What would your future-you have to say to you?

The no-pants guide to spending, saving, and thriving in the real world.

What would your future-you have to say to you?

Saving is hard. For years, we would either not save at all, or we’d save a bit, then rush to spend it. That didn’t get us very far. Years of pretending to save like this left us with nothing in reserve. Finally, we’ve figured out the strategy to save money.

First and foremost, make more than you spend. This holds true at any level of income. If you don’t make much money, then you need to not spend much, either. Sometimes, this isn’t possible under current circumstances. In those cases, you need to either increase your income or decrease your expenses. Cut the luxuries and pick up a side hustle. The wider the gap between your bottom line and your top line, the easier it is to save.

Next, make a budget and stick to it. There is no better way to track both your income and your expenses. I’ve discussed budgets before, so I won’t address that in detail today. Short version: Make a budget. Use any software you like. Use paper if you want. Make it and use it.

Pay yourself first. The first expense listed on your budget should be you. Save first. If you can’t afford to save, you can’t afford some of the other items in your budget. Cut the cable or take the bus, but save your money. Without an emergency fund, your budget is just a empty dream when something unexpected comes up. And something unexpected always comes up.

Automate that payment to yourself. Don’t leave yourself any excuse not to make that payment. Set up an automated transfer to another bank and forget about it. Schedule the transfer to happen on payday, every payday.

Now comes the hard part: Forget about the money. Don’t check your balance. Don’t think about it in any way. Just ignore it. For the first month or two, this will be difficult. After that, you’ll forget it exists for a few months and come back amazed at how much you’ve saved.

If you don’t forget about it, and you decide to dip into the account, you are undoing everything you’ve worked so hard to save. Do yourself a favor and leave the money alone.

In this installment of the Make Extra Money series, I’m going to show you how I do keyword research.

Properly done–unless you get lucky–this is the single most time-consuming part of making a niche site. If you aren’t targeting search terms that people use, you are wasting your time. If you are targeting terms that everybody else is targeting, it will take forever to get to the top of the search results.

Spend the extra time now to do proper keyword research. It will save you a ton of time and hassle later. This is time well-spent.

If you remember from the last installment, when we researched products to promote, we narrowed our choices down to a few products.

What I’ve done is create a spreadsheet to score the products. You can see the spreadsheet here. I’ll explain the columns as we populate them.

The first column contains the name of the product. Easy. We’ve got 10 products. I’m going to walk through scoring 1 product, then, through the magic of the internet, I’ll populate the rest, and you’ll get to see the results instantly. Wow.

The second column is the global search volume for the exact search term. I base my product niche sites primarily on the demand for a given product. Everything else is a secondary consideration.

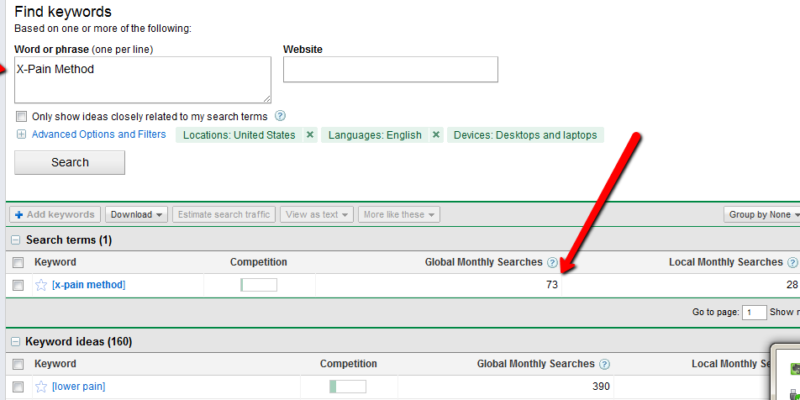

To find the demand for a product, go to the Google Adwords Keyword Tool. In the “word or phrase” box, enter your product name, exactly. In this case, it’s “X-Pain Method”. When the search results come up, change the match type to “Exact”. You should have something like this:

Enter the global search volume in column 2. In this case, it’s 73. Keep this window open, because we’ll be coming back to it.

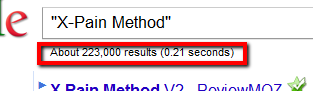

Column 3 is the search competition. Go to google and enter your product name, in quotes. In this case, “X-Pain Method”. Put the total number of search results in column 3: 223000.

Column 4 is the search competition, but only what appears in a page’s title. Your search query is intitle:”X-Pain Method”, which yields 4400 results.

The next column is for the average PageRank of the first page of search results. For this, I use Traffic Travis. I use the 4th edition, which is paid software, but you can get the free version of version 3, instead. I’ll use version 3 for this example. Open the software and click on “SEO Analysis” on the bottom left of the screen. Put your search term (“X-Pain Method”) in the “phrase to analyze” and set the “Analyze Top” to 10, then hit “Analyze”. When it’s done running, just add up all of the PRs and divide by 10. Ignore Travis’s difficulty rating.

Now, for the rest of the columns, we’re going to look at the keyword tool again. We’re going to pick 3 alternate search terms. Here are the criteria:

Once we pick the keywords, we’ll throw them into google to get the competition, just like we did to populate column 2.

“Exercises for back pain” has medium competition and 1900 monthly searches. It also has an estimated cost-per-click of $3.02, which means people are paying for this.

“Lower back pain exercises” has 6600 searches and medium competition. It’s actually on the lower end of medium, so it looks really promising.

“Lower back” has 4400 searches and low competition, with a CPC of $6.24. This should be a good one. Scratch that. It has 40 million search results, but only 4400 searches. That’s a lot of competition for a small market.

Instead, I’m going to search for “cure back pain” in the keyword tool and see what I get. “Upper back pain” is better. Low competition, 18000 searches each month, and only 2000000 competing search results. Now, I’ll score it.

You really want at least 500 searches per month for the product name. More than 2500 is better. I’m going to assign 1 point per 500 monthly searches.

You also want a lower number of search results. Less than 10,000 is ideal. Less than 100,000 is still decent. More than 250,000, I’d walk. So, under 10,000 gets 5 points. Under 50,001 gets 4. Under 100,001 gets 3. Under 200,001 gets 2. Under 250,001 gets 1. Any higher gets 0.

The ideal intitle search will have less than 2000 results. More than 100,000 is too time-consuming to deal with. 0-2000: 5 points; 2001-10,000: 4 points; 10001-25000: 3 points; 25001-50000: 2 points; 50001 to 100000: 1 point.

The perfect product will have the first page of search result all with a PageRank of 0. That’s a 5 point product. I’ll knock off half a point for every point of average PR.

The related terms are more relaxed. They are what’s known as “Latent Semantic Indexing” (LSI) terms. We will be creating articles to match those search terms, mostly to make our niche site look as natural and real as possible. Any actual traffic those pages drive is just gravy. Points for the related searches start at 10 and get 1 point knocked off for each 3 million results. We’ll be treating the 3 terms as one for this score.

That gives us a perfect score of about 25. There’s no actual upper limit, since the score for the search volume has no upper limit. X-Pain Method scored 18.22.

Now, excuse me a moment while I score the rest.

I’m back. Did you miss me?

I’ve finished scoring each of the products and sorted the results by score. The clear winner is the back pain product, but the lack of searches bothers me. The wedding guide looks much nicer, especially if I target the phrase “wedding planning guide” during the SEO phase of the project. That change alone brings the score almost to first place.

Frankly, I’d take either 2nd or 3rd place over the back pain product. The bare numbers don’t support it, but my judgement tells me they are better products to promote.

There is one final step before deciding on the product. I have to buy it. I can’t review the product without seeing it and I can’t promote it without approving of it.

That’s the secret to ethical niche marketing, you know. Only promote good products that you’ve personally read, watched, or used.

Investopedia ran a post on 20 lazy ways to save money. I thought it was worth sharing my take on the post.

1. Schedule automatic payments. I do this obsessively. I run all of my regular payments through my bank’s online bill-pay. I think there are 2 bills that get paid manually; 1 is a quarterly payment, the other is due annually.

2. Eat your groceries. According to the post, Americans–on average–throw away 15% of the groceries they buy. I totally believe that. We don’t throw away that much, but it’s still too much. It tends to be the fresh vegetables, which we eat as side dishes instead of the main course. We need to switch that mindset, both to use the vegetable efficiently and to eat healthier.

3. Bundle services. I refuse. I hate the idea of having a single point of failure for multiple systems. If the power goes out, I lose my cable, but I keep the phone. If, for some reason, I can’t pay my phone bill, I don’t lose my internet connection. I like keeping these things separated.

4. Pay off credit card. Hardly a lazy process, but otherwise…duh!

5. Mark your calendar. I use my Google Calendar as obsessively as I use automatic payments. I put in reminders, grocery lists, or anything else I need to know at a specific time.

6. File your taxes on time. I just helped a friend dig out of this mess. I pay as soon as all of my paperwork is delivered. The IRS doesn’t give up and they have leverage, including garnishment and even jail.

7. Roll it over. When you change jobs, take your 401k with you. Don’t leave it behind like a series of red-headed stepchildren. It’s too easy to lose track of the accounts. Don’t cash it out! I made that mistake once and lost far too much to taxes. A rollover doesn’t count against your 401k contribution limits.

8. Switch credit cards. If you can a good balance transfer offer that’s followed by a better interest rate than you currently have, use it. But don’t forget to pay attention to the transfer fees. Do the math. If it costs you $500 to transfer the money, how much interest do you have to save to make it worthwhile?

9. Use your privileges. If you have a AAA membership, use it. It gives you a discount on hotels, oil changes, car rentals, and more. Read the paperwork. Former military gets a ton of random discounts, too. Ask.

10. Rent instead of buy. Renting can save you money over buying, if it’s something you’ll only use once, but borrowing is free.

11. Buy instead of rent. Rent-a-center is a ripoff, but they can’t even legally operate here. If you’re going to use something regularly, buy it.

12. Ask. I love to call up every company I give money to and ask if there’s a way I can give them less. Outside of chain stores and restaurants I almost always ask for a lower price.

13. Just say no. Extended warranties are generally a waste of money. However, if I can’t afford to replace the item, I do get the warranty. On my car, I brought it in for a full inspection and repair a few weeks before the warranty ran out and made all of that money back. We are slowly building a warranty fund to replace the need for any future extended warranties.

14. Have the awkward conversation. We tried giving gift-giving the axe, but nobody enjoyed that. Now, we cap the gifts at $20 and do a round-robin type of gift. $40 for gifts keeps 10 adults happy.

15. Eat at home. Generally, I can cook almost anything better at home, but I really do enjoy eating out and trying new restaurants. We just keep it from being a regular expense.

16. Balance your checkbook. What a waste of time! With automatic payments and cash for all of the discretionary budget items, I balance the checkbook once a month.

17. Stick with your bank. Either use your own bank’s ATM network, or use a bank that refunds ATM fees. I only take out cash on the first of the month, for the entire month and I do that with a teller, so this is never an issue for us.

18. Use your TV. Cable movie packages instead of a video membership? Really? That’s a horrible idea.

19. Quit those bad habits. I quite smoking, saving $200 a month. I don’t drink much and I’m working on fixing my eating habits. Vices are fun, and this is certainly not a fun way to save money.

20. Forget the pet. There is no way this would fly at my house. we have 5 cats, 2 gerbils, and a dog. Our renter has 2 pythons. We’re a flippin’ zoo and honestly, mess and cost aside, we all like it that way.

How do you stand on these ideas?

Article written by money supermarket.

Sometimes the price you pay in-store for a product or service can change dramatically if you find the same product online, and in most cases the price in-store can be considerably higher. There’s nothing worse than getting home from a shopping trip thinking you have a bargain, until you realise that you could have saved a lot more had you have waited until you got home. Here are a few examples of things you should buy online to save money:

All movies, whether on DVD or Blu Ray format, are generally cheaper if bought online, it’s a fact that I have learned over the years. I’ve always found that searching the sites of film selling giants Amazon and Play, I can always find a movie that little bit cheaper and some considerably so. There are also some websites such as dvdpricesearch that compare prices of all of the big merchants for you; it’s a great way to save time and money.

In my opinion, the day of buying flights face to face is slowly on the decline, I seem to find considerably cheaper prices by searching online at home. I think the main reason for this is that, travel or holiday agents just do what we do, they search online for the best prices, and unless they have any exclusive deals then they will just be getting the same prices as us. I tend to use some online travel comparison websites that again do the searching for you; however, some work better than others so make sure you do your research.

I always purchase books online, whether in the standard physical format or in the form of an e-book. Books are just one of those things that always seem to be cheaper, with the likes of Amazon and Borders available online and offering fantastic discounts. There are also many websites that sell niche or rare books online that can be considerably cheaper than going direct to a book seller.

Auto insurance is one of those things that we all hate purchasing, but if you want to drive your vehicle on the road, then by law we have to spend our hard earned cash on it. Getting your auto insurance online can save you a lot of money. Using price comparison sites, you only have to fill in one form as if you’re applying for one quote, you will then be provided with a list of pricing options available to you.

Whether you are just buying a handset or if you’re looking for a monthly cell phone price plan, I always seem to find better deals online than I can in-store. Of course in-store you have the ability to try and haggle but I’ve found that the deals I get offered are never as good as those that I can find online. Online you can also search by provider website which is another great way to save money, and it would take you a lot of time to visit each store!

Jason’s note: I shop online a lot. I buy things that most people don’t realize are available online. An interesting counterpoint question: What should you buy in-person to save money?

Have you ever set a goal…and failed?

At some point, it happens to all of us. After all, our reach should exceed our grasp, right? That doesn’t make it easy to admit failure, or to correct it. Did you let a New Year’s resolution lapse, or slip off of a diet? Have you started shopping indiscriminately again, or stopped going to the gym?

It’s okay if you did, but it’s time to fix it.

How can you get back on track after failing a goal?

Just like when you first started towards your goal, you have to decide when you’re going to get back on board. If you can’t decide, just pick the beginning of the next month. A new beginning is a great time to tackle your new beginning.

You failed once. Accept it and move on. Past behaviors don’t have to be an indicator of future performance. Just do better this time.

Somebody has noticed that you aren’t on the wagon. Your coworkers are seeing you eating candy, or your spouse has noticed you buying things you don’t need. Talk to these people. Tell them you’re going to redo the things you’ve undone. You’ll change the world, but you have to start with yourself.

Unless I have seriously misjudged my audience, you are human. Humans sometimes make poor decisions. Being ashamed won’t help you, but take the opportunity to learn from the past. Do you know what caused you to fail? Are there triggers to your behavior that you can avoid this time around? When I quit smoking, I tried to avoid rush hour, because I smoked heavily while I drove and I wanted to avoid being in car for as long as possible, minimizing one of my triggers. What cause your lapse, and can you avoid it?

This one should be the most obvious, but the fact that it’s a problem means it’s not. Do whatever it takes to not make the same mistakes and uphold your goals. Don’t smoke. Don’t eat garbage. Exercise more. Whatever you’ve decided to do or not do, do it….or not.

Have you missed a goal? How have you picked it back up?