- Working on my day off and watching Teenage Mutant Ninja Turtles. #

- Sushi-coma time. #

- To all the vets who have given their lives to make our way of life possible: Thank you. #

- RT @jeffrosecfp: While you're grilling out tomorrow, REMEMBER what the day is really for http://bit.ly/abE4ms #neverforget #

- Once again, taps and guns keep me from staying dry-eyed. #

- RT @bargainr: Live in an urban area & still use a Back Porch Compost Tumbler to fertilize your garden (via @diyNatural) http://bit.ly/9sQFCC #

- RT @Matt_SF: RT @thegoodhuman President Obama quietly lifted a brief ban on drilling in shallow water last week. http://bit.ly/caDELy #

- Thundercats is coming back! #

- In real life, vampires only sparkle when they are on fire. -Larry Correia #

- Wife found a kitten abandoned in a taped-shut box. Welcome Cat #5 #

Paying for Rat

I’m cheap. I don’t even consider myself to be frugal. I’m cheap. A few days ago, I spent my entire year’s Halloween budget–on November 1st–so I could store my new treasures

for an entire year before using them, just to save $145.

However, there are some things that just aren’t worth going cheap.

When I first moved out on my own, a good friend walked me through the mistake of buying cheap cheese. A slice of the generic oil-and-water that some stores pass off as cheese will not cure a sandwich made from Grade D bologna.

That advice got me through some less horrible meals when I was younger.

Now, I’ve expanded the crappy cheese rule to extend to any meal I pay someone else to prepare. While I do occasionally hit a fast food restaurant when I’m traveling, I almost never do so any other time. I enjoy sitting down for a nice meal in a nice atmosphere while friendly people cater to my every whim. Well, almost every whim.

I’m not saying I go to $100 per plate steak houses every week, but I’m certainly not afraid to drop $20-$30 per meal.

My reasoning is simple: anything I can buy at a fast food restaurant or a cheap restaurant, I can make better at home for less. Why would I pay good money to sit at a sticky table and eat food that won’t let me forget it for 3 days?

If I’m going to spend the money, I’m going to eat something I either can’t make at home, or can’t make as well. Chinese food is one example. I can make it at home, but I don’t stock the ingredients, and I don’t enjoy the preparation, so I go out for it. Cheap Chinese food tends to be worse than anything else I’ve eaten, so I spring for good food. Cheap rat isn’t good rat.

How about you? What are you willing to pay full price for?

Year of the Unfair Fees

The year 2011 was a challenging economic year for many, with housing prices continuing to fall in many parts of the country, with unemployment numbers remaining high and with a credit crunch making it challenging for many to get new cards or unsecured loans.

Those going through economic turmoil were, unfortunately, faced with little understanding from many corporate conglomerates. In fact, so many companies instituted so many silly fees and surcharges that 2011 may as well be known as the year of unfair fees.

Whether you are taking out unsecured loans, opening a bank account or signing a TV service contract, it is up to you to read the contract carefully and be mindful of the fees you are being assessed.

Debit Card Use Fees

Many people who are trying to get out of debt and pay off credit cards, unsecured loans and other obligations may consider making a commitment to avoiding credit and using their debit card instead. Unfortunately, in 2011, many banks wanted to try to make this more expensive for consumers who were trying to be financially responsible.

Faced with a limit on the fees they could charge for debit transactions, a number of banks began to explore the idea of a monthly charge to consumers of between $4 and $5 just for using their debt card. Politicians and the public reacted so strongly against this, however, that the banks relented and gave up the plan. [ed. Just like Suze Orman’s new blunder!]

Fees for Depositing Cash

Also near the top of the list are the fees that certain banks institute to business customers who deposit large sums of money. Some banks will charge a small fee if you deposit in excess of a certain amount, depending upon the type for account you have. For instance, one major bank charges .20 for each $100 in cash deposited over $10,000. The fees are small, but some customers are still upset at the principle. After all, just what is that fee justified by since all you are going is giving the bank your cash to put into your account.

Airline Fees

Airline fees aren’t a new thing and almost everyone is now aware that they’ll be charged for bags on many flights. However, in 2011, some airlines decided to try to take things a step further. Passengers faced fees for booking a ticket, for printing a boarding pass at the counter instead of at home and even for taking a carry-on bag. These surprise fees that hit you may make it difficult to comparison shop for the best flights, making it harder for cash-strapped consumers to find affordable travel.

Early Termination Fees

Early termination fees have become standard for cell phone contracts, but the dreaded charges are now spreading to other industries as well. Some television service providers have now instituted early termination fees for consumers who end their contracts with the service providers early. The cable and satellite companies attempt to justify this by saying they need to cover the prices of the expensive equipment used to provide you with service, but the companies have come under fire anyway. In fact, one major satellite company recently had to settle with regulators over its business practices and cancellation policy.

Watching for Fees

Only by being diligent will you avoid the excessive fees that banks and other companies are beginning to institute in a time when every cent counts.

Post by MoneySupermarket.

Meditation

Life is crazy.

5 Things Guaranteed To Annoy Your Wife

One from the vaults….

If you’re married, or anything close to being married, you’ve irritated your wife. Even if you think you are perfect and the epitome of unannoyingness, I promise, there has been a day when she strongly wished you traveled for a living.

It’s long been known that the two things most likely to break up a marriage are money and sex. The former because there is too much, too little, or just the right amount going to the wrong places, and the latter because there is too much, too little, it’s not with each other, or it is with each other, but you’d really prefer otherwise. If your problem is the latter, I can’t help you.

If your problem is the former, I can help you understand some things you may be doing that are driving her batty. Kill-you-in-your-sleep-and-pretend-it-was-the-dog type of batty.

1. Nagging her about her shopping, but buying whatever you want. Gentlemen, this is known as a double standard. Don’t do it. In my house, my wife’s on an allowance. It was her idea. A few months later, I realized that I needed to be on one, too. Naturally, her allowance is bigger than mine. I don’t mind the disparity, because she still smokes. If her allowance didn’t give her room to smoke and shop, her allowance would be nothing more than a polite fiction. Whatever you do, find something that works for both of you and meets both of your needs, fairly. Anything else will only build a resentment that will burn for a long time.

2. Nagging her about her shopping, yet demanding she do all of the shopping. My wife has a weakness: clearance tags. If something is on sale, there’s a good chance it’s going to come to our house. I have an aversion to shopping. I hate it. Our budget dies a little bit each time my wife shops alone. We’ve come to an agreement. Now, I do most of the shopping, so she doesn’t feel tempted. I’m learning to embrace my inner material girl so we don’t have to have “discussions” every time she steps out for milk and comes home with $100 worth of clothes for the younger brats.

3. Nagging her about her shopping. Nobody likes being nagged. If you’re having a problem that keeps repeating itself, talking about it more won’t help. Neither will talking about it louder. You need to find a way to communicate that she will hear and understand. Different people communicate in different ways. Find the way that works for both of you.

4. Nagging her. A wise man once said, if everyone around you is a jerkface, maybe the problem isn’t everyone around you. Have you ever considered the idea that the problem might be you? If nagging is the only way you have to deal with people, you need to work on that. Don’t blame her. Maybe you’re ticked off about something that isn’t irritating. If that’s the case, she certainly has the right to be annoyed that you are nagging her.

5. Going on and on about how much you’d like to be me. Yes, I live the rockstar life, driving the station wagon with 6 disc changer and all. Yes, I am the neatest thing since sliced bread, and even that was a close contest, but really, confidence is important. You don’t have to be me to be cool. You’re swell, too. You’re right, this one isn’t about money, but it’s probably still irritating.

There you have it, my perfect solution to a happy marriage: don’t nag and quit trying to be me. There are other important bits, like love, respect, and communication, but this is a good start.

What do you do that annoys your spouse?

Actions Have Consequences

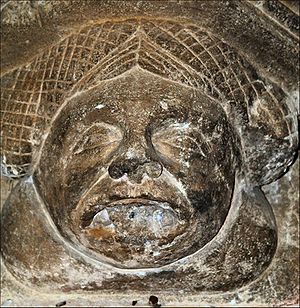

- Image by reidmix via Flickr

Six months ago, my laptop quit charging. This particular model has a history of having the power jack come loose inside the laptop, so I ordered the part and waited. When it came, I disassembled the computer, carefully tracking where each screw went. I installed the part, the put it back together, with only a few extra pieces.

It didn’t work.

After spending the money and doing the work, I tested the external power cord. I could have saved myself a few hours of work if I would have done that first. It was trash, so I ordered a new one. That’s time and money down the drain due to my poor research.

As an adult, I know that I am responsible for my actions, even if the consequences aren’t readily apparent. If I tap another car in a parking lot, I am going to have to pay for the damages, even if I didn’t see the car. This has manifested itself in credit card statements I didn’t read, speed limits signs I didn’t notice(or ignored!), and–on occasion–my wife and I not communicating about how much money we’ve spent.

Kids have a much harder time grasping that concept.

My son enjoys playing games online. Some of the games are multiplayer games he plays online with his friends, others are flash games he plays at home while his friends watch. They like to take the laptop into the dining room where they can play without being in the way. A small herd of 10 and 11 year old kids hopping around expensive electronics can’t be a good idea.

Yesterday, we saw that the power cord was fraying at the computer end from being dragged all over the house and jerked by kids tripping on the cord. We got six months of life out of the cord because of kids who should have known better not acting appropriately around the cord and the computer. Not happy.

My son got grounded for a week and honored with the privilege of replacing the cord. Now he isn’t happy, but he understands that he needs to pay for the damage he causes, even if he didn’t know that what he was doing could cause the damage. If it was something he would have had no way of knowing, there would have been no punishment, but he should have known not to jerk on the cord of leave it where it can be tripped over.

What do you think?