- RT @kristinbrianne: Get Talk and Txt Unlimited Cell Svc w/ Free Phone for $10 per month by joining DNA for Free. http://tinyurl.com/yyg5ohn #

- RT: @ChristianPF is giving away an iPod Touch! – RT to enter to win… http://su.pr/2LS3p5 #

- 74 inch armspan and forearms bigger than my biceps. No, I don't button my shirt cuffs. #

- RT @deliverawaydebt Money Hackers Network Carnival #111 – Don't Hassel the Hoff Edition http://bit.ly/9BIAvE #

- @bargainr What would it take to get you to include me in the personal-finance-bloggers list? #

- Working on a Penfed application to transform my worst interest rate into my best. #

- Gave the 1 year old pop rocks for the first time. Big smiles. #

- @Netflix @Wii disc works well and loads fast. Go, go gadget movie! #

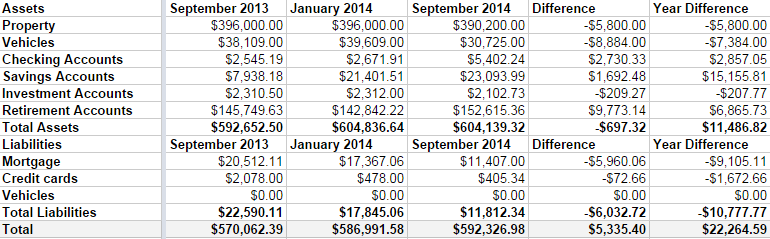

Net Worth Update – September 2014

It’s time for my irregular-but-usually-quarterly net worth update. It’s boring, but I like to keep track of how we’re doing. Frankly, I was a bit worried when I started this because we’ve been overspending this summer and Linda was off work for the season.

But, all in all, we didn’t do too bad.

Some highlights:

- Both of our properties lost around $3000 in value. I’m not worried, because we are keeping them both for the long haul. The rental is basically on auto-pilot, so that’s free money every month.

- We sold a boat that appraised for much less I had estimated in the last few updates. I had it listed for $5000, but it was worth $2000.

- I do have a credit card balance at the moment, but that goes away as soon as my expense check clears the bank, which will be in a day or two.

- We’re in the home stretch with the mortgage. There is $11,407 left to go, and we’ve paid down $9105 in the last year. By this time next year, I want that gone, gone, gone.

I can’t say I’m upset with our progress. We’ve paid down $6000 in debt in 2014, including 3 months with 1 income. We aren’t maxing our retirement accounts, yet, but I’d like to be completely debt free before I do that. It’s bad math, but having all of my debt gone will give me such a warm fuzzy feeling, I can’t not do it.

My immediate goal is to hit a $600,000 net worth by my next update in January. I’m only about $7000 off.

Time to hit the casino. Err, I mean, time to up my 401k contribution from 5% to 7%.

Twinkies: A Failure of Unionization

Twinkies may survive nuclear warfare, but the iconic sweet treat ultimately couldn’t withstand the might of the unionized workforce. Faced with mounting losses and overwhelming debt, due in no small part to the relentless demands of the various unions representing the nearly 19,000 employees, Hostess Brands filed bankruptcy for the second time in January 2012 and ultimately requested permission to liquidate it’s assets in November of last year when a buyer failed to materialize. While many factors played a part in the demise of the maker of such all-American snacks as Ding Dongs and Ring Dings, as well as childhood favorite Wonderbread, there is no denying the fact that costs imposed by union contracts were a major factor in the shuttering of this once-beloved company.

Certainly America’s changing eating habits, increased competition from such companies as McKee Foods, makers of Little Debbie snack cakes, and rising commodity costs all contributed to the ultimate demise of Twinkies. There is no doubt, though, that union contracts inhibited the company’s ability to adapt and make the necessary changes to remain profitable. Not only were employee costs out of control, ridiculous union rules made it nearly impossible for the company to make money. These are just a few of the rules that hampered Hostess’ management:

- Twinkies and Wonder Bread could not be delivered on the same truck.

- Drivers could only deliver one product, even if they did not have a load and a load of another product was waiting to go out.

- Drivers could only drive. They had to wait for loaders to fill their trucks.

- Likewise, loaders could only handle one product. Their contract prohibited a Twinkie loader from helping out if the Wonder Bread loaders were shorthanded.

Yes, management agreed to these terms, but often they were forced to do so in order to prevent a costly strike. In fact, it was a labor strike that lead to the decision to liquidate.

Unions are meant to protect workers from dangerous working conditions, overbearing management and unfair labor practices. Ensuring a living wage and decent benefits is another of their responsibilities. However, it is evident that in this case, the unions became as much an enemy of the Hostess employees as of the company’s management. As a result of their unwillingness to compromise and make wage and benefit concessions, almost 20,000 people no longer have a job that needs to be protected. In the end, the unions drove not only the company but themselves out of business.

Not to fear, however. Two private equity firms acquired Hostess’ assets last fall and are beginning to turn the company around. Production of Twinkies began again in June, and the gooey sponge cakes returned to store shelves on July 15. The workforce has been dramatically reduced and will not be unionized. In the end, probably the only winner in this battle is America’s sweet tooth.

Related articles

Why Kelly Rutherford’s bankruptcy should make you more prudent about your finances

Kelly Rutherford is an actress. Not just an actress, but a working actress. She is not a familiar looking extra or an actress who  frequently guest stars on television, but someone who has appeared as a series regular on multiple high profile shows since the 1990s. She recently ended a six-season run on the CW hit “Gossip Girl.” This all makes the recent revelations of her bankruptcy that much more surprising. How does someone who has made it in an ultra-competitive, well-compensated field end up with over $2 million in debt? There are several lessons that we can learn from Kelly Rutherford’s unfortunate bankruptcy.

frequently guest stars on television, but someone who has appeared as a series regular on multiple high profile shows since the 1990s. She recently ended a six-season run on the CW hit “Gossip Girl.” This all makes the recent revelations of her bankruptcy that much more surprising. How does someone who has made it in an ultra-competitive, well-compensated field end up with over $2 million in debt? There are several lessons that we can learn from Kelly Rutherford’s unfortunate bankruptcy.

2. Have a plan for paying your taxes

In addition to the $1.5 million in legal fees, Kelly owes $350,000 in income tax for 2012. For the majority of us, paying taxes is simple. Your company automatically takes deductions out of your paycheck that pay for your income tax.

If you are a contractor or self-employed, it’s important to remember that not all the money you earn is yours. Make sure to set aside a certain percentage of each paycheck that you will use to pay your taxes at the end of the year. Try to estimate your expected income and taxes for the year and set up a separate account that you can use to settle your tax bill. If possible, get some guidance from an accountant on how to pay your estimated taxes quarterly.

3. Set up an emergency fund

Kelly works in a profession in which rapid changes in income are quite common. One month you are earning $40,000 per month for being on a hit show, the next month your character is written off the show or the show comes to an end and you no longer have any income coming in. In any field in which income tends to drastically change, it is especially important to set aside an emergency fund to help account for the uncertainty in income stream.

While the majority of us likely have more certainty about how much we expect to earn in the future, it is still important to set aside some funds in an emergency account. Whether you are an actor or an office worker, there is always some uncertainty about the future, and having an emergency account can make it easier to ride the ups and downs as you encounter them.

While Kelly Rutherford’s bankruptcy is sad and alarming, there are lessons we can derive from it to make us all more prudent about our financial future.

Related articles

Twitter Weekly Updates for 2010-05-08

- The Festival of Frugality #278 The Pure Peer Pressure Edition is up. All of your friends are reading it. http://bit.ly/aqkn4K #

- RT @princewally: Happy StarWars Day!: princewally's world http://goo.gl/fb/rLWAA #

- Money Hacks Carnival #114 – Hollywood Edition http://bit.ly/dxU86w (via @nerdwallet) #

- I am the #1 google hit for "charisma weee". Awesome. #

Beat the Check

- Image via Wikipedia

Have you ever played a game of “Beat the Check”? Your rent is due tomorrow, but you don’t get paid until Friday, so you write the check today an, on payday, you run to the bank to get your paycheck deposited before it has a chance to clear. To stretch out the time, you write yourself a check from another account to cover the deficit, knowing that will take a few more days to clear. This is called “floating” a check.

Sound familiar?

I think most people who write checks have tried to rush a deposit in before a check clears.

In 2004, the Check 21 act went into effect, which turned the game on its head. This law gave check recipients an option to make a digital copy of a check, slashing processing time. Instead of boxes of checks being transported around the country, the check began getting scanned and instantly transferred, along with all of the encoding necessary to keep the digital checks organized. This dramatically cut the amount of time it took to clear a check. What was once a week was reduced to as little as 48 hours.

Now, as technology improves and banks update their infrastructure to match, the “float” time has been reduced even further. Many banks are using image control systems to instantly convert all incoming checks to digital format. Within a couple of hours, these images can be transmitted to the Federal Reserve, to be transmitted nearly instantly to the issuing bank. If both the issuing and the receiving banks are using modern image control systems, it is impossible to float a check. “Beat the Check” is a thing of the past. It’s like betting on purple at the roulette wheel.

Of course, this doesn’t mean that the funds are instantly available. That would eliminate the banks being able make use of the funds during that time. Don’t expect the banks to make a habit of allowing you the use of your money before the federal regulations demand it.