Please email me at:

Or use the form below.

[contact-form 1 “Contact form 1”]

The no-pants guide to spending, saving, and thriving in the real world.

If you want to make money, help someone get healthy, wealthy or laid.

This section was quick.

Seriously, those three topics have been making people rich since the invention of rich. Knowing that isn’t enough. If you want to make some money in the health niche, are you going to help people lose weight, add muscle, relieve stress, or reduce the symptoms of some unpleasant medical condition? Those are called “sub-niches”. (Side question: Viagra is a sub-niche of which topic?)

Still not enough.

If you’re going to offer a product to help lose weight, does it revolve around diet, exercise, or both? For medical conditions, is it a way to soothe eczema, instructions for a diabetic diet, a cure for boils, or help with acne? Those are micro-niches.

That’s where you want to be. The “make money” niche is far too broad for anyone to effectively compete. The “make money online” sub-niche is still crazy. When you get to the “make money buying and selling websites” micro-niche, you’re in a territory that leaves room for competition, without costing thousands of dollars to get involved.

Remember that: The more narrowly you define your niche market, the easier it is to compete. You can take that too far. The “lose weight by eating nothing but onions, alfalfa, and imitation caramel sauce” micro-niche is probably too narrowly defined to have a market worth pursuing. You need a micro-niche with buyers, preferably a lot of them.

Now the hard part.

How do you find a niche with a lot of potential customers? Big companies pay millions of dollars every year to do that kind of market research.

Naturally, I recommend you spend millions of dollars on market research.

No?

Here’s the part where I make this entire series worth every penny you’ve paid. Times 10.

Steal the research.

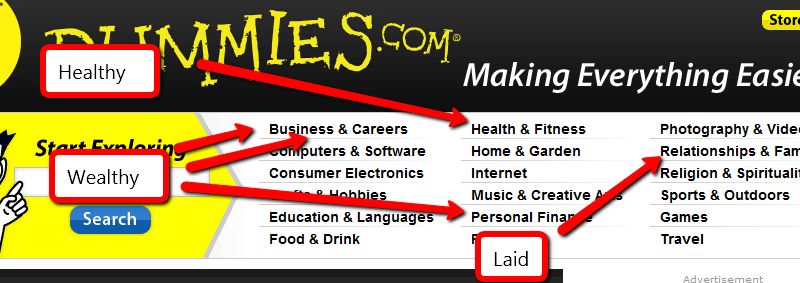

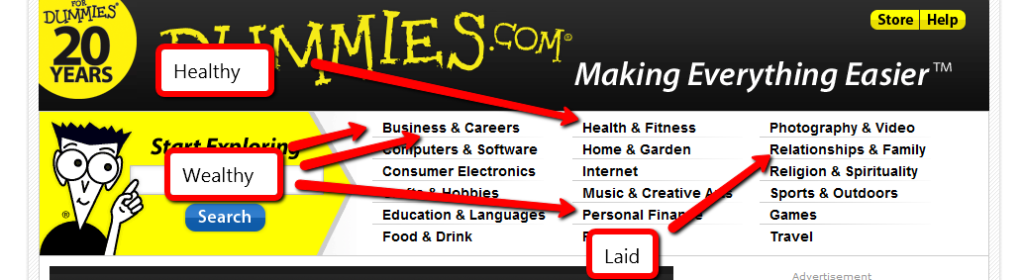

My favorite source of niche market research to steal is http://www.dummies.com/. Click the link and notice all of the wonderful niches at the top of the page. Jon Wiley & Sons, Inc. spends millions of dollars to know what topics will be good sellers. They’ve been doing this a long time. Trust their work.

You don’t have to concentrate on the topics I’ve helpfully highlighted, but they will make it easier for you. Other niches can be profitable, too.

Golf is a great example. Golfers spend money to play the game. You don’t become a golfer without having some discretionary money to spend on it. I’d recommend against consumer electronics. There is a lot of competition for anything popular, and most of that is available for free. If you choose to promote some high-end gear using your Amazon affiliate link, you’re still only looking at a 3% commission.

I like to stick to topics that people “need” an answer for, and can find that answer in ebook form, since I will be promoting a specific product.

With that in mind, pick a topic, then click one of the links to the actual titles for sale. The “best selling titles” links are a gold mine. You can jump straight to the dummies store, if you’d like.

Of the topics above, here’s how I would narrow it down:

1. Business and Careers. The bestsellers here are Quickbooks and home buying. I’m not interested in either topic, so I’ll go into “More titles”. Here, the “urgent” niches look like job hunting and dealing with horrible coworkers. I’m also going to throw “writing copy” into the list because it’s something I have a hard time with.

2. Health and Fitness. My first thought was to do a site on diabetic cooking, but the cooking niche is too competitive. Childhood obesity, detox diets and back pain remedies strike me as worth pursuing. I’m leaning towards back pain, because I have a bad back. When you’ve thrown your back out, you’ve got nothing to do but lie on the couch and look for ways to make the pain stop. That’s urgency.

3. Personal Finance. The topics that look like good bets are foreclosures and bankruptcies. These are topics that can cost thousands of dollars if you get them wrong. I hate to promote a bankruptcy, but some people are out of choices. Foreclosure defense seems like a good choice. Losing your home comes with a sense of urgency, and helping people stay in their home makes me feel good.

4. Relationships and Family. Of these topics, divorce is probably a good seller. Dating advice definitely is. I’m not going to detail either one of those niches here. Divorce is depressing and sex, while fun, isn’t a topic I’m going to get into here. I try to be family friendly, most of the time. Weddings are great topic. Brides are planning to spend money and there’s no shortage of resources to promote.

So, the niches I’ve chosen are:

I won’t be building 9 niche sites in this series. From here, I’m going to explore effective keywords/search terms and good products to support. There’s no guarantee I’ll find a good product with an affiliate program for a niche I’ve chosen that has keywords that are both highly searched and low competition, so I’m giving myself alternatives.

For those of you following along at home, take some time to find 5-10 niches you’d be willing to promote.

The important things to consider are:

1. Does it make me feel dirty to promote it?

2. Will there be customers willing to spend money on it?

3. Will those customers have an urgent need to solve a problem?

I’ve built sites that ignore #3, and they don’t perform nearly as well as those that consider it. When I do niche sites, I promote a specific product. It’s pure affiliate marketing, so customers willing to spend money are necessarily my target audience.

Today, I am continuing the series, Money Problems: 30 Days to Perfect Finances. The series will consist of 30 things you can do in one setting to perfect your finances. It’s not a system to magically make your debt disappear. Instead, it is a path to understanding where you are, where you want to be, and–most importantly–how to bridge the gap.

I’m not running the series in 30 consecutive days. That’s not my schedule. Also, I think that talking about the same thing for 30 days straight will bore both of us. Instead, it will run roughly once a week. To make sure you don’t miss a post, please take a moment to subscribe, either by email or rss.

On this, Day 7, we’re going to talk about paying off debt.

Until you pay off your debts, you are living with an anchor around your neck, keeping you from doing the things you love. Take a look at the amount you are paying to your debt-holders each month. How could you better use that money, now? A vacation, private school for your kids, a reliable car?

If you’ve got a ton of debt, the real cost is in missed opportunities. For example, with my son’s vision therapy being poorly covered by our insurance plan, we are planning a much smaller vacation this summer–a “staycation”–instead of a trip to the Black Hills. If we didn’t have a debt payment to worry about, we’d have a much larger savings and would have been able to absorb the cost without canceling other plans. The way it is, our poor planning and reliance on debt over the last 10 years have cost us the opportunity to go somewhere new.

The only way to regain the ability to take advantage of future opportunities is to get out of debt, which tends to be an intimidating thought. When we started on our journey out of debt, we were buried 6 figures deep, with a credit card balance that matched our mortgage. It looked like an impossible obstacle, but we’ve been making it happen. The secret is to make a plan and stick with it. Pick some kind of plan, and follow it until you are done. Don’t give up and don’t get discouraged.

What kind of plan should you pick? That’s a personal choice. What motivates you? Do you want to see quick progress or do you like seeing the effects of efficient, long-term planning? These are the most common options:

Popularized by Dave Ramsey, this is the plan with the greatest emotional effect. It’s bad math, but that doesn’t matter, if the people using it are motivated to keep at it long enough to get out of debt.

To prepare your debt snowball, take all of your debts–no matter how small–and arrange them in order of balance. Ignore the interest rate. You’re going to pay the minimum payment on each of your debts, except for the smallest balance. That one will get every spare cent you can throw at it. When the smallest debt is paid off, that payment and every spare cent you were throwing at it(your “snowball”) will go to the next smallest debt. As the smallest debts are paid off, your snowball will grow and each subsequent debt will be paid off faster that you will initially think possible. You will build up a momentum that will shrink your debts quickly.

This is the plan I am using.

A debt avalanche is the most efficient repayment plan. It is the plan that will, in the long-term, involve paying the least amount of interest. It’s a good thing. The downside is that it may not come with the “easy wins” that you get with the debt snowball. It is the best math; you’ll get out of debt fastest using this plan, but it’s not the most emotionally motivating.

To set this one up, you’ll take all of your bills–again–and line them up, but this time, you’ll do it strictly by interest rate. You’re going to make every minimum payment, then you’ll focus on paying the bill with the highest interest rate, first, with every available penny.

This is the plan promoted by David Bach. It stands for Done On Last Payment. With this plan, you’ll pay the minimum payment on each debt, except for bill that is scheduled to be paid off first. You calculate this by dividing the balance of each debt by the minimum payment. This gives you an estimate of the number of months it will take to pay off each debt.

This system is less efficient than the debt avalanche–by strict math–but is better than the snowball. It give you “quick wins” faster than the snowball, but will cost a bit more than the avalanche. It’s a compromise between the two, blending the emotional satisfaction of the snowball with the better math of the avalanche.

For each of these plans, you can give them a little steroid injection by snowflaking. Snowflaking is the art of making some extra cash, and throwing it straight at your debt. If you hold a yard sale, use the proceeds to make an extra debt payment. Sell some movies at the pawn shop? Make an extra car payment. Every little payment you make means fewer dollars wasted on interest.

Paying interest means you are paying for everything you buy…again. Do whatever it takes to make debt go away, and you will find yourself able to take advantage of more opportunities and spend more time doing the things you want to do. Life will be less stressful and rainbows will follow you through your day. Unicorns will guard your home and leprechauns will chase away evil-doers. The sun will always shine and stoplights will never show red. Getting out of debt is powerful stuff.

Your task today is to pick a debt plan, and get on it. Whichever plan works best for you is the right one. Organize your bills, pick one to focus on, and go to it.

Assuming you are in debt, how are you paying it off?

Even as a growing number of analysts are questioning the details of Obamacare, the sudden hospitalization of Teresa Heinz Kerry, the wife of former senator and current U.S. Secretary of State John Kerry, provides additional fodder to the ongoing healthcare debate.

Heinz, who is 74 years old, is the heir to the Heinz ketchup fortune. She is the widow of former Senator John Heinz, who was killed in 1991 in an aviation accident. Her marriage to Kerry in 1995 occurred when he was the senator from Massachusetts. Heinz was hospitalized on Sunday and is reported to be in critical condition after being flown to Massachusetts General Hospital in Boston.

Heinz was treated for breast cancer in December 2009 and went through two operations for lumpectomies. It is not known what specific health issues resulted in the current hospitalization. However, sources indicated that there was concern over the return of the cancer.

Regardless of the source of the current illness, it is taken for granted that Heinz will receive the very best of medical care, with cost being of no concern to treatments pursued. In the earlier process of treating her cancer, numerous doctors at the nation’s finest medical facilities were consulted. The issue of Heinz not having to worry about the costs of her care is the central theme of many who criticize our nation’s health care system.

For the millions of Americans who live daily without health insurance or any form of coverage, there is a constant concern over how they would deal with a medical emergency. These individuals know that they are one accident or serious illness away from devastating financial hardship. In fact, the single biggest reason for bankruptcy in the U.S. today is medical bills. According to the latest studies, the average hospital stay billed out at $15, 700, with an average daily cost of nearly $4,000.

These costs are onerous because so many people today find health insurance increasingly unaffordable. While the political debate over the current healthcare reform continues, there is one simple fact. That reality is that the annual cost of private health insurance, already out of the reach of many, has risen by as much as 50 percent in the last two years. Many plans for a family of four are now over $15,000 and it is predicted that a bronze plan under the implemented Obamacare will exceed $20,000 for that same family.

All of this brings us back to the hospitalization of Heinz. The reality we live in today means that many people diagnosed with cancer or other similar diseases have little hope of receiving the treatment or care that the wealthy can afford. Even with quality health care insurance, the co-pays and other costs create burdens that many cannot carry.

There are no simple or ready solutions to this situation. The morality of one patient dying because chemotherapy is too expensive while one with a large bank account survives is an issue that will see intensified debate in the coming months and years. Regardless of what caused the current hospitalization, Heinz is one of the lucky ones who will have superb medical care without financial considerations.

For the first time in 2 years(almost to the day), I am acquiring new debt that I can’t afford to pay off immediately. On a credit card.

Last Thursday, my son entered vision therapy. He has what is commonly known as a “lazy eye”, but is more properly called a “wandering eye”. His eyes don’t always lock on to whatever he is looking at. Instead, one of his eyes will (occasionally, but not always) drift to the side and shut off. His brain doesn’t interpret the signals from that eye.

We had two sessions of tests to diagnose the specific problems: $350.

We will have 28 weekly sessions of therapy @ $140 per session: $3920

There is an equipment fee: $85

That’s a total of $4355 over the next 7 months.

Insurance covers some of it, but the therapist is out-of-network, so it’s “pay first, get reimbursed later from the insurance company”. If we pay up front, we get 1 session free, bringing the price to $4215, minus insurance.

I have a health savings account that I have been trying to max out to cover this, to make my payments all pre-tax. I haven’t been able to get enough in there, yet. In fact, since I don’t have my kids on my insurance, my maximum HSA contribution is $3050.

Since finding out that vision therapy was going to be necessary, I have managed to save $1000 in cash, and about $1500 in my HSA. That’s $2500 of a $4215 bill, leaving $1715 that I still need to be able to cover.

Here is my plan:

We’re charging the entire $4215 at 11.9% interest on a card with a 2% travel rewards program. This will give me $84.30 worth of travel rewards good for reimbursing any travel expenses.

I will immediately pay off $1000 from cash savings.

I will also immediately file for an insurance reimbursement, which will cover 80% – $500, or $2972 minus a bit. Our insurance got a waiver on the pseudo-wonderful healthcare fraud act on the grounds that the plan sucks so bad that it would cost too much to comply with the law. No joke. I’m expecting about a $2500 reimbursement, and I have no idea how long that takes.

In 6 weeks, when I have maxed out my HSA contributions for the year, I will file for an HSA reimbursement for about $2500, leaving about $500 to cover some medical costs for the rest of the year. Vision therapy doesn’t count against my deductible, since my kids are on my wife’s insurance plan.

Starting in June, my debt snowball will no longer be going to max out my HSA and will instead go straight to this card, to finish paying it off as quickly as possible. That’s $750 per month.

Any money from any side work will also go towards this bill, but I don’t budget for that, because it isn’t reliable money.

The projected results:

$3215 on the credit card for 6 weeks @ 11.9% = $50 in interest payments.

After the HSA reimbursement, there will be $715 left to pay, which will be paid off in June for another $10 in interest.

When we get the insurance reimbursement, we’ll replenish the medical bill account, to start getting ready for the kid’s braces next year. We’ll drop $1500 into that account and use the remaining $1000 as a debt snowball payment.

We’ll end up paying $60 in interest to save $140 in therapy costs, so it’s good math, but I hate the idea of racking up another credit card bill. I could drop the interest costs a bit by raiding my emergency fund, but that still wouldn’t cover it all, and it would leave me with very little left for an actual emergency. I could raid the emergency fund for half of its value($700), and reduce the initial interest paid to $25 and the total interest paid to about $40, then use the $1000 leftover from the insurance reimbursement to replace my emergency fund.

Today is the 33rd anniversary of the death of Elvis, so I’m bringing you the “Elvis is Dead” edition of the Carnival of Personal Finance.

What can the King teach us about finance? The immediate lesson is, of course, to not let success destroy you or your life. Always remember what is important.

“Adversity is sometimes hard upon a man; but for one man who can stand prosperity, there are a hundred that will stand adversity.” -Elvis Presley

Before we get into the carnival, please take a moment to subscribe, either by rss or by email. If you are on twitter, please follow me at @LiveRealNow.

“When I was a child, ladies and gentlemen, I was a dreamer. I read comic books, and I was the hero of the comic book. I saw movies, and I was the hero in the movie. So every dream I ever dreamed has come true a hundred times…I learned very early in life that: ‘Without a song, the day would never end; without a song, a man ain’t got a friend; without a song, the road would never bend – without a song.’ So I keep singing a song. Goodnight. Thank you.”

-From his acceptance speech for the 1970 Ten Outstanding Young Men of the Nation Award. Given at a ceremony on January 16, 1971

Craig Ford from Money Help For Christians presents How to Buy Cars With Cash. This is great advice. My car will be paid off in the next few months and I will be doing exactly this.

FMF from Free Money Finance presents Are Tattoos at Work Really That Acceptable? Do tattoos limit your career? I reference this graphic when thinking about a tattoo.

Pop from Pop Economics presents Getting a raise: The negotiation. It’s always best to raise your top line as high as possible. Bringing in more money is far more effective that simply reducing your expenses.