- RT @ramseyshow: RT @E_C_S_T_E_R_I_: "Stupid has a gravitational pull." -D Ramsey as heard n NPR. I know many who have not escaped its orbit. #

- @BudgetsAreSexy KISS is playing the MINUTE state fair in August. in reply to BudgetsAreSexy #

- 3 year old is "reading" to her sister: Goldilocks, complete with the voices I use. #

- RT @marcandangel: 40 Useful Sites To Learn New Skills http://bit.ly/b1tseW #

- Babies bounce! https://liverealnow.net/hKmc #

- While trying to pay for dinner recently, I was asked if other businesses accepted my $2 bills. #

- Lol RT @zappos: Art. on front page of USA Today is titled "Twitter Power". I diligently read the first 140 characters. http://bit.ly/9csCIG #

- Sweet! I am the number 1 hit on Ask.com for "I hate birthday parties" #

- RT @FinEngr: Money Hackers Carnival #117 Wedding & Marriage Edition http://bit.ly/cTO4FU #

- Nobody, but nobody walks sexy wearing flipflops. #

- @MonroeOnABudget Sandals are ok. Flipflops ruin a good sway. 🙂 in reply to MonroeOnABudget #

- RT @untemplater: RT @zappos: "Do one thing every day that scares you." -Eleanor Roosevelt #

Christmas Magic

When I was little, the world was amazing. The first snowfall was among the best days of the year. Everything was worth exploring, in hopes of discovering something new and fascinating, and everything was fascinating.

Stepping on a crack had serious implications. The wishbone in a turkey earned its name. Blowing out all of the candles on a birthday cake could change your life. The idea of some dude half a world away, watching you, then sneaking into your house to dish our rewards and punishments wasn’t pervy and sick, it was wonderful.

Then, one day, it all changes.

Somebody–a classmate, a older brother, a neighbor–let’s it slip that Santa isn’t real, and the implications snowball. That day, the magic dies.

Wishing on a star? Over.

The Easter Bunny? Hasenpfeffer.

Growing up to be Superman? Welcome to the rat race.

It’s a sad day when kids stop believing in magic.

I don’t believe in lying to my children, but I also don’t believe in destroying their magic. It’s a balancing act.

When my son was 6, an older boy at daycare tried to kill Santa for him. He was upset.

“Dad, is Santa real?”

“What do you think?”

“I don’t believe in Santa.”

“Okay, I’ll let him know.”

“Nonononononono! Don’t tell him!”

Was it lying? Probably, but he obviously wasn’t ready to stop believing, so I let him continue. A year later, we had the same conversation, but the results were quite different.

“Dad, you’ve always said that you hate lying, so why did you let me believe in Santa?”

So I told him the truth. Magic is a frail thing that’s nearly impossible to reclaim and I wanted him to have that treasure for as long as possible. And, “Now that you know, you are in on the conspiracy. You’ve been drafted. Don’t kill the magic for anyone else.”

It was weird having him help me stuff stockings.

If you’ve got kids(and celebrate Christmas), how do you handle the Santa problem?

My Credit Cards

This announcement is a bit premature, but not everything that’s premature has to end in an evening of disappointment.

At the beginning of the year, I transferred the balance of my last credit card onto two different cards, each with a 0% interest rate. One card got a $4,000 transfer and the other got $13,850. The approximately $415 in fees I paid for the transfer saved me nearly $1500 in interest this year.

The card that got the big balance is the card we use for a lot of our daily spending. On my statement dated 2/18/2012, the balance on the this card was $14,865.23. At the same time, the smaller card had a balance of $3,925.09, for a total of $18,790.32. When I started my debt-murder journey in April 2009, it had peaked at just under $30,000.

When my payments clear later today, that balance will be gone.

That is nearly $19,000 paid down in 8 months.

Now, the inheritance we picked up did accelerate our repayment a bit, but only by a few months.

Starting from $90,394.70 in April 2009, we have paid down $63,746.70, leaving $26,648.00 on our mortgage.

I’m more than a little excited, which–as usual–is the cause for the prematurity.

New goal: pay off the mortgage in 2013.

Twinkies: A Failure of Unionization

Twinkies may survive nuclear warfare, but the iconic sweet treat ultimately couldn’t withstand the might of the unionized workforce. Faced with mounting losses and overwhelming debt, due in no small part to the relentless demands of the various unions representing the nearly 19,000 employees, Hostess Brands filed bankruptcy for the second time in January 2012 and ultimately requested permission to liquidate it’s assets in November of last year when a buyer failed to materialize. While many factors played a part in the demise of the maker of such all-American snacks as Ding Dongs and Ring Dings, as well as childhood favorite Wonderbread, there is no denying the fact that costs imposed by union contracts were a major factor in the shuttering of this once-beloved company.

Certainly America’s changing eating habits, increased competition from such companies as McKee Foods, makers of Little Debbie snack cakes, and rising commodity costs all contributed to the ultimate demise of Twinkies. There is no doubt, though, that union contracts inhibited the company’s ability to adapt and make the necessary changes to remain profitable. Not only were employee costs out of control, ridiculous union rules made it nearly impossible for the company to make money. These are just a few of the rules that hampered Hostess’ management:

- Twinkies and Wonder Bread could not be delivered on the same truck.

- Drivers could only deliver one product, even if they did not have a load and a load of another product was waiting to go out.

- Drivers could only drive. They had to wait for loaders to fill their trucks.

- Likewise, loaders could only handle one product. Their contract prohibited a Twinkie loader from helping out if the Wonder Bread loaders were shorthanded.

Yes, management agreed to these terms, but often they were forced to do so in order to prevent a costly strike. In fact, it was a labor strike that lead to the decision to liquidate.

Unions are meant to protect workers from dangerous working conditions, overbearing management and unfair labor practices. Ensuring a living wage and decent benefits is another of their responsibilities. However, it is evident that in this case, the unions became as much an enemy of the Hostess employees as of the company’s management. As a result of their unwillingness to compromise and make wage and benefit concessions, almost 20,000 people no longer have a job that needs to be protected. In the end, the unions drove not only the company but themselves out of business.

Not to fear, however. Two private equity firms acquired Hostess’ assets last fall and are beginning to turn the company around. Production of Twinkies began again in June, and the gooey sponge cakes returned to store shelves on July 15. The workforce has been dramatically reduced and will not be unionized. In the end, probably the only winner in this battle is America’s sweet tooth.

Related articles

Real Estate Customer Life Cycle

Recently, my wife and I have been searching for new tenants for our rental property. That’s an irritating customer cycle. We’ve had more no-shows at the showings than we’ve had prospects show up. Most people who call seem to think that the rent on a 2 bedroom, 1.5 bathroom house with a big yard and a 3 car garage 5 minutes from downtown Minneapolis is going to match their little subsidized Section 8 apartment.

Not going to happen.

So we keep looking. In the meantime, it’s interesting to look at how a real estate trainer breaks down the life cycle of a customer.

Enjoy!

NEC Online Degrees

NEC Online Degrees

Net Worth Update – September 2014

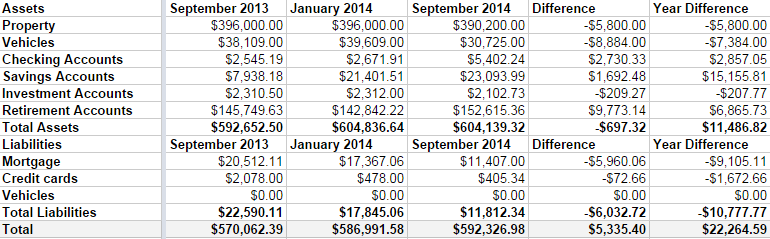

It’s time for my irregular-but-usually-quarterly net worth update. It’s boring, but I like to keep track of how we’re doing. Frankly, I was a bit worried when I started this because we’ve been overspending this summer and Linda was off work for the season.

But, all in all, we didn’t do too bad.

Some highlights:

- Both of our properties lost around $3000 in value. I’m not worried, because we are keeping them both for the long haul. The rental is basically on auto-pilot, so that’s free money every month.

- We sold a boat that appraised for much less I had estimated in the last few updates. I had it listed for $5000, but it was worth $2000.

- I do have a credit card balance at the moment, but that goes away as soon as my expense check clears the bank, which will be in a day or two.

- We’re in the home stretch with the mortgage. There is $11,407 left to go, and we’ve paid down $9105 in the last year. By this time next year, I want that gone, gone, gone.

I can’t say I’m upset with our progress. We’ve paid down $6000 in debt in 2014, including 3 months with 1 income. We aren’t maxing our retirement accounts, yet, but I’d like to be completely debt free before I do that. It’s bad math, but having all of my debt gone will give me such a warm fuzzy feeling, I can’t not do it.

My immediate goal is to hit a $600,000 net worth by my next update in January. I’m only about $7000 off.

Time to hit the casino. Err, I mean, time to up my 401k contribution from 5% to 7%.