- @Elle_CM Natalie's raid looked like it was filmed with a strobe light. Lame CGI in reply to Elle_CM #

- I want to get a toto portable bidet and a roomba. Combine them and I'll have outsourced some of the least tasteful parts of my day. #

- RT @freefrombroke: RT @moneybeagle: New Blog Post: Money Hacks Carnival #115 http://goo.gl/fb/AqhWf #

- TED.com: The neurons that shaped civilization. http://su.pr/2Qv4Ay #

- Last night, fell in the driveway: twisted ankle and skinned knee. Today, fell down the stairs: bruise makes sitting hurt. Bad morning. #

- RT @FrugalDad: And to moms, please be more selective about the creeps you let around your child. Takes a special guy to be a dad to another' #

- First Rule of Blogging: Don't let real life get in the way. Epic fail 2 Fridays in a row. But the garage sale is going well. #

Twitter Weekly Updates for 2010-07-03

- I miss electricity. #

- @prosperousfool Do you still need a dropbox referral? in reply to prosperousfool #

- @prosperousfool Dropbox: https://www.dropbox.com/referrals/NTE1Mjk2OTU5 in reply to prosperousfool #

- Don't let anyone tell you otherwise: Electricity is the bee's knees, the wasp's nipples and lots of other insect erogenous zones. #

- @prosperousfool Throw in a Truecrypt partition and the PortableApps launcher and it gets really neat. in reply to prosperousfool #

- @prosperousfool Universal accessibility. I put an encrypted partition on it so any receipts or credit card info or login info would be safe in reply to prosperousfool #

- RT @untemplater: RT @jenny_blake: Deep thought of the day: "How people treat you is their karma; how you react is yours." -Wayne Dyer #quote #

- @FARNOOSH So what's happening to the one good show on SOAPNet? in reply to FARNOOSH #

- RT @flexo: RT @mainstr: 1 million Americans have been swindled in an elaborate credit card scam and they may not know http://bit.ly/cr8DNK #

Winning the Mortgage Game

There’s a game that’s often mistakenly called “The American Dream”. This game is expensive to play and fraught with risk. It single-handedly ties up more resources for most people than anything else they ever do.

The game is called Home Ownership.

At some point, most people consider buying a house. On the traditional, idealized life-path, this step comes somewhere between marriage and kids. That’s usually the easiest way to organize it. If you have kids first, you’re much less likely to buy a home. This is a game with handicaps.

Once you get to the point where you are emotionally ready to invest in the 30-year commitment that is a house, your first impulse tends to be to rush to the bank to find out how much money you can borrow.

That’s a mistake. If you take as much as the bank will qualify you for, you’re most likely to overextend yourself and end up losing your house. That’s the quick way to lose the home ownership game.

The best thing you could do is figure out how much you can afford before you visit a bank. Conventional wisdom says that your mortgage payment should be no more than 28% of your gross income, but that’s absurd. Who builds their budget on their gross income? I like 28%, but only of your net income. To make the numbers easier to remember, I’d round it to 30%. If you take home $3000 per month, your mortgage payment should be no more than $900 per month.

From there, it pretty easy to figure out how much house you can afford. Using this e mortgage calculator, you’d be able to afford a mortgage of $175,000 if we assume an interest rate of 4.5%. Throughout most of the United States, that will buy you a reasonably sized home, though certainly nothing ostentatious. Clydesdale Bank also has an excellent loan calculator.

Some people like to start out with an interest-only loan. That same emortgage calculator shows that an income of $3000 per month would be able to afford a $240,000 with almost the same payment. That seems like a good plan, but eventually, you’ll have to pay more than just the interest. Taking out a loan that will one day be more than you can afford on the assumption that you’ll be making more money by then is not sound financial planning. That’s the same logic that helped me bury myself in debt.

When you buy a house, make sure to base your payments and your mortgage on what you can realistically afford. Anything else, and you’ll only end up poorer and less happy than when you started.

Why I chose a prepaid credit card

This is a guest post.

You can’t get credit without a credit card, and you can’t get a credit card without good credit. This is a dilemma that many people find themselves facing, whether they are trying to re-establish their credit or build credit for the first time. In fact, this is the dilemma that I found myself in. My solution was to get a prepaid card, and here’s why.

The Real Deal with Prepaid

Prepaid credit cards have earned a mixed reputation over the years. While it’s true that they usually have more fees than a regular credit card, they also offer a financial solution for people who don’t have good credit. And you should also keep in mind that they don’t charge interest because the cash that you are using is yours to begin with. The important thing to remember about prepaid cards is that they are a means to an end; once you rebuild your credit, you’ll find it much easier to apply for a card with better rates and fewer fees.

In addition, prepaid cards offer several advantages. The most important one for me was the convenience of having a card that I could use to make purchases. Prepaid cards look and work exactly like regular credit cards (you don’t have to enter a personal identification number to use them), so the only one who knows it is prepaid is me. And while I use cash for everyday purchases, there’s no avoiding the need for a card when you have to shop online or pay for gasoline at the pump, for example. Most digital merchants only accept payments from cards linked to large financial brands like Mastercard and Visa, and my card gives me a way to buy what I need from whoever has it in stock. In addition, my prepaid card offers me a way to keep track of all of my purchases electronically, which is helpful since I am trying to keep a closer eye on my budget.

Prepaid cards also offer security. Cash can easily be lost or stolen, but if you lose a prepaid card, you can easily get a replacement. More importantly, your balance is protected by a replacement guarantee from your bank, which comes in handy if you ever have to dispute fraudulent charges.

Perhaps the most convenient factor of a prepaid card, though, is how easy it is to get one. You don’t have to have a bank account in your name to receive a prepaid card. However, if you do have an account, you can easily link it to your prepaid card.

Changing my spending habits and getting out of debt hasn’t been easy for me, but one way for me to show creditors that I am getting better at managing finances is to build my credit with my prepaid card. It’s also a way for me to eventually be able to make big purchases that are necessary, such as a car, and hopefully one day, a home. Prepaid isn’t for everyone, but if you find yourself considering this option, it’s worth a second look.

Net Worth Update

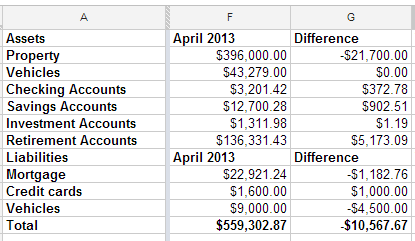

I looked back at the spreadsheet I use to track my net worth, and realized that I have been filling it out quarterly, though I can’t say that has been on purpose. Apparently, I get an itch to see my score about four times per year.

This quarter is the first time in a long time that my net worth has dropped. We got our property tax statements last week and found out that our houses have dropped a combined $21,700. Since we’re not planning to sell, that doesn’t matter much.

What’s interesting to me is that, even though our property values dropped $21,700, our total net worth only fell $10,567. We’ve been hustling trying to get the Tahoe paid off. It’s going a little bit slower than I had hoped, but it’s progressing nicely.

I do feel good that, even if I would have been focusing on my mortgage, I still would have lost the mortgage race. That means my misplaced priorities of acquiring more debt to snatch a fantastic deal didn’t cost me the race. Now, I’ll be forced to take a vacation in Texas, coincidentally in the same town as my wife’s long lost brother. I think we can make that work.

I rounded off the credit card and vehicle totals because one is used every day and paid off every month and the other has a steady stream of money getting thrown at it, so the numbers change often.

All in all, I don’t have any room to complain. I am looking forward to paying off the truck and focusing on the mortgage. We could swing quadruple payments, which would pay off the house shortly after the new year starts.

How come my back hurts?

My favorite book series is the Sword of Truth by Terry Goodkind. It’s a good sword-and-sorcery, good-versus-evil fantasy.

But I’m not here to talk about that series. Rather, I’m going to talk about one particular scene in book 6, Faith of the Fallen.

There’s a scene where Richard, the protagonist, ends up in a socialist workers’ paradise, where the government controls distribution and everybody is starving. Jobs are hard to come by, because everything is unionized and unions control access to work. That’s a non-accidental parallel to every country that has embrace socialist principles, or even leans that way. Go open a business with employees in France, I dare you.

So Richard goes out of his way to help someone with no expectation of reward. This person then offers to vouch for him at the union meeting, effectively offering him a job.

This is the conversation that follows:

Nicci shook her head in disgust. “Ordinary people don’t have your luck, Richard. Ordinary people suffer and struggle while your luck gets you into a job.”

“If it was luck,” Richard asked, “then how come my back hurts?”

If it was luck, how come my back hurts?

Seneca, a 2000-year-dead Roman philosopher said, “Luck is where the crossroads of opportunity and preparation meet.”

I won’t lie, I’ve got a pretty cushy job. I make decent money, I work from home, I love my company’s mission, and I kind of fell into the job.

By fell into, I mean:

- I started teaching myself to program computers when I was 7.

- I worked in a collection agency collecting on defaulted student loans to put myself through college while I had a baby at home.

- When I graduated, I went out of my way to help anyone I could, which positioned me for a promotion, getting my first programming job. The first one is the hardest.

- I spent 3 years studying the online marketing aspects of what I’m doing, with no promise of a payoff.

- I launched a side business in the same industry as the company I work for.

- I built a relationship with an author to include his books in the classes I teach. He happened to move to the company I’m with.

- I offered advice–for free, on a regular basis–on certain aspects of his business and his responsibilities with this company.

- He offered me a job.

That’s 25 years and tens of thousands of dollars spent earning my luck. How come my back hurts?

I have a friend on disability. He has a couple of partially-shattered vertebrae in his back, but he keeps pushing off the corrective surgery because the payments would stop after he heals. He refuses to get a regular job, because his payments would stop. He lives on $400 per month and whatever he can hustle for cash, and he will make just that until the day he dies. And he complains about his bad luck.

His back literally hurts, but not metaphorically. His bad luck is the product of deliberately holding himself down to keep that free check flowing.

I have another friend who made some bad decisions young. Some years ago, he decided that was over. He took custody of his kid and started a business that rode the housing bubble. When the bubble popped, so did his business. Instead of whining about his luck, he worked his way into an entry-level banking job.

He put in long (long!) hours, bending over backwards to help his customers and coworkers, and managed a few promotions, far earlier than normal. His coworkers whined about it. He’s so lucky. If it was luck, why does his back hurt?

We make our own luck.

If you bust your ass, working hard and helping people–your coworkers, your customers, your friends, your neighbors–and you are willing to seize an opportunity when it appears, you will get ahead. When you do, the people around you who do the bare minimum, who refuse–or are afraid–to seize an opportunity, who always ask what’s in it for them, they will will whine about your luck.

When they do, you will get to ask, “If it was luck, how come my back hurts?”