- RT @bargainr: Life in North Korea is absolutely dreadful http://nyti.ms/dAcL26 #

- RT @bitfs: Weekly Favorites and Gratitude!: My Favorite Posts this Week Jeff at Deliver Away Debt threw together the .. http://bit.ly/9J0gGo #

- @LiveRealNow is giving away a copy of Delivering Happiness(@dhbook). Follow and RT to enter. http://bit.ly/czd31X # #

- Baseless claims, biased assumptions, poor understanding of history. Don't bother. #AnimalSpirits #KeynesianCult #

- RT @zappos: Super exciting! "Delivering Happiness" hit #1 on NY Times Bestseller list! Thanks everyone! Details: http://bit.ly/96vEfF #

- @ericabiz Funny, we found a kitten in a box last week. Unfortunately, it was abandoned there, not playing. Now, we have a 5th cat. in reply to ericabiz #

Twitter Weekly Updates for 2010-07-10

- Happy Independence Day! Be thankful for what you've been given by those who have gone before! #

- Waiting for fireworks with the brats. Excitement is high. #

- @PhilVillarreal Amazing. I'm really Cringer. That makes me feel creepy. in reply to PhilVillarreal #

- Built a public life-maintenance calendar in GCal. https://liverealnow.net/y7ph #

- @ericabiz makes webinars fun! Even if her house didn't collapse in the middle of it. #

- BOFH + idiot = bad combination #

Debt Options

When you’re buried in debt, bankruptcy can seem like the only option. When you get make ends meet, no matter how hard you pull on them. When bill collectors interrupt every dinner. When you have to choose between food and rent. When there is always more month than money. Do you have another choice?

Yes, you do.

Before you rush to file bankruptcy, take the time to understand your options.

Debt Settlement

Debt settlement is when you quit paying your bills and start sending the money to settlement company. The settlement company does…nothing. Really. They take your money and drop it into investments or interest-bearing accounts. You don’t get the interest, they do. Eventually, when your creditors are howling, the settlement company offers to make a settlement on the account. If the creditor accepts pennies on the dollar to kill your debt, the settlement company pays them. If not, they get to howl louder and make you more miserable.

While this process is playing itself out over years, your credit is taking a beating. You are doing nothing to dig yourself out of the hole you’ve dug. Finally, when your creditors are so desperate that they accept the settlement offer, you get a huge additional hit to your credit. “SETTLED IN FULL” is not a good status to have on your credit report.

Debt settlement companies do nothing you can’t do for yourself, and doing it for yourself at least lets you keep the interest your money is earning.

Debt Consolidation

Consolidating your debt comes in two varieties, a debt consolidation loan and a debt management plan.

A debt management plan is when you send one large payment to a debt consolidation company, and they pay your creditors for you each month. The company will usually attempt to contact your creditors and negotiate your interest rate and payments to try to get you into a situation that precludes bankruptcy and will keep your creditors happy. In the simplest terms, this is a debt payment consolidation.

A debt consolidation loan is generally done by taking out a line of credit against your home or other collateral and using that money to pay off all of your bills. Then you make the payments to the bank, to pay off your line of credit. The problem is that, if you can’t make the individual payments, can you make the payment to the line of credit? If you can’t, you risk losing your house.

Repayment

This option is my personal favorite. It involves taking responsibility for your decisions, cutting out the unnecessary expenses in your life, and paying your bills. There are a few popular plans for accomplishing this, including Dave Ramsey‘s debt snowball. The most important thing to remember are 1) debt it bad so stop using it; and 2) pay off as much as you can afford to each month. It isn’t as sexy as making all of your debt disappear, but it’s still a good option.

Bankruptcy

Let’s see. You borrow money on the promise to pay it all back. After you borrow too much, you renege on your agreement. You admit your word means nothing and you get all of your debt cancelled, forcing your creditors to raise the interest rates for all of the responsible debtors out there, as a way to balance the risk of those who will never pay. In exchange you doom yourself to lousy credit for the next 10 years. In extreme circumstances, bankruptcy may be the only option, but, I’m not a fan.

As you can see, there are almost always better options than bankruptcy. Please, before you take that leap, look into the other choices.

This is a sponsored post written to provide some insight into the world of bankruptcy and debt consolidation.

Jobs I’ve Had

I’ve always worked. From the time I was young, I knew that, if I wanted to feed my G.I. Joe addiction, I needed a way to make money.

So I got a job.

I was the only kid in first grade earning a steady paycheck.

In the years since, I’ve had a dozen or so jobs at 10 different companies. The question has been asked, so this post is my answer: these are all of the jobs I’ve ever held.

- Paper route. Starting at age 6, I split a paper route with my brother. Initially, I made about $6 per month, which was enough for 1 G.I. Joe.

- Farm hand. I spent a couple of summers in junior high and high school doing odd farm jobs outside of my home town.

- Dishwasher. Starting in 9th grade, I gave up a study hall to work in the school cafeteria, serving food and washing dishes. It paid minimum wage for 1 hour per school day.

- Construction. For a couple of summers, I worked for my dad’s construction company. He was easily the hardest boss I’ve ever had, which was great preparation for the rest of my working life. The drunk bar owner who didn’t allow his employees a lunch break and got upset if they sat down on a smoke break was nothing by comparison. Thanks, Dad. Every employer since has been astonished by my work ethic, even when I’m having an off day.

- Dishwasher, take 2. Sixteen years old, thumped by the wisdom of “If you want a car, get a job to pay for it.” So I did. It paid a bit over minimum wage and gave me my first “Who the heck is FICA and why is he robbing me?” moment. I eventually got promoted to cook, which came with better pay, worse hours, and more opportunities to flirt with waitresses. It was grand.

- Palletizer. This is a fancy way of saying I stood at the end of a conveyor belt, picked up the 50 pound bags of powder as they came down the line, and stacked them neatly on a pallet. Rinse and repeat. 1500 times per night. By the time I left this job, I had arms that would make Popeye cry.

- Cook, take 2. I held this job at the same time as the palletizer position. I’d work 8 hours stacking pallets, then head to job #2, 5 miles away. My car was broken at the time, so I rode my bike. In the winter. In Minnesota. I was working 14-16 hour days, lifting a total of 75,000 pounds, biking 10 miles per day. I was in great shape and tough. I wasn’t tough enough, though. I could only maintain this schedule for a couple of months.

- Machine operator. During my stint with this company, I’d put a little piece of metal into a great big machine, push a button, then spend 15-20 minutes listening to the great big machine carve the little piece of metal into something worth selling. This was about when I started shopping for books based primarily on thickness. One night, I read The Stand in my spare time. I’d also pass the night by burning scrap magnesium flakes in the parking lot. What can I say? Twelve hour graveyard shifts with 3 hours of actual work are boring. I left a few months after my son was born, because I was missing too much of my family time. I took a 30% pay-cut, before overtime, to be with my wife and kid.

- Debt collector. I worked my way through college by collecting on defaulted student loans. I firmly believe that we should all live up to our obligations and responsibilities, including paying your bills, so I didn’t have a moral dilemma with the work. There are some bad apples, but I don’t see collectors as pariahs.

- Systems Administrator. After I graduated college, I got promoted and spent the rest of my time there managing the collection and auto-dialer software and the hodge-podge of other applications we needed, some of which, I wrote.

- Software engineer. This is where I am now. I’ve written a medium-scale ecommerce application that handles the online sales for quite a few companies, mostly in the B2B arena. The job also includes a large chunk of training, management, and even sales. I don’t particularly enjoy sales, but a programmer geek who can manage other programmers, coordinate with sales & marketing, and talk to customers during a sales demo is a rare bird.

To recap: I’m 32 and I’ve had 1 month out of the last 26 years that didn’t come with a paycheck. I’ve worked for 10 different companies and I start the job before this one when I was 20.

How many jobs have you had? What was the most memorable, or the oddest?

My Favorite Present

My favorite Christmas present this year was the one I gave to my 13 year old son.

Allow me to walk you through his evening….

First, he opened one of his presents. It was just a small box, about 3 inches by 4. A Japanese puzzle box. Inside the box was a note that read:

Closed off in the smallest room you will find a clue to bring you closer to your prize.

When he checked the cabinet below the sink in our basement bathroom, he found another note that sent him to my business website one a page with a url that contained “the square of my children”. When he eventually figured out that I meant their ages, not their quantity, he found a clue on my website.

This lead him to a section of his Minecraft server. It’s effectively a no-man’s land because he and his friends set off a nuke and turned it into a giant pit. They fall down and die there. Inside the pit was a cave. Inside the cave was a clue. The clue read:

Grandma and Grandpa love you.

What do you do when someone says they love you? You either get scared of the commitment and end a perfectly good relationship, or you say “I love you, too”. When the kid finally called his grandparents to tell them he loves them, they told him to give his parents a kiss.

I’m a jerk.

He came over and gave me a hug and a kiss. I handed him a piece of paper. When he looked at it, he asked if it was supposed to be torn in half. I reminded him that he has two parents, so Mom got a hug and a kiss, too. The resulting clue read:

The Answer to the Question of Life, the Universe, and Everything

Naturally, this points to The Hitchhiker’s Guide to the Galaxy, but the boy hadn’t read far enough into the book to understand the reference, so he had to hit google. After spending time looking for chapter 42, he finally thought to look at page 42, which had this clue:

My Little Pegasus

Two steps to the right

Two steps forward

Two steps up

This clue started at the My Little Pony I set next to a Pegasus in my daughters’ room. The boy was in dense mode because he had to ask his sister what a Pegasus was. She also had to suggest he open the closet door when one step forward made him bump his nose on it.

For all of that work, he got the Ticket to Ride game. He laughed the entire way through the treasure hunt, then decided he hated the whole process. However, for two nights running, he’s stopped the video games to play his new game with his family.

It’s a present he’ll remember forever.

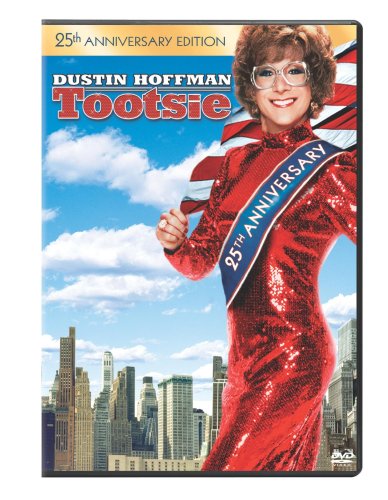

Tootsie – Does Beauty Have to be Expensive?

Many remember Dustin Hoffman dressed in drag in the classic film Tootsie, a movie that he now says made him realize how many women he’s missed out on meeting in life simply because he judged them by their looks. Every year women spend thousands of dollars on beauty products and cosmetics, hoping to increase their appearance and become attractive enough to the outside world. Although there are various degrees of beauty, it undoubtedly is usually determined by the amount of money spent to enhance features and upkeep the overall look.

The length of a woman’s hair often creates a more attractive look in the U.S., which is difficult to achieve with flat irons and curlers that create breakage and brittle hair from the heat. Women are now resorting to having hair extensions installed every three to five months to achieve beautiful hair that has a fuller texture and longer length, costing an average of $700. They can resort to shorter hair that saves a large amount of money, but they’re ultimately compromising a large part of their looks.

There’s a reason that celebrities appear more beautiful than the rest of the population, as their high school photos often show them to look like typical people. By spending thousands of dollars on personal trainers, stylists, and makeup artists, their appearance is immediately enhanced with the finest tools and products on the market. They are also able to have help with experts who have more knowledge on what creates the best look for their features.

Although beauty does not have to be expensive (just look at exotic women in Columbia and Brazil who are anything but high maintenance), it unfortunately is a requirement in the U.S. where rich housewives rule the reality shows and runways. True beauty is often defined by breast and waist sized, which few women can live up to, resulting in thousands of dollars spent on breast implants and liposuction, often impossible to attain otherwise.

Beauty may be in the eye of the beholder, but few men will argue that Angelina Jolie is unattractive or that Heidi Klum looks homely. The majority of men can agree when a woman is beautiful, and few women catch attention with a homemade manicure and dyed hair that came from a box. Perhaps going au natural will become a new trend in the coming years, but for now it’s expensive to be a woman, and even more costly to be a beautiful one.