- Screw April Fool's Day. I'm about ready to clear my entire feed queue. #

- I definitely need a reason to get up at 5 or I go back to sleep. #

- Bank tried to upsell me on my accounts today…through the drivethru. #

- Motorcycle battery died this morning. Surprise 4 mile hike. #

- RT @ramseyshow 'The rich get richer &the poor get poorer' is true! Rich keep doing what rich people do & poor keep doing what poor people do #

- RT @ramit: "How do you know if someone is a programmer?" I cannot stop laughing imagining half my programmer friends – http://bit.ly/9MOipi #

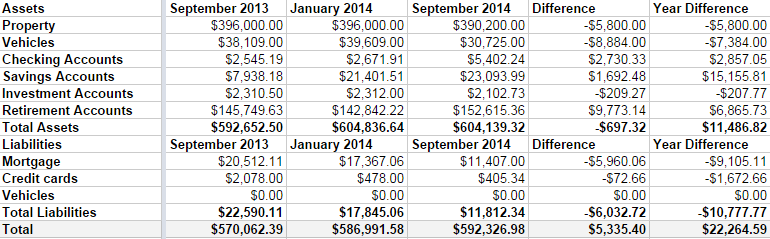

Net Worth Update – September 2014

It’s time for my irregular-but-usually-quarterly net worth update. It’s boring, but I like to keep track of how we’re doing. Frankly, I was a bit worried when I started this because we’ve been overspending this summer and Linda was off work for the season.

But, all in all, we didn’t do too bad.

Some highlights:

- Both of our properties lost around $3000 in value. I’m not worried, because we are keeping them both for the long haul. The rental is basically on auto-pilot, so that’s free money every month.

- We sold a boat that appraised for much less I had estimated in the last few updates. I had it listed for $5000, but it was worth $2000.

- I do have a credit card balance at the moment, but that goes away as soon as my expense check clears the bank, which will be in a day or two.

- We’re in the home stretch with the mortgage. There is $11,407 left to go, and we’ve paid down $9105 in the last year. By this time next year, I want that gone, gone, gone.

I can’t say I’m upset with our progress. We’ve paid down $6000 in debt in 2014, including 3 months with 1 income. We aren’t maxing our retirement accounts, yet, but I’d like to be completely debt free before I do that. It’s bad math, but having all of my debt gone will give me such a warm fuzzy feeling, I can’t not do it.

My immediate goal is to hit a $600,000 net worth by my next update in January. I’m only about $7000 off.

Time to hit the casino. Err, I mean, time to up my 401k contribution from 5% to 7%.

What to Take Away From John Cleese’s Divorce

If you haven’t been kept under a rock your whole life, you’re likely familiar with actor and comedian John Cleese. Part of the infamous Monty Python crew, he starred in films such as Monty Python’s Quest for the Holy Grail, and television shows such as Faulty Towers. However, are you familiar with what has happened to Mr. Cleese financially over the past few years?

When Cleese divorced his third wife she ended up with a divorce settlement that quite literally made her richer than him, despite the fact that they were married for only 16 years and had produced no children.

Divorce is, unfortunately, a fixture of modern society, and people of both sexes need to know how they can protect their personal finances in case of a divorce. After all, these days more than 50% of marriages end in divorce, so not preparing yourself financially for it is engaging is some rather wishful thinking. So how best to protect yourself and your personal finances, should you be unfortunate enough to have to go through one?

If you are the higher-earning party, get a pre-nup prior to marriage; this simply cannot be overemphasized. Cleese himself, already married to wife number four, incidentally, was told that he should have her sign a prenuptial agreement, he initially didn’t want to, despite having just been taken to the proverbial cleaners. He only reluctantly had one written up when his legal team essentially insisted. Even though prenups can be challenged or modified in court, if you are the party bringing more assets to the relationship, it is irresponsible of you not to solicit a prenuptial agreement from a potential spouse.

Another thing to keep in mind is that you should protect assets you have in joint accounts with your spouse, and also begin to actively monitor your credit, if things become acrimonious between you two. This way, you will prevent them from absconding with the totality of your shared funds, or ruining your credit if they are feeling malicious. If you need further information on how to do this properly, speak with a qualified financial planner.

So if you find yourself considering marriage and either have significant assets to protect or suspect you might have them in the future, you owe it to yourself to look into the legalities surrounding prenuptial agreements, and other thorny issues related to personal finance. Failure to do so can end up seriously impacting your life in a negative way, should you ever be faced with a vindictive or greedy spouse; protect yourself!

Related articles

3 Things You Need to Know About Homeowner’s Insurance

- Image by ecstaticist via Flickr

If you are a homeowner, you need homeowner’s insurance. Period. Protecting what is mostly likely the biggest investment of your life with a relatively small monthly payment is so important, that, if you disagree, I’m afraid we are so fundamentally opposed on the most basic elements of personal finance that nothing I say will register with you.

If, however, you have homeowner’s insurance, or–through some innocent lapse–need homeowner’s insurance and you just want some more information, welcome!

The basic principle of insurance is simple. You bet against the insurance company that you or your property are going to get hurt. If you’re right, you win whatever your policy limit is. If you’re wrong, the insurance company cleans up with your monthly premium. Insurance is gambling that something bad will happen to you. If you lose, you win!

Now, there are some things about homeowner’s insurance that you may not realize.

1. Homeowner’s insurance will not protect you against a flood. For that you need flood insurance. The easiest way to tell which policy covers water damage is to see if the water touched the ground before your house. An overflowing river, or heavy rain that seeps through the ground and your foundation are both considered flooding. On the other hand, hail breaking your windows and allowing the rain in or a broken pipe are both generally covered by your homeowner’s policy.

Do you need flood insurance? I would say that, if you live on the coast below sea level, you should have flood insurance. If you’re on a flood plain, you need flood insurance. If you’re not sure, use the handy tool at http://www.floodsmart.gov to rate your risk and get an estimate on premium costs. My home is in moderate-to-low risk of flooding, so full coverage starts at $120.

2. You can negotiate an insurance claim. When you have an insurance adjuster inspecting your home after you file a claim, most of the time they will lowball you. Generous adjusters don’t get brought in for the next round of claims. If you know the replacement costs are higher than they are offering, or even if you aren’t sure, don’t sign! Once you sign, you are locked into a contract with the insurance company. Take your time and do your research. Get a contractor out to give you a damage estimate, if you can.

3. Your deductible is too low. If you’ve built up an emergency fund, you can safely boost your deductible to a sizable percentage of that fund and save yourself a bunch of money. When we got our emergency fund up to about $2000, we raised our deductible from $500 to $1000 and saved a couple of hundred dollars per year. That change pays for itself every 2 years we don’t have a claim. I absolutely wouldn’t recommend this if you don’t have the money to cover your deductible, but, if you do, it can be a great money-saver.

Bonus tip: If you get angry that your homeowner’s insurance doesn’t cover flooding, even if you haven’t had to deal with a flood, and you cancel your insurance out of spite, and you subsequently have a ton of hail damage, your insurance company won’t cover the crap that happened during the window where you weren’t their customer.

Are you one of the misguided masses who prefer to trust their home to fate?

Do you have an insurance horror story?

$1500 Luxury

I’ve got some expensive habits. Not like Charlie Sheen snorting $2500 of blow of a hooker’s boobs, but still expensive.

My latest one is dancing lessons. Linda surprised me on one of weekly date nights a few months ago. She found a Groupon for the dancing studio we used before we got married. It was $69 for a month of unlimited group lessons.

When the month was up, we signed on for their beginner cycle of lessons, which cost another $400.

And now we’re starting the Social Foundation program.

Social Foundation is a series of classes that teach some advanced moves, but also to teach dancers how to lead and follow properly and how to dance socially and look respectable on a dance floor in any number of situations. Leading and following are important because every single dance move out there has specific cues that tell your partner what’s coming next. If she doesn’t know, you both look clumsy.

So we chose the four dances we’re going to learn better and signed up. We’re going to learn the Rumba, Waltz, Tango, and Swing. We’re already pretty good at Rumba and Swing, but we’re going to get better. Personally, I’m hoping to also figure out how to use the Tango on an open dance floor without crashing into people. That way, we can pretend to be Gomez and Morticia, my heroes.

Now, the thing is, dance lessons aren’t cheap. They cost about $100 per hour, where an hour is defined as 45 minutes. We’re rolling the last half of our beginner lessons into our social foundation lessons and paying $1400.

Ouch.

They gave us the option of financing it over 3-4 months, but I didn’t want to pay an extra $200 for the privilege. I think we’ll be tapping the vacation fund to pay for the lessons.

Why am I willing to pay this much?

Dancing is one of the very few things Linda and I both enjoy. We’re pretty good at it, it’s great exercise, it’s fun, and (shhh!) it counts as foreplay. It also doesn’t hurt to have the sidelines of the dance floor lined with people watching us dance, wishing they could do what we’re doing…or wishing their husbands were willing to learn how to dance. This also isn’t just something we’re doing at the studio. We are out on a dance floor dancing to a live band almost every week. That usually comes with about $25 in cover charges and drinks.

Fun, exercise, have sex, and inspire jealousy. That’s a winning combination. And finding things to do that we both love to do is difficult and easily worth the $2000 we’ve paid the dance studio this year.

100 Push-ups in 22 Days

One from the vault:

Last month, I set a goal to do one hundred push-ups in a single set by the end of the month. Before I started working on this, I hadn’t done a single pushup in at least 10 years. At the beginning, I didn’t know if it would be possible, or how much it would hurt. I knew it would be a challenge, and I was looking for a challenge.

Three days before the start of the month, I did one set of pushups. I wanted to find my baseline, so I could see the progress I was making, and I wanted a chance to recover, so I’d be starting from scratch on the first of the month. That day, I did 20 pushups. I pushed, but 21 wasn’t going to happen. That’s not an impressive number, but I ride a desk all day and had spent 10 years lazy. It could have been worse.

My initial plan was to do two sessions per day, morning and night. I’d be doing a total of 56 sessions. Each session would consist of 5 sets of my baseline, progressing to 100 push-ups in a set for the 56th session. That would mean I’d have to add 1.5 pushups to my sets each session. I decided to add 1 to each set in the morning and 2 in the evening sessions. My planned progression was 20, 22, 23, 25…95, 97, 98, 100 over the course of the month.

That lasted one day. February 1st, I did 100 push-ups in 5 sets of 20. That night I did 110 push-ups in 5 sets of 22. The next morning, I hurt so much I couldn’t do 10. I did something like 8/5/5/5/cry-like-a-baby. My abs were cramping and my shoulders burned. I ended the session in the fetal position, hoping all of the screaming muscles wouldn’t cramp up at the same time. If pain is weakness leaving the body, then I was making a significant contribution to the the problem of homeless weakness particles.

Plan A failed. As I waited for the pain to end, I had some time to think. In between “Please don’t cramp! Please don’t cramp! Please don’t cramp!”, I developed Plan B.

I decided to base everything on the previous session’s largest set. The largest set would set my baseline for the next session. The first set in the session would be half of the baseline. The next three sets would be 3/4 of the baseline, and the final set would be pushed until I couldn’t go any further, establishing the next session’s baseline. Starting from my newly established baseline of eight push-ups, my next session was 4/6/6/6/15. The session after that was 7/11/11/11/16, then 8/12/12/12/16.

Plan B became an aggressive, self-correcting progression. If I pushed too hard, the next session was done at a lower level, allowing me time to recover.

The first week hurt. Going from little-to-no real exercise to an aggressive exercise regimen is painful. I was stiff and sore, but I was progressing. One of the best things about Plan B: Set #1 is a good warm-up. Warming up is important.

By the end of week one, I was back to where I started, doing sets of 20. I wasn’t sure I’d make it. I had a few days in a row that didn’t improve my baseline at all. Then I skipped a day. When I came back, but baseline jumped by 10 push-ups. I had hit a small wall, gave myself a day to recover and had a 50% improvement. Guess what got incorporated into Plan B? If I had two days in a row without improvement over the four sessions, I skipped a day.

By the end of week two, my baseline was up to 60. I stopped increasing the warm-up set, so it would still be a warm-up and not create strain. I only went above 20 for the warm-up set once before I created this rule. At this point, my session was 20/45/45/45/60. That’s progress.

At the end of week three, my baseline was at 80. I took the weekend off.

On Monday, February 22nd, I decided to see where my absolute max was. I did a set of 20 to warm up. I followed up with a set of 30, to make sure I was ready. Set #3 was 100 push-ups, a full week early. I’m not going to lie and say push-up #100 was perfect, but it was done. I went from barely being able to do 20 push-ups to successfully doing 100 push-ups in 22 days. I spent the rest of the week perfecting my form. After 75-80 push-ups, it’s hard to tell exactly how straight your body is and how low you are going, without a spotter or a mirror.

Next, I’m applying Plan B to sit-ups.