- RT @ScottATaylor: Get a Daily Summary of Your Friends’ Twitter Activity [FREE INVITES] http://bit.ly/4v9o7b #

- Woo! Class is over and the girls are making me cookies. Life is good. #

- RT @susantiner: RT @LenPenzo Tip of the Day: Never, under any circumstances, take a sleeping pill and a laxative on the same night. #

- RT @ScottATaylor: Some of the United States’ most surprising statistics http://ff.im/-cPzMD #

- RT @glassyeyes: 39DollarGlasses extends/EXPANDS disc. to $20/pair for the REST OF THE YEAR! http://is.gd/5lvmLThis is big news! Please RT! #

- @LenPenzo @SusanTiner I couldn’t help it. That kicked over the giggle box. in reply to LenPenzo #

- RT @copyblogger: You’ll never get there, because “there” keeps moving. Appreciate where you’re at, right now. #

- Why am I expected to answer the phone, strictly because it’s ringing? #

- RT: @WellHeeledBlog: Carnival of Personal Finance #235: Cinderella Edition http://bit.ly/7p4GNe #

- 10 Things to do on a Cheap Vacation. https://liverealnow.net/aOEW #

- RT this for chance to win $250 @WiseBread http://bit.ly/4t0sDu #

- [Read more…] about Twitter Weekly Updates for 2009-12-19

Credit Card Glossary

As evil as credit cards are, most adults have one. Have you ever wondered what percentage of those people know the details of[ad name=”inlineright”] their credit card agreement, or even what all of the terms mean?

Here’s a quick list of the terms and their definitions.

- Average daily balance – This is the balance most card companies use to calculate your interest. They add the balance each day and divide it by the number of days in the billing cycle. This number times the interest rate is (roughly) the interest you have to pay.

- Annual Percentage Rate(APR) – This is the interest rate expressed as the interest accrued in one year. The actual calculation is much more complicated.

- Balance transfer – If you’ve ever paid your VISA with your Mastercard, you’ve done a balance transfer. These often have a great introductory rate and a lousy permanent rate.

- Cardholder agreement – This is the contract that defines all of the terms of your card: interest, default consequences, payment terms, and everything else. You should never sign for a card without reading and understanding this document.

- Charge-back – If you dispute a charge on your card, the issuer may issue a charge-back, and take the money back from the merchant to return to you.

- Credit line – This is the amount you are able to charge. You should fear this number and stay as far away from it as possible.

- Default – When you stop paying your card, you become delinquent. If it goes on too long, you will be in default. Read: screwed. This is when they crank your interest rate to the sky and cut your limit to match your balance. It’s also the point that affects your credit rating.

- Due date – This is the day which, if you miss it, will cause you to acquire an extra $15-39 fee for the privilege of misreading your calendar. Always pay your bill before this date.

- Finance charge – This is the actual interest accrued for the billing period. This is money you are paying for the privilege of borrowing the rest of the money. Next month, you’ll pay a finance charge on this money, too. Yay!

- Grace period – For most cards worth owning, you get 20-25 days before the issuer starts charging interest. The best way to manage your card is to pay it off completely twice a month. That way, you’ll never use up your grace period and never pay a cent of interest.

- Introductory rate – Many cards will offer a crazy-low interest rate for six months to lure you in…like crack. They’ll get you hooked, then raise the rate and force you to charge new toys at the higher rate. Ideally, you’ll never carry a balance, so you’ll never have to worry about the introductory rate.

- Minimum payment – If debt has an evil heart, this is it. If you pay nothing but the minimum required payment, you will be in debt for the rest of your life. Always pay more, even if it’s just an extra $20.

- Over-the-limit fee – If you ignore your credit limit and keep spending, you’ll get hit with another $15-39 fee for the privilege of not controlling your irresponsible impulses.

- Periodic rate – This is your APR expressed in relation to a specific time frame, usually as a daily periodic rate. For example, if your interest rate is 18%, your daily periodic rate is 18/365 or 0.0493%

- Pre-approved – When you get a pre-approved card, you are actually just getting a notice that you have been pre-screened as not being too much of a deadbeat for that particular card. You will still have a full credit check before the card is issued.

- Secured card – If you’ve got lousy credit, sometimes your only choice to repair it is to get a prepaid card. You give the company $200 and they will let you charge $200. They are almost always loaded with fees and are usually a very bad deal, but if it’s the only game in town…?

- Universal default – Sometimes, if you default on one card, every other card you have decides to gang up on you, because your “risk profile” has changed. Yet more proof of the evil that is credit-card debt.

- Variable interest rate – Some card tie your rate to the Prime interest rate, so when that changes, your rate does, too.

Did I miss any terms?

Net Worth and other stuff

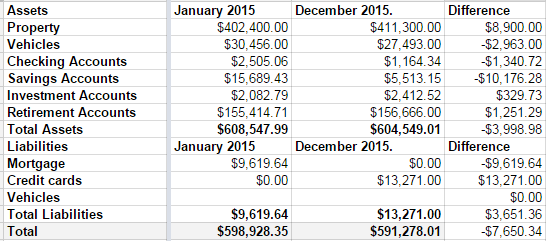

This was not a good year for our net worth.

Over the summer, we remodeled both of our bathrooms. At the same time.

1 out of 10: Don’t recommend.

We love the bathrooms, but–as with any project–it went over budget. Sucks to be us.

Then, towards the end of the year, we decided to push hard and pay off our mortgage in 2015. Part of doing that meant paying the credit card off slower than we’d like. It wasn’t the best long-term decision, but we’re mortgage-free now.

Those decision, coupled with a small slump in our investment accounts means we are worth $7650 going into 2016 than we were at the start of 2015.

Disappointing.

I’m also disappointed that our credit card discipline slipped last year.

New plan: No debt before tax day. Every cent of Linda’s paycheck, every cent of my monthly bonus checks, and every cent of any extra money we make is going into the remaining credit card debt. My math says that last debt will die on April 1st.

Then we get to talk about what to do with out money when there’s no debt. But never fear, I have a plan. A boring, boring plan.

- We’re going to save for college at a rate we should have started 10 years ago.

- We’re going to max out both of our retirement plans.

- We’re going to take some nicer family vacations.

- We’re going to buy a pony.

So not that boring.

And when our kids all decide to become certified sign-spinners, we’ll have a huge nest-egg in the college fund savings account to spend on lottery tickets.

Balance Your Borked Budget

You’ve got a budget worked out to the penny. You know every dollar that comes in and every dime that you spend. All of your bills are getting paid on time. Then, one day, it all comes crashing down. Your budget is no longer even a reasonable approximation of your cash flow. You’ve got no idea what’s coming in or going out. Bills are piling up and fees are digging you deeper in debt.

What happened? More importantly, how do you get back on track?

The first thing you need to do is identify the problem. What, exactly, went wrong? Did you lose your job or need a surprise botox injection? Your car died or your kid developed a hockey habit? Sports car or shoe sale? Whatever the cause, if you can’t identify it, you can’t deal with it. Some of the possible problems may be things that can get clubbed and buried in the backyard, while other things may be expenses that won’t be going away. If it’s a one-time expense, you can simply refocus your debt repayment to take it into account. If it’s an ongoing expense, you will need to adjust your other expenses, possibly in a drastic manner, to make ends meet. You can’t know which way to go without knowing what caused the problem.

Next, commit to to making it right. Don’t leave it at a mere commitment. Actually commit and actually do it right. Future-you is counting on you to fix the problem before he gets screwed. This is important. Without firm–and real–commitment, nothing else will matter. At best, you will be treading water. At worst, you will drown yourself in unanticipated bills.

Cut everything extra. Every expense–whether it’s your mortgage or your maid–is a rock in your pocket, one hundred miles from shore. How much can you carry and stay afloat? This isn’t the time to keep paying something because you enjoy it. If it isn’t absolutely necessary, it’s got to go. Cut your internet, cancel Netflix, learn to shut off the lights when you aren’t using them. Is the early termination fee less than 6 months of your cable bill, your satellite bill? Cancel it. You can always sign up again later. This is the time to be ruthless.

Is there a way to bring in some extra cash? Can you pick up a second job, or land a freelancing gig? If you’ve suddenly found yourself unemployed, can you spend some time on being a Mechanical Turk? Sell all of the things you don’t use anymore, or, more likely, never should have bought in the first place? Do you have a spare kidney?

Remember, this is a drastic situation calling for drastic measures. Your future is depending on you. Don’t make him come back and kick your butt.

Update: This post has been included in the Carnival of Personal Finance.

Make Extra Money, Part 5: Domains and Hosting

In this installment of the Make Extra Money series, I’m going to show you how to pick a domain and a host.

If you remember from the last installment, I’ve decided to promote The Master Wedding Planning Guide. Since then, I have bought the product and read enough to decide that’s it worth promoting. That is the secret to ethical internet product. Never promote a crap product. Now, when I bought the Guide, I used my own affiliate link, so the $37 product will have cost me about $13, once the commission check comes through. You can’t do that just to get a discount because Clickbank has measures in place to ensure that you are actually selling products.

Domain Name

The first thing we need is a domain name.

You can skip this if you want to host on blogger, but I wouldn’t do that, unless $10 is a major financial hardship. I dislike the idea of leaving everything in Google’s hands. Even if you use blogger for hosting(discussed later), pop for the domain name. That way, if you change your mind about hosting, you can move without losing everything.

Where should you go for your domain name? I use NameCheap and GoDaddy. I try to divide my domain names across each of the providers so all of my sites don’t look identical to Google. I may be paranoid, but it works for me.

Before you order, hit Google for a coupon code. Search for “namecheap coupon” or “godaddy coupon” and save some money. GoDaddy is offering $7.49 domains.

How do you pick a domain name?

I try to pick something that matches the product name, or the product’s site. In this case, the product’s site is http://www.masterweddingplanning.com and http://www.masterweddingplanning.net was available, so I grabbed it. I would have been happy with .com, .net, or .org. I won’t touch a .info domain. They are generally cheap, but they cost more to renew and people assume they are spam sites.

If the exact match domain isn’t available, I look for exact matches for the product. If that’s not available, I stick other words at the end that would be attractive to people looking to buy a product.

Acceptable domains would include:

- http://www.masterweddingplanning.org

- http://www.masterweddingplanningreview.com

- http://www.masterweddingplanningguide.net

- http://www.masterweddingplanningreviewed.org

Or nearly anything along those lines. Other good words to attach would be “revealed”, “exposed”, or something similar. Just put yourself in the shoes of a buyer. Would the domain name look like something that could help you decide whether or not to buy a product?

Hosting

Your host is where your website lives. Without a host, you can’t have a website.

When it comes to picking a host, you have some choices to make.

First, do you want to go free or paid? Free sounds great, and if money is tight, it’s not a bad choice, but it does limit your options.

If you’re going free, you’re going with Google’s Blogger. WordPress.com’s hosting eliminates your advertising options, as does almost every other free host. I do know of a couple of free WordPress hosts that will let you run ads and advertising campaigns, but the performance is horrible.

Another problem with using Google is that they can decide your site violates their Terms of Service and shut it down. It shouldn’t happen, but it’s not unheard of with affiliate marketing sites. If you go this route, plan to move to paid hosting when you start making money.

That leaves us with paid hosting.

There are a ton of hosts out there, but only three I have personal experience with.

I won’t use GoDaddy for hosting. I’ve never been happy with their technical support.

I have most of my domains on HostGator (c0upon code: HOSTINGBUDDY). I’m happy with them. Performance is good and the customer service is excellent. Their hosting packages start at $3.96 per month.

I also have a hosting account at HostTheName. I got that because, using coupon code “STARTUPWARRIOR”, hosting prices get down to $1 per month. At $36 for 3 years, I couldn’t turn it down. Initially performance was rocky, but they’ve upgraded and it’s good, now.

Once you’ve created your hosting account, you’ll need to go back to your domain name registrar and set the name servers. At NameCheap, after you log in, you’ll go to Domains > Manage Domains and click on the domain name. From there, click on “Domain Name Server Setup” on the left of the screen and enter the custom name server information listed on your hosting account.

When that’s done, go to your hosting account and add the domain. If you’re creating a new hosting account, this will be your main domain and the hosting company will ask you for the information during setup. If you’re adding this to an existing hosting account, log in, look for “Addon Domains” and follow the prompts.

At this point, you’ve chosen a product to promote and keywords/search terms to go with it. You’ve chosen and registered a domain name and you’ve set up a hosting account to hold your website. Next time, I’ll walk through setting up a WordPress site to make some money.

Any questions?

Make Extra Money Part 1: Introduction

Today, I’m re-launching a new series on how I make extra money online. This series fell off my radar for a while. I intend to finish it now.

Right now, I have 7 sites promoting specific products, or “niche” sites. When those products are bought through my sites, I get a commission, ranging from 40-75%. Of those sites, 5 make money, 1 is newly finished, and 1 is not quite complete. I’m not going to pretend I’m making retirement-level money on these sites, but I am making enough money to make it worthwhile.

Over the course of the series, I’m going to show you how to take advantage of multi-million dollar market research to choose a niche, at no cost to you. You’ll see how I choose a domain name, where to find products to sell, and how to promote your new site.

As I write the series, you’ll get to see exactly what is working, as it’s happening. I’ll be choosing the niche as I write the post on choosing a niche. As of this writing, I don’t know what niche I’ll be promoting, what product I’ll be using, or what keywords I’ll be targeting. This will be a live, totally transparent case study of how I make extra money.

Before we get started, I need you to understand a few things.

First, this is not overnight money. My first niche site took 6 months before it made me a penny. That was partially because my product selection research was faulty, but also because these things do take time. I’ll show you how to pick a niche and product that won’t take that long, but you can’t expect to quit your job tomorrow.

Second, this is work. Once everything is established and optimized, it won’t be a lot of work, but it will take time to do. There is no such thing as “set it and forget it” internet marketing. Anybody who tells you otherwise is selling you something you won’t be satisfied with.

Third, this isn’t free. I’m not going to charge you anything, but some parts of this will cost money to do effectively. I’m not a fan of throwing money away, so I won’t be suggesting anything outrageous. If I do recommend something that costs money, I will try to recommend a free or very cheap alternative, but that won’t always be possible. I started out slow and cheap, but now, when I launch a site, I spend some money to do it quickly and effectively. I am a fan of paying others to do the things I dislike doing.

That’s the plan. I’m going to tell you how I make extra money online, and I’m going to let you look over my shoulder while I set up my next site, start to finish.

Any questions?

Any comments on how you make extra money online?