- RT @ramseyshow: RT @E_C_S_T_E_R_I_: "Stupid has a gravitational pull." -D Ramsey as heard n NPR. I know many who have not escaped its orbit. #

- @BudgetsAreSexy KISS is playing the MINUTE state fair in August. in reply to BudgetsAreSexy #

- 3 year old is "reading" to her sister: Goldilocks, complete with the voices I use. #

- RT @marcandangel: 40 Useful Sites To Learn New Skills http://bit.ly/b1tseW #

- Babies bounce! https://liverealnow.net/hKmc #

- While trying to pay for dinner recently, I was asked if other businesses accepted my $2 bills. #

- Lol RT @zappos: Art. on front page of USA Today is titled "Twitter Power". I diligently read the first 140 characters. http://bit.ly/9csCIG #

- Sweet! I am the number 1 hit on Ask.com for "I hate birthday parties" #

- RT @FinEngr: Money Hackers Carnival #117 Wedding & Marriage Edition http://bit.ly/cTO4FU #

- Nobody, but nobody walks sexy wearing flipflops. #

- @MonroeOnABudget Sandals are ok. Flipflops ruin a good sway. 🙂 in reply to MonroeOnABudget #

- RT @untemplater: RT @zappos: "Do one thing every day that scares you." -Eleanor Roosevelt #

Sammy’s Story, Part 2

For those of you not following along, please read the previous installment of Sammy’s Story. The short version is that we’re thinking about helping someone launch a small business and put “at risk” teenagers and young adults to work.

Sammy called me a couple of days ago. He wanted to discuss working for some of the tools and toys he saw at my mother-in-law’s house and he said he had something to show us. When I picked him up, he had a leather portfolio-style notebook and looked excited.

When we got to the house, he opened up his notebook and handed me two pieces of paper. He said that the idea of being able to launch his business had him so excited that he couldn’t not do anything. He had handed me a landscaping plan and materials list for fixing my mother-in-law’s yard.

We talked about the landscape plan, the business plan, and my wife’s old skateboard, then he had to go. Last night was one of the nights he met “his” kids at a community center.

On the way to the community center, we stopped by his apartment, because he wanted to show me pictures of his kids, and his grandkids, and his foster mother. He told me about his mother dying when he was 13 and his father dropping him with an aunt before disappearing. He was nearly in tears when he asked how some strange white guy could see more in him than his own family did.

He told me about how the money he made working with me had put food on the table of the 14 year old he brought with–a 14 year old who is eager to work more. It paid the weekly rent for one of the other workers and contributed to the rehab of Sammy’s ex. The little bit we’ve done has already touched the lives of dozens of people.

We talked about the way he hates rap. Not because of it’s musical value, but because it’s building a culture that considers women to be nothing but “bitches and hoes” while convincing kids that the only way they can improve their situation is to land a recording contract. Those are the kids he wants to teach to take care of themselves and build their own lives.

Finally, he asked me for my honest opinion about his landscaping plan.

I said, “Sammy, that clinched the deal. I was leaning towards helping you, but now it’s definite. I know you’re serious, so we’re going to make this happen.”

He’s got no idea how to handle taxes, payroll, or insurance, and he has no tools, but we’re going to jump in with both feet.

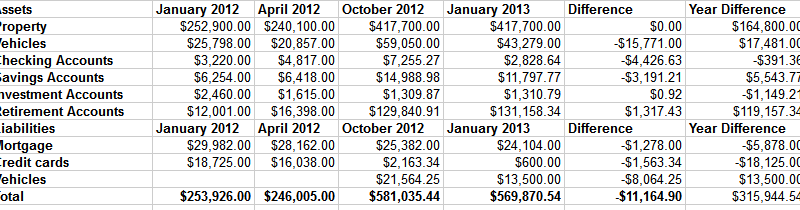

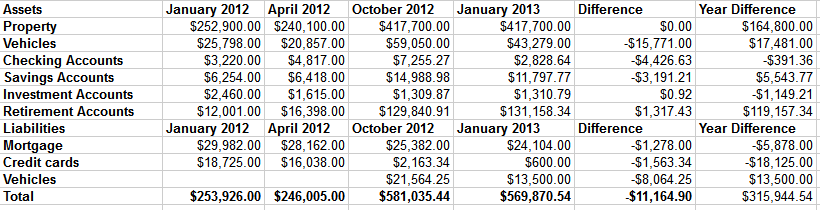

Net Worth Update

Welcome to the New Year. 2013 is the year we all get flying cars, right?

Here is my net worth update, along with the progress we made over the course of 2012.

As you can see, our net worth contracted by about $11,000. Part of that difference is due to selling our spare cars and–against my better judgement–taking payments with a lien on one of them. That is supposed to be paid off within a couple of months. If not, I’ll play repo man again.

The other part of the difference is in the final preparations for our rental property. The only things left to do are sanding and polishing the hardwood floors and cleaning the living room carpet. The final push to get to this point cost some money. All told, we’re nearly $30,000 into getting the house ready to rent. For the naysayers who think we should have sold it, we would have spent more getting it ready to sell.

Other than that, we’re not doing poorly. Our credit card is still being paid off every month and our mortgage is shrinking. If things continue to go well, we’ll have our truck paid off in a couple of months and the mortgage by mid summer.

Tootsie – Does Beauty Have to be Expensive?

Many remember Dustin Hoffman dressed in drag in the classic film Tootsie, a movie that he now says made him realize how many women he’s missed out on meeting in life simply because he judged them by their looks. Every year women spend thousands of dollars on beauty products and cosmetics, hoping to increase their appearance and become attractive enough to the outside world. Although there are various degrees of beauty, it undoubtedly is usually determined by the amount of money spent to enhance features and upkeep the overall look.

The length of a woman’s hair often creates a more attractive look in the U.S., which is difficult to achieve with flat irons and curlers that create breakage and brittle hair from the heat. Women are now resorting to having hair extensions installed every three to five months to achieve beautiful hair that has a fuller texture and longer length, costing an average of $700. They can resort to shorter hair that saves a large amount of money, but they’re ultimately compromising a large part of their looks.

There’s a reason that celebrities appear more beautiful than the rest of the population, as their high school photos often show them to look like typical people. By spending thousands of dollars on personal trainers, stylists, and makeup artists, their appearance is immediately enhanced with the finest tools and products on the market. They are also able to have help with experts who have more knowledge on what creates the best look for their features.

Although beauty does not have to be expensive (just look at exotic women in Columbia and Brazil who are anything but high maintenance), it unfortunately is a requirement in the U.S. where rich housewives rule the reality shows and runways. True beauty is often defined by breast and waist sized, which few women can live up to, resulting in thousands of dollars spent on breast implants and liposuction, often impossible to attain otherwise.

Beauty may be in the eye of the beholder, but few men will argue that Angelina Jolie is unattractive or that Heidi Klum looks homely. The majority of men can agree when a woman is beautiful, and few women catch attention with a homemade manicure and dyed hair that came from a box. Perhaps going au natural will become a new trend in the coming years, but for now it’s expensive to be a woman, and even more costly to be a beautiful one.

Related articles

How to Deal with Debt While You’re Out of a Job

This is a guest post from Marc Chase of My Credit Group.

Dealing with a lot of unpaid debt can be a hassle on its own. Having to pay those debts when you don’t even have a job to provide you with the money to do so can be a nightmare. While you’re hunting for a job to help make ends meet, your debts continue to pile up, leaving you scrambling to find a way to take care of them before they cause you to slip further into the poor house, and leave your finances needing credit repair services.

Since you’re likely more concerned about finding a job than anything else, we put together this handy checklist of what you should do to avoid your unpaid bills and debts getting the best of you while you search for a new job.

• Apply for unemployment benefits. This should be your first order of business after you’ve lost your job, especially if you’re one of the many Americans currently living paycheck to paycheck. Unemployment benefits go a long way towards helping consumers stay on top of their bills and credit accounts. Don’t make the mistake of thinking another job is just around the corner – there’s a good chance you can’t afford to wait.

• Keep paying the minimum balance. If you’re on the verge of drowning completely in unpaid debt, you may be tempted to stop paying your bills completely, at least until you get some additional funds in your account. Do this, and you’ll find yourself in need of credit score repair before you even get that call back for a follow-up interview.

Instead, do everything you can to at least pay the minimum balance on all of your credit accounts and bills. This will ensure that your credit history doesn’t take too much of a beating, and saves you from paying even more in interest fees down the line.

• Stop spending money like you have it. Because the sad truth is, while you’re still unemployed, you likely don’t have a lot of money to spare. If you’re still living your life as though you can afford to pay for everything – eating lunch and/or dinner out more than twice a week, generally buying things you don’t NEED – now’s the time to stop.

Stop charging every purchase you make to your credit card – break them out only in an emergency. This will help keep you from sinking further into debt while you’re out looking for a way to pay for your purchases.

• Eliminate and prioritize your bills. Now’s a great time to take a long look at some of the bills you’re paying, and deciding if they’re even worth the service. That doesn’t mean you should stop paying bills you consider “less important” than others; it means looking at some of the things that might have once been necessities (a land phone line if you primarily use a cell phone, a full package TV cable bill, etc.) and re-evaluating your stance on how important they are now that you can’t afford them all. In many cases, you can get in contact with your service provider(s) and talk about ways to reduce your bill (say, cancel cable but keep internet).

This is a guest post from Marc Chase, President of Product Development for My Credit Group, a website dedicated to helping consumers with managing their credit.

Rebates Suck

About a month ago, I bought a new laptop.

The old one still works, but it’s kind of slow, and kind of in demand, especially when Kid #1 has friends over. When I need to get on the computer and whip up some side-hustle money, I shouldn’t have to fight with kids and deal with the whiny “Are you done, yet?” every 10 minutes.

This wasn’t a spur-of-the-moment purchase. Since the old laptop still worked, we had quite a bit of time to find the new one, so I started watching sales. And I waited.

Eventually, I found a great deal. I got a much bigger/faster/smarter/nicer laptop for about $375 with tax. There was a sale, a coupon code, and a rebate all in play to make that happen.

I don’t mind coupons and sales. In fact, I am a fan.

Rebates, however, irritate me.

It shouldn’t have been bad. After all, I was going to Staples, home of the Easy Button®. I should have been able to go home, fire up their website, fill out a form, and get my money in a couple of weeks, right?

Grr.

Apparently, the easy rebate doesn’t apply to the good rebates. If you’re getting $1.05 back on a $100 printer, you can do it in a few clicks. But if you’re getting $50 back on a $400 laptop, watch out. Then, Staples has the same horrible rebate process as everyone else. Print the forms, peel off the UPC label, snail-mail it to the middle of nowhere and wait 4 to 100 months for a gift card.

Double grr.

Obviously, they are hoping a statistically significant percentage of their customers forget to claim their money.

Shady rebate garbage.

Rebates are a marketing ploy to convince customers they are getting a sale, while hoping the customer forgets to ask for the sale price, thereby paying full price and being happy about it.

Ethical businesses would just have a sale and be done with it. Treating your customers right is good for business. Really.

Now, where did I put that receipt?