What would your future-you have to say to you?

The no-pants guide to spending, saving, and thriving in the real world.

What would your future-you have to say to you?

I spent this week in my home town with my family: my parents, brothers, sisters-in-law, nieces, nephews, kids, uncles, aunts, and some cousins from Tennessee that I don’t see often.

In the evenings, after the kids were put to bed, we played Cards Against Humanity: A Party Game For Horrible People.

If you are a horrible, dirty-minded person, with a sense of humor that would make your grandmother blush–and you have friends to match–get this game. Then play it where you can’t wake up the neighbors. Seriously, it’s more fun than a super soaker filled with cat pee.

Yakezie Carnival hosted by Write and Get Paid

Carnival of Money Pros hosted by I Am 1 Percent

Carnival of Financial Camaraderie #39 hosted by My University Money

Carnival of Retirement #26 hosted by Write and Get Paid

Totally Money Carnival #72 hosted by MammaSaver

Festival of Frugality #342 hosted by Help Me to Save

Carnival of Money Pros hosted by Simple Finance Blog

Carnival of Financial Camaraderie #38 hosted by My University Money

Yakezie Carnival – Summer Vacation Edition hosted by One Cent at a Time

Carnival of Retirement #24 hosted by Making Sense of Cents

Yakezie Carnival – Arachnophobia Edition hosted by See Debt Run

Carnival of Money Pros hosted by Broke Professionals

Totally Money Carnival #70 hosted by Young Adult Finances

Yakezie Carnival – Sushi Edition hosted by Free Ticket to Japan

Festival of Frugality #340 hosted by See Debt Run

Carnival of Money Pros hosted by Financial Product Reviews

Yakezie Carnival – Birthday Edition hosted by 20’s Finances

Festival of Frugality #339 hosted by The Frugal Toad (My post was chosen as an editor’s pick!)

Thanks for including my posts.

You can subscribe by RSS and get the posts in your favorite news reader. I prefer Google Reader.

You can subscribe by email and get, not only the posts delivered to your inbox, but occasional giveaways and tidbits not available elsewhere.

You can ‘Like’ LRN on Facebook. Facebook gets more use than Google. It can’t hurt to see what you want where you want.

You can follow LRN on Twitter. This comes with some nearly-instant interaction.

You can send me an email, telling me what you liked, what you didn’t like, or what you’d like to see more(or less) of. I promise to reply to any email that isn’t purely spam.

Have a great weekend!

Welcome to the Yakezie Carnival. The Yakezie is a group of the best personal finance blogs on the internet. In short, we rock. Joining the Yakezie is a 6 month challenge involving Alexa ranking and cross-promotion.

These are posts submitted by Yakezie members. Please note, this is the 93 Edition, not the 93rd Edition.

Today is April 3rd, the 93rd day of the year.

93 is a Blum integer. For those of you who don’t know, a Blum integer is, to quote Wikipedia, a natural number n if n = p×q is a semiprime for which p and q are distinct prime numbers congruent to 3 mod 4. Now you know as much as you did before. If you understand that definition, you probably already knew what a Blum integer was. To me, this means a Blum integer is a number that has a definition that I have to copy and paste to even repeat coherently. It exists solely to make math geeks feel smart. I am not a math geek.

On to the carnival!

KrantCents brings us Cash or Credit, a post about the choice between using cash or credit for purchases. We’ve wrestled with this one before. A few months ago, we basically abandoned the cash-only system as inconvenient and too easy to ignore. Right now, we are transitioning to a travel rewards card for all of our regular purchases. I’m going to see how much of my trip to the Financial Blogger Conference I can get for free.

Using thelemic isopsephy, a form of numerology promoted by Aleister Crowley, Will + Love = 93. Crowley once said something to the effect of “Never lie. Just live the kind of life no one will believe.” I love that quote, but I can’t remember where I read it.

Dr. Dean presents 5 Tips Plus A Bonus On Saving Money: Today! and says “Dr Dean’s patients are telling him their costs are rising, despite the feds promise that inflation is under control. 5 tips to save a little money, now (with a fun bonus!)” As a father of 3, the bonus tip needs to be rethought. Long-term costs….

On February 8th, 1993, GM sued NBC for faking crashes that show GM trucks catching fire in car accidents. First, if Hollywood has taught me anything, it’s that cars catch fire in every accident, no matter how minor. Second, where’s Toyota’s lawsuit, now?

Jacob at My Personal Finance Journey bring us Are Extended Auto Warranties A Scam? and says “A look at the considerations that should go in to deciding whether or not extended warranties are worth their weight in gold.” I want to call extended auto warranties a scam, but I can’t. When I bought my car, I got the warranty and paid a couple of thousand dollars for it(I don’t remember exactly how much!). For years, it was worthless, but shortly before the warranty expired, I had a couple of problems that needed to be fixed, so I brought it in and asked for a complete inspection to go with the repair. All told, I got close to $5,000 in repairs for that $2,000 warranty and my car drives like new at 7 years old.

On May 10th, 1893, the United States Supreme Court officially declared the tomato to be a vegetable, proving once again that, not only will the government stick its nose into absolutely anything, but it doesn’t feel a need to base its decisions on facts or science. Remember that when you hear any government declaration regarding scientific facts or advances.

Money Reasons bring us Are We All COGs in the Machine Of Life? and says “Break away from the business machine that is using you as a COG spinning doing the owner’s bidding. Why just spin in circles wasting life away? Start your own business or develop some life fulfilling hobbies!” I love the idea of breaking out and doing what you love, whether or not it makes you any money. Life’s too short to hate everything about it.

In Q1, 1793, France declared war on Great Britain, Spain, and the Netherlands. Now, they make whine, pastries, and self-righteous politicians. The Earth is also 93 million miles from the sun. Coincidence? I think not.

Evan at My Journey to Millions offers up Important Dates When Investing in Dividend Producing Stocks and says “When you are dealing with dividend paying stocks there are dates whose definitions can be considered a term of art and you should know about including declaration date, ex-dividend date, record date and payment date.” I get lost when dealing with most investments. That’s mostly because, at this point in my financial journey, I don’t care. I’m still working on paying my way out of debt. I’ll worry about the investments later.

93 is located at the 42nd digit of pi. That is obviously significant. I should team up with Thelema to invent some mystical reason to take a paid holiday tomorrow to celebrate the works of Douglas Adams.

Melissa at Mom’s Plan presents How to Accomplish Your Goals Part Two: Write Down a Step-by-Step Timeline and says “Writing down the goal is only one step of the process; directing yourself as to how you will complete the process is just as important.” Having goals turns life into a game. Games are fun, so goals are good.

By contentment, the acquisition of extreme happiness. – 93rd Aphroism Patanjali’s Yoga Sutra

Darwin’s Money brings us Life Settlement Investment – Scam or Legit? and says “Life Settlement Investments – Profiting from Death? Scam? Or legitimate high yield alternative investment? Find out for yourself with the facts here.” Life settlement funds appeal to me in a totally morbid, Running Man kind of way. It’s less disturbing that Treadmill to Bucks.

Finally, 93 is the number of the flight that successfully fought back on 9/11. Never forget.

In this installment of the Make Extra Money series, I’m going to show you how I do keyword research.

Properly done–unless you get lucky–this is the single most time-consuming part of making a niche site. If you aren’t targeting search terms that people use, you are wasting your time. If you are targeting terms that everybody else is targeting, it will take forever to get to the top of the search results.

Spend the extra time now to do proper keyword research. It will save you a ton of time and hassle later. This is time well-spent.

If you remember from the last installment, when we researched products to promote, we narrowed our choices down to a few products.

What I’ve done is create a spreadsheet to score the products. You can see the spreadsheet here. I’ll explain the columns as we populate them.

The first column contains the name of the product. Easy. We’ve got 10 products. I’m going to walk through scoring 1 product, then, through the magic of the internet, I’ll populate the rest, and you’ll get to see the results instantly. Wow.

The second column is the global search volume for the exact search term. I base my product niche sites primarily on the demand for a given product. Everything else is a secondary consideration.

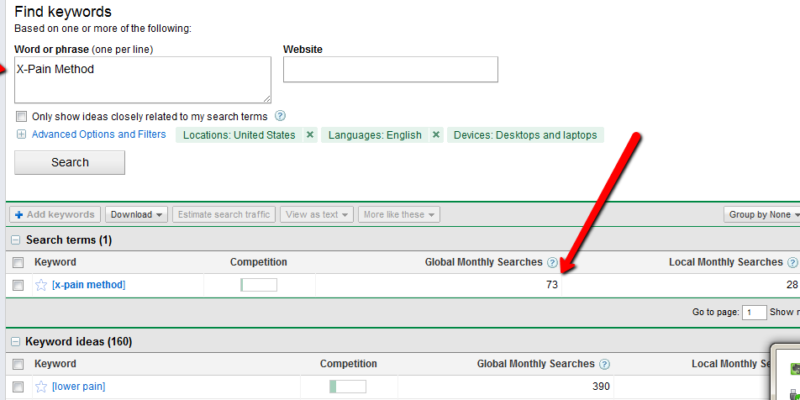

To find the demand for a product, go to the Google Adwords Keyword Tool. In the “word or phrase” box, enter your product name, exactly. In this case, it’s “X-Pain Method”. When the search results come up, change the match type to “Exact”. You should have something like this:

Enter the global search volume in column 2. In this case, it’s 73. Keep this window open, because we’ll be coming back to it.

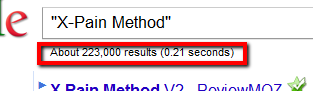

Column 3 is the search competition. Go to google and enter your product name, in quotes. In this case, “X-Pain Method”. Put the total number of search results in column 3: 223000.

Column 4 is the search competition, but only what appears in a page’s title. Your search query is intitle:”X-Pain Method”, which yields 4400 results.

The next column is for the average PageRank of the first page of search results. For this, I use Traffic Travis. I use the 4th edition, which is paid software, but you can get the free version of version 3, instead. I’ll use version 3 for this example. Open the software and click on “SEO Analysis” on the bottom left of the screen. Put your search term (“X-Pain Method”) in the “phrase to analyze” and set the “Analyze Top” to 10, then hit “Analyze”. When it’s done running, just add up all of the PRs and divide by 10. Ignore Travis’s difficulty rating.

Now, for the rest of the columns, we’re going to look at the keyword tool again. We’re going to pick 3 alternate search terms. Here are the criteria:

Once we pick the keywords, we’ll throw them into google to get the competition, just like we did to populate column 2.

“Exercises for back pain” has medium competition and 1900 monthly searches. It also has an estimated cost-per-click of $3.02, which means people are paying for this.

“Lower back pain exercises” has 6600 searches and medium competition. It’s actually on the lower end of medium, so it looks really promising.

“Lower back” has 4400 searches and low competition, with a CPC of $6.24. This should be a good one. Scratch that. It has 40 million search results, but only 4400 searches. That’s a lot of competition for a small market.

Instead, I’m going to search for “cure back pain” in the keyword tool and see what I get. “Upper back pain” is better. Low competition, 18000 searches each month, and only 2000000 competing search results. Now, I’ll score it.

You really want at least 500 searches per month for the product name. More than 2500 is better. I’m going to assign 1 point per 500 monthly searches.

You also want a lower number of search results. Less than 10,000 is ideal. Less than 100,000 is still decent. More than 250,000, I’d walk. So, under 10,000 gets 5 points. Under 50,001 gets 4. Under 100,001 gets 3. Under 200,001 gets 2. Under 250,001 gets 1. Any higher gets 0.

The ideal intitle search will have less than 2000 results. More than 100,000 is too time-consuming to deal with. 0-2000: 5 points; 2001-10,000: 4 points; 10001-25000: 3 points; 25001-50000: 2 points; 50001 to 100000: 1 point.

The perfect product will have the first page of search result all with a PageRank of 0. That’s a 5 point product. I’ll knock off half a point for every point of average PR.

The related terms are more relaxed. They are what’s known as “Latent Semantic Indexing” (LSI) terms. We will be creating articles to match those search terms, mostly to make our niche site look as natural and real as possible. Any actual traffic those pages drive is just gravy. Points for the related searches start at 10 and get 1 point knocked off for each 3 million results. We’ll be treating the 3 terms as one for this score.

That gives us a perfect score of about 25. There’s no actual upper limit, since the score for the search volume has no upper limit. X-Pain Method scored 18.22.

Now, excuse me a moment while I score the rest.

I’m back. Did you miss me?

I’ve finished scoring each of the products and sorted the results by score. The clear winner is the back pain product, but the lack of searches bothers me. The wedding guide looks much nicer, especially if I target the phrase “wedding planning guide” during the SEO phase of the project. That change alone brings the score almost to first place.

Frankly, I’d take either 2nd or 3rd place over the back pain product. The bare numbers don’t support it, but my judgement tells me they are better products to promote.

There is one final step before deciding on the product. I have to buy it. I can’t review the product without seeing it and I can’t promote it without approving of it.

That’s the secret to ethical niche marketing, you know. Only promote good products that you’ve personally read, watched, or used.

Every day, in some small way, it’s important to do something to improve your situation. Whether it’s paying down debt, researching inexpensive alternatives to your existing expenses, or something as simple as hugging your spouse or playing games with your kids.

I was once told that every day, you either get smarter, or you get dumber. Don’t do the latter. Never pass up an opportunity to educate yourself. Make the day good for you.

It’s incredibly important to understand your situation. If you don’t know where you are, how can you control where you’re going?

What’s left? Eliminate baggage. Kill your bills. If you’re paying for something you don’t want or need, get rid of it!

Unused or unnecessary bills are nothing but unhappiness generators. They don’t provide value so trim the waste and get rid of what you don’t need.

I have 16 personal savings accounts, 3 personal checking accounts, 2 business checking accounts, and 2 business savings accounts. That’s 23 traditional bank accounts, spread across 3 banks. Just talking about that gives my wife a headache.

Every account has a reason. Three of the savings accounts exist just to make the matching checking accounts free. One of the checking accounts handles all of my regular spending that isn’t put on my rewards card. 14 of the savings accounts are CapitalOne 360 accounts that have specific goals attached. A couple of the accounts were opened to boost the sales numbers for a friend who is a banker. Really, it’s almost too much to keep track of. One credit card, 5 checking accounts, 18 savings account, all on 4 websites.

Sometimes, when you extend your bank accounts this far, it gets easy to let it all slip away and lose track of where your money is going. How do I keep track of it all?

Whoa, you say? Simplify? I don’t simplify the number of accounts I have, I simplify the tracking, or specifically, the need to track.

Twice a month, I have an automated transfer that moves a chunk of money from my main checking account to C1360. I have a series of transfers set up there that move that money around to each of my savings goals. I move $100 to the vacation account, $75 to the braces account, and $10 to the college fund, among all of the other transfers. Doing that eliminates any need to keep track of the transfers, since it is all automated.

Using the same rules, I make every possible payment happen automatically, so I don’t have to worry about paying the gas bill or sending a check to the insurance company.

Simple.

As you saw in the opening sentence of this post, I also complicate the hell out of my accounts. On the surface, it would seem like that would make it harder to keep track, but in reality, the opposite is true. I have 14 savings accounts at C1360, each for a specific savings goal, like paying my property taxes or going to the to Financial Blogger Conference in October. I can log in to my account and tell at a glance exactly how much money I have for each of my goals. In the account nickname, I include how much each goal is for, so I can easily see if I am on track.

Everything I do gets set up in Quicken. This makes it easy to track how much actual money I have available. Since I’ve moved my daily expenses to a credit card, I only have about a dozen entries to worry about when I balance my checkbook at the end of the month. At that time, any excess funds get dropped into my debt snowball.

This may all leave me with a needlessly complicated system, but it’s a system that grew slowly to meet my needs and it is working well for me. I spend about 2 hours a month tracking my finances, and can–at any time–tell at a glance exactly how my finances look.

How do you keep your finance organized? Have you tried any unique savings strategies?