Please email me at:

Or use the form below.

[contact-form 1 “Contact form 1”]

The no-pants guide to spending, saving, and thriving in the real world.

Investopedia ran a post on 20 lazy ways to save money. I thought it was worth sharing my take on the post.

1. Schedule automatic payments. I do this obsessively. I run all of my regular payments through my bank’s online bill-pay. I think there are 2 bills that get paid manually; 1 is a quarterly payment, the other is due annually.

2. Eat your groceries. According to the post, Americans–on average–throw away 15% of the groceries they buy. I totally believe that. We don’t throw away that much, but it’s still too much. It tends to be the fresh vegetables, which we eat as side dishes instead of the main course. We need to switch that mindset, both to use the vegetable efficiently and to eat healthier.

3. Bundle services. I refuse. I hate the idea of having a single point of failure for multiple systems. If the power goes out, I lose my cable, but I keep the phone. If, for some reason, I can’t pay my phone bill, I don’t lose my internet connection. I like keeping these things separated.

4. Pay off credit card. Hardly a lazy process, but otherwise…duh!

5. Mark your calendar. I use my Google Calendar as obsessively as I use automatic payments. I put in reminders, grocery lists, or anything else I need to know at a specific time.

6. File your taxes on time. I just helped a friend dig out of this mess. I pay as soon as all of my paperwork is delivered. The IRS doesn’t give up and they have leverage, including garnishment and even jail.

7. Roll it over. When you change jobs, take your 401k with you. Don’t leave it behind like a series of red-headed stepchildren. It’s too easy to lose track of the accounts. Don’t cash it out! I made that mistake once and lost far too much to taxes. A rollover doesn’t count against your 401k contribution limits.

8. Switch credit cards. If you can a good balance transfer offer that’s followed by a better interest rate than you currently have, use it. But don’t forget to pay attention to the transfer fees. Do the math. If it costs you $500 to transfer the money, how much interest do you have to save to make it worthwhile?

9. Use your privileges. If you have a AAA membership, use it. It gives you a discount on hotels, oil changes, car rentals, and more. Read the paperwork. Former military gets a ton of random discounts, too. Ask.

10. Rent instead of buy. Renting can save you money over buying, if it’s something you’ll only use once, but borrowing is free.

11. Buy instead of rent. Rent-a-center is a ripoff, but they can’t even legally operate here. If you’re going to use something regularly, buy it.

12. Ask. I love to call up every company I give money to and ask if there’s a way I can give them less. Outside of chain stores and restaurants I almost always ask for a lower price.

13. Just say no. Extended warranties are generally a waste of money. However, if I can’t afford to replace the item, I do get the warranty. On my car, I brought it in for a full inspection and repair a few weeks before the warranty ran out and made all of that money back. We are slowly building a warranty fund to replace the need for any future extended warranties.

14. Have the awkward conversation. We tried giving gift-giving the axe, but nobody enjoyed that. Now, we cap the gifts at $20 and do a round-robin type of gift. $40 for gifts keeps 10 adults happy.

15. Eat at home. Generally, I can cook almost anything better at home, but I really do enjoy eating out and trying new restaurants. We just keep it from being a regular expense.

16. Balance your checkbook. What a waste of time! With automatic payments and cash for all of the discretionary budget items, I balance the checkbook once a month.

17. Stick with your bank. Either use your own bank’s ATM network, or use a bank that refunds ATM fees. I only take out cash on the first of the month, for the entire month and I do that with a teller, so this is never an issue for us.

18. Use your TV. Cable movie packages instead of a video membership? Really? That’s a horrible idea.

19. Quit those bad habits. I quite smoking, saving $200 a month. I don’t drink much and I’m working on fixing my eating habits. Vices are fun, and this is certainly not a fun way to save money.

20. Forget the pet. There is no way this would fly at my house. we have 5 cats, 2 gerbils, and a dog. Our renter has 2 pythons. We’re a flippin’ zoo and honestly, mess and cost aside, we all like it that way.

How do you stand on these ideas?

The vast majority of personal finance websites(including this one) focus on reducing your bottom line–cutting costs. The other end of the budget is at least as important. Have you tried raising your top line lately? Have you picked up a side hustle, sold an article, put ads on a website, or even sold some of your stuff? After we had our garage sale a few weeks ago, we were left with some furniture that was too nice to donate or discard, so we decided to sell it on Craigslist.

The key to selling your stuff on Craigslist is taking pictures. They don’t have to be good pictures, just something to let your customers know what they are getting. Take pictures, post the measurements and, if it’s electronic, the model number. Beyond that, a simple description will suffice.

Be safe when you are posting the listing. Don’t give your address and don’t post when you will be home. That’s just a job offer for burglars. When you talk to a potential buyer, never tell them there is nobody home. Tell them your roommate is the only one home and he doesn’t want to deal with the sale. Don’t give strangers on the internet an opportunity to rob you.

When you are meeting a buyer, pick a public place away from home, if at all possible. If you are selling furniture, it may not be possible, but it is for smaller items. Meeting in a busy gas station parking lot or even in front of the police department is a good way to stay safe. Secondary crime scenes are nasty things and inviting the wrong stranger in is offering one ready-made.

[ad name=”inlineleft”]Bring a friend. Preferably, an intimidating friend. Crime is less likely to happen if there is more than one person there. Bring a friend to a public place to meet the buyer to maximize your safety.

Don’t get ripped off. Craigslist scams abound. Bad checks, forged checks, and shipping scams are just some of the problems.

Only accept cash. It’s hard to forge a greenback.

One of the most common scams, after a bounced check, is the cashier’s check scam. You’ll get an email saying the item is great and payment is on the way. When the check clears, a relative of the buyer will come to pick up the item. Then, oops, their secretary made the check out for $3000, instead of $300. Would you mind sending the overpayment back by Western Union, minus $100 for your troubles? First sign of trouble: over-complicating a simple transaction. Second sign: not using cash. The cashier’s check will be forged. There is no way to verify funds on a cashier’s check, and the bank will post it as available well before it comes back bad. You will be able to spend the money, only to have the money disappear later. That means you can’t wait to see if the check clears before wiring back the overpayment. There is no way to recover your money.

If you get a response that includes a link, do not click it! Ever. No matter what the link looks like. Ever. No clickyclicky. It may be an innocuous link to your ad, but the link can be masked. Any other link is almost definitely a link to a virus-ridden website. Repeat after me: No clickyclicky.

If you get an email about Craigslist transaction protection or escrow, you are being scammed. Run away.

Craigslist can be great way to turn your junk into cash, but only if you actually get the cash. Keep yourself safe and scam-free.

I don’t attach much importance to dreams. They are just there to make sleepy-time less boring. Last night, I had a dream where I spent most of my time trying to prepare my wife to run our finances before telling my son that I wouldn’t be around to watch him grow up. That’s an unpleasant thought to wake up with. Lying there, trying to digest this dream, I started thinking about the transition from “I deal with the bills” to “I’m not there to deal with it”. We aren’t prepared for that transition. Last year, we started putting together our “In case of death” file, but that project fell short. The highest priorities are done. We have wills and health directives, but how would my wife pay the bills? Everything is electronic. Does she know how to log in to the bank’s billpay system? Which bills are only in my name, and will go away if I die? Is there a list of our life insurance policies?

I checked the incomplete file that contains this information. It hasn’t been updated since September. It’s time to get that finished. Procrastinating is inappropriate and denial is futile. Here’s a news flash: You are going to die. Hopefully, it won’t happen soon, but it will happen. Is your family prepared for that?

The questions are “What do I need?” and “What do I have?”

First and foremost, you need a will. If you have children and do not have a will, take a moment–right now– to slap yourself. A judge is not the best person to determine where your children should go if you die. The rest of it is minor, if you’re married. Let your next-of-kin, your spouse keep it. I don’t care. Just take care of your kids! Set up a trust to pay for the care of your children. Their new guardians will appreciate it. How hard is it to set up? I use Quicken Willmaker and have been very pleased. Of course, the true test is in probate court, and I won’t be there for it. If you are more comfortable getting an attorney, then do so. I’ve done it each way. You can cut some costs by using Willmaker, then taking it to an attorney for review.

It’s a sad fact that often, before you die, you spend some time dying. Do you have a health care directive? Does your family know, in writing, if and when you want the plug pulled? Who gets to make that decision? Have you set up a medical power of attorney, so someone can make medical decisions on your behalf if you aren’t able? Do you want, and if so, do you have a Do-Not-Resuscitate order? Willmaker will handle all of this, too.

What’s going to happen to your bank accounts? I’m personally a fan of keeping both of our names on all of our accounts. I share my life and my heart, I’d better be able to trust her with our money. If that’s not an option, for whatever reason, fill out the “Payable on Death” information for your accounts, establishing a beneficiary who can get access to your money if you die. Do you want your spouse to lose the house or the car if you die? Should your kids have to miss meals? Make sure necessary access to your money exists.

Does anybody know what you have for life insurance? Get a copy of the policy and make sure your spouse and someone else knows what company holds it and how much it is worth.

Now, it’s time to make some lists. You need to gather account numbers and contact information for everything.

Non-financial information to list:

Now, take all of this information and put it in a nice, fat envelope and lock it in the fireproof safe you have bolted to the floor. Make a copy and give it to someone you trust absolutely. Make sure someone knows the combination to the safe or where to find the key.

Your loved ones will appreciate it.

It’s that time of the year when people make public promises to themselves that last almost as long as the hangover most of them are going to earn tonight, otherwise known as New Year’s Resolutions.

Not a fan.

I am, however a fan of planning out some concrete goals and doing my best to meet them. I do this through a series of 30 day projects. I set a goal that can be reached in 30 days, and push for it. I tend to make my goals fairly aggressive, and I tend to meet them.

Here were my goals and results for 2010:

So I missed 4 months of projects. This year, I’m going to modify my overall plan and only do 6 projects, every other month. That will give me a month off to either relax or incorporate the goal into my ongoing habits without any stress.

Here are my goals:

That’s my plan for the new year. Six specific goals, each lasting 30 days. I could definitely use some help for September and November. Please give me some suggestions in the comments.

In this installment of the Make Extra Money series, I’m going to show you how I do keyword research.

Properly done–unless you get lucky–this is the single most time-consuming part of making a niche site. If you aren’t targeting search terms that people use, you are wasting your time. If you are targeting terms that everybody else is targeting, it will take forever to get to the top of the search results.

Spend the extra time now to do proper keyword research. It will save you a ton of time and hassle later. This is time well-spent.

If you remember from the last installment, when we researched products to promote, we narrowed our choices down to a few products.

What I’ve done is create a spreadsheet to score the products. You can see the spreadsheet here. I’ll explain the columns as we populate them.

The first column contains the name of the product. Easy. We’ve got 10 products. I’m going to walk through scoring 1 product, then, through the magic of the internet, I’ll populate the rest, and you’ll get to see the results instantly. Wow.

The second column is the global search volume for the exact search term. I base my product niche sites primarily on the demand for a given product. Everything else is a secondary consideration.

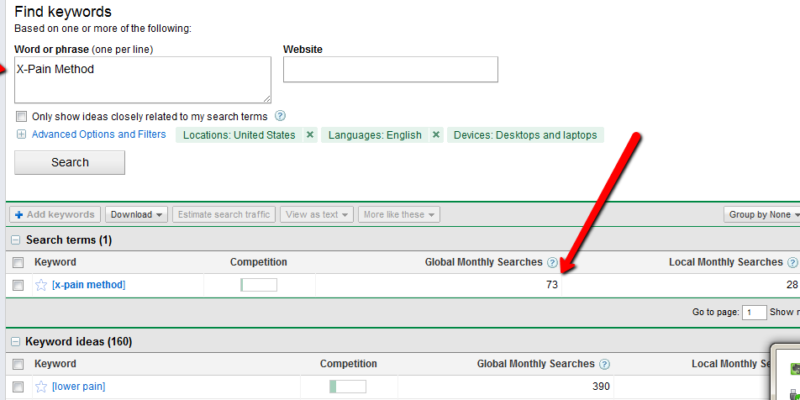

To find the demand for a product, go to the Google Adwords Keyword Tool. In the “word or phrase” box, enter your product name, exactly. In this case, it’s “X-Pain Method”. When the search results come up, change the match type to “Exact”. You should have something like this:

Enter the global search volume in column 2. In this case, it’s 73. Keep this window open, because we’ll be coming back to it.

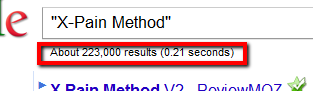

Column 3 is the search competition. Go to google and enter your product name, in quotes. In this case, “X-Pain Method”. Put the total number of search results in column 3: 223000.

Column 4 is the search competition, but only what appears in a page’s title. Your search query is intitle:”X-Pain Method”, which yields 4400 results.

The next column is for the average PageRank of the first page of search results. For this, I use Traffic Travis. I use the 4th edition, which is paid software, but you can get the free version of version 3, instead. I’ll use version 3 for this example. Open the software and click on “SEO Analysis” on the bottom left of the screen. Put your search term (“X-Pain Method”) in the “phrase to analyze” and set the “Analyze Top” to 10, then hit “Analyze”. When it’s done running, just add up all of the PRs and divide by 10. Ignore Travis’s difficulty rating.

Now, for the rest of the columns, we’re going to look at the keyword tool again. We’re going to pick 3 alternate search terms. Here are the criteria:

Once we pick the keywords, we’ll throw them into google to get the competition, just like we did to populate column 2.

“Exercises for back pain” has medium competition and 1900 monthly searches. It also has an estimated cost-per-click of $3.02, which means people are paying for this.

“Lower back pain exercises” has 6600 searches and medium competition. It’s actually on the lower end of medium, so it looks really promising.

“Lower back” has 4400 searches and low competition, with a CPC of $6.24. This should be a good one. Scratch that. It has 40 million search results, but only 4400 searches. That’s a lot of competition for a small market.

Instead, I’m going to search for “cure back pain” in the keyword tool and see what I get. “Upper back pain” is better. Low competition, 18000 searches each month, and only 2000000 competing search results. Now, I’ll score it.

You really want at least 500 searches per month for the product name. More than 2500 is better. I’m going to assign 1 point per 500 monthly searches.

You also want a lower number of search results. Less than 10,000 is ideal. Less than 100,000 is still decent. More than 250,000, I’d walk. So, under 10,000 gets 5 points. Under 50,001 gets 4. Under 100,001 gets 3. Under 200,001 gets 2. Under 250,001 gets 1. Any higher gets 0.

The ideal intitle search will have less than 2000 results. More than 100,000 is too time-consuming to deal with. 0-2000: 5 points; 2001-10,000: 4 points; 10001-25000: 3 points; 25001-50000: 2 points; 50001 to 100000: 1 point.

The perfect product will have the first page of search result all with a PageRank of 0. That’s a 5 point product. I’ll knock off half a point for every point of average PR.

The related terms are more relaxed. They are what’s known as “Latent Semantic Indexing” (LSI) terms. We will be creating articles to match those search terms, mostly to make our niche site look as natural and real as possible. Any actual traffic those pages drive is just gravy. Points for the related searches start at 10 and get 1 point knocked off for each 3 million results. We’ll be treating the 3 terms as one for this score.

That gives us a perfect score of about 25. There’s no actual upper limit, since the score for the search volume has no upper limit. X-Pain Method scored 18.22.

Now, excuse me a moment while I score the rest.

I’m back. Did you miss me?

I’ve finished scoring each of the products and sorted the results by score. The clear winner is the back pain product, but the lack of searches bothers me. The wedding guide looks much nicer, especially if I target the phrase “wedding planning guide” during the SEO phase of the project. That change alone brings the score almost to first place.

Frankly, I’d take either 2nd or 3rd place over the back pain product. The bare numbers don’t support it, but my judgement tells me they are better products to promote.

There is one final step before deciding on the product. I have to buy it. I can’t review the product without seeing it and I can’t promote it without approving of it.

That’s the secret to ethical niche marketing, you know. Only promote good products that you’ve personally read, watched, or used.