- Uop past midnight. 3am feeding. 5am hurts. Back to bed? #

- Stayed up this morning and watched Terminator:Salvation. AWAKs make for bad plot advancement. #

- Last night, Inglorious Basterds was not what I was expecting. #

- @jeffrosecfp It's a fun time, huh. These few months are payment for the fun months coming, when babies become interactive. 🙂 in reply to jeffrosecfp #

- RT @BSimple: RT @bugeyedguide: When we cling to past experiences we keep giving them energy…and we do not have much energy to spare #

- RT @LivingFrugal: Jan 18, Pizza Soup (GOOOOOD Stuff) http://bit.ly/5rOTuc #budget #money #

- Free Turbotax for low income or active-duty military. http://su.pr/29y30d #

- To most ppl,you're just somebody [from casting] to play the bit part of "Other Office Worker" in the movie of their life http://su.pr/1DYMQZ #

- RT @MoneyCrashers: Money Crashers 2010 New Year Giveaway Bash – $8,300 in Cash and Amazing Prizes http://bt.io/DQHw #

- RT: @flexo: RT @wisebread: Tylenol, Motrin, Rolaids, and Benadryl RECALLED! Check your cabinets: http://bit.ly/4BVJfJ #

- New goal for Feb. 100 pushups in 1 set. Anyone care to join me? #

- RT @BSimple: Your future is created by what you do today, not tomorrow"— Robert Kiyosaki So take action now. #

- RT @hughdeburgh: "Everything you live through helps to make you the person you are now." ~ Sophia Loren #

- Chances of finding winter boots at a thrift store in January? Why do they wear our at the worst time? #

- @LenPenzo Anyone who make something completely idiot proof underestimates the ingenuity of complete idiots. in reply to LenPenzo #

- RT @zappos: "Lots of people want to ride w/ you in the limo, but what you want is someone who will take the bus w/ you…" -Oprah Winfrey #

- RT @chrisguillebeau: "The cobra will bite you whether you call it cobra or Mr. Cobra" -Indian Proverb (via @boxofcrayons) #

- RT @SuburbanDollar: I keep track of all my blogging income and expenses using http://outright.com it is free&helps with taxes #savvyblogging #

- Reading: Your Most Frequently Asked Running Questions – Answered http://bit.ly/8panmw via @zen_habits #

Saturday Roundup

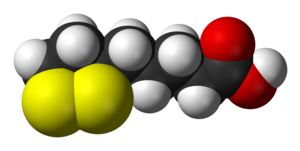

- Image via Wikipedia

Don’t miss a thing! Please take a moment to subscribe to Live Real, Now by email.

Holiday weeks are supposed to be short, aren’t they?

I’m 11 days into my 30 Day “Compact”. So far, it has gone well. Unfortunately, there have been a couple of books launched that I’d love to own, and a friend keeps showing me new gadgets that I’d love to get. Not shopping at all is harder than it sounds.

The Best Posts of the Week:

Brian Wood, without a doubt, understood the responsibility he took on as a father. The story makes me get all misty.

On Wise Bread, they asked if you are saving too much. Don’t save as an excuse to stop living your life.

Free Money Finance will help you save money on travel.

Parent Hacks has a great use for a Google Voice number. I have a spare, so I think I’ll start using it.

I’m a big fan of selling on Craigslist. I’ve never sold a car there, so this was informative.

Finally, a list of the carnivals I’ve participated in:

5 Reasons to Quit Saving and Start Living was included in the Carnival of Personal Finance.

Bonding Relationships was in the Carnival of Wealth.

Hippy Month was the Editor’s Pick in the Festival of Frugality!

If I missed a carnival, please let me know. Thanks to those who have included me!

Fixing Your Credit Report

Sometimes, negative things appear on your credit report. Usually, they do a good job of maintaining

Credit card (Photo credit: Wikipedia)accuracy, but mistakes do happen. The creditor or the reporting agency may screw up, or you may have your identity stolen. If either of these situations are true, you’ll want to correct your credit report, making yourself eligible for lower rates on future credit and, occasionally, lowering the cost of things like auto insurance.

If you throw “credit repair” into Google, you get 18 million hits. Most of those are either outright scams or hopelessly optimistic about what they can accomplish. As I said once before:

Credit Repair is almost always a scam. There are ways to get correct bad information removed from your credit report. If the information is correct, those methods are illegal. There are two legal methods to repair your credit. First, stop generating bad credit. Make your payments on time and eventually, the bad items will fall off. Second, write letters disputing the actual incorrect items on your credit report. There are no quick fixes, and anybody telling you different is flirting with a jail sentence, possibly yours.

There are ways to avoid the scammers.

- Avoid advance-fee credit repair. If they are any good, you will pay for results, not intentions. If they charge beforehand, they are already breaking the law.

- If they insist they can erase the accurate, but negative information, run away.

- If they tell you to dispute everything negative, even the accurate information, run away.

- If they tell you to create a new credit identity, don’t just run, report them. It’s a felony.

Legally, you cannot get valid information removed from your credit report. Anyone who tells you differently is advocating a crime. However, according to the Fair Credit Reporting Act (FCRA), you are entitled dispute incorrect records.

To verify the accuracy of your credit report, you need to see it. You can get a free report if your credit is used to deny you for something. This is known as an “adverse action” . You have 60 days from the denial to request the report. You can also get one free report from each of the major credit bureaus each year. I space out these requests so I see my credit report every 4 months.

If there is inaccurate information on your report, dispute it in writing. Send a letter to the credit bureau that is reporting the error. Explain the problem and politely demand an investigation. They will contact the creditor, who usually has 30 days to respond. In the meantime, send a dispute letter to the creditor, along with proof of the inaccuracy. If the investigation does not go your way, the creditor will have to report the dispute status to the credit bureaus in the future.

If the negative items are accurate, there is only one way to get it off of your report legally: Wait. Most negative information can only be reported for 7 years, while a bankruptcy will be reported for 10.

Another way to build your credit in the face of negative credit is to start building good credit to overshadow the bad. Get a credit card. Your first credit card from the bottom of the debt-barrel will probably be a gas card or a store-branded credit card. That’s fine. The main consideration is are low or nonexistent fees. Don’t accept application fees, activation fees, fees for carrying a balance or fees for not carrying a balance. Annual fees are becoming a fact of life, so look for low fees. The interest rate does not matter. You will be paying this card off immediately, meaning no less often that every two weeks. Make sure every penny is paid during the grace period, and make sure your card comes with a grace period. Some don’t. Those are bad cards to get.

There are no quick fixes for bad credit, just good new habits and time.

Cheap Vacations

- Image via Wikipedia

Last month, we went on vacation for a week. It was our first debt-free vacation, ever! We had a busy week, full of fun activities and it didn’t break the bank. We saved money on everything we could.

Hotel

We save a lot of money by staying at a casino/hotel that was a 20 minute trip away from our vacation city. This won’t save money if you have a problem with gambling. The only time we went to the casino was to get to the connected restaurant.

We made the hotel even cheaper by arriving on a Sunday and leaving on a Friday, avoiding the weekend rates. That gave us a full 6 day vacation with no rush to pack and 2 days to recover and relax when we were done. We just didn’t see the point of checking out on Saturday, just to head home, when we could check out on Friday, spend the day seeing the sights, then leave late.

Meals

I like good food, but feeding a family of five for a week costs far too much. So we compromised.

We brought milk and cereal to the hotel. Instead of rushing to get out of the hotel for breakfast, we had a leisurely breakfast in our jammies and took our time getting moving. No stress. For our daytrips, we packed sandwiches, juice, and snacks; avoiding the need for lunchtime restaurants. Dinner was our extravagance. Every night, we ate someplace nice. Not fancy, but nice. Our food budget was about $30 for the week, not counting dinner.

Attractions

I had a plan to keep every day fun, without resorting to using an agenda. We were far to flexible to call it an agenda. They just don’t make vacations fun for me. We had one thing planned each morning, one each afternoon, and one each evening. Every day, one of those things was spending a couple of hours in the hotel pool. No stress.

The first thing I did was hit the city’s tourism website for coupons. Yay us!

We tried to group our activities geographically to save on parking. For example, one day we went on a sight-seeing boat tour, then walked over the a retired-ore-freighter-turned-museum and only paid one parking fee, which was actually reimbursed by the tour company.

We also hit a lot of state parks, which was mostly free, except for the daily parking permits.

Some of the museums had gotten together to offer a “3 attractions for the price of 2” deal. This was available to us, but I didn’t find out about it until the end of the week. Luckily, it only cost us a few dollars more to use the other coupons.

When we had some spare time, we did other things, like bowling or catching a matinee. They were just some cheap time-fillers, but still good times.

All in all, we had a great time. Nobody was bored and we didn’t end up broke. A good time was had by all, and I got to teach my son how to play poker.

How do you save money on vacation?

Debt Burnout

You’ve got a budget. You’ve got a debt repayment plan. You’ve been paying off your debt. You’ve even paid off a few of your smaller debts. Now you’re staring down the barrel of your big debts: your mortgage, a $30,000 credit card, maybe a car payment. You’re looking at months of payments with no quick wins; no more watching your debts die every few months. You’re in the middle of a very long slog.

All of the easy milestones have been reached and the next one is a year or more away. This is when debt repayment gets hard. How can you avoid getting burnt out doing the same thing, month after month, with no major visible progress?

1. Keep your eye on the prize. Try focusing on the end result, while ignoring the time it takes to get there. Do you have a reward planned for when you pay off your debt? If not, consider that to be your new shining goal-post. My wife and I plan on taking an Alaskan cruise when our debt is repaid.

2. Ignore the prize. If #1 doesn’t work for you, try focusing on just the current month’s progress. How much did you pay off this month? Was it more than last month?

3. Make micro-goals. Try breaking the long slog into bite-sized pieces. How fast can you pay off the next $1000? How many months will it take to pay off that TV you bought last year? Sometimes, meeting a smaller goal can make the whole works feel like it’s going by faster.

4. Take a snowball vacation. For just one month, take every dollar you would normally apply to your debt–except your required payments–and have some fun with it. Take a weekend trip, have a fancy dinner, or pick up that video game system you’ve been eying. Something. Anything to take your mind off of your repayment plan for a while. Be careful not to make this a habit or you will never get out of debt.

5. Start a blog to share your pain.

A debt snowball is a long, intense process. If you’re not careful, you can burn out and let the whole thing collapse. How do you avoid burnout?

Slow Carb Diet: How to Avoid Going Bat-**** Crazy

I received an email recently, asking “what kinds of things are you eating so that you don’t go bat-**** crazy?”

First, some background.

On January 2, 2011, I started Tim Ferriss’s Slow Carb Diet and, as of 2/18/2011, I have lost 30 pounds. The first 11 or so were water weight, but I’ve still been losing 4-5 pounds per week. This diet has a few—but only a few—rules.

- Eat nothing white. That means no sugar(including fructose), no flour, no potatoes, no rice(even brown), and no milk(or any dairy). Beer is white.

- Breakfast is high-protein.

- Cheat day once a week. On cheat day, there are no rules after breakfast.

- Meals should consist of 40% protein, 30% vegetables and 30% legumes(beans or lentils).

- If you get hungry between meals, you didn’t eat enough at the last meal.

That’s it. The rules are simple and don’t require that I refer back to the book for anything.

Here is a typical day for me on this diet:

For breakfast most mornings, I have 3 eggs and 2-3 sausage links. I bought brown-and-serve sausages so this takes 10 minutes to cook in the morning.

On the way to work, I have a diet soda if we have any in the house. If not, I skip it. I like pop, but I’ve broken my caffeine addiction completely.

For lunch, I will either have leftovers from the night before or some stir-fry with beans and whatever protein is convenient. I’ve been keeping pre-cooked brats(wurst, not kid) or polish sausages as a convenience food.

Several times a week, I make some stir-fry. I use a basic, flexible recipe.

- Chop whatever vegetables are on hand. We usually have onions, broccoli, a variety of peppers, and mushrooms. If I have celery, asparagus, or almost any other vegetable. Lettuce works poorly in a stir-fry.

- Put some oil in a hot pan. I prefer sesame oil, but I’m not picky. I’ll use whatever oil we have on hand.

- Cook the vegetables, stirring constantly. Cook them in the order of how long they take to cook. Onions are usually first. Celery tends to be last.. While they are cooking, I sometimes sprinkle ginger powder over the top.

- If you are getting sick of eating beans, toss them into the stir-fry, cooked. They mash and disintegrate, giving you the benefit and some flavor, without the mouth-feel.

- When the vegetables are cooked to your satisfaction, put them in a bowl. They will keep in the refrigerator for a few days.

I tend to cook the meat separately, as that lets me vary the meal more. I’ll make some chicken or steak ready to toss in the stir-fry before I re-heat it.

I vary the seasonings, vegetables, and oil to get different flavors I rarely make the same stir-fry twice. The real trick to keeping the food satisfying is to experiment with seasonings. They make a huge difference between bland and yummy. Seasonings can make or break a meal all by themselves.

If I don’t have any stir-fry or leftovers, I’ll bring some salad and a polish sausage. Most salad dressing is sugar-based, so I either go light on the dressing, or use balsamic vinegar. I try to avoid doing this more than once every couple of weeks. It’s boring and doesn’t taste that great. It’s okay, but that’s all.

I try to always have cooked beans or lentils in the refrigerator. They provide a significant part of my calorie intake. Beans are kind of a necessity. Vegetables taste better, but are a low-calorie, bulky food. You can’t stay full all day on nothing but lettuce. Beans get old. I’ll usually toss a few spoonfuls of salsa to change the taste. When I cook lentils, sometimes, I’ll cook it in beef broth with fried onions and garlic to make a tasty change.

For dinner, I have whatever vegetables we are cooking for the kids, a scoop of beans, and a protein that usually isn’t cooked for the family.

The protein source varies based on whatever was on sale when we went grocery shopping. It can be steak, chicken, or anything else. This week, we bought 16 chicken drumsticks. We spread them out on a cookie sheet and seasoned them 3 different ways, just for variety. Some got garlic salt, some got Italian seasoning, and some got a Greek rub. After an hour in a 350 degree oven, we had a delicious meal.

If I feel a need for a snack, or a craving for sweets, I just take a spoonful of peanut butter. It helps.

Exercise

I’m not doing any major form of exercise. I wanted to test the diet on its own merits, first. What I am doing is some timed exercises shortly before and 90 minutes after I eat, when I remember. The exercises are resistance-based and 60-90 seconds in duration. The purpose is to crank up my metabolism before the food gets introduced into my body, and then keep it up and running for a while afterward.

I use a mid-level elastic rehab strap, doubled-over twice. I do 75 chest extensions about 5 minutes before I eat. Most days, I forget to do them again 90 minutes later. There are any number of other exercises that would work, including air squats or push-ups.

Supplements

I am not your doctor. In fact, I am not a doctor in any capacity. Similarly, I am not a nutritionist, a dietitian, or even a board-certified snake-oil salesman. I have no qualifications here, in any way, shape or form. Follow this at your own risk.

I take 5 supplements.

Policosanal. This is an herbal supplement that is supposed to help with cholesterol, which is a helpful thing to do when you are on a low-carb, high-protein diet. More importantly, a side effect is weight loss. Hurray for helpful side effects!

Alpha-lipoic Acid(ALA). This is an antioxidant that helps your body produce vitamins C and E. It is also supposed to inhibit triglyceride and fat storage. To quote from the book, “ALA helps you store the carbohydrates you ea in your liver as opposed to in fat.”

Decaffeinated Green Tea Extract. This inhibits your body’s ability to store carbs as fat and it accelerates fat cell death. The second bit means it should help prevent the rebounding so many dieters experience.

Garlic Extract. This assists with cholesterol management and the inhibition of fat regain.

B Complex. I take a B complex vitamin with vitamin C. The B vitamins help balance out some of the things the rest of the supplement regimen does to cellular metabolism while giving your overall metabolism a boost.

I take the whole mess in the morning and again before bed. Shortly before lunch and dinner, I take the ALA, green tea extract and garlic extract.

Ice

As a pure body-hack, I ice my upper back every night. I have an ice-pack sheet that I place on my upper back for 30-45 minutes each night before bed. This lowers my core body temperature, forcing my body to work harder to maintain 98.6 degrees. That burns calories. An additional benefit: getting cold makes you tired, which helps with my chronic insomnia.

This combination of factors has resulted in my losing an average of .7 pounds per day, without meaningful exercise. It’s a violation of a number traditional dieting principles, but it’s working. Is everything I’m doing necessary? Useful? Possibly not. Over the next few months, I’m going to be experimenting with dropping individual pieces of the plan, to see if my rate of loss drops for any of it.

For now, it’s working, and doing so at a rate I like. Dieting usually sucks, because the results are so slow. This is much more satisfying.