What would your future-you have to say to you?

The no-pants guide to spending, saving, and thriving in the real world.

What would your future-you have to say to you?

In April, my wife and I decided that debt was done. We have hopefully closed that chapter in our lives. I borrowed, then purchased, The Total Money Makeover by Dave Ramsey.  budget” width=”300″ height=”213″ />We are almost following his baby steps. Our credit has always been spectacular, but we used it a lot. Our financial plan is Dave Ramsey’s The Total Money Makeover, with some adjustments.

budget” width=”300″ height=”213″ />We are almost following his baby steps. Our credit has always been spectacular, but we used it a lot. Our financial plan is Dave Ramsey’s The Total Money Makeover, with some adjustments.

The budget was painful, and for the first couple of months, impossible. We had no idea what bills were coming due. There were quarterly payments for the garbage bill and annual payments for the auto club. It was all a surprise. Surprises are setbacks in a budget.

When something came up, we’d start budgeting for it, but stuff kept coming up. We’re not on top of all of it, yet, but we are so much closer. We’ve got a virtual envelope system for groceries, auto maintenance, baby needs(we have two in diapers) and some discretionary money. We set aside money for everything that isn’t a monthly expense, and have a line item for everything that is. My wife is eligible for overtime and monthly bonuses. That money does not get budgeted. It’s all extra and goes straight on to debt, or to play catch-up with the bills we had previously missed. I figure it will take a full year to get all of the non-monthly expenses in the budget and caught up.

Ramsey recommends $1000, adjusted for your situation. I decided $1000 wasn’t enough. That isn’t even a month’s worth of expenses. We settled on $1800, plus $25/month. It’s still not enough, but it’s better. Hopefully, we’ll be able to ignore it long enough that the $25/month accrues to something worthwhile.

This is the controversial bad math. Pay off the lowest balance accounts first, then take those payments and apply them to the higher balance accounts. Emotionally, it’s been wonderful. We paid off the first credit card in a couple of weeks, followed 6 weeks later by my student loan. Since April, we’ve dropped nearly $10,000 and we haven’t made huge cuts to our standard of living. At least monthly, we re-examine our expenses to see what else can be cut.

We aren’t on this step yet. In step 2, we are consistently depositing more, making us more secure every month.

I have not stopped my auto-deposited contribution. It’s stupid to pass up an employer match. My wife’s company does not match, so she is currently not contributing.

We have started a $10 College fund.

I don’t see the point in handling this one separately. Our mortgage is debt, and when the other debts are paid, we will be less than a year from owning our house, free and clear. This is rolled in with step three. All debt is going away, immediately.

We have cut off most of our charitable giving. Every other year, it has been a significant percent of our income, and in a few more years, will be so again. The only exception to this is children knocking on the door for fundraisers. I have no problems with saying no to a parent fundraising for their kid, but when the kids is doing the work, door-to-door, especially in the winter, I buy something. My son’s school, on the other hand, gets fundraisers ignored. When they come home, I send a check to the school, ignoring the program. I bypass the overhead and make a direct donation.

I spent most of last week at the Financial Blogger Conference, or FINCON.

First, since this is a personal finance blog, here is what it cost:

Hotel: $695.75 – I paid $119 per night, plus taxes and fees. The travel rewards on my credit card will be making this go away.

Airfare: $211.80 – I bought early and live next to a Delta hub airport. This will also be getting erased by my credit card rewards.

Ticket: $175.84 – I got a $25 discount for being a repeat attendee and I paid an extra $99 for the Bootcamp extension, which was 2 extra days that–alone–made the whole trip worthwhile.

Food: $203.53 – This includes a $90 splurge meal at Ruth’s Chris, which I was looking forward to for months before the conference.

Other – $113 – I brought $183 in cash with me. This was used for some meals not included above, cab fare, and tips for bartenders, housekeeping, and the concierge. I always tip a bartender, even if it’s an open bar. It guarantees fast service and full-strength drinks all night.

Total cost: $1399.92

Total after credit card reimbursement: $492.37

Now for the important part: Was it worth it?

Yes.

The Bootcamp was a fantastic time to meet–and actually get to know–other bloggers. There were only 50 of us, instead of 500 at the main event, so we were able to break into small groups and brainstorm useful projects and activities. I learned more about podcasting than I ever had before and I got a chance to share some of what I know about SEO and managing virtual assistants. In the larger sessions, questions are rushed and people are shy.

I got to beat up on my comfort zones.

I presented some awards with Crystal at the Plutus Awards ceremony, which means cracking jokes about Canadians in front of 500 people who don’t know me. I regularly stand and teach 30-50 people, but that’s always a warm crowd on a topic I know extremely well. This was new for me.

I sang anatomically explicit songs to strangers during the Bootcamp karaoke night. Selections were from Monty Python, DaVinci’s Notebook, and Denis Leary.

I was on a panel, by surprise. I was asked to be available if I were needed for questions, then got dragged to the front of the room for the entire session. I would do that again.

That’s 3 things that were all well outside of my comfort zone, but I’m happy I did them. I don’t believe in not doing something simply because I’m afraid to do it.

Random gatherings are fun.

From people stopping by our staked-out territory in the lobby, to a surprise game of Cards Against Humanity in the lobby bar with Joe and Len to having a discussion about the meaning of “No” when you’ve got a pre-determined safeword, it was a good week.

The last 5 days were easily the most extroverted days I’ve ever had. Since I didn’t force myself into any large groups for long periods of time, I never felt drained like I often do in similar situations. It’s good to find a balance that let’s me meet and connect with other without exhausting myself. I am seriously an off-the-charts introvert, even if I’m not even a little bit shy.

FINCON was totally worth it. I was excited to go, and I’m excited to start acting on what I’ve learned, including being a part of a new mastermind group, with the awesomest lounge lizards in the PF world.

My financial life right now is boooring.

And that’s a good thing.

When I started this site I was $90,000 in debt, and considering bankruptcy. I’d just started on the Dave Ramsey plan and was looking for every possible way to scrape up any extra money I could.

Now, the debt is nearly gone.

Our credit card is almost paid off every month. There’s occasionally some overlap between our auto-payment and our charges. And sometimes the budgeted auto-payment doesn’t match the reality of our spending and I don’t notice for a week or two. Except for the end of last year, but that’s a post for another day.

The short version is: We’re doing well, and we’re nearing the end of our financial problems.

Our scheduled mortgage over-payments will have it completely paid off in October. Then we are debt-free and can hopefully manage to live the rest of our lives without paying interest on money that isn’t earning us more than we are paying. For example, I’m willing to take out a mortgage to buy another rental property, but I’m going to wait to do that until our current mortgage is paid and we have a substantial down payment ready.

No debt.

I’m not kidding when I say it’s been a long 6 years of fighting our debt. Counting a car loan we got and paid early, we’ve paid more than $110,000 of debt in six years.

I’ve run side businesses, aggressively negotiated raises, and left companies(voluntarily and otherwise) for better pay & benefits.

I’ve watched friends and family take vacations around the world.

I’ve turned my kids down for so many things that I would love to buy them, but couldn’t because being financially secure is a much higher priority than spoiling children. Try explaining that to a 6 year old.

And now, the debt-ridden part of our financial journey is almost over. Finally.

So what’s next?

I have no idea. I’d like to travel more. Linda and the girls want us to move to a hobby farm and get horses. We want more rental properties.

Whatever “next” is, it will be done from a position of strength that won’t destroy our financial world or put out futures at risk.

This is a guest post written by Jason Larkins. He writes at WorkSaveLive – a blog he started to help people change the way they think about their finances, careers, and lives.

Who doesn’t like to buy stuff?

Okay…I’m sure there are a few of you out there that take pride in never buying a new “toy,” but I know personally that I LOVE stuff!

Not to the point that I make dumb financial decisions that jeopardizes my family’s financial well-being, but I do have that natural American desire to have nice things and to be able to do fun stuff!

If you’re in the market to buy a Big-Ticket item (i.e. a new car, TV, or other technology gadget), what are some of the things you should be thinking through as you contemplate making the purchase?

The first mistake people make is buying on impulse. The massive majority of Americans don’t even have a thought process when it comes to buying toys, so that’s why I decided to dedicate a post on a few things you should ponder.

1. Avoid spending extra for add-ons, or features, that you’re never going to use.

It is easy to get an appliance or technology gadget that has a ton of amazing features on it – but why pay for them if you won’t use them?

Consider buying the item that may be a step below what you’re looking at.

I know that I personally love the thought of having an Ipad 2, but am I really going to utilize it to it’s full capabilities?

Probably not!

It doesn’t mean I shouldn’t have one, but it does mean I can look at the older Ipad and save some money. Or, I can avoid the purchase altogether if I don’t think it’s going to be worth the money.

2. Be cautious with offers such as “no money down,” “90 days same as cash,” or “12 months interest free.”

Nearly 88% of the “90 days same as cash” offers are actually converted to payments because the purchaser couldn’t pay off the bill before the offer was up.

3. Don’t buy it just because it’s the cheapest.

Always be sure to do research prior to your purchase – check consumer reviews and product reviews. Saving money may not be worth it if the product breaks down quickly or doesn’t have the functionality that you’re looking for.

1. Prepare for large purchases and pay cash for them.

If you can’t pay cash for the item, then there is a good chance that you can’t afford it.

Determine how much money you will need to spend on a particular item and save up for it! This is going to help you in a couple of ways:

2. Buy at the end of the month, or at the end of the year!

Consumers rarely think of this, but it’s important for you to know that every store (and store manager) has monthly/yearly sales to report.

If they’re wanting to close out the month/year strong, they’re much more inclined to offer you a deal on whatever you’re buying!

3. Avoid the extended warranty!

Insurance (in general terms) is the act of transferring risk – the more people that pool money together to help mitigate risk (buy insurance), then the lower the cost of the insurance becomes.

The reason to avoid the extended warranties is because the cost you’re paying to cover your item also includes: commissions paid to the retail store, overhead for the insurance company (wages for employees, building costs, utilities, etc), and some profit for the insurance company as well.

Sure, you may be in the miniscule percentage of buyers that has their item break down on them, but the reality is that it’s unlikely.

If it was likely for your item to break down, then the insurance wouldn’t be available because it wouldn’t be a profitable endeavor for the insurance company (and they’d be out of business).

Whenever you’re buying something that has a large price tag, you should develop a process that you think through before buying it!

Always pay in cash, get a deal, and make sure you actually need everything you’re paying for.

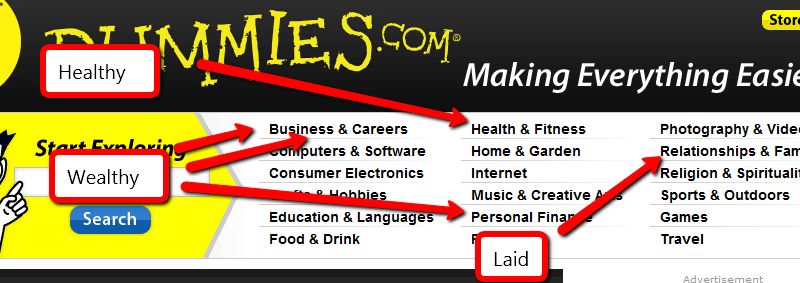

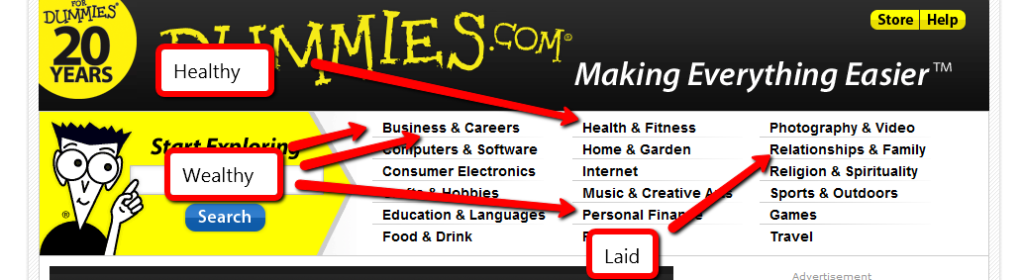

If you want to make money, help someone get healthy, wealthy or laid.

This section was quick.

Seriously, those three topics have been making people rich since the invention of rich. Knowing that isn’t enough. If you want to make some money in the health niche, are you going to help people lose weight, add muscle, relieve stress, or reduce the symptoms of some unpleasant medical condition? Those are called “sub-niches”. (Side question: Viagra is a sub-niche of which topic?)

Still not enough.

If you’re going to offer a product to help lose weight, does it revolve around diet, exercise, or both? For medical conditions, is it a way to soothe eczema, instructions for a diabetic diet, a cure for boils, or help with acne? Those are micro-niches.

That’s where you want to be. The “make money” niche is far too broad for anyone to effectively compete. The “make money online” sub-niche is still crazy. When you get to the “make money buying and selling websites” micro-niche, you’re in a territory that leaves room for competition, without costing thousands of dollars to get involved.

Remember that: The more narrowly you define your niche market, the easier it is to compete. You can take that too far. The “lose weight by eating nothing but onions, alfalfa, and imitation caramel sauce” micro-niche is probably too narrowly defined to have a market worth pursuing. You need a micro-niche with buyers, preferably a lot of them.

Now the hard part.

How do you find a niche with a lot of potential customers? Big companies pay millions of dollars every year to do that kind of market research.

Naturally, I recommend you spend millions of dollars on market research.

No?

Here’s the part where I make this entire series worth every penny you’ve paid. Times 10.

Steal the research.

My favorite source of niche market research to steal is http://www.dummies.com/. Click the link and notice all of the wonderful niches at the top of the page. Jon Wiley & Sons, Inc. spends millions of dollars to know what topics will be good sellers. They’ve been doing this a long time. Trust their work.

You don’t have to concentrate on the topics I’ve helpfully highlighted, but they will make it easier for you. Other niches can be profitable, too.

Golf is a great example. Golfers spend money to play the game. You don’t become a golfer without having some discretionary money to spend on it. I’d recommend against consumer electronics. There is a lot of competition for anything popular, and most of that is available for free. If you choose to promote some high-end gear using your Amazon affiliate link, you’re still only looking at a 3% commission.

I like to stick to topics that people “need” an answer for, and can find that answer in ebook form, since I will be promoting a specific product.

With that in mind, pick a topic, then click one of the links to the actual titles for sale. The “best selling titles” links are a gold mine. You can jump straight to the dummies store, if you’d like.

Of the topics above, here’s how I would narrow it down:

1. Business and Careers. The bestsellers here are Quickbooks and home buying. I’m not interested in either topic, so I’ll go into “More titles”. Here, the “urgent” niches look like job hunting and dealing with horrible coworkers. I’m also going to throw “writing copy” into the list because it’s something I have a hard time with.

2. Health and Fitness. My first thought was to do a site on diabetic cooking, but the cooking niche is too competitive. Childhood obesity, detox diets and back pain remedies strike me as worth pursuing. I’m leaning towards back pain, because I have a bad back. When you’ve thrown your back out, you’ve got nothing to do but lie on the couch and look for ways to make the pain stop. That’s urgency.

3. Personal Finance. The topics that look like good bets are foreclosures and bankruptcies. These are topics that can cost thousands of dollars if you get them wrong. I hate to promote a bankruptcy, but some people are out of choices. Foreclosure defense seems like a good choice. Losing your home comes with a sense of urgency, and helping people stay in their home makes me feel good.

4. Relationships and Family. Of these topics, divorce is probably a good seller. Dating advice definitely is. I’m not going to detail either one of those niches here. Divorce is depressing and sex, while fun, isn’t a topic I’m going to get into here. I try to be family friendly, most of the time. Weddings are great topic. Brides are planning to spend money and there’s no shortage of resources to promote.

So, the niches I’ve chosen are:

I won’t be building 9 niche sites in this series. From here, I’m going to explore effective keywords/search terms and good products to support. There’s no guarantee I’ll find a good product with an affiliate program for a niche I’ve chosen that has keywords that are both highly searched and low competition, so I’m giving myself alternatives.

For those of you following along at home, take some time to find 5-10 niches you’d be willing to promote.

The important things to consider are:

1. Does it make me feel dirty to promote it?

2. Will there be customers willing to spend money on it?

3. Will those customers have an urgent need to solve a problem?

I’ve built sites that ignore #3, and they don’t perform nearly as well as those that consider it. When I do niche sites, I promote a specific product. It’s pure affiliate marketing, so customers willing to spend money are necessarily my target audience.