What would your future-you have to say to you?

The no-pants guide to spending, saving, and thriving in the real world.

What would your future-you have to say to you?

If you want to make money, help someone get healthy, wealthy or laid.

This section was quick.

Seriously, those three topics have been making people rich since the invention of rich. Knowing that isn’t enough. If you want to make some money in the health niche, are you going to help people lose weight, add muscle, relieve stress, or reduce the symptoms of some unpleasant medical condition? Those are called “sub-niches”. (Side question: Viagra is a sub-niche of which topic?)

Still not enough.

If you’re going to offer a product to help lose weight, does it revolve around diet, exercise, or both? For medical conditions, is it a way to soothe eczema, instructions for a diabetic diet, a cure for boils, or help with acne? Those are micro-niches.

That’s where you want to be. The “make money” niche is far too broad for anyone to effectively compete. The “make money online” sub-niche is still crazy. When you get to the “make money buying and selling websites” micro-niche, you’re in a territory that leaves room for competition, without costing thousands of dollars to get involved.

Remember that: The more narrowly you define your niche market, the easier it is to compete. You can take that too far. The “lose weight by eating nothing but onions, alfalfa, and imitation caramel sauce” micro-niche is probably too narrowly defined to have a market worth pursuing. You need a micro-niche with buyers, preferably a lot of them.

Now the hard part.

How do you find a niche with a lot of potential customers? Big companies pay millions of dollars every year to do that kind of market research.

Naturally, I recommend you spend millions of dollars on market research.

No?

Here’s the part where I make this entire series worth every penny you’ve paid. Times 10.

Steal the research.

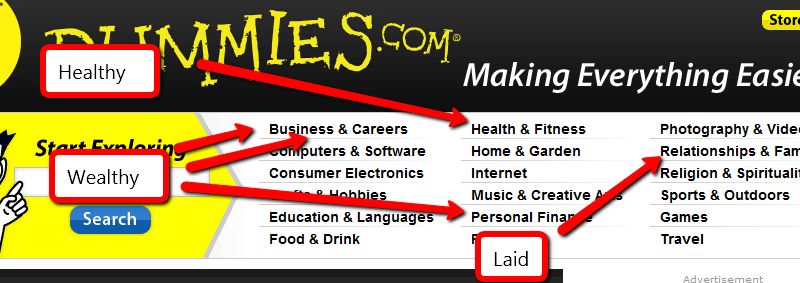

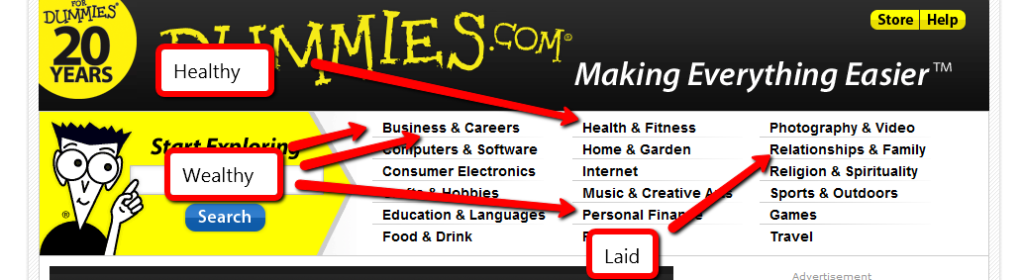

My favorite source of niche market research to steal is http://www.dummies.com/. Click the link and notice all of the wonderful niches at the top of the page. Jon Wiley & Sons, Inc. spends millions of dollars to know what topics will be good sellers. They’ve been doing this a long time. Trust their work.

You don’t have to concentrate on the topics I’ve helpfully highlighted, but they will make it easier for you. Other niches can be profitable, too.

Golf is a great example. Golfers spend money to play the game. You don’t become a golfer without having some discretionary money to spend on it. I’d recommend against consumer electronics. There is a lot of competition for anything popular, and most of that is available for free. If you choose to promote some high-end gear using your Amazon affiliate link, you’re still only looking at a 3% commission.

I like to stick to topics that people “need” an answer for, and can find that answer in ebook form, since I will be promoting a specific product.

With that in mind, pick a topic, then click one of the links to the actual titles for sale. The “best selling titles” links are a gold mine. You can jump straight to the dummies store, if you’d like.

Of the topics above, here’s how I would narrow it down:

1. Business and Careers. The bestsellers here are Quickbooks and home buying. I’m not interested in either topic, so I’ll go into “More titles”. Here, the “urgent” niches look like job hunting and dealing with horrible coworkers. I’m also going to throw “writing copy” into the list because it’s something I have a hard time with.

2. Health and Fitness. My first thought was to do a site on diabetic cooking, but the cooking niche is too competitive. Childhood obesity, detox diets and back pain remedies strike me as worth pursuing. I’m leaning towards back pain, because I have a bad back. When you’ve thrown your back out, you’ve got nothing to do but lie on the couch and look for ways to make the pain stop. That’s urgency.

3. Personal Finance. The topics that look like good bets are foreclosures and bankruptcies. These are topics that can cost thousands of dollars if you get them wrong. I hate to promote a bankruptcy, but some people are out of choices. Foreclosure defense seems like a good choice. Losing your home comes with a sense of urgency, and helping people stay in their home makes me feel good.

4. Relationships and Family. Of these topics, divorce is probably a good seller. Dating advice definitely is. I’m not going to detail either one of those niches here. Divorce is depressing and sex, while fun, isn’t a topic I’m going to get into here. I try to be family friendly, most of the time. Weddings are great topic. Brides are planning to spend money and there’s no shortage of resources to promote.

So, the niches I’ve chosen are:

I won’t be building 9 niche sites in this series. From here, I’m going to explore effective keywords/search terms and good products to support. There’s no guarantee I’ll find a good product with an affiliate program for a niche I’ve chosen that has keywords that are both highly searched and low competition, so I’m giving myself alternatives.

For those of you following along at home, take some time to find 5-10 niches you’d be willing to promote.

The important things to consider are:

1. Does it make me feel dirty to promote it?

2. Will there be customers willing to spend money on it?

3. Will those customers have an urgent need to solve a problem?

I’ve built sites that ignore #3, and they don’t perform nearly as well as those that consider it. When I do niche sites, I promote a specific product. It’s pure affiliate marketing, so customers willing to spend money are necessarily my target audience.

We are all stuck on the same planet with each other. There is nothing any of us are going to do to get the option of leaving for long. Do you want to live in a miserable, run-down world, or one that’s happy and filled with kittens and ice cream?

The kind of world you live in is more a function of your state of mind than the place you live, the job you have, or the person you married. Here are a few ways to improve that state of mind.

1. Be kind. Smile at a teller. Let someone merge in front of you in traffic. Drop a dollar in a homeless man’s jar. Have you ever had a lousy day make a total turnaround because of some inconsequential bit of yay? Doing some small act of kindness can make a world of difference in someone’s day. Next time you’re in the drive-through at Caribou, buy coffee for the person behind you. That random bit of love will put a smile on both your faces.

2. Be positive. Don’t complain. So many of us live in a negative world, watching the world go buy through coffin-colored glasses. Have you ever considered going an entire day without making a negative comment? A week? A month? Some of you are shaking your heads right now, thinking it’s impossible. Have you thought about how much happier you would be if you banned the negative crap in your life?

3. Be a good neighbor. We’ve all had the same problems: a neighbor that plays music too loud, too late; the jerk across the street who yells at you for park on the street in front of his house; the guy who’s too busy to mow his lawn; or the crazy cat lady who makes the entire neighborhood smell like a litter box. Don’t be that guy. I’ve had 90% of my neighbors for more than 5 years. If we don’t make accommodations for the people we have to deal with every day, we’re going to be miserable.

4. Learn something new. If you feel good about yourself, you feel better about the world. If you feel better about the world, you’re more likely to do things to improve it. One of the best ways to feel good about yourself is to improve yourself. Take a class, read a book, or find a mentor to teach you. The method doesn’t matter, just do something to learn something you’re interested in.

What are you doing to make your world better?

When you’re buried in debt, bankruptcy can seem like the only option. When you get make ends meet, no matter how hard you pull on them. When bill collectors interrupt every dinner. When you have to choose between food and rent. When there is always more month than money. Do you have another choice?

Yes, you do.

Before you rush to file bankruptcy, take the time to understand your options.

Debt settlement is when you quit paying your bills and start sending the money to settlement company. The settlement company does…nothing. Really. They take your money and drop it into investments or interest-bearing accounts. You don’t get the interest, they do. Eventually, when your creditors are howling, the settlement company offers to make a settlement on the account. If the creditor accepts pennies on the dollar to kill your debt, the settlement company pays them. If not, they get to howl louder and make you more miserable.

While this process is playing itself out over years, your credit is taking a beating. You are doing nothing to dig yourself out of the hole you’ve dug. Finally, when your creditors are so desperate that they accept the settlement offer, you get a huge additional hit to your credit. “SETTLED IN FULL” is not a good status to have on your credit report.

Debt settlement companies do nothing you can’t do for yourself, and doing it for yourself at least lets you keep the interest your money is earning.

Consolidating your debt comes in two varieties, a debt consolidation loan and a debt management plan.

A debt management plan is when you send one large payment to a debt consolidation company, and they pay your creditors for you each month. The company will usually attempt to contact your creditors and negotiate your interest rate and payments to try to get you into a situation that precludes bankruptcy and will keep your creditors happy. In the simplest terms, this is a debt payment consolidation.

A debt consolidation loan is generally done by taking out a line of credit against your home or other collateral and using that money to pay off all of your bills. Then you make the payments to the bank, to pay off your line of credit. The problem is that, if you can’t make the individual payments, can you make the payment to the line of credit? If you can’t, you risk losing your house.

This option is my personal favorite. It involves taking responsibility for your decisions, cutting out the unnecessary expenses in your life, and paying your bills. There are a few popular plans for accomplishing this, including Dave Ramsey‘s debt snowball. The most important thing to remember are 1) debt it bad so stop using it; and 2) pay off as much as you can afford to each month. It isn’t as sexy as making all of your debt disappear, but it’s still a good option.

Let’s see. You borrow money on the promise to pay it all back. After you borrow too much, you renege on your agreement. You admit your word means nothing and you get all of your debt cancelled, forcing your creditors to raise the interest rates for all of the responsible debtors out there, as a way to balance the risk of those who will never pay. In exchange you doom yourself to lousy credit for the next 10 years. In extreme circumstances, bankruptcy may be the only option, but, I’m not a fan.

As you can see, there are almost always better options than bankruptcy. Please, before you take that leap, look into the other choices.

This is a sponsored post written to provide some insight into the world of bankruptcy and debt consolidation.

It’s been one heck of a spring summer for my family, financially speaking, and it turned out to be a bit more than we had budgeted for.

Here’s what we’ve done on top of our regular spending, so far:

Taken in reverse order…

Mattress

The wire frame on our mattress broke. I wish that was a complement to my prowess, but nothing was happening when it snapped. Sleeping with a jagged piece of steel poking you sucks, to say the least.

Dancing

Ballroom dancing is something my wife and I both enjoy, and it’s good exercise, so we decided to keep it up. We are officially in training for competition-level dancing, but now that our favorite place to dance is closed, we may not continue. The lessons are paid for through next spring, though.

Air conditioner

My A/C system “grenaded”. Basically, the insides decided to disintegrate and go flowing through the rest of the system, mucking it all up. And making the car undriveable. On the plus side, this hard-to-find leak I’ve been ignoring in favor of annual $75 A/C recharges is fixed, now.

Swimming, not dying

My youngest kids have never had swimming lessons and my oldest isn’t a strong swimmer. Helping my kids not drown is a good thing.

Camp

We put the down payment on camp back in February, then promptly forgot about paying for the rest of it until the deadline hit. I paused while typing this to add it to my budget so I don’t forget for next year.

The remodel

We had, at one point, $9500 set aside for the remodel, but I raided that account a few times if we went over on our monthly spending. Then, when we got the estimate, we neglected to include one of the subtotals together when we agreed to it, so the job cost more than I was expecting from the start. We still got a great price, though.

Until the tub surround didn’t come in a color we liked and could get in less than 6 weeks. So, we upgraded to porcelain tile.

And the ceiling started peeling.

And we decided to get nice fixtures, so it would be a bathroom we loved enough to demonstrate physically, for years to come.

And we noticed the basement bathroom floor tiles were loose.

So much money just poured out of my credit card.

At the moment, we have approximately $8,000 on our credit cards. That’s the highest balance we’ve carried in years. This month was the first time I’ve paid interest on a credit card since August 2012.

What’s our plan for the credit cards?

That’s $1500 as an immediate payment, plus about $2300 per month on top of our normal spending to pay off the cards.

That means we’ll be down to about $4300 in two weeks. When my wife gets her first full paycheck at the end of September, we’ll have the cards paid off.

Then comes the challenge of catching back up on the mortgage. Until yesterday, we were projected to pay off our house on December 1. Our current balance is $4660, with a mandatory monthly payment of $470.58. That’s about 10 months of payments. We were making an extra $520 interest payment each month, which brought it down to the December payoff date. For the next 3 months, we’re only going to be paying roughly the minimum, which means we’ll have to pay a bit over triple for November and December to be done with it this year.

I think we can do it.

How do we avoid this in the future?

With our renters paying full rent now, our goal is to pretend Linda isn’t getting paid when her work picks up again in September. We want to save or invest everything she makes, on top of the current savings. Not all of that will be long-term, and not all of it will be spendable. That saving will include things like braces for the younger kids, vacations that are more than just long weekends, and maxing out both of our retirement accounts.

That should still let us pad out our emergency fund to 4 months of expenses by spring, which is a pretty good cushion for us.

I hope. I haven’t done the math.

Getting out of debt is primarily a matter of changing your habits. We’ve all heard people swear by skipping your morning cup of coffee to get rich, but that’s just a small habit. Much more important are the big habits, the lifestyle habits. Here are 5 habits to cultivate for financial success.

“Beware of little expenses; a small leak will sink a great ship”– Benjamin Franklin

As Chris Farrel wrote in “The New Frugality“, being frugal is not about being cheap, but finding the best value for your money. When my wife and I had our second baby, we couldn’t justify spending $170 on a breast pump, so we bought the $30 model. It was quite a bit slower than the expensive model, and was only a “single action”, but for $140 of savings, it seemed worth the trade. Six weeks later, it burned out so we bought a new one, still afraid to justify $170 on quality. This thing took at least 45 minutes to do its job. When it burned out 6 weeks later, we decided to go with the high-end model. This beauty had dual pumps, “baby-mouth simulation” and it was fast. The time was cut from a minimum of 45 minutes to a maximum of 15. That’s 3 hours of life reclaimed each day fro $140. Six months of breastfeeding for each of two kids means my wife regained 45 days of her life in exchange for that small amount of money. At the rate of 6 weeks per burnout, we would have gone through 8 cheap pumps, costing $240. The high-end unit was still going strong when we weaned baby #3. Buying quality saved us both time and money. I wish we would have gone with the good one from the start. Sometimes, the expensive option is also the cheap option.

“Maturity is achieved when a person postpones immediate pleasures for long-term values.” -Joshua Loth Liebman

Being a mature, rational adult is hard. It means accepting delayed gratification over the more enjoyable instant variety. We save for retirement instead of charging a vacation. It takes a lot of restraint to put off buying the latest toys, clothes, gadgets, cars or whatever else is currently turning your crank until you actually have the money to actually afford it. It means planning your future instead of looking like a surprised bunny caught in a spotlight every time your property taxes come due. (Who knew that the year changed every year? Do they really expect annual payments annually? Geez! There’s so much to learn!) It means thinking about your purchases and buying what you actually need, actually want, and will actually use instead of resorting to retail therapy whenever you feel like a sad panda. The only benefit to mature, rational management of your finances is that, given time, you will have the security of knowing that, no matter what happens, you will be okay. That’s a huge benefit.

“Do not bite at the bait of pleasure, till you know there is no hook beneath it.” – Thomas Jefferson

If it hurts, you won’t do it. You have to learn to take pleasure from from things that won’t make you broke and you have to learn not to hate putting off the things you can’t afford. Take pleasure in the little things. Enjoy the time with your family. Presence means so much more than presents. So many people never learn how to enjoy themselves. Take the time to experience life and enjoy doing it.

Update: This post has been included in the Carnival of Debt Reduction.