- Getting ready to go build a rain gauge at home depot with the kids. #

- RT @hughdeburgh: "Having children makes you no more a parent than having a piano makes you a pianist." ~ Michael Levine #

- RT @wisebread: Wow! Major food recall that touches so many pantry items. Check your cupboards NOW! http://bit.ly/c5wJh6 #

- Baby just said "coffin" for the first time. #feelingaddams #

- @TheLeanTimes I have an awesome recipe for pizza dough…at home. We make it once per week. I'll share later. in reply to TheLeanTimes #

- RT @bargainr: 9 minute, well-reasoned video on why we should repeal marijuana prohibition by Judge Jim Gray http://bit.ly/cKNYkQ plz watch #

- RT @jdroth: Brilliant post from Trent at The Simple Dollar: http://bit.ly/c6BWMs — All about dreams and why we don't pursue them. #

- Pizza dough: add garlic powder and Ital. Seasoning http://tweetphoto.com/13861829 #

- @TheLeanTimes: Pizza dough: add lots of garlic powder and Ital. Seasoning to this: http://tweetphoto.com/13861829 #

- RT @flexo: "Genesis. Exorcist. Leviathan. Deu… The Right Thing…" #

- @TheLeanTimes Once, for at least 3 hours. Knead it hard and use more garlic powder tha you think you need. 🙂 in reply to TheLeanTimes #

- Google is now hosting Popular Science archives. http://su.pr/1bMs77 #

- RT @wisebread 6 Slick Tools to Save Money on Car Repairs http://bit.ly/cUbjZG #

- @BudgetsAreSexy I filed federal last week, haven't bothered filing state, yet. Guess which one is paying me and which one wants more money. in reply to BudgetsAreSexy #

- RT @ChristianPF is giving away a Lifetime Membership to Dave Ramsey’s Financial Peace University! RT to enter to win… http://su.pr/2lEXIT #

- RT @MoneyCrashers: 4 Reasons To Choose Community College Out Of High School. http://ow.ly/16MoNX #

- RT @hughdeburgh:"When it comes to a happy marriage,sex is cornerstone content.Its what separates spouses from friends." SimpleMarriage.net #

- RT @tferriss: So true. "Nearly all men can stand adversity, but if you want to test a man's character, give him power." – Abraham Lincoln #

- RT @hughdeburgh: "The most important thing that parents can teach their children is how to get along without them." ~ Frank A. Clark #

Pros and Cons of Cashback Credit Cards

The news that the Bank of America is introducing a cashback credit card is of little surprise. The credit card industry is competitive and customers enjoy the thought of earning while they are spending!

There are both pros and cons of cashback credit cards however and they are not suitable for every circumstance. So, before committing to a card, consider the advantages and disadvantages.

Firstly, cashback cards can be financially profitable but this depends on whether you have the funds to make the repayments. If you are having difficulties with debt, these cards are probably not the most suitable.

The strategies for maximizing your benefits from cashback credit cards depend on making repayment deadlines. Prioritize cards that have a 0% APR introductory rate.

If you can make your repayments within this 0% interest rate, or on time each month, you will not incur any interest charges. It is important to be organized so that you always meet repayment dates.

Once the 0% APR has finished, cashback credit cards will often then revert to a high APR. If you cannot pay all your debt, these charges will mount up quickly.

If this is likely to happen to you, consider looking at alternative cards with a low but constant APR, so that you do not encounter such high charges while repaying your debt.

Cashback cards are not always the smartest move financially when it comes to outstanding debt. Although they may offer a 0% balance transfer, this is not always as simple as it sounds.

If you transfer an outstanding balance to a new card, even with a 0% APR introductory period, any repayments made will be charged against your newest purchases.

This means that it is more difficult to pay off the original balance transfer if you are also using the card to purchase new items and of course, it is very tempting to do so as you have the 0% APR available.

Be aware that if you do not pay the balance transfer amount by the end of the 0% period, you will then have to pay a much higher rate on this amount.

So you either need to be sure that you can pay off the balance transfer in full in addition to new purchases or consider using a separate card just for a balance transfer.

Although this may seem more work, it can potentially save you a great deal of money in interest charges. Remember any credit card is only worthwhile if it helps you manage your money.

Some cashback cards also have a minimum spend requirement and often this is paired with a specific time frame. Read all the criteria about the card before committing to it.

Otherwise, you could be charged for not reaching the minimum spend limit or not doing so within the required time frame. Consider these issues when choosing a card.

Cashback cards can be very useful and allow you to earn money while you are spending, but they need to be used with wisdom. Research your options to ensure you select the right card for you.

Post by MoneySupermarket.

Why I Hate Payday Loans

I hate payday loans and payday lenders.

The way a way a payday loan works is that you go into a payday lender and you sign a check for the amount you want to borrow, plus their fee. They give you money that you don’t have to pay back until payday. It’s generally a two-week loan.

Now, this two week loan comes with a fee, so if you want to borrow $100, they’ll charge you a $25 fee, plus a percent of the total loan, so for that $100 loan, you’ll have to pay back $128.28.

That’s only 28% of actual interest; that’s not terrible. However, if you prorate that to figure the APR, which is what everyone means when they say “I’ve got a 7% interest rate”, it comes out to 737%. That’s nuts.

They are a very bad financial plan.

Those loans may save you from an overdraft fee, but they’ll cost almost as much as an overdraft fee, and the way they are rigged–with high fees, due on payday–you’re more likely to need another one soon. They are structured to keep you from ever getting out from under the payday loan cycle.

For those reasons, I consider payday loan companies to be slimy. Look at any of their sites. Almost none are upfront about the total cost of the loan.

So I don’t take their ads. When an advertiser contacts me, my rate sheet says very clealy that I will not take payday loan ads. The reason for that is–in my mind–when I accept an advertiser, I am–in some form–endorsing that company, or at least, I am agreeing that they are a legitimate business and I am helping them conduct that business.

In all of the time I’ve been taking ads, I’ve made exactly one exception to that rule. On the front page of that advertiser’s website, they had the prorated APR in bright, bold red letters. It was still a really bad deal, but with that level of disclosure, I felt comfortable that nobody would click through and sign up without knowing what they were getting into. That was a payday lender with integrity, as oxymoronic as that sounds.

Huh?

Am I the only one who just noticed that it’s Wednesday? The holiday week with the free day is completely screwing me up.

Just to make this a relevant post:

Spend less!

Save more!

Invest!

Wee!

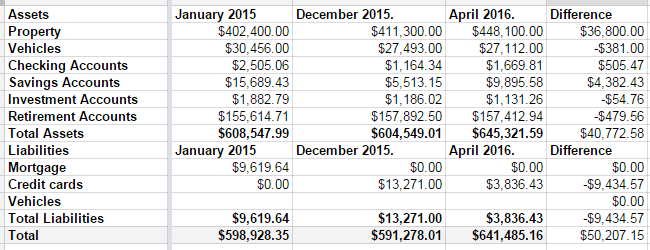

Net Worth, April 2016

Last year wasn’t a good year for my net worth. It came with a $7000 drop.

Q1 2016, however, was a great quarter.

In December, we had $13,271 in credit card debt. At the time I took this screenshot, it was down to $3836.43. As of this moment, it’s down to $2640.91. If things go as expected this week, I should wake up on Friday to a paid-off credit card. I had to raid some of our savings accounts to make it happen, but it’s happening. Some of it was a tax refund, some of it was the fact that my mortgage payment went away in December.

That’s seven years of hard work, almost to the day. Seven years ago, I was researching bankruptcy, and stumbled across Dave Ramsey. Seven years ago, we were drowning in debt.

Next week, we’re free. No more debt, hanging over our heads. We’re free to take vacations. We’re free to finally save for college, when my son is 16, and stand a chance of being able to pay for it for him. We’re free to do…whatever we want to do. Our monthly nut after the debt is paid–only in fall/winter/spring when my wife is working–is roughly 1/3 of our take-home pay.

That’s how hard we’ve cut to make sure we can pay our bills and make debt die. We do have some things that would be considered extravagant. We’re not savages. But my car is 10 years old. My wife’s is 7. My motorcycles are 35 and 30; one of them was purchased before we cared about our debt.

Back to the net worth….

The biggest change came from our property values, which sucks. That was $36,000 of the difference, which comes with the painful tax bump to go with it. A large chunk of the savings increase was the money we set aside every month to cover the property tax bill, and that will go away next month.

Still, $641,000 dollars is a long way from nothing. I’m pretty happy.

The Secret to Fearless Change

Put one foot in front of the other

And soon you’ll be walking cross the floor

Put one foot in front of the other

And soon you’ll be walking out the door

You never will get where you’re going

If you never get up on your feet

Come on, there’s a good tail wind blowing

A fast walking man is hard to beat

Put one foot in front of the other

And soon you’ll be walking cross the floor

Put one foot in front of the other

And soon you’ll be walking out the door

If you want to change your direction

If your time of life is at hand

Well don’t be the rule be the exception

A good way to start is to stand

Put one foot in front of the other

And soon you’ll be walking cross the floor

Put one foot in front of the other

And soon you’ll be walking out the door

If I want to change the reflection

I see in the mirror each morn

You mean that it’s just my election

To vote for a chance to be reborn