- Uop past midnight. 3am feeding. 5am hurts. Back to bed? #

- Stayed up this morning and watched Terminator:Salvation. AWAKs make for bad plot advancement. #

- Last night, Inglorious Basterds was not what I was expecting. #

- @jeffrosecfp It's a fun time, huh. These few months are payment for the fun months coming, when babies become interactive. 🙂 in reply to jeffrosecfp #

- RT @BSimple: RT @bugeyedguide: When we cling to past experiences we keep giving them energy…and we do not have much energy to spare #

- RT @LivingFrugal: Jan 18, Pizza Soup (GOOOOOD Stuff) http://bit.ly/5rOTuc #budget #money #

- Free Turbotax for low income or active-duty military. http://su.pr/29y30d #

- To most ppl,you're just somebody [from casting] to play the bit part of "Other Office Worker" in the movie of their life http://su.pr/1DYMQZ #

- RT @MoneyCrashers: Money Crashers 2010 New Year Giveaway Bash – $8,300 in Cash and Amazing Prizes http://bt.io/DQHw #

- RT: @flexo: RT @wisebread: Tylenol, Motrin, Rolaids, and Benadryl RECALLED! Check your cabinets: http://bit.ly/4BVJfJ #

- New goal for Feb. 100 pushups in 1 set. Anyone care to join me? #

- RT @BSimple: Your future is created by what you do today, not tomorrow"— Robert Kiyosaki So take action now. #

- RT @hughdeburgh: "Everything you live through helps to make you the person you are now." ~ Sophia Loren #

- Chances of finding winter boots at a thrift store in January? Why do they wear our at the worst time? #

- @LenPenzo Anyone who make something completely idiot proof underestimates the ingenuity of complete idiots. in reply to LenPenzo #

- RT @zappos: "Lots of people want to ride w/ you in the limo, but what you want is someone who will take the bus w/ you…" -Oprah Winfrey #

- RT @chrisguillebeau: "The cobra will bite you whether you call it cobra or Mr. Cobra" -Indian Proverb (via @boxofcrayons) #

- RT @SuburbanDollar: I keep track of all my blogging income and expenses using http://outright.com it is free&helps with taxes #savvyblogging #

- Reading: Your Most Frequently Asked Running Questions – Answered http://bit.ly/8panmw via @zen_habits #

Black Friday

- Image by Getty Images via @daylife

Today being the biggest shopping day of the year, I thought I’d get in the game.

First, instead of helping you spend money, I’m going to help you save it. As I’ve mentioned before, I am a big fan of INGDirect. They make it easy to create savings accounts for specific savings goals and they have a decent interest rate. I’ve never had a problem with any of my accounts.

For Black Friday(through Sunday!), they are offering the following:

- Earn $103. Open Electric Orange November 26th – 28th, and make a total of 7 purchases using your Electric Orange Card or Person2Person Payments (or any combination of the two) within 45 days.

- Open a Kids Savings Account November 26th – 28th and we’ll(ING) put a $25 bonus into your new account.

- Use your Electric Orange Debit MasterCard® at least one time from 8:00 AM ET, November 26th – 7:59 PM ET, November 26th, and you’ll be automatically entered into the 100% Cash Back Giveaway.

- Open a 36-month IRA CD with ING DIRECT November 26th – November 28th and get 2.00% Annual Percentage Yield (APY). Ask them about work at home moms and dads spousal IRA.

- Apply online November 26th – 28th for Easy Orange or the Orange Mortgage or call a Mortgage Specialist at 1-866-327-4599 and get up to $2,000 off closing costs. If your costs are less than $2,000, you pay nothing.

- 25% rebate on Sharebuilder trades that execute today or Monday.

Click here to open an account with the best bank to ever hold my money.

Now, to help you spend some money.

All of my websites are hosted by HostGator. I’ve never had noticeable downtime or any technical problems. The one issue I had that couldn’t be controlled by their interface was fixed by technical support in minutes. Not hours, minutes. They are having an amazing deal today. From 5AM to 9AM CST, all of their products are 80% off. The rest of the day, it’s all 50% off. Unfortunately, this doesn’t apply to existing customers, but if you are looking for a website host, paying $35 for 3 years of hosting can’t be beat.

2010 Budget Changes

We’re making some changes to how we manage our finances this year. Our destination isn’t changing, but the trip is.

- All of the cards are going away. Not necessarily destroyed, but certainly inconvenient. There’s a $7000 overdraft protection account attached to our debit cards. There’s no need for an “emergency” card. If it’s truly an emergency, we are covered. We are going to destroy some and ice the rest.

- We’re going to go “cash only”. We’ve going to the envelope system. There will be an envelope for grocery money, gas money, discretionary money, and baby crap. If there isn’t enough money in an envelope, it will have to come out of another envelope. If we don’t have enough money, we’ll have to do without, instead of spending imaginary money at 10% interest. Gas will be the exception, so we don’t have to bundle the kids up to pay for gas. No money, no spendy. We tried a “virtual envelope”, with every purchase tracked by category in a spreadsheet, but it didn’t work. Real cash, real empty envelopes. Discretionary money covers school activities, miscellaneous household item, and anything else that pops up.

- We’re going to start the “30 day list”. If we want something, we’ll put it on a list. If we still want it 30 days later, it will be okay, provided there’s money for it. This is part of what the discretionary budget is for.

- My wife is getting $50/month “blow money”. Absolutely unaccountable. If she doesn’t have this vent, the whole system will fall apart.

This is all stuff my wife and I have talked about and agreed to, but now, it’s organized and laid out. We HAVE to do it or something similar. We are both on board with this plan. We should see our debt management plan skyrocket, without feeling like we are missing out on life.

5 Things to Do in the New Year

- Image via Wikipedia

CNN Money has an article up on 5 things to do this year. After posting a similar article a couple of weeks ago, I thought it’d be interesting to post about someone else’s perspective.

1. Shop for a no-fee checking account.

If you are paying fees for a checking account, go somewhere else. There are so many alternatives available that you shouldn’t be throwing money away. Ally Bank has a great no-fee checking account, as does INGDirect, though ING won’t let you write paper checks against the account. The same principle applies to credit cards. If you have a card with an annual fee and you aren’t getting some monster services or rewards to go with it, run away.

2. Save your raise.

I don’t necessarily agree with this one. If you are in debt, it’s better to use the raise to pay off that garbage, first. When I got my last raise, I immediately boosted the automatic payment for my car to use every new penny. I’ve never had the money available, so I haven’t missed it. Whatever you do, fight lifestyle inflation. Just because you have some more money doesn’t mean you need to spend it. At my last job, I got a substantial raise, so I bought a new car, only to get laid off a few months later.

3. Go for a checkup

Wealth doesn’t matter if you squander your health. Go get a physical. Every disease is easier to treat if you catch it earlier as opposed to later. Don’t make the mistake of running your body into the ground. You will regret it later. Effective this year, most health plans will cover a physical with no copay, co-insurance, or deductible allowed.

4. Score a better rewards card.

B***-****. If you’ve still got debt, don’t concentrate on using more of it. Get that crap paid off. If you’re out of debt, look into getting a rewards card that aligns with your goals. If you like to travel, get a card that gives you frequent flier miles. Otherwise, I’d go with a cash-back rewards card.

5. Use your vacation days.

37% of Americans don’t take all of the vacation to which they are entitled. That’s insane! We work harder and better when we have time to recuperate and relax. Unfortunately, I usually fall into that unfortunate 37%. My vacation resets on February 1st, and this will be the first year in a lot of years that I haven’t had to roll it over or even lose some.

What is your financial plan for the new year?

Future Dreams

While jogging with my wife a few days ago, we had a conversation that we haven’t had in years. We discussed our dreams.

It’s an important conversation for couples to have. What are your hopes? What are your dreams? Where do you want to be in 10 years? In 20? In 50? Planning for the future gives you a map for the present.

My wife and I hadn’t had this conversation in years. A few days ago, we did. Our life-goals are simple and achievable.

I want to leave the corporate world and support my family with writing and the training classes I do. I want a chunk of land outside of any major metropolitan area, but close enough for the entertainment and shopping. I want enough land to expand my classes on my own property, relying on no one.

My wife wants enough land to have some horses. It was unspoken, but I think she wants my goals to take off so they can support her goals, too.

We want a comfortable retirement and we want to help the kids with college.

We’re a bit behind the game for college funding. That’s ok, though. There is nothing wrong with a kid working his way through college and learning those life lessons.

We are also behind on the retirement. But, if I can support us doing the things I love, I don’t need $X million. Retirement isn’t a cessation of activity, it is taking the time to do the things you love on your own schedule. If writing a book while sitting on my private range is enough to fund our life, that’s the perfect retirement.

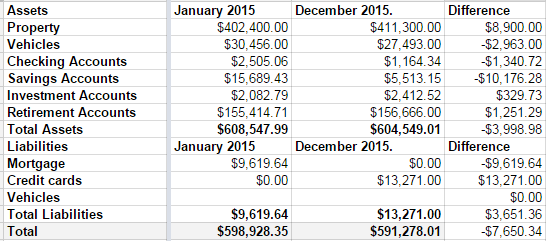

Net Worth and other stuff

This was not a good year for our net worth.

Over the summer, we remodeled both of our bathrooms. At the same time.

1 out of 10: Don’t recommend.

We love the bathrooms, but–as with any project–it went over budget. Sucks to be us.

Then, towards the end of the year, we decided to push hard and pay off our mortgage in 2015. Part of doing that meant paying the credit card off slower than we’d like. It wasn’t the best long-term decision, but we’re mortgage-free now.

Those decision, coupled with a small slump in our investment accounts means we are worth $7650 going into 2016 than we were at the start of 2015.

Disappointing.

I’m also disappointed that our credit card discipline slipped last year.

New plan: No debt before tax day. Every cent of Linda’s paycheck, every cent of my monthly bonus checks, and every cent of any extra money we make is going into the remaining credit card debt. My math says that last debt will die on April 1st.

Then we get to talk about what to do with out money when there’s no debt. But never fear, I have a plan. A boring, boring plan.

- We’re going to save for college at a rate we should have started 10 years ago.

- We’re going to max out both of our retirement plans.

- We’re going to take some nicer family vacations.

- We’re going to buy a pony.

So not that boring.

And when our kids all decide to become certified sign-spinners, we’ll have a huge nest-egg in the college fund savings account to spend on lottery tickets.