- RT @kristinbrianne: Get Talk and Txt Unlimited Cell Svc w/ Free Phone for $10 per month by joining DNA for Free. http://tinyurl.com/yyg5ohn #

- RT: @ChristianPF is giving away an iPod Touch! – RT to enter to win… http://su.pr/2LS3p5 #

- 74 inch armspan and forearms bigger than my biceps. No, I don't button my shirt cuffs. #

- RT @deliverawaydebt Money Hackers Network Carnival #111 – Don't Hassel the Hoff Edition http://bit.ly/9BIAvE #

- @bargainr What would it take to get you to include me in the personal-finance-bloggers list? #

- Working on a Penfed application to transform my worst interest rate into my best. #

- Gave the 1 year old pop rocks for the first time. Big smiles. #

- @Netflix @Wii disc works well and loads fast. Go, go gadget movie! #

Anchor Price Your Salary

- Image by Dalboz17 via Flickr

Conventional wisdom says that, when negotiating your salary or a raise, you should make whatever crazy ninja maneuvers it takes to get the other person to name a number first.

Horse pellets.

Have you ever watched an infomercial? Those masters of of impulse marketing geared towards insomniacs, invalids, and inebriates?

“How much would you pay for this fabulous meat tenderizer/eyelash waxer? $399? $299? No! If you call within the next 73 seconds, we will let you take this home for the low, low price of just $99.99!”

That’s the magic of anchor pricing.

The first number you hear is the number you will base all further numbers on. If you hear a high number, other lower numbers will feel much lower by comparison. The number doesn’t even have to be about money.

There was a study done that had the subjects compare a price to the last two digits of their social security numbers. Those with higher digits found higher prices to be acceptable, while those with lower prices only accepted cheaper prices.

What does an infomercial marketing ploy have to do with your salary?

If you are negotiating your salary and your potential employer gives a lowball offer, every higher counteroffer after that will much, much higher than than it would otherwise. On the other hand, if you start with your “perfect” salary, they amount you will be happy to settle for won’t seem to be nearly as high to the employer. At the same time, you will be less likely to accept a lowball offer if you set your anchor price high.

For example, if you are looking to make $50,000:

The employer offers you $40,000. $60,000 seems too high by comparison, so you counter with $50,000, then compromise and settler for $45,000. Or, you could start at $60,000, making the employer feel that $40,000 is too low, so he counters with $45,000, leaving a compromise at $52,000. That’s a hypothetical $7,000 boost, just for bucking conventional wisdom and taking a cue from the marketing industry.

How have you negotiated your salary?

What do you do?

You’re not your job. You’re not how much money you have in the bank. You’re not the car you drive. You’re not the contents of your wallet. You’re not your ******* khakis. -Tyler Durden

“What do you do?”

They typical answer is usually something like “I’m a computer programmer.” Or a DJ, a cop, a barista, a stripper, or whatever.

The answer is always given in the context of work. Is work the center of your life? Is your career the most important thing you have? For many, it is. Our jobs become a fully integrated piece of our identities. Even when we pay lip-service to putting our families first, all too often, we spend more of our waking hours working than actually living.

We spend 40, 50, 60 hours each week at our jobs. It’s natural for that to become a part of us.

We go too far.

I am not my job. I am not my career.

I am a father, a husband, a writer, a blogger, and more. I have hopes, dreams, and ambitions entirely apart from my career.

I hope you do, too.

The next time someone asks you what you do, try responding with your passion.

“I’m a parent.”

“I grow freaking awesome roses.”

“I travel whenever I can.”

“I obsess over politics.”

Leave the tradition work-centric script behind. You’re going to confuse the people who are expecting it. They think they are asking about your job and you are responding with something that truly matters to you.

What do you do?

$1,000,000 Business Idea

I’m sick of working my day job.

I’m sick of working my side hustles.

I’m sick of working.

To make up for all of that, I’m going to launch a new business. My business model is guaranteed to generate $1,000,000 in revenue the first month.

Seriously.

It’s going to be a father/son enterprise, and to prove that the business model scales, I’m going to help him generate another $1,000,000 in revenue the first month.

This plan is infinitely replicable and infinitely scalable. Steal my business plan and you can have a million dollar business, too.

Ready?

First, my son is going to sell his XBox for $100. Yes, he’s taking a loss, but that’s the cost of getting into the business. Oh, and he’s selling it to me.

$100 for him.

Second, I’m going to sell it back to him for $100.

$100 for me.

He sells it to me for $100.

$200 for him.

I sell it to him for $100.

$200 for me.

If we do this just 9,998 more times, we’ll have generated $1,000,000 in revenue. At 1 minute per transaction, I figure we can both be running million dollar business after just 2 weeks of full-time work.

That’s a two-week vacation every single month.

Phenomenal plan.

Some of the haters are going to explode with comments about “profit” and “expenses”, but I don’t care. Cash flow is king. They can sit at home and whine about their $50,000 jobs while I’m making millions. Sure, my profit (the money leftover after expenses are taken from the revenue) is on the low side, but I can make that up in volume.

Millions.

If I do this every month, I’ll be sitting on a $12,000,000 business. I bet I can sell that for 5 times my annual profits.

Any buyers out there?

Any entrepreneurs ready to copy my business model?

Anybody have a better grasp of the difference between cash flow and profit than I do?

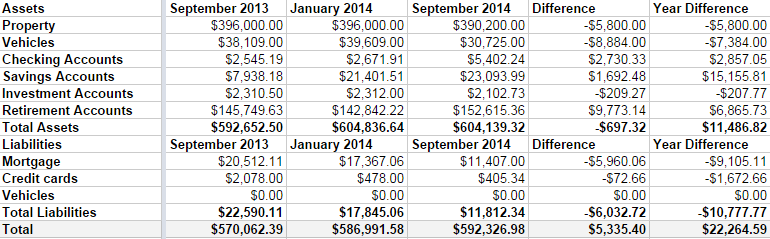

Net Worth Update – September 2014

It’s time for my irregular-but-usually-quarterly net worth update. It’s boring, but I like to keep track of how we’re doing. Frankly, I was a bit worried when I started this because we’ve been overspending this summer and Linda was off work for the season.

But, all in all, we didn’t do too bad.

Some highlights:

- Both of our properties lost around $3000 in value. I’m not worried, because we are keeping them both for the long haul. The rental is basically on auto-pilot, so that’s free money every month.

- We sold a boat that appraised for much less I had estimated in the last few updates. I had it listed for $5000, but it was worth $2000.

- I do have a credit card balance at the moment, but that goes away as soon as my expense check clears the bank, which will be in a day or two.

- We’re in the home stretch with the mortgage. There is $11,407 left to go, and we’ve paid down $9105 in the last year. By this time next year, I want that gone, gone, gone.

I can’t say I’m upset with our progress. We’ve paid down $6000 in debt in 2014, including 3 months with 1 income. We aren’t maxing our retirement accounts, yet, but I’d like to be completely debt free before I do that. It’s bad math, but having all of my debt gone will give me such a warm fuzzy feeling, I can’t not do it.

My immediate goal is to hit a $600,000 net worth by my next update in January. I’m only about $7000 off.

Time to hit the casino. Err, I mean, time to up my 401k contribution from 5% to 7%.

Twitter Weekly Updates for 2010-05-08

- The Festival of Frugality #278 The Pure Peer Pressure Edition is up. All of your friends are reading it. http://bit.ly/aqkn4K #

- RT @princewally: Happy StarWars Day!: princewally's world http://goo.gl/fb/rLWAA #

- Money Hacks Carnival #114 – Hollywood Edition http://bit.ly/dxU86w (via @nerdwallet) #

- I am the #1 google hit for "charisma weee". Awesome. #