- RT @kristinbrianne: You won't believe it… I just entered to win the #KodakSweeps on http://tweetphoto.com/contest Pls RT #

- RT @wilw The single most insulting thing you can tell a creative person is, upon viewing their creation, "you have too much free time." #

- Hmm. I share a birthday with Linus Torvalds. #

- @freefrombroke I'm following you and would love to be followed back. in reply to freefrombroke #

- RT: @SuburbanDollar: New Post: : The Art of Delayed Gratification http://bit.ly/5gsKXy #

- RT @FrugalYankee: #NEWYear's #QUOTE: All the things I really like to do are either immoral, illegal or fattening. ~ Alexander Woollcott #

- Crackberry is certainly accurate. I may be too connected. #

- MIL thinks a Kitchenaid stand mixer will make it easier to remove the snow in the driveway. Bad logic, but she's buying one for us, anyway. #

- What magic is in a saw-palmetto capsule and why does my prostate need the power of 1000 of them? #

- RT: @SuburbanDollar: Sounds like he's asking you to rent him a date. #

- RT @hughdeburgh: "I'd rather die fighting for freedom than live as a slave." ~ Judge Andrew Napolitano #Iran #in2010 #USA #

- Happy New Year, 3 minutes early. #

- Billy Jack vs Chuck Norris. Winner? #

- Getting my hair brushed by an 18 month old while watching Married With Children. It's a good evening. #

- RT @FrugalYankee: #NEWYEARS #QUOTE: The most important political office is that of private citizen. ~ Louis Brandeis #

- RT @ScottATaylor: 40,697 Laws Take Effect Today http://ff.im/-dFXNR #

- 5AM. It'd be so easy to go right back to sleep. #

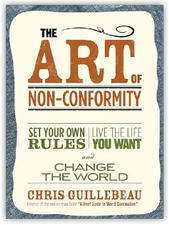

Book Review: The Art of Non-Conformity

We grew up in a world of expectations: Eat your vegetables, don’t poop on the carpet, do your homework. It continues right up to “Go to college”, “Get married”, “Having a dozen kids”. Are those the expectations you want to use to guide your life?

Chris Guillebeau, author of The Art of Non-Conformity (the blog and the book) puts the question like this: We we were younger, we heard “If everyone else was jumping off of a cliff, would you do that too?” In theory, that meant we were supposed to think for ourselves. Yet, as adults, we are absolutely expected to conform and do the things everyone else is doing. Work your 40, take a week’s vacation once a year, and repeat until retirement or death.

Is that our only choice?

The Art of Non-Conformity attempts to be a guidebook, showing you how to live the live you want to live. Chris has made a lifelong series of decidedly unconventional choices, from dropping out of high school to attending 3 colleges simultaneously to spending 4 years as a volunteer in Africa. For the past few years, he has been working his way through visiting every country in the world. He is an expert on non-conformity.

The books tells a lot (a LOT) of stories of people who have either made the leap into a self-defined life or people who have done nothing but talk about taking that leap while staying comfortable in their soul-numbing careers.

The Good

The Art of Non-Conformity is an inspirational book. It spends a lot of time explaining how to break through the wall of fear to take control of your like. More important, it explains why you’d want to. It does not pretend to define how you should live your life, it just provides the framework for the mentality to help you make that decision for yourself.

The Bad

If you’re looking for a step-by-step guide, complete with a list of possible work-alternatives, this isn’t the book for you. This book approaches lifestyle design from the conceptual end rather than the practical. If you want a practical manual, I’d get the 4 Hour Workweek by Timothy Ferris. Ideally, you should get both. They complement each other well.

Overall, I thoroughly enjoyed the book. If you’re considering taking a non-standard path or just hate the career- or life-track you are on, you should read The Art of Non-Conformity. I’m planning to read it again in a couple of weeks, just to make sure I absorb all of the lessons.

My Net Worth

While I find it fascinating to read about other people’s net worth, I’ve never bothered to figure out my own. With the start of the new year, I thought it would be fun to do. This is me, upping my personal transparency bar.

Assets

- House: $255,400. Estimated market value according to the county tax assessor.

- Cars: $23,445. Kelly Blue Book suggested retail value for both of our vehicles and my motorcycle.

- Checking accounts: $2,974. I have accounts spread across three banks.

- Savings accounts: $4,779. I have savings accounts spread across a few banks. This does not include my kids’ accounts, even though they are in my name. This includes every savings goal I have at the moment.

- CDs: $1,095. I consider this a part of my emergency fund.

- IRAs: $11,172 (Do you know your IRA contribution limits? Do you have a Roth IRA?)

- Total: $298,865

Liabilities

- Mortgage: $33,978

- Car loan: $1,226. This will be paid off this month.

- Credit card: $23,524. This is the next target of my debt snowball.

- Total: $58,728

Overall: $240,137

Update: I wrote and scheduled this before I paid off my car loan.

Phone Insurance

Thursday, at parent/teacher conferences, I sat on my phone and broke the screen.

Not just the glass, but the LCD.

Not a problem. I pay for Sprint’s repair plan.

Little did I know that Sprint–in their infinite #$!$%#$%–considers a phone unrepairable if there is more than one crack on the screen. That effectively means that any broken screen is a total loss.

It’s good to know my $4/month has been wasted.

Other than a phone I had stolen last year, I still own every phone I’ve ever owned. None have had water damage or anything catastrophic happen to them, so I didn’t get the replacement side of Sprint’s insurance plan.

To summarize:

- I broke my phone in a way that Sprint won’t fix, even though I pay for the fixit plan.

- My phone costs $600 when you aren’t signing a new contract.

- My phone has the most expensive LCD to replace at the moment.

The Total Equipment Protection program costs $11 per month. Given my history, that’s a waste of $11, though it would actually be a waste of $7, since I have been happy to pay $4 for the repair plan.

$7 per month since I got my first smartphone in about 2008, means I’ve saved $420 in insurance fees I haven’t used.

Today, I paid $298 to replace the LCD on my phone. That includes overnighting the part to the shop since it’s not stocked and I’m leaving town tomorrow.

An insurance claim from Sprint comes with a $150 deductible.

All told, I’m $270 to the good.

Would I get the insurance if I were signing papers today?

Probably not. A $7 monthly bill doesn’t hurt, while a $300 surprise does, but that’s why I have a repair fund.

Do you have insurance on your phone? Have you used it?

$1500 Luxury

I’ve got some expensive habits. Not like Charlie Sheen snorting $2500 of blow of a hooker’s boobs, but still expensive.

My latest one is dancing lessons. Linda surprised me on one of weekly date nights a few months ago. She found a Groupon for the dancing studio we used before we got married. It was $69 for a month of unlimited group lessons.

When the month was up, we signed on for their beginner cycle of lessons, which cost another $400.

And now we’re starting the Social Foundation program.

Social Foundation is a series of classes that teach some advanced moves, but also to teach dancers how to lead and follow properly and how to dance socially and look respectable on a dance floor in any number of situations. Leading and following are important because every single dance move out there has specific cues that tell your partner what’s coming next. If she doesn’t know, you both look clumsy.

So we chose the four dances we’re going to learn better and signed up. We’re going to learn the Rumba, Waltz, Tango, and Swing. We’re already pretty good at Rumba and Swing, but we’re going to get better. Personally, I’m hoping to also figure out how to use the Tango on an open dance floor without crashing into people. That way, we can pretend to be Gomez and Morticia, my heroes.

Now, the thing is, dance lessons aren’t cheap. They cost about $100 per hour, where an hour is defined as 45 minutes. We’re rolling the last half of our beginner lessons into our social foundation lessons and paying $1400.

Ouch.

They gave us the option of financing it over 3-4 months, but I didn’t want to pay an extra $200 for the privilege. I think we’ll be tapping the vacation fund to pay for the lessons.

Why am I willing to pay this much?

Dancing is one of the very few things Linda and I both enjoy. We’re pretty good at it, it’s great exercise, it’s fun, and (shhh!) it counts as foreplay. It also doesn’t hurt to have the sidelines of the dance floor lined with people watching us dance, wishing they could do what we’re doing…or wishing their husbands were willing to learn how to dance. This also isn’t just something we’re doing at the studio. We are out on a dance floor dancing to a live band almost every week. That usually comes with about $25 in cover charges and drinks.

Fun, exercise, have sex, and inspire jealousy. That’s a winning combination. And finding things to do that we both love to do is difficult and easily worth the $2000 we’ve paid the dance studio this year.

Welcome to Unemployment

Last week, I was let go from my job. The reasons are unimportant.

http://gty.im/167334756

So now, I am unemployed right before Christmas.

And my renters are moving out at the end of the month.

Normally, this should be a time for panic, but strangely, it’s not.

It actually came with a feeling of relief. Again, the reasons are unimportant.

But still, my predictable income has suddenly become unpredictable.

It is times like this that I’m glad I’ve spent the last 5 years crushing my debt. I currently have about $1000 on a credit card from my monthly expenses and around $10,000 on my mortgage.

That’s it. There’s no soul-destroying credit card debt. No car payment.

Trimming down to the not-painful-but-not-barebones basics puts my monthly nut at $3300. Leaving a bit of comfort and savings in place, that jumps to $4000.

Our income from my wife’s job and the renter in our home comes to about $1600 per month. That’s $1700 per month that we’re off from the basics and $2400 we’re off from a comfortable level.

However, I expect to have our rental house rented by the end of the year. There are some repairs we have to make after the current tenants leave. That will bring in a minimum of $1200 per month, hopefully $1500. That closes the gap to $500-1200.

Now, aside from the biggest benefit of killing out debt(no monthly payments!), we’ve also been saving about 20% of our income outside of our retirement accounts. We have enough to bridge that gap for 25-60 months. Unemployment will also provide enough to cover the difference for about 6 months. That means without doing any side work…sitting on my butt playing video games…I could cover my bill comfortably for two and a half years. If I cut down to bare minimum expenses, I can stretch that to nearly 7 years.

That’s why I don’t drive a new car or wear expensive clothes. That’s why I don’t vacation on my credit cards. That’s why my kids don’t have the latest, greatest video game systems and we don’t have a big screen TV.

It’s because we chose to prioritize our financial security over pure luxuries. We chose to sacrifice optional things now so we wouldn’t have to sacrifice things like food if life took a surprise turn down a bad road.

Now, before anybody reads this and understands it as “Jason’s taking a decade off”, in the week I’ve been unemployed, I’ve had 2 phone interviews, and a request for another. One of those has turned into a tentative job offer already. I expect to remain unemployed for less than a month.