Please email me at:

Or use the form below.

[contact-form 1 “Contact form 1”]

The no-pants guide to spending, saving, and thriving in the real world.

For the past couple of years, my daughters have been riding in horse shows with a local saddle club. We’ve been lucky in that my wife’s cousin has let us borrow her horse for the shows, so costs have been minimal.

Unfortunately, that horse isn’t available this year. We knew that a few months ago, so the plan was to take a year off from the shows and focus on lessons, to get the girls some real skills. We found a great instructor at a stable about 30 miles from our house. Since we live less than two miles from the border of the biggest city in the state, that’s a comparatively short drive.

We pay her $200 per month for 1 lesson per week for both girls. They each get 30-45 minutes on the horse during each lesson.

Now that show season has started, the plan seems to have changed. The girls will be riding a different borrowed pony tomorrow. The shows cost about $50 for registration, lunch, and gas. Our club has 1 show per month, but my wife has assured me they’ll only be hitting three shows this season and limiting the number of events to keep the cost down.

The direct costs aren’t too bad, but there’s a problem with keeping-up-with-the-Joneses accessorizing. Vests and boots and helmets and belts and shirts, oh my.

I’d guess our costs for the summer will be $300 per month.

One thing we’ve been considering is buying a pony. We can get an older pony for around $500-1000. Older is good because they are calmer and slower. Boarding the thing will cost another $200 per month. We’ve been slowly accumulating the stuff to own a horse, so I’m guessing the “OMG, he let me buy a horse, now I need X” shopping bill will come to around $1500, but I’ll figure $2000 to be safe. We already have a trailer, a saddle, blankets, buddy-straps, combs, brushes, buckets, rakes, shovels, and I-bought-this-but-I-will-just-put-it-in-the-pile-of-horse-stuff-so-Jason-will-never-notice stuff. We’re certainly close to being ready to buy.

(FYI: If you’re starting from scratch, don’t think you’re going to get into horse ownership for less than $10,000 the first year, and that’s being a very efficient price-shopper.)

So we’re looking at $5400 for a horse, gear, and boarding the first year. If we cancel the lessons, by spring we’d have $2000 of that saved and most of the rest can be bought over time.

On the other hand, if we go that route, we’ll never save enough to buy the hobby farm we’re looking for.

Decisions, decisions. I should just buy a new motorcycle. Within a year, I win financially.

You know exactly how much you make, to the penny. You’ve listed all of your bills in a spreadsheet, including the annual payment for your membership to Save the Combat-Wombat. You know exactly how much is coming in and how much has to go out each month. Your income is more than your expenses, yet somehow, you still have more month than money.

What’s going on?

The short answer is that a budget is not enough.

A budget is not…

…a checkbook register. Do you track everything you spend? Are you busting your budget on $10 lattes or DVDs every few days? Is the take-out you have for lunch every day adding up to 3 times your food budget? Are you sure? If you don’t track what you spend, how do you know what you’ve actually spent? You have to keep track of what you are spending. Luckily there are ways to do this that don’t involve complex calculation, laborious systems or even proper math. The easy options include using cash for all of your discretionary spending(no money, no spendy!), rounding your spending up so you always have more money than you think you do, or even keeping your discretionary money is a separate debit account. That will let you keep your necessary expenses covered. You’ll just have to check your discretionary account’s balance often and always remember that sometimes, things take a few days to hit your bank.

…a debt repayment plan. You may know how much you have available, but if you aren’t exercising the discipline to pay down your debt and avoid using more debt, you not only won’t make progress, but you’ll continue to dig a deeper hole. Without properly managing the money going out, watching the money coming in is pointless.

…an alternative to responsible spending. Your budget may say you have $500 to spare every month, but does that mean you should blow it on smack instead of setting up an emergency fund? I realize most heroin addicts probably aren’t reading this, but dropping $500 at the bar or racetrack is just as wasteful if you don’t have your other finances in order. Take care of your future needs before you spend all of your money on present(and fleeting) pleasures.

A budget is a starting point for keeping your financial life organized and measuring a positive cash flow. By itself, it can’t help you. You need to follow it up with responsible planning and spending.

I just noticed this didn’t post on time.

There are a few ways to get more out of this site.

Live Real, Now by email. You get a choice between having all of the posts delivered to your inbox, or just occasional updates and deals. Both options get my Budget Lessons, free of charge.

RSS subscription. You can have every post delivered to your favorite newsreader.

Twitter. I’m @LiveRealNow. You can get my snark and pseudo-wisdom 140 characters at a time. Ooh!

Facebook. Everybody has a fan page, right?

Now, for the part you’ve all been waiting for…

This week’s roundup:

It’s time to buy school supplies again. Don’t let it break the bank.

Chewbacca on a squirrel, fighting Nazis.

A pizza peel with a conveyor belt. The pinnacle of pizza-making awesomeness.

Have you ever looked into the psychology of a restaurant menu?

Carnivals I’ve participated in:

Carnival of Personal Finance #267 at Beating Broke posted A Budget Isn’t Enough.

Wealth Informatics hosted the Festival of Frugality and posted Payday Loans Suck.

Canajun Finances hosted the Best of Money Carnival and posted Life Altering Lessons I Learned From My Debt.

This is a guest post written by Andreas Nicolaides, a financial author for UK based MoneySupermarket.com.

Whether your aim is to save money for a special occasion or you just want to make sure you don’t have to struggle financially when it comes to the end of the month, a budget can be a saving grace. Budgets help us quickly and easily identify our total income and all our expenditure, allowing us to plan for the best and prepare for the worst financial situations.

Set yourself a target

If you have decided to set up a budget, then there must be a reason. Are you looking to save for an upcoming event? Or maybe you have realised that you are struggling to make your payments every month and you would like to feel more financially secure. Based on what you would like to get out of your budget, you should set yourself a specific, measurable objective.

My first objective I set for myself was to save $100 every month for a year. This sort of objective is easy to manage and easy to monitor and this is what we are trying to achieve. One important thing I would mention here is to ensure your objective is achievable; don’t set yourself a target that is too far out of your reach, being realistic is extremely important.

How do you set up your budget?

The main key thing when you start to put your budget together is to make sure you’re as honest as possible. Get yourself a pen and some paper and on one page detail all of your income. Include the obvious and also remember to include any benefits you are entitled too. Then grab another piece of paper and detail all of your monthly outgoings, remember to be honest and thorough and try not to forget anything. Once you have both figures, deduct your expenditure from your monthly income that will give you your monthly figure.

You have some extra cash?

If when you have your figure you realise that there is some cash left over, you can then decide what you want to do with it. My advice here depends on your own personal circumstances, for example if you have high levels of debt, your main aim should be tackle your high interest debt aggressively and as often as possible.

If you have some money left over and your aim is to save, then set up an interest bearing bank account. If you are based in the US then you could look to set up an LSA or lifetime savers account. In the UK we have the equivalent, that is called a cash ISA saving account.

No money left over?

If after working out your budget you find you have no money left over, then you need to do something about it. Debt is one of those things that won’t just disappear overnight; it’s something that takes time and commitment, but not giving up is paramount.

How to cut down your expenditures?

One of the main things you can do when you realise you are in a bad situation is to try and cut down on your expenditure. Here’s a couple of quick ways:

A budget is used by many just to monitor what they spend month to month, but I hope I have detailed how it can be a helpful financial tool that can help you reach your financial goals. I hope my tips to budget successfully will help you get started on your way to financial freedom.

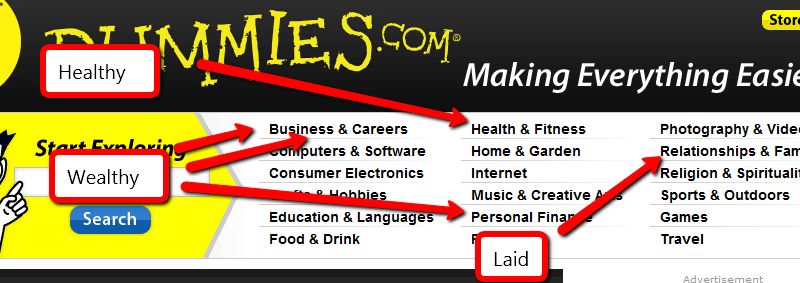

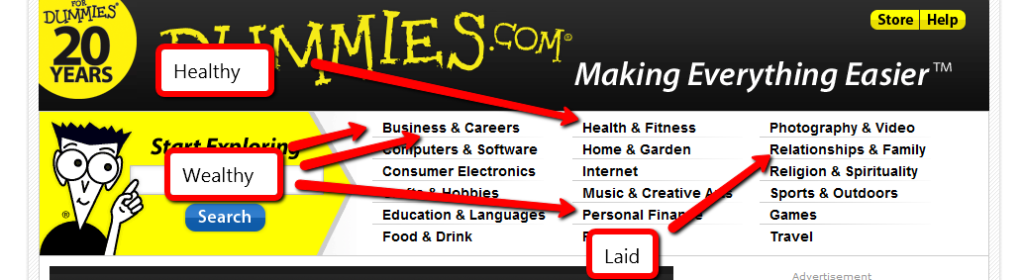

If you want to make money, help someone get healthy, wealthy or laid.

This section was quick.

Seriously, those three topics have been making people rich since the invention of rich. Knowing that isn’t enough. If you want to make some money in the health niche, are you going to help people lose weight, add muscle, relieve stress, or reduce the symptoms of some unpleasant medical condition? Those are called “sub-niches”. (Side question: Viagra is a sub-niche of which topic?)

Still not enough.

If you’re going to offer a product to help lose weight, does it revolve around diet, exercise, or both? For medical conditions, is it a way to soothe eczema, instructions for a diabetic diet, a cure for boils, or help with acne? Those are micro-niches.

That’s where you want to be. The “make money” niche is far too broad for anyone to effectively compete. The “make money online” sub-niche is still crazy. When you get to the “make money buying and selling websites” micro-niche, you’re in a territory that leaves room for competition, without costing thousands of dollars to get involved.

Remember that: The more narrowly you define your niche market, the easier it is to compete. You can take that too far. The “lose weight by eating nothing but onions, alfalfa, and imitation caramel sauce” micro-niche is probably too narrowly defined to have a market worth pursuing. You need a micro-niche with buyers, preferably a lot of them.

Now the hard part.

How do you find a niche with a lot of potential customers? Big companies pay millions of dollars every year to do that kind of market research.

Naturally, I recommend you spend millions of dollars on market research.

No?

Here’s the part where I make this entire series worth every penny you’ve paid. Times 10.

Steal the research.

My favorite source of niche market research to steal is http://www.dummies.com/. Click the link and notice all of the wonderful niches at the top of the page. Jon Wiley & Sons, Inc. spends millions of dollars to know what topics will be good sellers. They’ve been doing this a long time. Trust their work.

You don’t have to concentrate on the topics I’ve helpfully highlighted, but they will make it easier for you. Other niches can be profitable, too.

Golf is a great example. Golfers spend money to play the game. You don’t become a golfer without having some discretionary money to spend on it. I’d recommend against consumer electronics. There is a lot of competition for anything popular, and most of that is available for free. If you choose to promote some high-end gear using your Amazon affiliate link, you’re still only looking at a 3% commission.

I like to stick to topics that people “need” an answer for, and can find that answer in ebook form, since I will be promoting a specific product.

With that in mind, pick a topic, then click one of the links to the actual titles for sale. The “best selling titles” links are a gold mine. You can jump straight to the dummies store, if you’d like.

Of the topics above, here’s how I would narrow it down:

1. Business and Careers. The bestsellers here are Quickbooks and home buying. I’m not interested in either topic, so I’ll go into “More titles”. Here, the “urgent” niches look like job hunting and dealing with horrible coworkers. I’m also going to throw “writing copy” into the list because it’s something I have a hard time with.

2. Health and Fitness. My first thought was to do a site on diabetic cooking, but the cooking niche is too competitive. Childhood obesity, detox diets and back pain remedies strike me as worth pursuing. I’m leaning towards back pain, because I have a bad back. When you’ve thrown your back out, you’ve got nothing to do but lie on the couch and look for ways to make the pain stop. That’s urgency.

3. Personal Finance. The topics that look like good bets are foreclosures and bankruptcies. These are topics that can cost thousands of dollars if you get them wrong. I hate to promote a bankruptcy, but some people are out of choices. Foreclosure defense seems like a good choice. Losing your home comes with a sense of urgency, and helping people stay in their home makes me feel good.

4. Relationships and Family. Of these topics, divorce is probably a good seller. Dating advice definitely is. I’m not going to detail either one of those niches here. Divorce is depressing and sex, while fun, isn’t a topic I’m going to get into here. I try to be family friendly, most of the time. Weddings are great topic. Brides are planning to spend money and there’s no shortage of resources to promote.

So, the niches I’ve chosen are:

I won’t be building 9 niche sites in this series. From here, I’m going to explore effective keywords/search terms and good products to support. There’s no guarantee I’ll find a good product with an affiliate program for a niche I’ve chosen that has keywords that are both highly searched and low competition, so I’m giving myself alternatives.

For those of you following along at home, take some time to find 5-10 niches you’d be willing to promote.

The important things to consider are:

1. Does it make me feel dirty to promote it?

2. Will there be customers willing to spend money on it?

3. Will those customers have an urgent need to solve a problem?

I’ve built sites that ignore #3, and they don’t perform nearly as well as those that consider it. When I do niche sites, I promote a specific product. It’s pure affiliate marketing, so customers willing to spend money are necessarily my target audience.