- RT @ScottATaylor: Get a Daily Summary of Your Friends’ Twitter Activity [FREE INVITES] http://bit.ly/4v9o7b #

- Woo! Class is over and the girls are making me cookies. Life is good. #

- RT @susantiner: RT @LenPenzo Tip of the Day: Never, under any circumstances, take a sleeping pill and a laxative on the same night. #

- RT @ScottATaylor: Some of the United States’ most surprising statistics http://ff.im/-cPzMD #

- RT @glassyeyes: 39DollarGlasses extends/EXPANDS disc. to $20/pair for the REST OF THE YEAR! http://is.gd/5lvmLThis is big news! Please RT! #

- @LenPenzo @SusanTiner I couldn’t help it. That kicked over the giggle box. in reply to LenPenzo #

- RT @copyblogger: You’ll never get there, because “there” keeps moving. Appreciate where you’re at, right now. #

- Why am I expected to answer the phone, strictly because it’s ringing? #

- RT: @WellHeeledBlog: Carnival of Personal Finance #235: Cinderella Edition http://bit.ly/7p4GNe #

- 10 Things to do on a Cheap Vacation. https://liverealnow.net/aOEW #

- RT this for chance to win $250 @WiseBread http://bit.ly/4t0sDu #

- [Read more…] about Twitter Weekly Updates for 2009-12-19

Is Your Budget Doing More Harm Than Good?

Do you stress over your money?

Is your spouse under the impression that you are constantly fighting over money?

Are you constantly fighting over money?

Have you completely eliminated your quality of life?

Do you spend hours each week analyzing where your money has gone?

A total budget can have a negative effect on the other parts of your life. If your spouse isn’t 100% on board, maybe he/she needs some “blow money” that doesn’t need to be tracked. If you aren’t spending enough time with your children because you are tracking expenses and adjusting your budget every day, you need to automate something, or at least loosen your standards. Maybe tracking every penny isn’t the right method of budgeting for you.

Don’t let the perfect budget destroy the rest of your life. If money is still a fight, you’re going to need to compromise on something, now, or you’ll end up compromising with the help of a divorce attorney.

Don’t forget, you are living now, not in the future. Plan for the future, but live in the present. There is a balance there, somewhere. Find it, or you and your loved ones won’t be happy.

Update: This post has been included in the Money Hacks Carnival.

Net Worth and other stuff

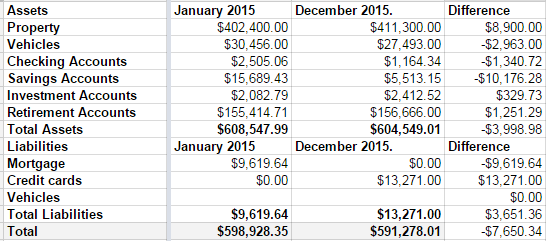

This was not a good year for our net worth.

Over the summer, we remodeled both of our bathrooms. At the same time.

1 out of 10: Don’t recommend.

We love the bathrooms, but–as with any project–it went over budget. Sucks to be us.

Then, towards the end of the year, we decided to push hard and pay off our mortgage in 2015. Part of doing that meant paying the credit card off slower than we’d like. It wasn’t the best long-term decision, but we’re mortgage-free now.

Those decision, coupled with a small slump in our investment accounts means we are worth $7650 going into 2016 than we were at the start of 2015.

Disappointing.

I’m also disappointed that our credit card discipline slipped last year.

New plan: No debt before tax day. Every cent of Linda’s paycheck, every cent of my monthly bonus checks, and every cent of any extra money we make is going into the remaining credit card debt. My math says that last debt will die on April 1st.

Then we get to talk about what to do with out money when there’s no debt. But never fear, I have a plan. A boring, boring plan.

- We’re going to save for college at a rate we should have started 10 years ago.

- We’re going to max out both of our retirement plans.

- We’re going to take some nicer family vacations.

- We’re going to buy a pony.

So not that boring.

And when our kids all decide to become certified sign-spinners, we’ll have a huge nest-egg in the college fund savings account to spend on lottery tickets.

How You’re Finding Me

Every once in a while, I like to dig through Google Analytics and see how people are finding this site. Some of the search terms are interesting.

“father of three” mid life crisis

Here’s a free piece of advice. As a father of three, you don’t get to have a mid-life crisis. It’s not allowed. Rather, it’s allowed, but you aren’t allowed to act on it. At a minimum, until your children are out of the house, you need to man up and provide all of the support you possibly can. No sports cars you can’t afford and no 22 year old hardbodies. Be there for your kids.

“payday loans” which accepts guest posts

Payday loan marketing. Just go away. You aren’t running a guest post here.

“slow carb” hungry all the time

You’re doing it wrong. If you are hungry, eat more bacon. Or beans. Beans fill you up longer.

$1000000 business idea

Ideas are the easy part. Execution makes you a millionaire.

articles on why appearance shouldn’t matter?

Appearances do matter, and always will. Your appearance is what makes the initial impression when you meet someone new. You don’t have to be a model, but basic grooming and fashion sense is necessary. Take this with a grain of salt. I’ve got a week’s growth of a beard and I wear a different plaid, button-down shirt every day.

are push ups supposed to be hard

Only the first 50. After that, I kind of go on blissed-out autopilot. If you can do 100 pushups, you can probably do 200.

acceptable place to put tattoo

If you wear clothes there, you can put a tattoo there. Visible tattoos are called “job stoppers” for a reason. If you put a tattoo on your face, the only job you qualify for is “drug dealer’s girlfriend”. Or possibly prison janitor.

burning bridges with toxic people

If you must burn bridges, filling them with toxic people first isn’t a bad idea.

candied pork butt

Rule 34: If it exists, there is porn of it. Interesting side story: while double-checking the rule number, I stumbled across My Little Ponies doing things they never advertise on the box.

cut my wife’s hair

I did this once. Pro tip: In the back, at the bottom, cut small chunks and leave them longer than you think they should be. You can always cut more, but uncutting hair is really hard.

f***** on the roadside by your mechanic

He probably deserves a tip for that.

girls fart for money and girls live farts

See the bit about the pork butt, remove the funny, and…ewww.

how to be a successful debtor

I recommend starting by paying your bills. When the debts are gone, you win. Success!

i ate bacon on slow carb diet

So did everyone else, sweetie. It’s the biggest draw to the slow carb diet.

in memory of pets tattoos

When I get a pet, I get it with the understanding that I’m going to outlive it. The day I bring it home, some small part of me is preparing for the day when I have to dig a hole in my backyard. Tattooing that day? Not gonna happen.

thickening felt behind testicle

Why are you on google? Go to the doctor. Please?

Interesting. Between girls farting and my post about being well-trained, there is a significant amount of fetish traffic coming through here. Maybe I need to explore a new advertising strategy.

What Is Your Binary Options Strategy?

When you are just entering the world of binary options trading or investing, you may be on the receiving end of a lot of advice. It is not uncommon to hear people tell you to implement different gambling strategies because binary options are based on chance more than anything else. You will also hear a lot of advice from those who say there are many good ways to develop an effective strategy using indicators and market signals. Some will insist that with proper analysis of market data, a solid strategy can be developed too.

When you are just entering the world of binary options trading or investing, you may be on the receiving end of a lot of advice. It is not uncommon to hear people tell you to implement different gambling strategies because binary options are based on chance more than anything else. You will also hear a lot of advice from those who say there are many good ways to develop an effective strategy using indicators and market signals. Some will insist that with proper analysis of market data, a solid strategy can be developed too.

Are they all correct? Interestingly enough, the answer is yes. The reason for this is simple, and as one expert writes, “there is no such thing as a perfect strategy for every trader. There is only a best strategy for each individual trader.” Thus, your strategy has to be shaped around a few things:

- Your willingness and ability to follow your chosen strategy.

- Your personality. For instance, are you restless if you are taking the safe route or a higher risk strategy?

- Your budget and goals,

Identifying the answers to these questions is the first step to formulating a strategy. You should also understand that the winning percentage of most strategies will be somewhat constant, but the total number of successful trades varies on an individual basis and is based entirely on the strategies used.

For instance, some investors want a high percentage of winning trades and are more comfortable with risk averse trading. Others are ready to take more risk and are entirely comfortable winning fewer trades if the returns on winning trades are dramatically higher. This enables them to implement higher risk trades. The interesting thing about strategies and the kinds of trades they generate is that they are all built from the same data.

The Data of Strategy

For example, almost all strategies will look at issues like market trends, trading trends, highs and lows, reversals, and various kinds of indicators. The reason that high and low trends pay off in strategy development is simple: binary options trading applies to whether or not an asset rises above a strike price or doesn’t. It is the proverbial “yes or no” part of the proposition and analysis for either outcome pays off.

As an example, a lot of risk-averse investors will look for breakouts. They use these for trend line investing, which can be as brief as sixty seconds to a day, but can be used to coordinate investing in the direction of a short trend. Although this seems complex, it really is not. The key is that analysis cannot be broad and across all available markets. Instead, focused analysis on a specific area will allow even a novice investor to analyze for a breakout and then invest in binary options accordingly.

Just being able to detect a reversal or a downward trend over the course of a day can yield a very rewarding investment. The key is to understand your strategy based on your budget, personality, and your ability to stick with the strategy, even if it does not yield immediate success. When you do this, and use the right tools for analysis, you can create an effective strategy that brings you closer to your goals.

This is a guest post.

Money Hacks Carnival #105: The All Government, All the Time Edition

Welcome to the 105th edition of the Money Hacks Carnival: The All Government, All the Time Edition. Deep in the bowels of tax season, it’s not surprising that tax- and government-related articles are popular.

Editor’s Picks

LeanLifeCoach presents What Is Your Learning Style? This is an important lesson for anyone trying to teach. My main side hustle involves teaching. We try to address each learning style to engage all of our students. I’m a visual learner. In school, I always read ahead and I’ve never been able to focus while someone reads to me.

Consumer Boomer presents The Best IRA for You. Holy Educational Post, Batman! Be careful, you’ll learn something if you read this post.

PT presents How to Find Free Stuff Online Without Getting Spammed. I like free things. I hate spam. I’m a part of the target audience of this post. I use an active Gmail account for getting freebies. The spam filter can’t be beat.

Fanny Seto presents 5 Tips on How to Get a Job in this Economy. I’m glad I haven’t had to deal with this recently. If you’re unemployed, take the opportunity to develop a hobby or explore other opportunities. You may be out of work, but that means you have the one thing you can’t replace: time. Use it wisely.

Taxes or Feeding the Monster

Jeff Rose presents How to File Taxes with Your 1099s. All you’ve ever wanted to know (and more!) about the 1099.

Paul Williams presents Deduct Haiti Earthquake Relief Donations on Your 2009 Tax Return. If you itemize, make sure you include any donations to Haiti relief.

freefrombroke presents TurboTax Online 2009 Overview. I love TurboTax. I use it every year and have done so since I discovered I wasn’t capable of figuring out the Earned Income Credit.

Four Pillars presents What Happens If You Lose Your W2 Form?. Keeping track of your tax documents is always important, but what do you do if that doesn’t work?

Matthew Paulson presents Troublesome Tax Myths. Taxes aren’t optional. Ask Wesley Snipes.

Working for a Living or Earning the Monster’s Feed

Darwin presents 10 Highest Paying Degrees 2010 – Best Majors in Demand Now. The part that doesn’t surprise me is that the hard sciences pay well. Art-as-science comes with a smaller paycheck. Hmm….

J. Money presents Life in Grad School Doesn’t Have to Suck…All Your Money. I’ve didn’t make it to grad school, but I did work my way through college with a small baby. It’s good to have a support network.

The Financial Blogger presents Getting Ready for Another Purchase!. I’ve never given any thought to buying a blog. It’s a fascinating read. Make sure you read the related posts to get the full value.

Banking, Credit, and Investing or He Who Pays the Piper Calls the Tune

GLBL presents What to Expect From Mortgage Rate Trends for 2010. I learn something every day. Define “intraday”.

pkamp3 presents Cutting Up the Card. It may be caused by a down economy, but less consumer debt isn’t a bad thing.

D4L presents 20 Dividend Stocks Riding The Tsunami Of Dividend Increases. My first dividend-paying stock paid me 16 cents once. Stocks kind of scare me. In my mind, they’re not much different than a slot machine, so I don’t buy much. I think I had 20 shares of that first stock.

Personal Finance or The Government Doesn’t Have to Be Involved

Matt_SF presents Personal Finance Equations You Should Know: the Cash Flow Equation. If equations make you smile, this is the post for you.

Craig Ford presents 101 Ways To Improve Your Marriage Money Relationship. This goes beyond finance and dips firmly into happy relationship territory.

Hedy presents My Better Business Bureau experience. I’ve found that the sincere threat of a Better Business Bureau complaint can be effective, too.

2 Cents presents Economics: Your Personal Finance Weather Forecast. As a sci-fi junkie, I love the quote at the beginning of the article.

Dodging Taxes and Anarchism

Nope. No submissions in this category.

That’s all. While you’re here, don’t forget to subscribe to my rss feed and follow me on twitter.