- RT @ramseyshow: RT @E_C_S_T_E_R_I_: "Stupid has a gravitational pull." -D Ramsey as heard n NPR. I know many who have not escaped its orbit. #

- @BudgetsAreSexy KISS is playing the MINUTE state fair in August. in reply to BudgetsAreSexy #

- 3 year old is "reading" to her sister: Goldilocks, complete with the voices I use. #

- RT @marcandangel: 40 Useful Sites To Learn New Skills http://bit.ly/b1tseW #

- Babies bounce! https://liverealnow.net/hKmc #

- While trying to pay for dinner recently, I was asked if other businesses accepted my $2 bills. #

- Lol RT @zappos: Art. on front page of USA Today is titled "Twitter Power". I diligently read the first 140 characters. http://bit.ly/9csCIG #

- Sweet! I am the number 1 hit on Ask.com for "I hate birthday parties" #

- RT @FinEngr: Money Hackers Carnival #117 Wedding & Marriage Edition http://bit.ly/cTO4FU #

- Nobody, but nobody walks sexy wearing flipflops. #

- @MonroeOnABudget Sandals are ok. Flipflops ruin a good sway. 🙂 in reply to MonroeOnABudget #

- RT @untemplater: RT @zappos: "Do one thing every day that scares you." -Eleanor Roosevelt #

Christmas Magic

When I was little, the world was amazing. The first snowfall was among the best days of the year. Everything was worth exploring, in hopes of discovering something new and fascinating, and everything was fascinating.

Stepping on a crack had serious implications. The wishbone in a turkey earned its name. Blowing out all of the candles on a birthday cake could change your life. The idea of some dude half a world away, watching you, then sneaking into your house to dish our rewards and punishments wasn’t pervy and sick, it was wonderful.

Then, one day, it all changes.

Somebody–a classmate, a older brother, a neighbor–let’s it slip that Santa isn’t real, and the implications snowball. That day, the magic dies.

Wishing on a star? Over.

The Easter Bunny? Hasenpfeffer.

Growing up to be Superman? Welcome to the rat race.

It’s a sad day when kids stop believing in magic.

I don’t believe in lying to my children, but I also don’t believe in destroying their magic. It’s a balancing act.

When my son was 6, an older boy at daycare tried to kill Santa for him. He was upset.

“Dad, is Santa real?”

“What do you think?”

“I don’t believe in Santa.”

“Okay, I’ll let him know.”

“Nonononononono! Don’t tell him!”

Was it lying? Probably, but he obviously wasn’t ready to stop believing, so I let him continue. A year later, we had the same conversation, but the results were quite different.

“Dad, you’ve always said that you hate lying, so why did you let me believe in Santa?”

So I told him the truth. Magic is a frail thing that’s nearly impossible to reclaim and I wanted him to have that treasure for as long as possible. And, “Now that you know, you are in on the conspiracy. You’ve been drafted. Don’t kill the magic for anyone else.”

It was weird having him help me stuff stockings.

If you’ve got kids(and celebrate Christmas), how do you handle the Santa problem?

My Credit Cards

This announcement is a bit premature, but not everything that’s premature has to end in an evening of disappointment.

At the beginning of the year, I transferred the balance of my last credit card onto two different cards, each with a 0% interest rate. One card got a $4,000 transfer and the other got $13,850. The approximately $415 in fees I paid for the transfer saved me nearly $1500 in interest this year.

The card that got the big balance is the card we use for a lot of our daily spending. On my statement dated 2/18/2012, the balance on the this card was $14,865.23. At the same time, the smaller card had a balance of $3,925.09, for a total of $18,790.32. When I started my debt-murder journey in April 2009, it had peaked at just under $30,000.

When my payments clear later today, that balance will be gone.

That is nearly $19,000 paid down in 8 months.

Now, the inheritance we picked up did accelerate our repayment a bit, but only by a few months.

Starting from $90,394.70 in April 2009, we have paid down $63,746.70, leaving $26,648.00 on our mortgage.

I’m more than a little excited, which–as usual–is the cause for the prematurity.

New goal: pay off the mortgage in 2013.

Net Worth Update – September 2014

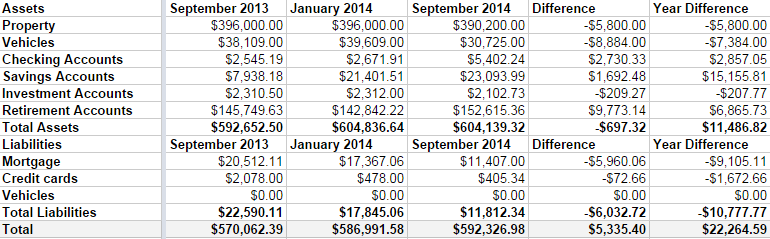

It’s time for my irregular-but-usually-quarterly net worth update. It’s boring, but I like to keep track of how we’re doing. Frankly, I was a bit worried when I started this because we’ve been overspending this summer and Linda was off work for the season.

But, all in all, we didn’t do too bad.

Some highlights:

- Both of our properties lost around $3000 in value. I’m not worried, because we are keeping them both for the long haul. The rental is basically on auto-pilot, so that’s free money every month.

- We sold a boat that appraised for much less I had estimated in the last few updates. I had it listed for $5000, but it was worth $2000.

- I do have a credit card balance at the moment, but that goes away as soon as my expense check clears the bank, which will be in a day or two.

- We’re in the home stretch with the mortgage. There is $11,407 left to go, and we’ve paid down $9105 in the last year. By this time next year, I want that gone, gone, gone.

I can’t say I’m upset with our progress. We’ve paid down $6000 in debt in 2014, including 3 months with 1 income. We aren’t maxing our retirement accounts, yet, but I’d like to be completely debt free before I do that. It’s bad math, but having all of my debt gone will give me such a warm fuzzy feeling, I can’t not do it.

My immediate goal is to hit a $600,000 net worth by my next update in January. I’m only about $7000 off.

Time to hit the casino. Err, I mean, time to up my 401k contribution from 5% to 7%.

Birthday Parties are Evil

This is a post from my archives.

I hate birthday parties. Well, not all birthday parties. Not even most parties. Just the expensive-for-the-sake-of-expensive parties. The bar-raising parties. The status-boosting parties. I’m done.

My son is seven years older than my first daughter. In those seven years, with only one kid, we managed to spoil him regarding birthday parties. Every party was big and there were a lot of presents. That’s an expensive way to run a birthday and it is a lot of stress. We even moved the parties home, but still invited all of our friends and family. It was much too stressful.

A good friend used the pizza and game place, buying tokens for everyone at the party. That’s incredibly expensive. Even if I wanted to, I couldn’t afford that for three kids. There’s an element of keeping up with everyone around me, but I just can’t make myself care about that anymore. They aren’t paying my debt or cleaning my house. They don’t get a vote.

My plan this year was to have a sleepover for my son. He had five friends spend the night, playing games and watching movies. They giggled and squealed for eighteen hours, all for the cost of some take-and-bake pizzas and snacks. It was a hit for everyone involved. The other parents got a night off and all of the kids had a blast.

My girls are one and two. We’re done with parties for them, too. They got big parties for their first birthdays. Those are parties for the adults; the kids don’t care. In a few years–even a few months–they won’t remember the party. My older daughter’s birthday will be a trip to the apple orchard, followed by cake and ice cream. She’ll get presents. She’ll get “her day”. She’ll remember that her birthday is special, without costing a lot of money.

We want them to have fun. We want them all to feel special. We also want to manage their expectations and keep the parties from breaking the budget. So far this year, it is working.

How do you run a birthday party on a budget?

Winning the Mortgage Game

There’s a game that’s often mistakenly called “The American Dream”. This game is expensive to play and fraught with risk. It single-handedly ties up more resources for most people than anything else they ever do.

The game is called Home Ownership.

At some point, most people consider buying a house. On the traditional, idealized life-path, this step comes somewhere between marriage and kids. That’s usually the easiest way to organize it. If you have kids first, you’re much less likely to buy a home. This is a game with handicaps.

Once you get to the point where you are emotionally ready to invest in the 30-year commitment that is a house, your first impulse tends to be to rush to the bank to find out how much money you can borrow.

That’s a mistake. If you take as much as the bank will qualify you for, you’re most likely to overextend yourself and end up losing your house. That’s the quick way to lose the home ownership game.

The best thing you could do is figure out how much you can afford before you visit a bank. Conventional wisdom says that your mortgage payment should be no more than 28% of your gross income, but that’s absurd. Who builds their budget on their gross income? I like 28%, but only of your net income. To make the numbers easier to remember, I’d round it to 30%. If you take home $3000 per month, your mortgage payment should be no more than $900 per month.

From there, it pretty easy to figure out how much house you can afford. Using this e mortgage calculator, you’d be able to afford a mortgage of $175,000 if we assume an interest rate of 4.5%. Throughout most of the United States, that will buy you a reasonably sized home, though certainly nothing ostentatious. Clydesdale Bank also has an excellent loan calculator.

Some people like to start out with an interest-only loan. That same emortgage calculator shows that an income of $3000 per month would be able to afford a $240,000 with almost the same payment. That seems like a good plan, but eventually, you’ll have to pay more than just the interest. Taking out a loan that will one day be more than you can afford on the assumption that you’ll be making more money by then is not sound financial planning. That’s the same logic that helped me bury myself in debt.

When you buy a house, make sure to base your payments and your mortgage on what you can realistically afford. Anything else, and you’ll only end up poorer and less happy than when you started.