What would your future-you have to say to you?

The no-pants guide to spending, saving, and thriving in the real world.

What would your future-you have to say to you?

People can’t be happy in a vacuum. We are social creatures. Even the most anti-social among us needs some human contact. How can you make that contact happen in a meaningful way? How can you connect with other people beyond some superficial meaningless chatter?

According to Keith Ferrazzi in his book, Who’s got your back, there are four mindsets necessary to build lifelong relationships.

1. Generosity. This is your promise to help others succeed. If have a skill that can help someone you know, why not give them a hand? when you help others, you are building social capital, which is a currency that cannot be bought. Since our lives are not ledger books, you can’t do favors with repayment in mind, but it is reasonable to assume that the people ou help will want to help you some day.

An often overlooked generosity strategy is to give away 90% of everything. I’m not suggesting you give away 90% of your wealth or possessions. I’m suggesting you give away 90% of your personal product. Plan to give away 9 times more than your receive. This will not only keep your from being disappointed, but it will also leave you feeling very fulfilled.

2. Vulnerability. It is important to let down your guard and let the world see your humanity. It’s almost impossible to truly connect with someone who’s shields are always up: the guy who seems to be invulnerable and unapproachable. The people you spend time with know your flaw anyway. If you pretend they don’t exist, you are only fooling yourself. I have a lot of problem with this one. Letting down my guard is incredibly difficult, in almost every circumstance. It is far easier to be strong than to let myself be vulnerable.

3. Candor. Total honesty is vital to establishing–and maintaining– lifelong relationships. Even the white lies can destroy your connections. If you can lie about the little things, you are planting doubts on everything else you do and say. Who can trust you then? Lying is inappropriate in almost all conceivable cases. I was raised that a man’s word is his bond. Almost everything you have can be taken away from you, but not your honor. That can only be destroyed by you. Without it, what do you really have?

4. Accountability. You need to follow through on your promises. Be Mr. Reliable(or Mrs!). If you say you will do something, do it! Nothing builds resentment faster than disappointing the people who are counting on you. If you can’t meet a commitment, let the soon-to-be-let-down know as early as possible, so other plans can be made. If you have a hard time keeping promises, then make fewer of them.

If you embrace these principles, you will be well on your way to building–and keeping–strong, satisfying relationships that benefit everyone.

How do you build your relationships?

This is a guest post.

It is hard to deny, that we are currently in a financial crisis. This is true not just in the United States but in the entire world! Indeed if

you look at what has been happening in Europe, the United States is not even in the worst shape among the advanced countries. Ireland, Portugal and especially Greece are suffering slow economic growth and crippling debt, with many other European countries not far behind them. Even countries that are still experiencing strong growth like China and India have no insurance against suffering a slow down in their rate of expansion.

However the United States is the world’s largest economy, so our milder economic problems have a larger proportional effect on the rest of the world. As the saying goes among economists, “When the U.S. catches a cold, the rest of the world gets pneumonia!” Therefore there is tremendous pressure on the United States to resolve the current financial crisis. America is trying to lower its debt and balance its budget before a serious financial crisis develops here like in Europe. If Congress and the President can agree on how this can be done then strong U.S. growth may return and thereby stimulate economic growth worldwide.

Alas, this debt cutting and budget balancing is easier said than done. Cutting spending means reducing or even eliminating government services that people have become accustomed to and prefer not to give up. Social Security for retirement, Medicare for health insurance, food stamps for the poor and many other spending programs all have people who depend on them and who are not happy to have them curtailed or eliminated. When such cuts were attempted in Greece and Great Britain, rioting broke out in major cities by those opposed to the cutbacks. Such violence is not expected in the United States, but it is still politically very difficult to make the kinds of cuts required for fiscal recovery. In fact the U.S. recently had one of its major credit ratings lowered because of skepticism that America has the political will to make the necessary changes.

On the plus side the United States has always managed to gets its financial house in order in the past, and most observers believe it will do so again, although there may be some spectacular political fireworks along the way! In the meantime many are wondering how to enhance their safety against today’s uncertainty and how to achieve financial freedom and peace of mind until better times arrive. While it is not possible to shield oneself completely from the financial crisis, it may be wise to get some cheap insurance quote to discover what types of insurance policies may give you some protection.

Whatever your financial status, there are always ways to protect what you own if you are willing to shop around. But whether one receives cheap insurance quotes or higher ones, now is the time to protect your assets until today’s financial crisis passes.

[Editor: This is a guest post from my good friend Terra. I’ve know her for–jeez, really–20 years. If you’re looking for a staff writer, hit her up. Seriously. She’s good people.]

[Editor: This is a guest post from my good friend Terra. I’ve know her for–jeez, really–20 years. If you’re looking for a staff writer, hit her up. Seriously. She’s good people.]

Who doesn’t want a brighter future for their child? Book store shelves overflow with parenting advice tomes and how-to guides to make “uber-kids”. Eager parents lap up promises to raise their children’s I.Q., increase their chances to get into college, and improve their social skills.

From books to apps to specialized software, there is a dizzying number of products available to help your child grow into the genius you know he or she is.

But what if I told you that the secrets to increasing your child’s likelihood to succeed in life were absolutely free. Simple things you have complete control over. No batteries or special upgrades required. No matter your income, education level, or what country you live in, these deceptively simple tips offer powerful results.

Food connects people. From the dawn of time, our species has gathered around the fire, to break bread and share our stories.

In modern times, our schedule can be crazy (between work, social activities, and, you know, life) so having dinner on the table at 6 o’clock every night is not always possible. However, studies consistently show that having a family meal at least 3 times a week has huge benefits for children (from teenagers being less likely to abuse drugs and alcohol, to increased academic success, to reduced risk of developing eating disorders or becoming obese, the implications are impressive). And it doesn’t have to be dinner, any meal will work. Consistency is the key.

Far from being boring, children find the predictable routine of family meals reassuring, promoting warm, fuzzy feelings of closeness and comfort (though teenagers will never admit it). Whether it’s take-out or made from scratch goodness, nothing says “I care about you” like sharing a meal.

Quality matters here, so remove distractions during meal time (turn off the TV, ban phones) and focus on each other. Take this time to reconnect and talk about your day and ask the kids about theirs. Make this time sacred. It matters that much.

“We need 4 hugs a day for survival. We need 8 hugs a day for maintenance. We need 12 hugs a day for growth.” – Virginia Satir, psychotherapist

Receiving a loving hug feels wonderful. But beyond feeling “nice”, hugs literally have the power to heal us and improve our lives.

Hugs have superpowers. A hug has the power to release a “happiness hormone cocktail” of oxytocin (natural antidepressant, promotes feelings of devotion, trust and bonding), dopamine (intense pleasure), and serotonin (elevates mood, negates pain and sadness) in both the giver and receiver. Bonus, hugs are naturally gluten-free, organic, and have no unpleasant side effects.

To get the most benefits, prolonged hugging is recommended, around 20 seconds. A full-body hug stimulates your nervous system while decreasing feelings of loneliness, combating fear, increasing self-esteem, defusing tension, and showing appreciation. However, this hug fest only works its magic if you’re hugging someone you trust. Since children love to be held and cuddled, this is ideal for family bonding. Not so much with that new client you just landed (awkward…).

How does hugging effect children specifically? Children who aren’t hugged have delays in walking, talking, and reading. Hugging boosts self-esteem; from the time we’re born our family’s touch shows us that we’re loved and special. All of those cuddles we give to our children are imprinted on them at a cellular level and will still be imbedded in their nervous system as adults. Hugs today equal the ability to self-love as adults. That’s an awesome gift.

We all know how important reading aloud to children is, from infants to teenagers. Reading is one of the most important factors affecting the development of a child’s brain. But reading skills are not hardwired into us; we don’t pop out of the womb quoting “Pride and Prejudice”. Reading skills need to be taught and encouraged.

Parents are a child’s first, and most important, teachers. While children can learn from flashcards and workbooks, nothing is more powerful than seeing your passion for reading. Whether you like it or not, your children are learning from your every move. What you find important, they will find important. No pressure! Teaching reading to your child requires attention, focus, and motivation. It also requires access to books, lots and lots of books.

Libraries are a great resource for developing a love of reading in your child. Most have a thoughtfully arranged children’s area offering story-time and other enrichment opportunities. However, nothing beats having a book to call your own, to hold and cherish, until the edges are worn with love.

Having a well-stocked home library, it turns out, matters. A lot. This study found that having a 500-book library was equivalent to having university-educated parents in terms of increasing the level of education their children will attain. That’s pretty powerful. It doesn’t matter if your family is rich or poor, from North America or Asia, if your parents are illiterate or college-educated, what matters is that you have books in your home.

Don’t’ have the space for 500 books? No worries. Having as few as 20 books in the home still has a significant impact on propelling a child to a higher level of education, and the more books you add, the greater the benefit.

Having a variety of books available makes a difference; especially important are reference books, with history and science texts having the greatest benefit.

No money for books? No Excuse! Dolly Parton’s Imagination Library is a great resource for free, high-quality children’s books. When you sign up, your child is mailed a new book each month until the age of five, addressed to them (a very special thing indeed).

I hope these tips empower you to take action. Small changes can have a big impact on your child’s future. Just remember, it’s not the money you make or the tutor you’ve hired or the new app you’ve installed that will catapult your baby Einstein ahead in life. It’s the quiet moments with you at home, eating, hugging, and reading that will carry them through whatever life brings their way.

Are these things you would like to focus on in your family? Do you have simple parenting tips that have made a difference in your child’s life?

My son, at 10 years old, is a deal-finder. His first question when he finds something he wants is “How much?”, followed closely by “Can I find it cheaper?” I haven’t–and won’t–introduced him to Craigslist, but he knows to check Amazon and eBay for deals. We’ve been working together to make sure he understands everything he is looking at on eBay, and what he needs to check before he even thinks about asking if he can get it.

The first thing I have him check is the price. This is a fast check, and if it doesn’t pass this test, the rest of the checks do not matter. If the price isn’t very competitive, we move on. There are always risks involved with buying online, so I want him to mitigate those risks as much as possible. Pricing can also be easily scanned after you search for an item.

The next thing to check is the shipping cost. I don’t know how many times I’ve seen “Low starting price, no reserve!” in the description only to find a $40 shipping and handling fee on a 2 ounce item. The price is the price + shipping.

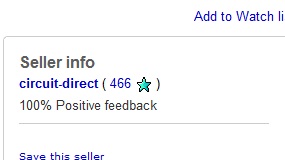

Next, we look at the seller’s feedback. The feedback rating has a couple of pieces to examine. First, what is the raw score? If it’s under 100, it needs to be examined closer. Is it all buyer feedback? Has the seller sold many items? Is everything from the last few weeks? People just getting into selling sometimes get in over their heads. Other people are pumping up their ratings until they have a lot of items waiting to ship, then disappear with the money. Second, what is the percent positive? Under 95% will never get a sale from me. For ratings between 95% and 97%, I will examine the history. Do they respond to negative feedback? Are the ratings legit? Did they get negative feedback because a buyer was stupid or unrealistic? Did they misjudge their time and sell more items than they could ship in a reasonable time? If that’s the case, did they make good on the auctions? How many items are they selling at this second?

[ad name=”inlineright”] After that, we look at the payment options. If the seller only accepts money orders or Western Union, we move on. Those are scam auctions. Sellers, if you’ve been burned and are scared to get burned again, I’m sorry, but if you only accept the scam payment options, I will consider you a scammer and move on.

Finally, we look at the description. If it doesn’t come with everything needed to use the item(missing power cord, etc.), I want to know. If it doesn’t explicitly state the item is in working condition, the seller will get asked about the condition before we buy. We also look closely to make sure it’s not a “report” or even just a picture of the item.

Following all of those steps, it’s hard to get ripped off. On the rare occasion that the legitimate sellers I’ve dealt with decide to suddenly turn into ripoff-artists, I’ve turned on the Supreme-Ninja Google-Fu, combined with some skip-tracing talent, and convinced them that it’s easier to refund my money than explain to their boss why they’ve been posting on the “Mopeds & Latex” fetish sites while at work. Asking Mommy to pretty-please pass a message about fraud seems to be a working tactic, too. It’s amazing how many people forget that the lines between internet and real life are blurring more, every day.

If sending them a message on every forum they use and every blog they own under several email addresses doesn’t work and getting the real-life people they deal with to pass messages also doesn’t work, I’ll call Paypal and my credit card company to dispute the charges. I only use a credit card online. I never do a checking account transfer through Paypal. I like to have all of the possible options available to me.

My kids are being raised to avoid scams wherever possible. Hopefully, I can teach them to balance the line between skeptical and cynical better than I do.

Finance is made out to be difficult, but it’s really not. All financial advice really boils down to 2 sentences: “Spend less than you earn. Save or invest the rest.” Everything else is an unnecessary complication, unless you need to be told that commemorative plates aren’t actually an investment. Unfortunately, we’re all people. (Except for you in the back. I see you, and you are not people.) People make mistakes. People sometimes need things spelled out, or at least explained in a way that makes it seem less intimidating to get started.

With that in mind, here are four steps that will get you out of debt and, over a long enough timeline, make you rich:

1. Lower your interest rates. If you’ve got debt, particularly credit card debt, you’re paying too much interest. It doesn’t matter what the interest rate is, it could be better. It’s time to pick up the phone and politely ask your credit card company to lower your interest rate. If they refuse, mention that their competitor is offering you 3% interest on a balance transfer with no transfer fee. Mention a competitor by name, but don’t worry about a specific offer. There are always offers being tossed about.

If they won’t lower your rate, find a company who will. 5% on a 10,000 balance is $500 per year. That’s 3 months of payments for free.

2. Lower your monthly payments. Do you have a cable bill? A phone bill? Any other bills? Put them in a stack and call them. Every. Single. One. Ask if there is any way you can lower your bill. Can you get put on a new customer promotion? My electric company offers a saver switch for my air conditioner that will lower my bill by 15% just for giving them the ability to toggle my AC on and off. When we had that installed, I never noticed it in use.

3. Save $1000. When you’ve got no money, every unexpected expense is an emergency. When you’ve got a little bit socked away, you can ride out the problems without much worry. $1000 may not be enough to ride out an extended bout of unemployment, but it does a pretty good job of taking the sting out of car repairs. Do whatever you have to do, but get some money in an emergency fund. Then, don’t touch it!

4. Categorize wants and needs. I want a vacation. My kid needs braces. I want a big screen TV. My gas bill needs to get paid. I want a new car. My family needs food. Are you sensing a theme? Pay attention to what you spend. Ask yourself if it’s something you need, or just something you really, really want. Just the act of categorizing it can make it easier to avoid buying whatever it is.

5. Use the savings from 1-4 to pay off whatever you owe. Don’t blow your new-found savings on spinner rims or soap made from rich-people tallow. Use it to finally get ahead of the game.