- @fcn Yahoo Pipes into GReader. 50 news sites filtered to max 50 items/day–all on topic. in reply to fcn #

- @fcn You can filter on keywords, so only the topics you care about come through. in reply to fcn #

- It's a sad day when you find out that your 3 year old can access anything in the house. Sadder when she maces herself with hairspray. #

- 5 sets of 15 pushups to start my day. Only 85 to go! Last 5 weren't as good as first 5. #30DayProject #

- What happens to your leftover money in your flex-spending account? http://su.pr/9xDs6q #

- Enter to Win iPod Touch from @DoughRoller http://tinyurl.com/y8rpyns #DRiPodTouch #

- Arrrgh! 3 year old covered in nail polish. And clothes. And carpet. And sister. #

- Crap. 5 sets of 5 pushups. #30dayproject #

- Woo! My son just got his first pin in a wrestling meet! #

- RT @Doughroller: Check out this site that gives your free credit report AND score without asking for a cc# or social… http://bit.ly/bRhlMz #

- Breaking news! Penicillin cures syphilis, not debt. https://liverealnow.net/KIzE #

- Win a $25 Amazon GC via @suburbandollar RT + Fllw to enter #sd1Yrgvwy Rules -> http://bit.ly/sd1Yrgvwy2 #

- This won't be coming to our house. RT @FMFblog: Wow! Check out the new Monopoly: http://tinyurl.com/ygf2say #

- @ChristianPF is giving away a Flip UltraHD Camcorder – RT to enter to win… http://su.pr/2ZvBZL #

AAA – Save Some Cash

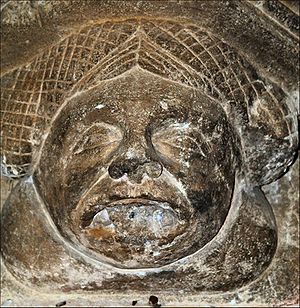

- Image via Wikipedia

Have you ever driven off the road at 100 miles per hour into a grove of trees at midnight, only to have 2 cops and your father spend 2 hours looking for your car with high-powered spotlights? Let me tell you–from experience–that a free two will, in fact, make that night a little bit better.

Enter AAA.

At its most basic level, AAA is just a roadside assistance service. If your car breaks down, you lock your keys in, or run out of gas, you call AAA from the side of the road and they send a hero at any time of day or night. I’ve used the service to get a car pulled out of an impound lot and out of a ditch. They’ve helped move broken-down cars from my driveway to the mechanic.

We pay $85 per year for the basic service, which includes 5 miles of towing, up to 4 timers a year; lockout service; gas delivery; “stuck in a ditch” service; free maps, trip planning and trip interruption protection. Higher membership levels boost those services and include things like free passport photos, complimentary car rental when you use the tow service, concierge service and more.

I’ve been a member since I got my driver’s license at 16, and over the years, just the roadside assistance has paid for my lifetime of membership several times over.

But–as the man said–wait, there’s more!

They certify mechanics. Not for skill, but reputation. It’s harder to get screwed by a AAA mechanic.

Then there are the discounts.

Most chain hotels, some oil-change shops, and a lot of car-rental services have AAA discounts. Combined with the trip planning, the discounts can easily pay for themselves, if you travel even once a year.

There are also discounts at a ton of restaurants and attractions, sometimes adding up to savings of $50 or more. I don’t think I’ve ever had a year where AAA didn’t pay for itself, and I don’t even use the services efficiently.

For example:

- 10% off Target.com

- Discounts on Magellen GPS units

- Theater(stage and screen) discounts

- Discounts on minor league baseball and college football tickets

- Prescription savings plan

- $3 of at our local for-profit aquarium

- 10-30% discounts from Dell

- 5% off at UPS

- 20% off at Sirius Satellite Radio

- 10% off PODS(hoarders take notice!)

- 10% at Amtrak

- Up to $200 off at DirecTV

- A crapload more

I know I sound like a salespitch, but they didn’t pay for this post. I’m just a happy customer.

Do you use a roadside assistance or a discount-from-a-million-places membership?

5 Things Guaranteed To Annoy Your Wife

One from the vaults….

If you’re married, or anything close to being married, you’ve irritated your wife. Even if you think you are perfect and the epitome of unannoyingness, I promise, there has been a day when she strongly wished you traveled for a living.

It’s long been known that the two things most likely to break up a marriage are money and sex. The former because there is too much, too little, or just the right amount going to the wrong places, and the latter because there is too much, too little, it’s not with each other, or it is with each other, but you’d really prefer otherwise. If your problem is the latter, I can’t help you.

If your problem is the former, I can help you understand some things you may be doing that are driving her batty. Kill-you-in-your-sleep-and-pretend-it-was-the-dog type of batty.

1. Nagging her about her shopping, but buying whatever you want. Gentlemen, this is known as a double standard. Don’t do it. In my house, my wife’s on an allowance. It was her idea. A few months later, I realized that I needed to be on one, too. Naturally, her allowance is bigger than mine. I don’t mind the disparity, because she still smokes. If her allowance didn’t give her room to smoke and shop, her allowance would be nothing more than a polite fiction. Whatever you do, find something that works for both of you and meets both of your needs, fairly. Anything else will only build a resentment that will burn for a long time.

2. Nagging her about her shopping, yet demanding she do all of the shopping. My wife has a weakness: clearance tags. If something is on sale, there’s a good chance it’s going to come to our house. I have an aversion to shopping. I hate it. Our budget dies a little bit each time my wife shops alone. We’ve come to an agreement. Now, I do most of the shopping, so she doesn’t feel tempted. I’m learning to embrace my inner material girl so we don’t have to have “discussions” every time she steps out for milk and comes home with $100 worth of clothes for the younger brats.

3. Nagging her about her shopping. Nobody likes being nagged. If you’re having a problem that keeps repeating itself, talking about it more won’t help. Neither will talking about it louder. You need to find a way to communicate that she will hear and understand. Different people communicate in different ways. Find the way that works for both of you.

4. Nagging her. A wise man once said, if everyone around you is a jerkface, maybe the problem isn’t everyone around you. Have you ever considered the idea that the problem might be you? If nagging is the only way you have to deal with people, you need to work on that. Don’t blame her. Maybe you’re ticked off about something that isn’t irritating. If that’s the case, she certainly has the right to be annoyed that you are nagging her.

5. Going on and on about how much you’d like to be me. Yes, I live the rockstar life, driving the station wagon with 6 disc changer and all. Yes, I am the neatest thing since sliced bread, and even that was a close contest, but really, confidence is important. You don’t have to be me to be cool. You’re swell, too. You’re right, this one isn’t about money, but it’s probably still irritating.

There you have it, my perfect solution to a happy marriage: don’t nag and quit trying to be me. There are other important bits, like love, respect, and communication, but this is a good start.

What do you do that annoys your spouse?

Meal Plans

- Image by Getty Images via @daylife

When we don’t have a meal plan, food costs more.

Our regular plan is to build a menu for the week and go to the grocery store on Sunday. This allows planning, instead of scrambling for a a meal after work each night. It also give us a chance to plan for leftovers so we have something to eat for lunch at work.

We work until about 5 every weekday. When we don’t have the meal planned, it’s usually chicken nuggets or hamburger helper for dinner. Not only is that repetitive, but it’s not terribly healthy. It is, however, convenient. If we plan for it, we can get the ingredients ready the night before and know what we are doing when we get home, instead of trying to think about it after a long day of work.

If we don’t plan for leftovers, we tend to make the right amount of food for the family. When this happens, there’s nothing to bring to work the next day, which means I’ll be hungry about lunchtime with nothing I can do about it except buy something. Buying lunch is never cheaper than making it. I can get a sandwich at Subway for $5, but I could make a sandwich just as tasty and filling for less than half of that, using money that is meant to be used for food. All during wrestling season, we make 30-inch sandwiches on meet nights for a cost of about $5, feeding ourselves and at least a couple of others who didn’t have time to make their dinner before the 5:30 meet.

No leftovers also means no Free Soup, which is a wonderful low-maintenance meal that leaves everybody full. Nobody ever gets bored of Free Soup. (Hint: Don’t ever put a piece of fish in the Free Soup, or the flavor will take over the entire meal.)

Unhealthy, repetitive food for dinner. Over-priced, low-to-middle-quality food for lunch.

OR

We plan our meals right and have inexpensive, healthy food that doesn’t get boring for every meal.

It seems to be a no-brainer. Except, I don’t have lunch today because we didn’t plan our meals and used the last of the leftover hamburger helper for dinner last night.

Update: This post has been included in the Carnival of Personal Finance.

How Cheap Can a Disney Vacation Be?

Earlier this month, I took my family to Disney World. That’s me, my wife, and my three kids (ages 8, 9, 16). Disney is one of the most expensive vacations you can take in the U.S.

We went from one Saturday to the next, in the beginning of August. August is just after peak season, so prices and crowds were down a bit from early summer. During the school year is out of the question because my wife is a school bus driver at an understaffed company. It was a bit hotter, but the price and family availability balanced out the heat nicely.

We stayed in a 1 bedroom resort on Disney property. It was a bit more expensive, but the room slept all five of us, my wife and I had a separate bedroom, and it was equipped with a full kitchen and laundry.

This wasn’t cheap.

We spent:

- $1595.96 on airfare and car rental, as a package

- $75 on upgrading the seats on our flight one way, because those were the only seats available next to each other.

- $131.11 upgrading our rental car during pickup. The third row seating was nice, both for our day trip to Cocoa Beach and for our grocery run with five suitcases.

- $4396.21 for the hotel, 4 days of Disney parks, and the included Magic Bands. Magic Bands are the awesomest way to handle hotel rooms, resort tickets, and food. You don’t need to carry a wallet in Disney World.

- $715.26 on things charged to our Magic Bands, including miscellaneous coffee, snack, and water purchases in the park, a few small souvenirs, approximately $380 at in-park restaurants, and a couple of gifts for the people who took care of our pets while we were gone.

- $15 for parking at the Cocoa Beach Pier

- $152.28 for lunch at the restaurant on the pier

- Roughly $350 on groceries and one fast food drive through meal one night

- $118.31 at the horrible Wolfgang Puck Express restaurant at the Disney Springs shopping center

- $31.59 on gas for the rental car.

- $47.35 for a movie to kill time between hotel checkout and airport check-in

- Total: $7628.07

We saved:

- $1404.14 by using signup bonus miles from two Chase Sapphire cards, bringing the flight plus rental to $188.82 plus upgrades.

- $1870.16 by using Capital One Venture card rewards. A bonus reward on one card, and regular miles on another.

- Total: $3274.30

Grand Total: $4353.77

We had about $2000 of that saved before we bought the tickets and $2000 more budgeted to pay the remaining bill quickly. $4350 spent on a trip with a $4000 budget isn’t too bad.

We opened the rewards cards more than a year ago to make sure we’d hit the sign-up bonus qualifications in time.

A few Disney tips:

- Your first day in the park, find a Disney Vacation Club booth. Go to a timeshare sales pitch. For real. It’s a low-pressure pitch that’s over in 45 minutes if you’re not interested (and you won’t be. Timeshares–especially at retail price–are stupid. Don’t sign up.) that will net you three tap-and-go fast passes and a $100 gift card. The fast passes alone saved us about 3 hours of lines.

- Install the Disney app. You can get directions to rides and manage fast passes and dinner reservations.

- Subscribe to Touring Plans. It costs $10 if you have a coupon, and there’s always a coupon. You can plan out your day at each park, including fast passes and breaks. It will give you wait times and walking times and suggest what is possibly the most efficient way to see everything you want to see. We saw 90% of everything everyone was interested in without running around. You really can do all of each of the parks in 4 days.

- Take breaks. We got there early, then left a bit after lunch time to head back to the hotel for food, rest, and swimming. We came back shortly before dinner and spent the evening. That skipped the hottest, busiest part of the day and helped avoid small children getting crabby. Take breaks.

- Go to each of the parks on their least busy day. It’s easiest to see it all if you plan to be there when fewer other people are competing for line space.

- Don’t waste your fast passes on rides with short lines. We made it through the Pirates of the Caribbean line in 10 minutes. That would have been wasteful.

- Try to book all of your fast passes in the morning, so you can schedule new ones for later in the day. You can’t add new ones while you have pending ones on your account.

- Use the timeshare fast passes at Magic Kingdom. They don’t have to be scheduled and must be used on a moving ride. Magic Kingdom is the heaviest concentration of moving rides, and they have the longest lines.

- Have fun. For real, don’t forget to have fun. If people are getting crabby, pack up and head to the hotel for a few hours. The only park that makes this a pain is Magic Kingdom, since they hide the park a mile away from the parking. Don’t force the park experience, just let go and let things happen. Says the guy who brought an optimized agenda to each park

This was a good time for us. I’m glad we waited. We’re in the short window where the girls will remember the trip and the boy hasn’t moved out and gotten a busy life of his own.

Refinancing Your Existing Loan to Purchase An Investment Property

Many people are looking at the housing market slump right now as an investment opportunity. Here are a few of the things that you need to know before getting a new home loan or refinancing your existing loan in order to make that happen.

Amount You Want to Borrow

A lot of borrowers go shopping for real estate and have exactly no idea how much money they can borrow. One of the first questions that you need to ask before going real estate hunting is how much can I borrow. You can ask a bank, lender, or financial institution to give you a ballpark figure of the amount of loan that you would qualify for. This will make it easier for you to narrow down exactly what type of property you can afford and what areas you can concentrate on.

Amount of Interest You Will Pay

Too many people are overly concerned with the purchase price of the home that they are buying. They fail to find out how much interest they will have to pay back to the bank in order to make their home ownership dreams come true. This is where a home loan calculator can be really useful. You can find out exactly how much interest you will repay over a 10, 20, or 30 year loan time period. You can also change the interest rate and down payment amount on those calculators to see if you can secure a lower monthly payment.

Credit Score Needed to Qualify

It doesn’t matter if you are buying a home for the first time or refinancing an existing loan. Your credit score matters. You need to start doing some research now if you want to secure a loan with a really low interest rate. This involves taking the time to see what credit scores traditional lenders are looking for and doing the work necessary to qualify for this loan. Your credit score will make a big difference in determining if an investment property purchase is a profitable endeavor or one that winds up costing you money. It will depend heavily on what kind of loan your credit score allowed you to negotiate.

Make the Choice

Once you know how much you will need and exactly how much you will be paying out over the life of another mortgage, you can decide whether you want to refinance your current home loan to get another one. Adding on another huge debt to an existing one is a big risk. Make sure to think it through fully before jumping in.