- Bad. My 3yr old knows how the Nationwide commercial ends…including the agent's name. Too much TV. #

- RT @MoneyCrashers: Money Crashers 2010 New Year Giveaway Bash – $9,100 in Cash and Amazing Prizes http://bt.io/DZMa #

- Watching the horrible offspring of Rube Goldberg and the Grim Reaper: The Final Destination. #

- Here's hoping the franchise is dead: #TheFinalDestination #

- Wow. Win7 has the ability to auto-hibernate in the middle of installing updates. So much for doing that when I leave for the day. #

- This is horribly true: Spending Other People's Money by @thefinancebuff http://is.gd/75Xv2 #

- RT @hughdeburgh: "You can end half your troubles immediately by no longer permitting people to tell you what you want." ~ Vernon Howard #

- RT @BSimple: The most important thing about goals is having one. Geoffry F. Abert #

- RT @fcn: "You have enemies? Good. That means you've stood up for something, sometime in your life." — Winston Churchill #

- RT @FrugalYankee: FRUGAL TIP: Who knew? Cold water & salt will get rid of onion smell on hands. More @ http://bit.ly/WkZsm #

- Please take a moment and vote for me. (4 Ways to Flog the Inner Impulse Shopper) http://su.pr/2flOLY #

- RT @mymoneyshrugged: #SOTU 2011 budget freeze "like announcing a diet after winning a pie-eating contest" (Michael Steel). (via @LesLafave) #

- RT @FrugalBonVivant: $2 – $25 gift certificates from Restaurant.com (promo code BONUS) http://bit.ly/9mMjLR #

- A fully-skilled clone would be helpful this week. #

- @krystalatwork What do you value more, the groom's friendship or the bride's lack of it?Her feelings won't change if you stay home.His might in reply to krystalatwork #

- I ♥ RetailMeNot.com – simply retweet for the chance to win an Apple iPad from @retailmenot – http://bit.ly/retailmenot #

- Did a baseline test for February's 30 Day Project: 20 pushups in a set. Not great, but not terrible. Only need to add 80 to that nxt month #

Saturday Roundup

- Image via Wikipedia

This weekend, my wife is spending three days scrapbooking, which makes it a great time to visit my parents and let my niece and nephew entertain my girls for me.

Best Posts

Following your passion doesn’t always pay the bills. Sometimes, there is a tangent that can cover the mortgage while still allowing you to do what you love.

Not everyone enjoys it, but cooking isn’t hard. It’s not even a talent, but a skill that can be learned. Winging it, or creating your own dishes is a talent.

Did you know the spork’s predecessor was invented thousands of years ago?

Here’s a site to help you avoid conflicts with local customs when you travel.

Potluck game night. I think we need to make this happen at our house.

Carnivals I’ve Rocked

6 Ways to Stretch a Meal was an Editor’s Pick in this week’s Festival of Frugality. GenX Finance rocks.

Cheap Drugs – How I Saved $25 in 3 Minutes was included in the Carnival of Personal Finance.

Questions From a Reader was in the Carnival of Money Stories.

Thank you!

If I’ve missed anyone, please let me know.

Clearing Up Social Debt in 3 Steps

Debt can be thought of as a disease–probably social. Most of the time, it was acquired through poor decision making, possibly while competing with your friends, occasionally after having a few too many, often as an ego boost. Unfortunately, you can’t make it go away with a simple shot of penicillin. It takes work, commitment and dedication. Here are three steps to treating this particular affliction.

1. Burn it, bash it, torch it, toss it, disinfect. Get rid of the things that enable you to accumulate debt. If you keep using debt as debt, you will never have it all paid off. That’s like only taking 3 days of a 10 day antibiotic. Do you really want that itchy rash bloodsucking debt rearing its ugly head when you’ve got an important destination for your money? Take steps to protect yourself. Wrap that debt up and keep it away.

2. Quit buying stuff. Chances are, you have enough stuff. Do you really need that Tusken Raider bobble-head or the brushed titanium spork? They may make you feel better in the short term, but after breakfast, what have you gained? A fleeting memory, a bit of cleanup, and an odd ache that you can’t quite explain to your friends. Only buy the stuff you need, and make it things you will keep forever. If you do need to indulge, hold off for 30 days to see if it’s really worthwhile. If it’s really worth having, you can scratch that itch in a month with far fewer regrets.

3. Spend less. This is the obvious one. The simple one. The one that makes breaking a heroin addiction look like a cake-walk(My apologies to recovering heroin addicts. If you’re to the point that personal finance is important to you, you’ve come a long way. Congratulations!). Cut your bills, increase your income. Do whatever it takes to lower your bottom line and raise your top line. Call your utilities. If they are going to take your money, make them work for it. If they can’t buy you drinks or lower your payments, get them out of your life. There’s almost always an alternative. Don’t be afraid to banish your toxic payments. Eliminate your debt payments. This page has a useful guide to debt and how to clear it off.

Update: This post has been included in the Festival of Frugality.

3 Habits Every Soon-to-be-Successful Debtor Needs to Cultivate

Getting out of debt is primarily a matter of changing your habits. We’ve all heard people swear by skipping your morning cup of coffee to get rich, but that’s just a small habit. Much more important are the big habits, the lifestyle habits. Here are 5 habits to cultivate for financial success.

Frugality

“Beware of little expenses; a small leak will sink a great ship”– Benjamin Franklin

As Chris Farrel wrote in “The New Frugality“, being frugal is not about being cheap, but finding the best value for your money. When my wife and I had our second baby, we couldn’t justify spending $170 on a breast pump, so we bought the $30 model. It was quite a bit slower than the expensive model, and was only a “single action”, but for $140 of savings, it seemed worth the trade. Six weeks later, it burned out so we bought a new one, still afraid to justify $170 on quality. This thing took at least 45 minutes to do its job. When it burned out 6 weeks later, we decided to go with the high-end model. This beauty had dual pumps, “baby-mouth simulation” and it was fast. The time was cut from a minimum of 45 minutes to a maximum of 15. That’s 3 hours of life reclaimed each day fro $140. Six months of breastfeeding for each of two kids means my wife regained 45 days of her life in exchange for that small amount of money. At the rate of 6 weeks per burnout, we would have gone through 8 cheap pumps, costing $240. The high-end unit was still going strong when we weaned baby #3. Buying quality saved us both time and money. I wish we would have gone with the good one from the start. Sometimes, the expensive option is also the cheap option.

Maturity

- Image via Wikipedia

- Image via Wikipedia

“Maturity is achieved when a person postpones immediate pleasures for long-term values.” -Joshua Loth Liebman

Being a mature, rational adult is hard. It means accepting delayed gratification over the more enjoyable instant variety. We save for retirement instead of charging a vacation. It takes a lot of restraint to put off buying the latest toys, clothes, gadgets, cars or whatever else is currently turning your crank until you actually have the money to actually afford it. It means planning your future instead of looking like a surprised bunny caught in a spotlight every time your property taxes come due. (Who knew that the year changed every year? Do they really expect annual payments annually? Geez! There’s so much to learn!) It means thinking about your purchases and buying what you actually need, actually want, and will actually use instead of resorting to retail therapy whenever you feel like a sad panda. The only benefit to mature, rational management of your finances is that, given time, you will have the security of knowing that, no matter what happens, you will be okay. That’s a huge benefit.

Pleasure

[ad name=”inlineleft”]

“Do not bite at the bait of pleasure, till you know there is no hook beneath it.” – Thomas Jefferson

If it hurts, you won’t do it. You have to learn to take pleasure from from things that won’t make you broke and you have to learn not to hate putting off the things you can’t afford. Take pleasure in the little things. Enjoy the time with your family. Presence means so much more than presents. So many people never learn how to enjoy themselves. Take the time to experience life and enjoy doing it.

Update: This post has been included in the Carnival of Debt Reduction.

Saturday Roundup

- Image via Wikipedia

I wrote this yesterday. According the forecast, when this post goes live, I’ll be moving 5-8 inches of snow off of my driveway.

That, or watching TV and thinking about moving snow.

Maybe I’ll just sleep in and wait for spring to melt the snow.

Don’t forget to enter my drawing for a $100 Amazon gift card! Go here for details. It ends on the 15th, so don’t wait too long.

Best Posts

Crazy-easy ice cream bread. How could this possibly be bad?

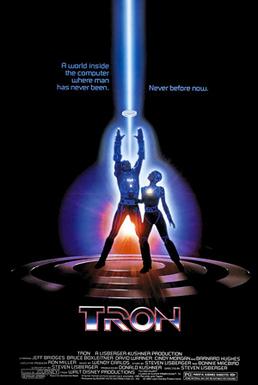

Tron comes out in 2 weeks. I’d love to show up on a custom street-legal Troncycle.

Arsenic-based lifeforms are shaking up the way we understand life to work. I’m of the opinion that life will probably exist almost everywhere that isn’t a completely dead dry rock. I say that as an expert in…well, nothing related to astrobiology.

Following Erica’s advice is currently making me a few hundred dollars per month, with every sign of growing as time goes on. I hate to sound like a fanboy, but if she pimps a product, I’m at least going to give it some serious consideration.

Carnivals I’ve Rocked

10 Dumb Money Moves was featured in the Carnival of Debt Reduction.

Book Review: The Art of Non-Conformity was included in the Carnival of Personal Finance.

Things You Should Buy Online to Save Money was included in the Festival of Frugality.

Thank you! If I missed anyone, please let me know.

LRN Timewarp

This is a new feature to share the gift that is me with anyone new to LRN. This week, I’m going to share some posts from my first week blogging here.

The $10 College Fund. In the last year, not only have I not changed my mind about the $10 college fund, but I haven’t raised the amount. The point is to just get started. I’ve done that. I’ll raise the amount when my debt is paid off. We are now up to $166.09. The numbers are off because I stuck a little bit extra in one month.

In the last year, our dreams haven’t changed. We haven’t made any direct progress, but indirectly we are doing well. First things first. We need to pay the debt off before we look at a hobby farm.

My second day blogging, I wrote about why we handled money so poorly.

Financial Spread Betting

Spread betting is a method of trading that has a high potential for both loss and gain. The nature of spread betting is highly speculative. Through it, traders can potentially make money when the market is going up or down, depending on the bet that they place.

Traders only make money when they correctly predict the direction the market is going in. If a trader feels that the market will be going down, then he or she would bet against the market. If the trader feels that the market will be going up, then he or she would bet with the direction of the market. Gains in income come from the spreads – the difference in price between the bet and the direction the market takes.

Traders place their bets in terms of points. Each point has a set monetary value assigned to it. The money that the trader makes depends on how many points that the trader loses or gains. Traders can place stop orders to protect themselves. A stop order is a simple computer command that tells the trading system to cancel the transaction when there is a certain gain or loss in the market. This is how traders protect themselves from potentially wild market swings – executing a stop order saves the trader.

Gains from spread betting are tax-free in the UK and can be done through many online sites. It can be an especially lucrative form of investment for UK traders.

The risks of spread betting are often too large for many who don’t have much of an appetite for risk. The most frustrating part of this business is being unable to predict the market. You can potentially stay in a position where you are losing a lot of money if you aren’t careful. This is tempting when you are convinced that there are gains to be realized from the position you are trading in. If you find that this is the case, then you should evaluate why you bought the position in the first place. A penny saved is a penny earned, and this is certainly true in the investment world.

The best way to begin is by visiting website operated by Cantor Index and setting up a

spread betting demo account until you get better at timing the market. You won’t be tempted to make silly mistakes that many other traders make and having a demo account will give you the confidence to trade with real money.

While risky, with time and practice you will get better at spread betting. Once you learn how to time the market, and you gain practice, your luck with trading will be better. This is one of the best ways to mitigate the risks involved – getting better at the game. You will lose money in the market, but the objective of being a trader is to make more than you lose.

This is a sponsored guest post provided by Chris, working in partnership with Cantor Index.