- Getting ready to go build a rain gauge at home depot with the kids. #

- RT @hughdeburgh: "Having children makes you no more a parent than having a piano makes you a pianist." ~ Michael Levine #

- RT @wisebread: Wow! Major food recall that touches so many pantry items. Check your cupboards NOW! http://bit.ly/c5wJh6 #

- Baby just said "coffin" for the first time. #feelingaddams #

- @TheLeanTimes I have an awesome recipe for pizza dough…at home. We make it once per week. I'll share later. in reply to TheLeanTimes #

- RT @bargainr: 9 minute, well-reasoned video on why we should repeal marijuana prohibition by Judge Jim Gray http://bit.ly/cKNYkQ plz watch #

- RT @jdroth: Brilliant post from Trent at The Simple Dollar: http://bit.ly/c6BWMs — All about dreams and why we don't pursue them. #

- Pizza dough: add garlic powder and Ital. Seasoning http://tweetphoto.com/13861829 #

- @TheLeanTimes: Pizza dough: add lots of garlic powder and Ital. Seasoning to this: http://tweetphoto.com/13861829 #

- RT @flexo: "Genesis. Exorcist. Leviathan. Deu… The Right Thing…" #

- @TheLeanTimes Once, for at least 3 hours. Knead it hard and use more garlic powder tha you think you need. 🙂 in reply to TheLeanTimes #

- Google is now hosting Popular Science archives. http://su.pr/1bMs77 #

- RT @wisebread 6 Slick Tools to Save Money on Car Repairs http://bit.ly/cUbjZG #

- @BudgetsAreSexy I filed federal last week, haven't bothered filing state, yet. Guess which one is paying me and which one wants more money. in reply to BudgetsAreSexy #

- RT @ChristianPF is giving away a Lifetime Membership to Dave Ramsey’s Financial Peace University! RT to enter to win… http://su.pr/2lEXIT #

- RT @MoneyCrashers: 4 Reasons To Choose Community College Out Of High School. http://ow.ly/16MoNX #

- RT @hughdeburgh:"When it comes to a happy marriage,sex is cornerstone content.Its what separates spouses from friends." SimpleMarriage.net #

- RT @tferriss: So true. "Nearly all men can stand adversity, but if you want to test a man's character, give him power." – Abraham Lincoln #

- RT @hughdeburgh: "The most important thing that parents can teach their children is how to get along without them." ~ Frank A. Clark #

Budgeting tips – sticking to your budget

If you are looking to get out of debt, or you are currently debt-free and want to stay that way, then it is important that you get a grip of your financial situation and live within your means.

A good way to do this is to create a budget as this gives you a clear indication of how much money is coming in, how much is going out and also highlights any areas where you may need to make cut backs should you be falling short each month.

Once you have sorted out the figures and made necessary amendments, for example paying bills by direct debit in order to make savings or cutting existing debts by carrying out a balance transfer to a lower rate credit card, it is time to start focussing on the lifestyle changes.

As you will find, it is one thing to create a budget and quite another to stick to it, but by adhering to the following steps and exercising a certain amount of will power, you should be able to ensure that you live within your means and resist the urge to reach for that credit card.

Keep focussed

Before you start to look at how you can stick to your budget you need to clarify why you need to stick to your budget!

A budget can initially seem like something that has been devised with the sole intention of stopping you having fun and buying or doing the things that you want. So it is important to remember that, though some cutbacks may be necessary in the short term, a budget is a long-term strategy that will allow you to take control of your finances and, all being well, live a happy life that is free from the worry of excessive debt.

Change your habits

Unfortunately, a successful budget can require a change in lifestyle and this can be one of the most difficult things to adhere to.

For example, if you have previously enjoyed eating out regularly then you may have to make cut backs in this area to ensure that you are living within your means. But, instead of seeing this as a negative, try to focus on the positives and remember the reasons why you are budgeting.

And a change in habits doesn’t necessarily mean that you have to cut back on your enjoyment of life and it may actually open your eyes to other pursuits you may not have previously considered.

For example, instead of eating out try preparing a meal at home and turn your dining room into a restaurant. This means that you can still have the fine dining experience but at a fraction of the price and without the worry of making a reservation!

Shop smarter

Lists figure heavily when creating a personal budget and list-making is a habit that you should get used to when trying to stick to your budget.

When budgeting it is vitally important to avoid impulse buying and a great way to do this is to always make a list of things you need before you go shopping.

This means that you will have a clear idea of what you need and you will be less inclined to make random purchases that may just turn out to be an unnecessary drain on your finances. It’s also worth mentioning at this point that you should always differentiate and prioritise the things you need over the things you simply want.

If you are unsure how to make the distinction then put off making the purchase for a couple of days and then reconsider if you actually need it. This cooling off period will often convince you that you can do without it and save you money.

In addition, savings can be made on your shopping by simply swapping big name brands for supermarket own varieties, using discount coupons and looking for any special offers.

Overall, it is important to be fully focussed and committed to your budget plan and to be aware that a change in finances may require a change in lifestyle. But a few short term changes may well add up to better finances in the long term.

Article written by Les Roberts, budget reporter at Moneysupermarket.com.

Paying for Rat

I’m cheap. I don’t even consider myself to be frugal. I’m cheap. A few days ago, I spent my entire year’s Halloween budget–on November 1st–so I could store my new treasures

for an entire year before using them, just to save $145.

However, there are some things that just aren’t worth going cheap.

When I first moved out on my own, a good friend walked me through the mistake of buying cheap cheese. A slice of the generic oil-and-water that some stores pass off as cheese will not cure a sandwich made from Grade D bologna.

That advice got me through some less horrible meals when I was younger.

Now, I’ve expanded the crappy cheese rule to extend to any meal I pay someone else to prepare. While I do occasionally hit a fast food restaurant when I’m traveling, I almost never do so any other time. I enjoy sitting down for a nice meal in a nice atmosphere while friendly people cater to my every whim. Well, almost every whim.

I’m not saying I go to $100 per plate steak houses every week, but I’m certainly not afraid to drop $20-$30 per meal.

My reasoning is simple: anything I can buy at a fast food restaurant or a cheap restaurant, I can make better at home for less. Why would I pay good money to sit at a sticky table and eat food that won’t let me forget it for 3 days?

If I’m going to spend the money, I’m going to eat something I either can’t make at home, or can’t make as well. Chinese food is one example. I can make it at home, but I don’t stock the ingredients, and I don’t enjoy the preparation, so I go out for it. Cheap Chinese food tends to be worse than anything else I’ve eaten, so I spring for good food. Cheap rat isn’t good rat.

How about you? What are you willing to pay full price for?

Perez Hilton: The Cost of Living in New York City

Ahhh, New York City. The Mecca of all that is glamorous, rich, luxurious and exciting. To some, the good life. So, you’re ready to pack your bags and head for the big city? Slow down there, big dreamer. The cost of

EVERYTHING in the city is higher than the national average, meaning your 70K per year needs to be 166K in New York City to keep your current lifestyle. Let’s talk about the basics here: lodging, food and entertainment:

If rent has not broken you, you must also eat! I mean, you won’t be eating MUCH after paying rent, but you will need a nibble here and there. It will come as no surprise that the restaurants in New York City are pricey. Celebrity favorites such as the Four Seasons, Le Cirque and Nobu are over $50.00 PER PERSON. I just choked on my Diet Coke. Eateries such as McDonald’s and local Mexican restaurants are abundant, but they too are higher priced than elsewhere. Your best bet? Learn to cook. Eat leftovers. Use coupons. Pair those coupons with sale items. Find a generous and rich companion. Skip meals.

As far as entertainment goes, I’m afraid at this point, your only entertainment will be browsing the web for supplementary forms of income. Seriously, unless you are in the 1%, utilize the many forms of free entertainment that New York City has to offer. A jog through Central Park, window shopping or a walk through the city all offer ample opportunity for fun free of charge. Sadly, Broadway plays and designer shopping must be left to the rich and famous.

In conclusion, one can lead a good, but not extravagant, life in New York City on a normal income. Be prepared to work hard, save hard and live frugally. Unless you’re living on money that is coming from an investment or dividend, you shouldn’t expect anything more. Listen, New York City is exciting, good grief, it’s the “city that never sleeps,” but it isn’t cheap. Of course, the people I know who have lived there for a short stint of time had little money and have since moved on – with no regrets and countless memories from that season of life.

Related articles

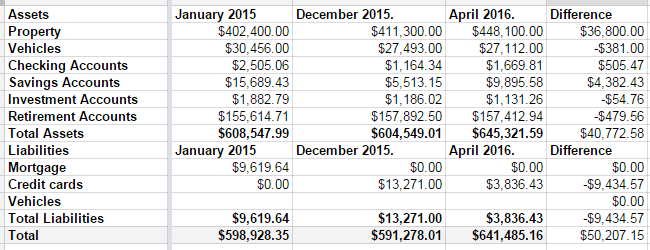

Net Worth, April 2016

Last year wasn’t a good year for my net worth. It came with a $7000 drop.

Q1 2016, however, was a great quarter.

In December, we had $13,271 in credit card debt. At the time I took this screenshot, it was down to $3836.43. As of this moment, it’s down to $2640.91. If things go as expected this week, I should wake up on Friday to a paid-off credit card. I had to raid some of our savings accounts to make it happen, but it’s happening. Some of it was a tax refund, some of it was the fact that my mortgage payment went away in December.

That’s seven years of hard work, almost to the day. Seven years ago, I was researching bankruptcy, and stumbled across Dave Ramsey. Seven years ago, we were drowning in debt.

Next week, we’re free. No more debt, hanging over our heads. We’re free to take vacations. We’re free to finally save for college, when my son is 16, and stand a chance of being able to pay for it for him. We’re free to do…whatever we want to do. Our monthly nut after the debt is paid–only in fall/winter/spring when my wife is working–is roughly 1/3 of our take-home pay.

That’s how hard we’ve cut to make sure we can pay our bills and make debt die. We do have some things that would be considered extravagant. We’re not savages. But my car is 10 years old. My wife’s is 7. My motorcycles are 35 and 30; one of them was purchased before we cared about our debt.

Back to the net worth….

The biggest change came from our property values, which sucks. That was $36,000 of the difference, which comes with the painful tax bump to go with it. A large chunk of the savings increase was the money we set aside every month to cover the property tax bill, and that will go away next month.

Still, $641,000 dollars is a long way from nothing. I’m pretty happy.

Deathbed Relationships

My great-uncle has been depressed lately.

He lives in the same apartment building and my grandmother, his sister. They are just down the hall from each other.

Over the holidays, he’s seen a steady stream of people visiting my grandma, bringing cards and pictures, or taking her out to eat. Over Christmas weekend, she spent far more time away from home, celebrating with her kids, grandkids, and great-grandkids than she did at home.

He’s never met his great-grandchildren. He’s in his 70s, living in a retirement home attached to the nursing home he will most likely die in, and he’d like to see his descendants.

It’s too late.

He didn’t lose his relationship with his kids and grandkids in a fight. Instead, he spent his entire life doing his best to avoid all forms of responsibility. He spent 50 years avoiding supporting his family. He wasn’t there for them.

Of course they won’t be there for him.

There is a simple way to get your kids and your grandkids to dote on you in your old age: You spend your entire life being there when you’re needed.

Simple.

Building a relationship that can survive–or even thrive–in the times when you’ve got very little left to give takes a lifetime of commitment.

It starts the day your children are born, when you hold that precious little high-maintenance paperweight and swear that nothing bad will ever be allowed to happen to them. Then you teach them to walk, and teach them to talk, and kiss their booboos when they fall. And they will.

Day in, day out, you be there. You feed them, clothe them, punish them when necessary, and love them unconditionally even when they make it hard to like them. Every blessed day.

You soothe their pains, manage their fears, help them grow and turn into useful adults. Every flipping year.

When they are adults, you lend an ear, you lend a hand, you help with their babies, you offer advice, you listen and talk and you are there. Decade after decade.

Then, when you are old and broke and broken down, you’ve got people who love you, who cherish their memories with you. These are the people who will drive an hour out of their way to pick you up for dinner. They’ll carry you up the stairs you have trouble with. They’ll sit at your feet and listen to you tell stories. They’ll be there for you because you’ve always been there for them.

That’s how you get your kids and grandkids to visit you in the nursing home. Simple, not easy.

If you’ve missed their childhood–for whatever reason–it’s still possible to build that relationship, but it’s so much harder. You start by taking time out of your life to do spend time and be there. Help when you can with what you can. Be there.

If you wait until you are old and broke and broken down to start your relationship, it’s too late. Your kids will know that it’s just another example of your selfishness. If you’ve never made an effort to give, you’ve got know business expecting to get. You’ll be lucky to get an occasional phone call and a greeting card for the holidays.