- Guide to finding cheap airfare: http://su.pr/2pyOIq #

- As part of my effort to improve every part of my life, I have decided to get back in shape. Twelve years ago, I wor… http://su.pr/6HO81g #

- While jogging with my wife a few days ago, we had a conversation that we haven’t had in years. We discussed ou… http://su.pr/2n9hjj #

- In April, my wife and I decided that debt was done. We have hopefully closed that chapter in our lives. I borrowed… http://su.pr/19j98f #

- Arrrgh! Double-posts irritate me. Especially separated by 6 hours. #

- My problem lies in reconciling my gross habits with my net income. ~Errol Flynn #

- RT: @ScottATaylor: 11 Ways to Protect Yourself from Identity Theft | Business Pundit http://j.mp/5F7UNq #

- They who are of the opinion that Money will do everything, may very well be suspected to do everything for Money. ~George Savile #

- It is an unfortunate human failing that a full pocketbook often groans more loudly than an empty stomach. ~Franklin Delano Roosevelt #

- The real measure of your wealth is how much you'd be worth if you lost all your money. ~Author Unknown #

- The only reason [many] American families don't own an elephant is that they have never been offered an elephant for [a dollar down]~Mad Mag. #

- I'd like to live as a poor man with lots of money. ~Pablo Picasso #

- Waste your money and you're only out of money, but waste your time and you've lost a part of your life. ~Michael Leboeuf #

- We can tell our values by looking at our checkbook stubs. ~Gloria Steinem #

- There are people who have money and people who are rich. ~Coco Chanel #

- It's good to have [things that money can buy], but…[make] sure that you haven't lost the things that money can't buy. ~George Lorimer #

- The only thing that can console one for being poor is extravagance. ~Oscar Wilde #

- Money will buy you a pretty good dog, but it won't buy the wag of his tail. ~Henry Wheeler Shaw #

- I wish I'd said it first, and I don't even know who did: The only problems that money can solve are money problems. ~Mignon McLaughlin #

- Mnemonic tricks. #

- The Wilbur and Orville Wright Papers http://su.pr/4GAc52 #

- Champagne primer: http://su.pr/1elMS9 #

- Bank of Mom and Dad starts in 15 minutes. The only thing worth watching on SoapNet. http://su.pr/29OX7y #

- @prosperousfool That's normal this time of year, all around the country. Tis the season for violence. Sad. in reply to prosperousfool #

- In the old days a man who saved money was a miser; nowadays he's a wonder. ~Author Unknown #

- Empty pockets never held anyone back. Only empty heads and empty hearts can do that. ~Norman Vincent Peale #

- RT @MattJabs: RT @fcn: What do the FTC disclosure rules mean for bloggers? And what constitutes an endorsement? – http://bit.ly/70DLkE #

- Ordinary riches can be stolen; real riches cannot. In your soul are infinitely precious things that cannot be taken from you. ~Oscar Wilde #

- Today's quotes courtesy of the Quote Garden http://su.pr/7LK8aW #

- RT: @ChristianPF: 5 Ways to Show Love to Your Kids Without Spending a Dollar http://bit.ly/6sNaPF #

- FTC tips for buying, giving, and using gift cards. http://su.pr/1Yqu0S #

- .gov insulation primer. Insulation is one of the easiest ways to save money in a house. http://su.pr/9ow4yX #

- @krystalatwork It's primarily just chat and collaborative writing. I'm waiting for someone more innovative than I to make some stellar. in reply to krystalatwork #

- What a worthless tweet that was. How to tie the perfect tie: http://su.pr/1GcTcB #

- @WellHeeledBlog is giving away 5 copies of Get Financially Naked here http://bit.ly/5kRu44 #

- RT: @BSimple: RT @arohan The 3 Most Neglected Aspects of Preparing for Retirement http://su.pr/2qj4dK #

- RT: @bargainr: Unemployment FELL… 10.2% -> 10% http://bit.ly/5iGUdf #

- RT: @moolanomy: How to Break Bad Money Habits http://bit.ly/7sNYvo (via @InvestorGuide) #

- @ChristianPF is giving away a Lifetime Membership to Dave Ramsey’s Financial Peace University! RT to enter to win… http://su.pr/2lEXIT #

- @The_Weakonomist At $1173, it's only lost 2 weeks. I'd call it popped when it drops back under $1k. in reply to The_Weakonomist #

- @mymoneyshrugged It's worse than it looks. Less than 10% of Obama's Cabinet has ever been in the private sector. http://su.pr/93hspJ in reply to mymoneyshrugged #

- RT: @ScottATaylor: 43 Things Actually Said in Job Interviews http://ff.im/-crKxp #

- @ScottATaylor I'm following you and not being followed back. 🙁 in reply to ScottATaylor #

Balance Your Borked Budget

You’ve got a budget worked out to the penny. You know every dollar that comes in and every dime that you spend. All of your bills are getting paid on time. Then, one day, it all comes crashing down. Your budget is no longer even a reasonable approximation of your cash flow. You’ve got no idea what’s coming in or going out. Bills are piling up and fees are digging you deeper in debt.

What happened? More importantly, how do you get back on track?

The first thing you need to do is identify the problem. What, exactly, went wrong? Did you lose your job or need a surprise botox injection? Your car died or your kid developed a hockey habit? Sports car or shoe sale? Whatever the cause, if you can’t identify it, you can’t deal with it. Some of the possible problems may be things that can get clubbed and buried in the backyard, while other things may be expenses that won’t be going away. If it’s a one-time expense, you can simply refocus your debt repayment to take it into account. If it’s an ongoing expense, you will need to adjust your other expenses, possibly in a drastic manner, to make ends meet. You can’t know which way to go without knowing what caused the problem.

Next, commit to to making it right. Don’t leave it at a mere commitment. Actually commit and actually do it right. Future-you is counting on you to fix the problem before he gets screwed. This is important. Without firm–and real–commitment, nothing else will matter. At best, you will be treading water. At worst, you will drown yourself in unanticipated bills.

Cut everything extra. Every expense–whether it’s your mortgage or your maid–is a rock in your pocket, one hundred miles from shore. How much can you carry and stay afloat? This isn’t the time to keep paying something because you enjoy it. If it isn’t absolutely necessary, it’s got to go. Cut your internet, cancel Netflix, learn to shut off the lights when you aren’t using them. Is the early termination fee less than 6 months of your cable bill, your satellite bill? Cancel it. You can always sign up again later. This is the time to be ruthless.

Is there a way to bring in some extra cash? Can you pick up a second job, or land a freelancing gig? If you’ve suddenly found yourself unemployed, can you spend some time on being a Mechanical Turk? Sell all of the things you don’t use anymore, or, more likely, never should have bought in the first place? Do you have a spare kidney?

Remember, this is a drastic situation calling for drastic measures. Your future is depending on you. Don’t make him come back and kick your butt.

Update: This post has been included in the Carnival of Personal Finance.

Naked Money

In our house, the bills don’t get hidden. I’ve never tried to hide our finances from our children. I believe doing that is part of the reason I reached adulthood with no brakes. Growing up, finances were almost entirely invisible. Now, I believe is financial transparency.

Now, as a father, I balance the checkbook and pay bills on the laptop in the living room where my children can see me. They see the stack of bills and they watch me balance the checkbook. We discuss how much things cost and how we can cut expenses while the bills are being paid. Even the toddlers know Daddy is doing something important.

My ten-year-old son knows what sales tax is and where to find it on a receipt. He knows what property taxes are and how much they are in our neighborhood. He knows roughly what percentage of a paycheck gets withheld. I work to make my son financially aware. My girls are too young to understand the concept of money, but they will be receiving a thorough financial education as soon as they are able to grasp the concepts.

The hard part is explaining to my son how we screwed up our finances. I’ve shown him my paycheck and discussed our debt. I have explained to him that we were making much less money when we accumulated our doom debt, while maintaining a higher standard of living. Now, when we go to the store, he doesn’t even ask if he can borrow money until we get to his bank account. He has learned to dislike debt in almost all forms. I’m fairly proud that my kid voluntarily practices delayed gratification.

What he doesn’t quite grasp is the idea of living within your means, even if your means are limited. “But, Dad, what if you don’t have much money? Then you have to borrow money for nice things, right?” I’m not sure how to break him of that. Delayed gratification is an understandable concept for him, but the difference between wants and needs seems to be missing. Any ideas?

Free Tivo

- Image by Marcin Wichary via Flickr

TV is causing problems in my life.

We watch too much TV. Often, we’re only watching because there’s a crappy show in between two shows we do want to watch. In the winter–during the new seasons–my son has wrestling practice 4 or 5 nights per week, which means I miss the new shows I like. We recently downgraded our service provider, so there’s no functional guide button in the house.

That all makes me sad.

Then I found out that Tivo’s lifetime service is attached to the unit. If you sell a unit with lifetime service, you can transfer the service to the buyer. You can’t, however, transfer the service to a new box. That means that everyone who upgrades and sells their old box is selling the lifetime service with it. If you don’t mind having older equipment, you can pick up a used box with full lifetime service for less than the cost of a new box.

After reading Erica’s method of finding 750 extra hours per year, we decided to give it a shot. We are taking back control of our TV. No more rushing home to catch a new episode. No more mindlessly channel-surfing to kill time between good shows. No more commercials. And a guide! I like having a guide button.

I started shopping. My goal was to get a Series 2 Tivo with full lifetime service for about $100 before shipping. I came close a few times, but always lost the auction, in the end. I wasn’t in a hurry, and I didn’t actually have the money budgeted, so it was good to lose.

Then, a friend found himself in a situation that didn’t work with a Tivo and decided to sell his heavily upgraded, heavily accessorized Tivo HD for $100 + shipping. A quick call to my wife resulted in just one objection: Where were we getting the money? We don’t have an opportunity fund, yet and I needed to take advantage of this quick if we were going to get it.

I decided to make it free.

When I automated all of our bills, I rounded up. If a bill was for $63.50, I paid $64. If a bill wasn’t exactly consistent, I paid enough to cover the higher amount. For example, I didn’t have a text messaging plan on my cell phone until December. Before that, I’d get about a dozen texts each month, so I budgeted for paying for the texts. If I didn’t get the texts, I’d get a credit on my bill. I never lowered the automated payment. All of my bills were set up like that. My insurance company dropped my rates, but I left the payment alone. I slowly started accumulating a credit on a number of bills. My intention was to skip a month when the billed amount got to $0, and apply the money to debt. It was just a mind-game to play with myself to make the debt easier to pay.

I flipped through the bills, looking at the credits. I adjusted the payments to match the bills this month and found more than enough to buy the Tivo. This is a purchase that doesn’t influence my budget in any way. Almost. This unit doesn’t have lifetime service, so I will be paying for the monthly fee, but that’s been more than balanced out by reducing our television service.

This is a recently-high-end model for free, as far as my budget is concerned. I used money that wasn’t even on the table before I went looking for it. It’s like searching the couch cushions for money to catch a movie.

Now, I’ll have control of my TV–with a strong measure of convenience to boot–for $13 per month. The time savings is yet-to-be-determined.

A free Tivo simply because I rounded my bills up when I automated last year. That’s a pain-free opportunity fund.

Update: After I wrote this, I found out that I dropped the ball in budgeting for child-care now that summer is here and my oldest won’t be in school. These costs are going up $350 per month. I spent an hour scavenging the couch cushions of my budget this week. I had to adjust some savings and repayment goals, but I’ve effectively paid for a summer worth of care for my boy the same way. Free.

The Obligatory Thanksgiving Post

Tomorrow is Thanksgiving. Tomorrow is also Thursday, and I don’t post on Thursdays, so I’ll be posting about Thanksgiving today.

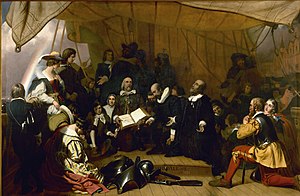

Thanksgiving is a day to be thankful for–first and foremost–capitalism.

When the Pilgrims first landed, they set up a communal farming arrangement, figuring that a good Christian community could take care of its own. From each according to his ability, to each according to his need, and all that. Everyone worked for the good of everyone else, so everyone benefited, right?

The Pilgrims, like every other group that has ever advocated communism, neglected to consider human nature. If you have no incentive to work, you don’t. If sleeping in and making babies still gets you fed and clothed, why work?

On the other side, if you work hard, only to see your hard work go to benefit your lazy neighbor, sleeping in and rattling the headboard, but never doing anything productive, why bother?

It didn’t take long for the Pilgrims to notice this tragedy of government wasn’t working.

The strong, or man of parts, had no more in devission of victails and cloaths, then he that was weake and not able to doe a quarter the other could; this was thought injuestice. The aged and graver men to be ranked and equalised in labours, and victails, cloaths, etc., with the meaner and yonger sorte, thought it some indignite and disrespect unto them. And for mens wives to be commanded to doe servise for other men, as dresing their meate, washing their cloaths, etc., they deemd it a kind of slaverie, neither could many husbands well brooke it. Upon the poynte all being to have alike, and all to doe alike, they thought them selves in the like condition, and ove as good as another; and so, if it did not cut of those relations that God hath set amongest men, yet it did at least much diminish and take of the mutuall respects that should be preserved amongst them.

It didn’t take long before nobody was working. Neighbors resented each other, because everyone had a right to the work of the other, with no need to compensate each other. That’s a case of “I’m starving because you aren’t working hard enough, but it’s not my fault you’re starving.”

At one point, the production of the colony was down so much that the colonists’ ration of corn was just 4 kernels per day. That’s how you kill a colony.

But they learned from their mistakes before they all died.

Yet notwithstanding all those reasons, which were not mine, but other mens wiser then my selfe, without answer to any one of them, here cometh over many quirimonies, and complaints against me, of lording it over my brethern, and making conditions fitter for theeves and bondslaves then honest men, and that of my owne head I did what I list. And at last a paper of reasons, framed against that clause in the conditions, which as they were delivered me open, so my answer is open to you all. And first, as they are no other but inconvenientes, such as a man might frame 20. as great on the other side, and yet prove nor disprove nothing by them, so they misse and mistake both the very ground of the article and nature of the project. For, first, it is said, that if ther had been no divission of houses and Lands, it had been better for the poore. True, and that showeth the inequalitie of the condition; we should more respecte him that ventureth both his money and his person, then him that ventureth but his person only.

The slavery of working for the benefit of others didn’t work, unless you were “theeves and bondslaves”. Then, it was great, living off of the sweat of others.

To make a long story short, the starvation ended when the Pilgrims were given parcels of land and told they could keep what they built from it. They went from the edge of extinction to being prosperous in a short time. The old and weak were cared for, not by the governor’s decree, but by the generosity of their neighbors.

Everybody in the colony won.

Whiners

I have a lot of friends and family in different financial stages in their lives. Some are deeper in debt than I am, others are just starting to dig their own pit, still others have paid off every cent of debt they’ve ever used. That’s okay; as they say, it takes all kinds to make the world go round.

Out of all of those, the only ones who irritate me are the spendthrift whiners. These are the people who spend 28 days a month struggling to make ends meet and complaining about how hard their lives are. They make snide comments about how easy other people have it, and act like they are being cheated out of their birthright whenever anybody does anything fun that they can’t do because they are too broke.

The other two days—or sometimes three—of the month, are payday. These are the days the the spendthrift whiners try to make themselves feel rich for 24 hours, while wondering why you aren’t willing to hit the fancy restaurants and expensive vacations with them. This is the day they will buy a dozen moves, or a new home theater system, or a big screen TV. It’s the day they will drop a non-refundable deposit on an exotic vacation, or shop for a new car. Before they know what’s happening, the money is gone and they are broke again until next payday, condemned to whining about their horrible situation, while their spendthrift-whiner friends and neighbors complain about the injustice of having to go without luxuries while our hypothetical spendthrift whiners have a big screen TV and an exotic vacation to Dubuque booked.

These people give no thought to the future. Their life savings consist of depreciating electronics and a fancy scrapbook. What do they do when life catches them by surprise? They come begging for a loan, or charge the emergency to a credit card while complaining about the cost of interest. Ultimately, everyone who plans ahead and sets some money aside is obviously trying to rip them off, because nobody can actually do well for themselves without being crooked.

They are absolutely convinced that life is too hard to succeed, and they refuse to examine their own behavior to find the cause of their problems.

Until payday.

What’s your biggest financial pet peeve?

This was originally a guest post written for a blog swap run by the Yakezie personal finance blog network to answer the question “What is your biggest financial pet peeve?“ It ran on Faith and Finance.