customers have an urgent need to solve a problem?

I’ve built sites that ignore #3, and they don’t perform nearly as well as those that consider it. When I do niche sites, I promote a specific product. It’s pure affiliate marketing, so customers willing to spend money are necessarily my target audience.

Frugal cooking can be an intimidating concept. It’s easy to turn a meal into a huge expense, but it’s not that hard to trim your grocery budget without sacrificing variety and flavor. It just takes some planning and a few money-saving techniques. We usually feed our family of five, often with guests, for about $100 per week.

Schedule your meals. Find or make a weekly meal planner. I recommend this or this. Cross out the meals you don’t need to worry about due to your schedule that week. If you won’t be home, you don’t have to cook that meal. Fill in the meals in the remaining slots. Keep your schedule in mind. If you get home from work at 5:30 and have to be somewhere by 6:30, dinner needs to be something quick. Also, make sure you include every side dish you will be serving. Now, look at the recipe for each dish in every meal. Write down everything you need to make all of the food you plan to eat that week. While planning your meals, think about how to use your leftovers. If you cook chicken breasts one day, the leftovers can be chicken nuggets the next.

Take inventory. Take your meal plan and a pen while you look through all of your cabinets and your refrigerator. Why buy what you already have? If you already have steaks in the freezer, don’t waste your money buying more. If you have it, cross it off of your meal plan shopping list. Whatever is left is your shopping list. Review it. Is there anything that can be combined or eliminated? Is there a key ingredient for a sauce that’s missing?

Don’t forget the staples. If flour or sugar is on sale, stock up. Anything you use on a regular basis is a staple, buy it when it’s cheap.

Build a shopping list from your meal plan. When you are in the store, stick to your list. It’s hard, but avoid impulse purchases at all costs. Don’t shop hungry, don’t buy things just because they are on sale, and don’t dawdle. Get what you need and get out.

Avoid pre-processed food. We slice and shred our own cheese. Buying the pre-shredded cheese costs an extra $5 and saves just 5 minutes. Don’t buy pre-sliced apples or anything that will only save a few minutes for several dollars of cost.

Every couple of weeks, I cook a large pot of either beans or rice and keep it in the refrigerator. Almost every meal that we cook gets a cup or two of beans or rice added to it. It doesn’t alter the flavor much, but it adds a few extra servings for pennies. It’s a healthy way to stretch any meal on the cheap.

We have a large bowl in the refrigerator filled with mixed greens. We buy whatever salad-like greens are on sale and prepare the large salad all at once. Most meals start with a salad, which makes it easier to fill up without relying on the protein dish, which is generally the most expensive part of a meal. As a dedicated meat-eater, it took some getting used to, but it’s a good meal–cheap and healthy.

Cook enough for at least 3 meals. That will eliminate 2/3 of the work involved in cooking. Plan ahead to make your meals simple and easy.

Freeze the leftovers in usable sizes. Stock up on semi-disposable meal-sized containers. Freeze some in single-serving sizes for work, and others in family-size servings for last minute meals at home. Preparing for last minute meals keeps you from serving garbage or takeout when life gets in the way of your plans.

Avoid wasting leftovers. Wasted food is wasted money.

When you are done cooking meat, take any drippings or scraps and throw them into the slow-cooker along with any vegetable scraps laying around. Cook it overnight, then strain it into an ice cube tray. You now have stock/broth ready to be added to any recipe.

Plan for serial meals. Chicken breast leftover from today’s meal can become chicken nuggets tomorrow, to be shredded into chicken salad the next day.

When there isn’t enough left for a full serving, we put the remains in a resealable bag in the freezer. When we accumulate enough to fill our slow-cooker, we dump in all of the bags with a couple cups of water. I look through the refrigerator for any leftovers that have been overlooked that week or any vegetables getting close to being too old. It all gets cut up and added to the cooker to cook on low all day. I rarely add seasoning because everything going in the pot tastes good. We never get the same meal twice and our “free soup” is never bland.

That’s how we cook cheap, without sacrificing too much time. How do you save money cooking?

This post is a blast from the past. Originally posted here in January 2010.