- @Elle_CM Natalie's raid looked like it was filmed with a strobe light. Lame CGI in reply to Elle_CM #

- I want to get a toto portable bidet and a roomba. Combine them and I'll have outsourced some of the least tasteful parts of my day. #

- RT @freefrombroke: RT @moneybeagle: New Blog Post: Money Hacks Carnival #115 http://goo.gl/fb/AqhWf #

- TED.com: The neurons that shaped civilization. http://su.pr/2Qv4Ay #

- Last night, fell in the driveway: twisted ankle and skinned knee. Today, fell down the stairs: bruise makes sitting hurt. Bad morning. #

- RT @FrugalDad: And to moms, please be more selective about the creeps you let around your child. Takes a special guy to be a dad to another' #

- First Rule of Blogging: Don't let real life get in the way. Epic fail 2 Fridays in a row. But the garage sale is going well. #

Do 1 Thing

- Image by Sailing “Footprints: Real to Reel” (Ronn ashore) via Flickr

I’m lazy.

Really, I am. When I get home from work, I want nothing more than to plop down on the couch, dial up a movie and ignore the world for a few hours. I need some downtime to relax.

While I am keeping the couch from flying away, my wife gets home, makes dinner, does the dishes, changes the cat litter and maybe vacuums the floor. Once dinner is cooking, she usually throws in a load of laundry. Three kids is a great way to guarantee a lot of laundry needs to get washed.

I have just two things to say about that:

- It makes me feel really lazy.

- I love you, honey!

I’ve never considered it a problem because I work my butt off on the weekend. My wife isn’t happy with the arrangement because I tend to do next to nothing during the week. I think it’s a good balance. I’m productive on the weekend, she’s productive during the week. Unfortunately, my habitual laziness has caused a bit of tension. We’ve had a few “discussions” about that balance. It’s obviously not working.

Over the past few weeks, I’ve been trying something new. When I get home from work I’ve been doing just 1 thing. I do one thing per day. One day, I fold laundry, another day I do the dishes. Some days, I pick a room to organize. It’s never very much, but it’s always something that needs to be done and, possibly most important, it looks like I’m doing more so my wife feels less abandoned to the housework. I’m not actually doing more, but it gets spread out over the week, so it looks like more. Slowly, surely, all of the work is getting done.

It’s not a perfect solution, but it seems to be working. More is getting done, my wife feels like I’m helping out more and I get more time on the weekends to pursue whatever I feel like pursuing. It’s a win for each of us.

How do you balance relaxation and a shared workload?

Net Worth Update

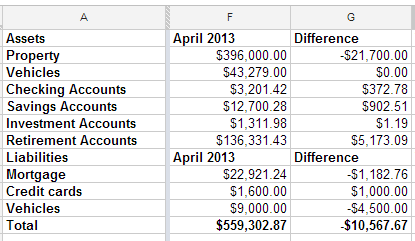

I looked back at the spreadsheet I use to track my net worth, and realized that I have been filling it out quarterly, though I can’t say that has been on purpose. Apparently, I get an itch to see my score about four times per year.

This quarter is the first time in a long time that my net worth has dropped. We got our property tax statements last week and found out that our houses have dropped a combined $21,700. Since we’re not planning to sell, that doesn’t matter much.

What’s interesting to me is that, even though our property values dropped $21,700, our total net worth only fell $10,567. We’ve been hustling trying to get the Tahoe paid off. It’s going a little bit slower than I had hoped, but it’s progressing nicely.

I do feel good that, even if I would have been focusing on my mortgage, I still would have lost the mortgage race. That means my misplaced priorities of acquiring more debt to snatch a fantastic deal didn’t cost me the race. Now, I’ll be forced to take a vacation in Texas, coincidentally in the same town as my wife’s long lost brother. I think we can make that work.

I rounded off the credit card and vehicle totals because one is used every day and paid off every month and the other has a steady stream of money getting thrown at it, so the numbers change often.

All in all, I don’t have any room to complain. I am looking forward to paying off the truck and focusing on the mortgage. We could swing quadruple payments, which would pay off the house shortly after the new year starts.

Saturday Roundup

- Image via Wikipedia

Congratulations to Claudia for winning the $100 Amazon gift card.

This week started with my wife getting sick and ended with her passing it on to me. I hate being sick.

On a positive note, Tron is out this week, and is on IMAX 3D at a theater near me. I get to share a piece of my childhood with my son this afternoon.

Best Posts

When a guy named Dragon says, “Hold my beer a second,” you know something badass is about to happen.

Michael Moore’s Cuban healthcare lies propaganda is too much even for Cuba. Apparently, they are afraid the proles would revolt if they saw how good the ruling class has it in comparison to the 150-year-old rat-hole hospital the peasants are forced to use. But hey, it’s free!

I could think of worse ways to get laws passed than Last Man Standing. It would at least put a stop to frivolous crap that hurts everyone.

I had an eBay seller try to screw me once. I had access to a number of skiptracing tools at the time. When I sent him his phone number, his girlfriend’s phone number, his parents’ phone number, his place of employment, and all of those address, I got my refund the next day.

ChristianPF has a post on buying bulk herbs and spices. Not all spices can be stored for long, even in the freezer.

LRN Timewarp

This is where I revisit the posts I wrote a year ago.

4 Ways to Flog Your Inner Impulse Shopper was my first bondage-themed post. I still smile when I re-read it.

My post on cheap birthday parties is something I need to read every year. The party this fall wasn’t nearly as cheap as it has been in recent years.

And finally, my Grinch post on saving money on Christmas. My secret: buy less for fewer people.

Carnivals I’ve Rocked

First Steps – Ramsey Was Wrong was included in the Carnival of Personal Finance.

A Moment of Clarity was included in the Carnival of Money Stories.

Top 7 Reasons To Trade Forex Over Other Financial Instruments was included in the Festival of Frugality.

Thank you! If I missed anyone, please let me know.

Is It Time For a New Car?

So far this summer, we’ve sold a 1984 Cadillac, a 1994 Mercury Sable, and a 1976 Lincoln Continental.

That’s most of the vehicles we inherited in April.

Now, we’ve got a 2005 Chrysler Pacifica, a 2001 Ford F150, a 2009 Dodge Caliber, and a 1986 Honda Shadow.

According to Kelly Blue Book, the Caliber has a resale value of $10,065 and a trade-in value of $8470.

The F150 is worth $6,418/4,923.

The Pacifica is worth $7,738/$6,093.

The bike is worth about $1,500.

We own all of them, free and clear, right now.

With our current situation, the F150 and the Caliber aren’t working. We have 3 kids. The oldest is 12 and pushing 6 feet tall. He barely fits in the backseat of either and is forced to wedge himself against a car seat if we take either of these vehicles anywhere. Even the front seats don’t have a lot of leg room, and I’m not exactly short or small.

We are also a popular place to hang out and almost always have an extra kid or two on the weekends. Right now, that means we take two cars if we have to go somewhere.

On top of that, my girls ride in a saddle club on borrowed horses. We are planning to buy a horse trailer and (shudder) lease a couple of ponies next summer.

So, our requirements are:

- Seat 7-8 people

- Full-sized 3rd row

- Towing capacity of at least 5000 pounds

- More than 20mpg highway

- Comfortable front seat

Based on our initial research, the Chevy Traverse meets our needs. Depending on the configuration, it seats 7 or 8 people with a full-sized 3rd row, has a 5200 pound towing capacity, and is rated for 24 mpg on the highway. Locally, there is a 2010 model with 50,000 miles for $19,000, which is dead-on with blue book. For another $1500, we can make it all wheel drive and 2011, which is below blue book. Consumer reports rates it pretty high, but Edmunds has some mixed reviews.

We should be able to sell the F150 and the Caliber for $12-13,000. That only leaves about $6,000 left, which we should have after the remodel on our rental property. I’m almost positive we’ll pull the trigger on a new car in the next month or two.

What do you think? Am I missing anything? Any experience with a Traverse? Have a better idea for something that meets our needs? Please leave a comment and help me out.

A Look Back

I’m on vacation this week and thought it would be nice to post a look back at some of my early posts. These posts are some of my favorites, but were written when there were only 3 or 4 of you paying attention.

Since I know you don’t want to miss anything, here are 5 of my favorite early posts, in no particular order:

1. Cthulhu’s Guide to Finance. I’m more than a bit of a horror geek. Books, movies, or games; all keep me entertained. Over the weekend, I taught my Mom how to play Zombie Fluxx and Gloom. When Cthulhu approached me about writing a guest post, I couldn’t refuse.

2. Birthday Parties Are Evil. It’s hard to remember to be cheap when your little girl is asking for a bowling party. It can run $200 to get a dozen kids an hour of bowling and a bit of pizza.

3. No Brakes. This is a post about why I had a hard time coming to grips with financial responsibility.

4. 4 Ways to Flog the Inner Impulse Shopper. Who can’t love a BDSM-themed personal finance post? Every blog needs a dominatrix mascot, right?

5. Fighting Evil by Phone. In which I share the method of convincing Big Nasty Telephone Company and their Contracted, Soulless Long Distance Provider to leave me the heck alone and stop demanding $800 they refused to admit was their mistake.