What would your future-you have to say to you?

The no-pants guide to spending, saving, and thriving in the real world.

What would your future-you have to say to you?

Life is all about trade-offs. You trade your time for a paycheck. Your trade your paycheck for food, rent, and security. Don’t get so obsessed with saving and security that you forget to live your life. There are many good reasons to put your savings on hold in order to really live. Here are five of them:

1. You have an adequate emergency fund. You will never hear me advise against an emergency fund. If you don’t have one, stop reading this and get one. Go. Without an emergency fund, your budget is a financial crisis waiting to happen. With an emergency fund, you can weather life’s speed-bumps without watching them become total train-wrecks.

2. Your retirement is on autopilot. You are not allowed to stop saving and investing for retirement. Ever. Assuming you have a traditionally scheduled career that involves you working until you hit 65 and deferring a huge chunk of living until then, your income will cease when you retire. Do you know how long you will live? Do you want to spend your retirement broke and bored? Are you relying on the responsible financial management of the federal government to make sure you will still get your Social Security? Invest in your retirement and get this investment on autopilot so you can stop worrying about it.

3. Your income is set. I don’t believe in the fairy tale of a company being loyal to its employees. The aren’t. However, if you have a stable-ish job, an in-demand career, and some side-income coming from alternate sources, your emergency fund can be enough to carry you through the low times. That’s what it’s there for.

4. You have dreams. If you’ve always wanted to travel the world, follow a band on your, volunteer extensively, or anything else, it’s time to do it. Don’t postpone your passion.

5. Deathbed regrets suck. Very few people lie on their deathbed lamenting the things they did. Regrets tend to be focused on opportunities missed, skipped, or indefinitely postponed. Do the things that are important to you before it’s too late to do them. Don’t abandon your future in favor of current pleasures, but don’t forget to live, now.

Do you have any other reasons to stop saving?

Baby Steps” width=”180″ height=”240″ />

Baby Steps” width=”180″ height=”240″ />Fixing a lifetime of financial mistakes can be an intimidating process. Scratch that. It’s always an intimidating process. Where do you start? You’ve got a pile of bills, a dozen messages from bill collectors and two bi-weekly paystubs. What next?

Traditionally, and according to Dave Ramsey, the first step to fixing your finances is to make a budget, but he and tradition are wrong. The first step is to get everybody involved in your finances on the same page. If your spouse isn’t on board with paying off the debt and spending responsibly, nothing else will work.

Once you have that out of the way, you can move on to the traditional first step, making a budget. I’ve gone over my process to build a personal financial plan in quite a bit of detail, so I’ll just hit the highlights this time.

First, make a list of all of your expenses. Include all of your utilities, debt payments, tax payments and absolutely everything else. You need to know the amount of the payment and the frequency. If a bill is due quarterly, divide it by three and you’ll know what you need to set aside each month. Round up in all cases so you can build an automatic cushion.

Next, make a list of your income sources. For most people, this is far easier than tracking their expenses. Figure out your monthly income. If you get paid weekly, that that amount times 52, then divide by 12 to get your monthly income.

Finally, subtract your expenses from your income. If your total is a positive number then you are golden. If you total is negative, you have been a bad monkey. You need to make some cuts, and they may be painful. If your outgoing money is more than your incoming money, it is not possible to get ahead.

Once you have your income and expenses recorded, and you have made the cuts necessary to have a positive balance at the end of the month, you have a successful budget. Congratulations!

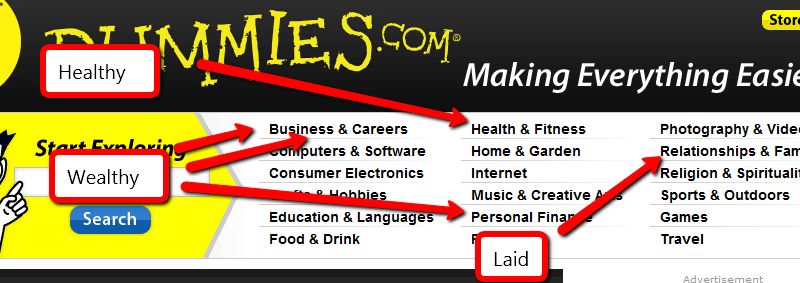

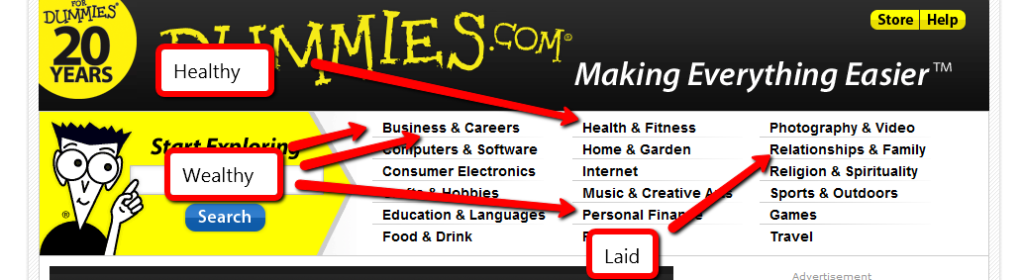

If you want to make money, help someone get healthy, wealthy or laid.

This section was quick.

Seriously, those three topics have been making people rich since the invention of rich. Knowing that isn’t enough. If you want to make some money in the health niche, are you going to help people lose weight, add muscle, relieve stress, or reduce the symptoms of some unpleasant medical condition? Those are called “sub-niches”. (Side question: Viagra is a sub-niche of which topic?)

Still not enough.

If you’re going to offer a product to help lose weight, does it revolve around diet, exercise, or both? For medical conditions, is it a way to soothe eczema, instructions for a diabetic diet, a cure for boils, or help with acne? Those are micro-niches.

That’s where you want to be. The “make money” niche is far too broad for anyone to effectively compete. The “make money online” sub-niche is still crazy. When you get to the “make money buying and selling websites” micro-niche, you’re in a territory that leaves room for competition, without costing thousands of dollars to get involved.

Remember that: The more narrowly you define your niche market, the easier it is to compete. You can take that too far. The “lose weight by eating nothing but onions, alfalfa, and imitation caramel sauce” micro-niche is probably too narrowly defined to have a market worth pursuing. You need a micro-niche with buyers, preferably a lot of them.

Now the hard part.

How do you find a niche with a lot of potential customers? Big companies pay millions of dollars every year to do that kind of market research.

Naturally, I recommend you spend millions of dollars on market research.

No?

Here’s the part where I make this entire series worth every penny you’ve paid. Times 10.

Steal the research.

My favorite source of niche market research to steal is http://www.dummies.com/. Click the link and notice all of the wonderful niches at the top of the page. Jon Wiley & Sons, Inc. spends millions of dollars to know what topics will be good sellers. They’ve been doing this a long time. Trust their work.

You don’t have to concentrate on the topics I’ve helpfully highlighted, but they will make it easier for you. Other niches can be profitable, too.

Golf is a great example. Golfers spend money to play the game. You don’t become a golfer without having some discretionary money to spend on it. I’d recommend against consumer electronics. There is a lot of competition for anything popular, and most of that is available for free. If you choose to promote some high-end gear using your Amazon affiliate link, you’re still only looking at a 3% commission.

I like to stick to topics that people “need” an answer for, and can find that answer in ebook form, since I will be promoting a specific product.

With that in mind, pick a topic, then click one of the links to the actual titles for sale. The “best selling titles” links are a gold mine. You can jump straight to the dummies store, if you’d like.

Of the topics above, here’s how I would narrow it down:

1. Business and Careers. The bestsellers here are Quickbooks and home buying. I’m not interested in either topic, so I’ll go into “More titles”. Here, the “urgent” niches look like job hunting and dealing with horrible coworkers. I’m also going to throw “writing copy” into the list because it’s something I have a hard time with.

2. Health and Fitness. My first thought was to do a site on diabetic cooking, but the cooking niche is too competitive. Childhood obesity, detox diets and back pain remedies strike me as worth pursuing. I’m leaning towards back pain, because I have a bad back. When you’ve thrown your back out, you’ve got nothing to do but lie on the couch and look for ways to make the pain stop. That’s urgency.

3. Personal Finance. The topics that look like good bets are foreclosures and bankruptcies. These are topics that can cost thousands of dollars if you get them wrong. I hate to promote a bankruptcy, but some people are out of choices. Foreclosure defense seems like a good choice. Losing your home comes with a sense of urgency, and helping people stay in their home makes me feel good.

4. Relationships and Family. Of these topics, divorce is probably a good seller. Dating advice definitely is. I’m not going to detail either one of those niches here. Divorce is depressing and sex, while fun, isn’t a topic I’m going to get into here. I try to be family friendly, most of the time. Weddings are great topic. Brides are planning to spend money and there’s no shortage of resources to promote.

So, the niches I’ve chosen are:

I won’t be building 9 niche sites in this series. From here, I’m going to explore effective keywords/search terms and good products to support. There’s no guarantee I’ll find a good product with an affiliate program for a niche I’ve chosen that has keywords that are both highly searched and low competition, so I’m giving myself alternatives.

For those of you following along at home, take some time to find 5-10 niches you’d be willing to promote.

The important things to consider are:

1. Does it make me feel dirty to promote it?

2. Will there be customers willing to spend money on it?

3. Will those customers have an urgent need to solve a problem?

I’ve built sites that ignore #3, and they don’t perform nearly as well as those that consider it. When I do niche sites, I promote a specific product. It’s pure affiliate marketing, so customers willing to spend money are necessarily my target audience.

Today, I am continuing the series, Money Problems: 30 Days to Perfect Finances. The series will consist of 30 things you can do in one setting to perfect your finances. It’s not a system to magically make your debt disappear. Instead, it is a path to understanding where you are, where you want to be, and–most importantly–how to bridge the gap.

I’m not running the series in 30 consecutive days. That’s not my schedule. Also, I think that talking about the same thing for 30 days straight will bore both of us. Instead, it will run roughly once a week. To make sure you don’t miss a post, please take a moment to subscribe, either by email or rss.

On this, Day 11, we’re going to talk about one method of paying for college.

I have a secret to share. Are you listening? Lean in close: College is expensive.

You’re shocked, I can tell.

The fact is, college prices are rising entirely out of proportion to operation costs, salaries, or inflation. The only thing college prices seem to be pegged to is demand. Demand has gotten thoroughly out of whack. The government forces down the interest rates on student loans, then adds some ridiculous forgiveness as long as you make payments for some arbitrary number of years, creating an artificial demand that wouldn’t be there if the iron fist of government weren’t forcing it into place.

Somebody in Washington has decided that the American dream consists of home ownership and a college education. Everything is a failure. He’s an idiot.

College isn’t for everybody.

Read that again. Not everyone should go to college. Not everyone can thrive in college.

Fewer than half of students who start college graduate. The greater-than-half who drop out still have to repay their loans. Do you think college was a good choice for them?

Then you get the people who major in art history and minor in philosophy. Do you know what that degree qualifies you for? Burger flipping.

Yes, I know. Just having a degree qualifies you for a number of jobs. It’s not because the degree matters, it’s because HR departments set a series of fairly arbitrary requirements just to filter a 6 foot stack of resumes. The only thing they care about is that having a degree proves that you were able to stick college out for 4 years. That HR requirement matters less as time goes on and you develop relevant work experience.

A liberal arts education also—properly done—trains your mind in the skill of learning. First, not everyone is capable of learning new things. Second, not everyone is willing to learn new things. Third, a passion for learning can be fed without college. If you don’t have that passion, college won’t create it. Most of the most learned people throughout history managed without college, or even formal education. Even if you want to feed that passion in a formal classroom, you’re assuming the professors are interested in training your mind instead of indoctrinating it with their views.

Now there are some pursuits that outright require a college education. The sciences like engineering, physics, astronomy, and psychiatry all require college. You know what doesn’t require college? Managing a cube farm. Data entry. Sales. I’m not saying those are bad professions, but they can certainly be done without dropping $50,000 on college.

Some careers require an education, but don’t require a 4 year degree, like nursing(in most states), computer programming(it’s not required, but it makes it a lot easier to break into) and others. Do you need to hit a 4 year school and get a Bachelor’s degree, or can you hold yourself to a 2 year program at a technical college and save yourself 40,000 or more?

That should be an easy choice. Don’t go to college just because you think you should or because somebody said you should, or to get really drunk. College isn’t for everybody and it’s possible it’s not for you.

This topic has been blatantly stolen from Budgets are Sexy.

1) How do you spend: cash, debit or credit? I use cash almost exclusively. I live in Minnesota and have two small children, so bundling the brats up to go inside the gas station to pay is nuts. Gas stations get the debit card. Online shopping, or automatic payments set up in the payee’s system are done on a credit card that gets paid off every month.

[ad name=”inlineright”]2) Do you bank online? How about use a financial aggregator (Mint, Wesabe, Yodlee, etc.)? I bank online. I use USBank for my daily cash flow, INGDirect for savings management and Wells Fargo for business. I used Mint strictly as a net worth calculator and alerting system. I use Quicken to manage my money and a spreadsheet for my budget, but I really like the quick, hands-off way that Mint gathers my account information and emails low balance alerts.

3) What recurring bills do you have set on autopay? Absolutely everything except daycare, 2 annual payments, and 1 quarterly payment.

4) How are your finances automated? I use USBank’s billpay system, instead of setting up autopayments at every possible payee. This gives me instant total control and reminders before each payment. The exceptions are my mortgage, netflix, and Dish. My mortgage company takes the money automatically from my checking. The other two hit a credit card automatically. Our paychecks are direct-deposited and automatically transferred to the different accounts and banks, as necessary.

5) Do you write checks? If so, how often? Once per week, for daycare. Occasionally for school fundraisers.

6) Where do you stash your short-term savings? I have quite a few savings accounts with INGDirect to meet all of my savings goals. For the truly short term, I add a line item in Quicken and just leave the money in my checking account.

Who’s next?