- RT @bargainr: Life in North Korea is absolutely dreadful http://nyti.ms/dAcL26 #

- RT @bitfs: Weekly Favorites and Gratitude!: My Favorite Posts this Week Jeff at Deliver Away Debt threw together the .. http://bit.ly/9J0gGo #

- @LiveRealNow is giving away a copy of Delivering Happiness(@dhbook). Follow and RT to enter. http://bit.ly/czd31X # #

- Baseless claims, biased assumptions, poor understanding of history. Don't bother. #AnimalSpirits #KeynesianCult #

- RT @zappos: Super exciting! "Delivering Happiness" hit #1 on NY Times Bestseller list! Thanks everyone! Details: http://bit.ly/96vEfF #

- @ericabiz Funny, we found a kitten in a box last week. Unfortunately, it was abandoned there, not playing. Now, we have a 5th cat. in reply to ericabiz #

Why I chose a prepaid credit card

This is a guest post.

You can’t get credit without a credit card, and you can’t get a credit card without good credit. This is a dilemma that many people find themselves facing, whether they are trying to re-establish their credit or build credit for the first time. In fact, this is the dilemma that I found myself in. My solution was to get a prepaid card, and here’s why.

The Real Deal with Prepaid

Prepaid credit cards have earned a mixed reputation over the years. While it’s true that they usually have more fees than a regular credit card, they also offer a financial solution for people who don’t have good credit. And you should also keep in mind that they don’t charge interest because the cash that you are using is yours to begin with. The important thing to remember about prepaid cards is that they are a means to an end; once you rebuild your credit, you’ll find it much easier to apply for a card with better rates and fewer fees.

In addition, prepaid cards offer several advantages. The most important one for me was the convenience of having a card that I could use to make purchases. Prepaid cards look and work exactly like regular credit cards (you don’t have to enter a personal identification number to use them), so the only one who knows it is prepaid is me. And while I use cash for everyday purchases, there’s no avoiding the need for a card when you have to shop online or pay for gasoline at the pump, for example. Most digital merchants only accept payments from cards linked to large financial brands like Mastercard and Visa, and my card gives me a way to buy what I need from whoever has it in stock. In addition, my prepaid card offers me a way to keep track of all of my purchases electronically, which is helpful since I am trying to keep a closer eye on my budget.

Prepaid cards also offer security. Cash can easily be lost or stolen, but if you lose a prepaid card, you can easily get a replacement. More importantly, your balance is protected by a replacement guarantee from your bank, which comes in handy if you ever have to dispute fraudulent charges.

Perhaps the most convenient factor of a prepaid card, though, is how easy it is to get one. You don’t have to have a bank account in your name to receive a prepaid card. However, if you do have an account, you can easily link it to your prepaid card.

Changing my spending habits and getting out of debt hasn’t been easy for me, but one way for me to show creditors that I am getting better at managing finances is to build my credit with my prepaid card. It’s also a way for me to eventually be able to make big purchases that are necessary, such as a car, and hopefully one day, a home. Prepaid isn’t for everyone, but if you find yourself considering this option, it’s worth a second look.

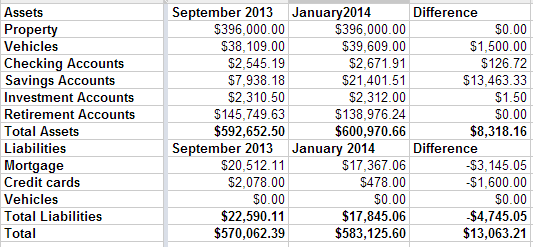

Net Worth Update – January 2014

This may be the most boring type of post I write, but it’s important to me to track my net worth so I can see my progress. We are sliding smoothly from debt payoff mode to wealth building mode.

Our highlights right now are nothing to speak of. We did let our credit card grow a little bit over the last couple of months, but paid it off completely at the end of December. It grew mostly as a matter of not paying attention while we were doing our holiday shopping and dealing with some car repairs.

That’s it. We haven’t remodeled our bathrooms yet, but we have the money sitting in a savings account, waiting for the contractor. We haven’t bought a pony yet, but we did decide that a hobby farm wouldn’t be the right move for us. We’ll be boarding the pony instead of moving, at least for the foreseeable future.

Our net worth is up $13,000 since September. Our savings are up and our retirement accounts are down because there are two inherited IRAs that we need to slowly cash out and convert to regular IRAs.

Twinkies: A Failure of Unionization

Twinkies may survive nuclear warfare, but the iconic sweet treat ultimately couldn’t withstand the might of the unionized workforce. Faced with mounting losses and overwhelming debt, due in no small part to the relentless demands of the various unions representing the nearly 19,000 employees, Hostess Brands filed bankruptcy for the second time in January 2012 and ultimately requested permission to liquidate it’s assets in November of last year when a buyer failed to materialize. While many factors played a part in the demise of the maker of such all-American snacks as Ding Dongs and Ring Dings, as well as childhood favorite Wonderbread, there is no denying the fact that costs imposed by union contracts were a major factor in the shuttering of this once-beloved company.

Certainly America’s changing eating habits, increased competition from such companies as McKee Foods, makers of Little Debbie snack cakes, and rising commodity costs all contributed to the ultimate demise of Twinkies. There is no doubt, though, that union contracts inhibited the company’s ability to adapt and make the necessary changes to remain profitable. Not only were employee costs out of control, ridiculous union rules made it nearly impossible for the company to make money. These are just a few of the rules that hampered Hostess’ management:

- Twinkies and Wonder Bread could not be delivered on the same truck.

- Drivers could only deliver one product, even if they did not have a load and a load of another product was waiting to go out.

- Drivers could only drive. They had to wait for loaders to fill their trucks.

- Likewise, loaders could only handle one product. Their contract prohibited a Twinkie loader from helping out if the Wonder Bread loaders were shorthanded.

Yes, management agreed to these terms, but often they were forced to do so in order to prevent a costly strike. In fact, it was a labor strike that lead to the decision to liquidate.

Unions are meant to protect workers from dangerous working conditions, overbearing management and unfair labor practices. Ensuring a living wage and decent benefits is another of their responsibilities. However, it is evident that in this case, the unions became as much an enemy of the Hostess employees as of the company’s management. As a result of their unwillingness to compromise and make wage and benefit concessions, almost 20,000 people no longer have a job that needs to be protected. In the end, the unions drove not only the company but themselves out of business.

Not to fear, however. Two private equity firms acquired Hostess’ assets last fall and are beginning to turn the company around. Production of Twinkies began again in June, and the gooey sponge cakes returned to store shelves on July 15. The workforce has been dramatically reduced and will not be unionized. In the end, probably the only winner in this battle is America’s sweet tooth.

Related articles

Family Bed: How to Make It Stop

baby on the cheek.” width=”300″ height=”199″ />

baby on the cheek.” width=”300″ height=”199″ />For years, my kids shared my bed.

When my oldest was a baby, I was working a graveyard shift, so my wife was alone with the baby at night. It was easy to keep a couple of bottles in a cooler by the bed and not have to get out of bed to take care of him when he woke up once an hour to drink a full bottle.

Then he got older. And bigger. And bigger.

We tried to move him to his own bed a few times, but it never worked well. He’d scream if we put him in a crib, so we got him a bed at 9 months old. That just meant he was free to join us whenever he woke up. Brat.

We finally got him to voluntarily move to his own bed after his sister was born. Shortly after she was born, I woke up to see him using her as a pillow. To paint the proper picture, this kid is 5’9″ and wears size 12 shoes. At 11. When I woke him up to tell him what he was doing, he decided to sleep in his own bed.

Method #1 to get your kids in their own bed: Have kid 1 try to crush kid 2 and feel bad about it.

Method #1 isn’t a great solution.

Soon, baby #3 showed up and we had 2 monsters in bed with us again. Once they started getting bigger, it became difficult for the 4 of us to sleep. We tried to get them into their own beds. Unfortunately, even as toddlers, my kids had a stubborn streak almost as big as my own. Nothing worked.

Eventually, they got big enough that I was crowded right out of the bed. At least we had a comfortable couch.

Sleeping on a couch gets old.

When the girls got old enough to reason with, we had a choice: We either had to find a way to convince them they wanted to sleep in their own room, or we had to have a fourth brat for them to attempt to crush at night.

We went with bribery. Outright, blatant bribery.

We put a chart on the wall with each of their names and 7 boxes. Every night they slept in their own beds, they got to check a box. When all of the boxes were checked, they got $5 and a trip to the toy store.

It took 10 days to empty our bed and it’s been peaceful sleeping since. That’s $5 well-spent.

Have you done a family bed? How did it work? How long did it last?

Whose Line Is It Anyway? Why do some shows return from the dead?

Watching TV in the summer used to mean surfing channels of reruns, but lately there seems to be a slew of “new” shows that are repeating old ones. Networks and cable channels are bringing back previously popular shows such as “Whose Line is it Anyway?”, “Hawaii Five-O”, and “Dynasty”. While some people are thrilled that their favorite shows are back, a lot more of us are wondering why we need to keep rehashing the past.

These factors mean that TV stations are not very willing to take risks with new shows. A new drama or science fiction show can take millions of dollars to produce, and in some cases it will be pulled within a few episodes if it fails to catch on. When reviving an old show, a network has some guarantee that it will be popular. While not every remake catches on (Charlie’s Angels anyone?), a remake will usually attract enough interest to make the first episode a success.

The costs to produce these shows are also much lower than “new” shows. In many cases, networks already own the property rights to the show as well as contracts with many of the former actors, directors, and producers. In several cases, they also have access to props, costumes, and set pieces. Because of this, they can produce a pilot for a much lower costs than a “new” show.

Finally, advertisers like the idea of bringing back a show. While a network usually has to struggle to find sponsors for shows that don’t have a full season of Nielsen data to show, they can easily sell a show that advertisers are already familiar with. Furthermore, advertisers like that they know what to expect. Without seeing a single episode, an advertiser can accurately guess at the demographic that will be attracted to the show just by looking at the data from the original show. Because advertisers are familiar with the plot of these shows, they are also more willing to negotiate for product placement within the show itself. In some cases, advertisers have even suggested how their product could be incorporated into an episode before the first script is even finalized.