Am I the only one who just noticed that it’s Wednesday? The holiday week with the free day is completely screwing me up.

Just to make this a relevant post:

Spend less!

Save more!

Invest!

Wee!

The no-pants guide to spending, saving, and thriving in the real world.

I’ve been a bit of a slacker when it comes to posting the carnivals I’ve been included in. This is me playing catch-up.

Live Real, Now was included in five carnivals last week:

You can subscribe by RSS and get the posts in your favorite news reader. I prefer Google Reader.

You can subscribe by email and get, not only the posts delivered to your inbox, but occasional giveaways and tidbits not available elsewhere.

You can ‘Like’ LRN on Facebook. Facebook gets more use than Google. It can’t hurt to see what you want where you want.

You can follow LRN on Twitter. This comes with some nearly-instant interaction.

You can send me an email, telling me what you liked, what you didn’t like, or what you’d like to see more(or less) of. I promise to reply to any email that isn’t purely spam.

Have a great week!

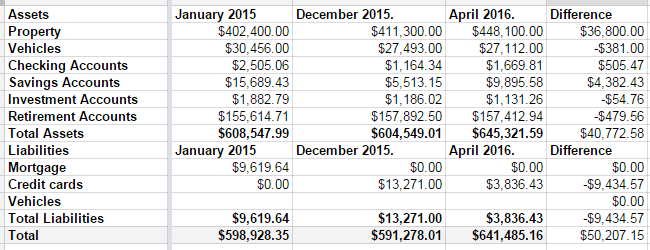

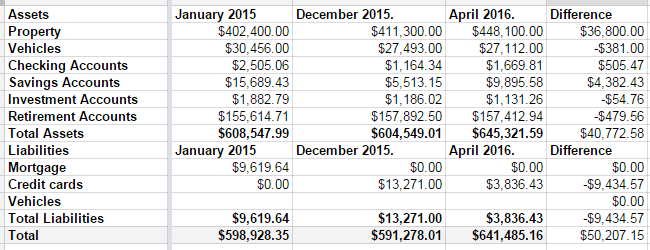

Last year wasn’t a good year for my net worth. It came with a $7000 drop.

Q1 2016, however, was a great quarter.

In December, we had $13,271 in credit card debt. At the time I took this screenshot, it was down to $3836.43. As of this moment, it’s down to $2640.91. If things go as expected this week, I should wake up on Friday to a paid-off credit card. I had to raid some of our savings accounts to make it happen, but it’s happening. Some of it was a tax refund, some of it was the fact that my mortgage payment went away in December.

That’s seven years of hard work, almost to the day. Seven years ago, I was researching bankruptcy, and stumbled across Dave Ramsey. Seven years ago, we were drowning in debt.

Next week, we’re free. No more debt, hanging over our heads. We’re free to take vacations. We’re free to finally save for college, when my son is 16, and stand a chance of being able to pay for it for him. We’re free to do…whatever we want to do. Our monthly nut after the debt is paid–only in fall/winter/spring when my wife is working–is roughly 1/3 of our take-home pay.

That’s how hard we’ve cut to make sure we can pay our bills and make debt die. We do have some things that would be considered extravagant. We’re not savages. But my car is 10 years old. My wife’s is 7. My motorcycles are 35 and 30; one of them was purchased before we cared about our debt.

Back to the net worth….

The biggest change came from our property values, which sucks. That was $36,000 of the difference, which comes with the painful tax bump to go with it. A large chunk of the savings increase was the money we set aside every month to cover the property tax bill, and that will go away next month.

Still, $641,000 dollars is a long way from nothing. I’m pretty happy.

In an effort to promote the crap out of the Yakezie Beta Chapter, I’ve created a search specific to us. This will make it easy to find Beta Challengers to promote.

The current list in the search is:

Live Real, Now

http://www.YourSmartMoneyMoves.com

http://meinmillions.blogspot.com/

http://www.rentingoutrooms.com

http://www.yesiamcheap.com

http://SimpleVesting.com

http://untildebtdouspart.blogspot.com/

http://www.blondeandbalanced.com

http://jamesfowlkes.com/

http://www.mightybargainhunter.com

http://www.beatingtheindex.com

http://www.thepassiveincomeearner.com

http://www.prairieecothrifter.com

http://sustainablepersonalfinance.com/

http://www.toddswanderings.com

More will be added as I have time to dig through the forums. If you’re a Beta Challenger and don’t see your name, leave a comment below and I’ll get you added ASAP.

No matter how many excellent books you read, or how many experts you consult, sometimes the best advice comes from beast out fertilizing my yard. My dog is pretty smart. At middle-age, she’s got no debt, no stress, and no possibility of being fired. I asked her what her secrets are, and she gave me 5 rules for managing her finances.

Maybe I shouldn’t write while watching my dog poop at 5AM.

Update: This post has been included in Festival of Frugality.