There comes a time when it’s too late to tell people how you feel.

There will come a day when the person you mean to talk to won’t be there. Don’t wait for that day.

“There’s always tomorrow” isn’t always true.

The no-pants guide to spending, saving, and thriving in the real world.

Last weekend, we held a garage sale at my mother-in-law’s house. It was technically an estate sale, but we treated it exactly as a garage sale.

A week before we started, a friend’s mother came to buy all of the blankets and most of the dishes, pots, and non-sharp utensils so she could donate them all to a shelter she works with. She took at least 3 dozen comforters and blankets away.

Even after that truckload, we started with two double rows of tables through the living room and dining room. The tops of the tables were as absolutely full as we could get them, and the floor under the tables was also used for displaying merchandise.

Have you ever had to display 75 brand-new pairs of shoes in a minimal about of space? They claimed about 16 feet of under-table space all by themselves. Thankfully, the blankets weren’t there anymore.

We also had half of the driveway full of furniture, toys, and tools.

We had a lot of stuff.

Now, most people hold a sale to make some money. Not us. We held a sale to let other people pay us for the privilege of hauling away our crap. As such, it was all priced to move. The most expensive thing we sold was about $20, but I can’t remember what that was. Most things went for somewhere between 25 cents and $1.

At those prices, we sold at least 2000 items. That isn’t a typo. We ended the day with $1325. After taking out the initial seed cash, lunches we bought for the people helping us, and dinner we bought one night, we had a profit of $975.

At 25 cents per item.

We optimized to sell instead of optimizing for profit. At the end of a long summer of cleaning out a hoarding house, it all needed to go.

In the next part, I’ll explain exactly how we made it work.

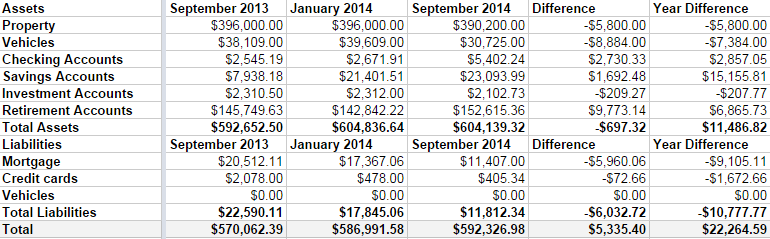

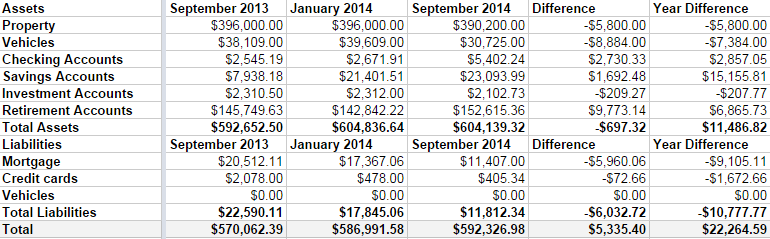

It’s time for my irregular-but-usually-quarterly net worth update. It’s boring, but I like to keep track of how we’re doing. Frankly, I was a bit worried when I started this because we’ve been overspending this summer and Linda was off work for the season.

But, all in all, we didn’t do too bad.

Some highlights:

I can’t say I’m upset with our progress. We’ve paid down $6000 in debt in 2014, including 3 months with 1 income. We aren’t maxing our retirement accounts, yet, but I’d like to be completely debt free before I do that. It’s bad math, but having all of my debt gone will give me such a warm fuzzy feeling, I can’t not do it.

My immediate goal is to hit a $600,000 net worth by my next update in January. I’m only about $7000 off.

Time to hit the casino. Err, I mean, time to up my 401k contribution from 5% to 7%.

When I found myself doing an abrupt unemployment tour this month, the first thing I did was dig into my budget. I did it so I could see how long it would be before our finances got scary and to see what could be eliminated.

Gah! So much could be eliminated.

There were things that I’d set up on automatic payments, added to my budget, then ignored.

There were things that I’d signed up for and used, but didn’t get as much enjoyment out of any more.

Example Number 1: Netflix

We love Netflix. It gets used every single day. But the DVDs often sit on the kitchen counter for a month before we get around to watching them. We clearly don’t need the DVD plan any more.

Example Number 2: Software Subscription

I use some software to track the Google rank of several of my websites. There is an addon that makes the software work much better. The addon costs $20 per quarter. The problem is that I’m not looking at the rankings of these sites any more. Some of the sites have been shut down, or I’m no longer involved with the clients. That makes the paid addon a total waste. I canceled it and told the tracking software to run slower so it would give Google a fit.

Example Number 3: Extra Domains

Hello, my name is Jason and I’m a domain addict. Seriously, for a while, I was buying domains every time I had a good idea for a website. Some of them were developed, and some were sketched out and put on hold. I also bought domains to help with the search engine rankings of the developed websites. I topped out at about 120 domains. All of them were on auto-renew. I’ve been letting them expire, but some didn’t have the auto-renew settings changed, so they (surprise!) renewed automatically.

These are just three examples of several years of development, exploration, and automation of my complicated financial life, and they add up to more than $100 a month essentially wasted.

Here’s what I want you to do.

Right now.

Not “tomorrow”, not “when you get around to it”.

Now.

Pull up your bank statement, your Paypal account and your credit card statements.

Is there anything in there that’s happening every month that you forgot about, don’t need, or don’t even want?

Ax that crap. Kill it with fire. Nuke it from orbit. Stop wasting your money.

I’d be willing to bet 99% of everyone has something they are paying for every month that they don’t even want, but either forgot was happening or have just let inertia keep paying the bills.

Be the 1%.