- @fcn Yahoo Pipes into GReader. 50 news sites filtered to max 50 items/day–all on topic. in reply to fcn #

- @fcn You can filter on keywords, so only the topics you care about come through. in reply to fcn #

- It's a sad day when you find out that your 3 year old can access anything in the house. Sadder when she maces herself with hairspray. #

- 5 sets of 15 pushups to start my day. Only 85 to go! Last 5 weren't as good as first 5. #30DayProject #

- What happens to your leftover money in your flex-spending account? http://su.pr/9xDs6q #

- Enter to Win iPod Touch from @DoughRoller http://tinyurl.com/y8rpyns #DRiPodTouch #

- Arrrgh! 3 year old covered in nail polish. And clothes. And carpet. And sister. #

- Crap. 5 sets of 5 pushups. #30dayproject #

- Woo! My son just got his first pin in a wrestling meet! #

- RT @Doughroller: Check out this site that gives your free credit report AND score without asking for a cc# or social… http://bit.ly/bRhlMz #

- Breaking news! Penicillin cures syphilis, not debt. https://liverealnow.net/KIzE #

- Win a $25 Amazon GC via @suburbandollar RT + Fllw to enter #sd1Yrgvwy Rules -> http://bit.ly/sd1Yrgvwy2 #

- This won't be coming to our house. RT @FMFblog: Wow! Check out the new Monopoly: http://tinyurl.com/ygf2say #

- @ChristianPF is giving away a Flip UltraHD Camcorder – RT to enter to win… http://su.pr/2ZvBZL #

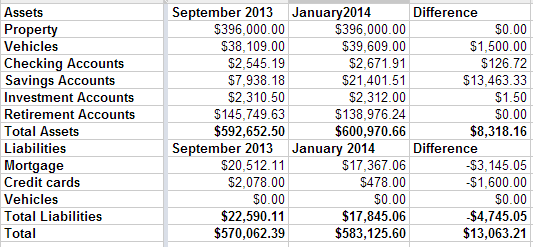

Net Worth Update – January 2014

This may be the most boring type of post I write, but it’s important to me to track my net worth so I can see my progress. We are sliding smoothly from debt payoff mode to wealth building mode.

Our highlights right now are nothing to speak of. We did let our credit card grow a little bit over the last couple of months, but paid it off completely at the end of December. It grew mostly as a matter of not paying attention while we were doing our holiday shopping and dealing with some car repairs.

That’s it. We haven’t remodeled our bathrooms yet, but we have the money sitting in a savings account, waiting for the contractor. We haven’t bought a pony yet, but we did decide that a hobby farm wouldn’t be the right move for us. We’ll be boarding the pony instead of moving, at least for the foreseeable future.

Our net worth is up $13,000 since September. Our savings are up and our retirement accounts are down because there are two inherited IRAs that we need to slowly cash out and convert to regular IRAs.

Meal Plans

- Image by Getty Images via @daylife

When we don’t have a meal plan, food costs more.

Our regular plan is to build a menu for the week and go to the grocery store on Sunday. This allows planning, instead of scrambling for a a meal after work each night. It also give us a chance to plan for leftovers so we have something to eat for lunch at work.

We work until about 5 every weekday. When we don’t have the meal planned, it’s usually chicken nuggets or hamburger helper for dinner. Not only is that repetitive, but it’s not terribly healthy. It is, however, convenient. If we plan for it, we can get the ingredients ready the night before and know what we are doing when we get home, instead of trying to think about it after a long day of work.

If we don’t plan for leftovers, we tend to make the right amount of food for the family. When this happens, there’s nothing to bring to work the next day, which means I’ll be hungry about lunchtime with nothing I can do about it except buy something. Buying lunch is never cheaper than making it. I can get a sandwich at Subway for $5, but I could make a sandwich just as tasty and filling for less than half of that, using money that is meant to be used for food. All during wrestling season, we make 30-inch sandwiches on meet nights for a cost of about $5, feeding ourselves and at least a couple of others who didn’t have time to make their dinner before the 5:30 meet.

No leftovers also means no Free Soup, which is a wonderful low-maintenance meal that leaves everybody full. Nobody ever gets bored of Free Soup. (Hint: Don’t ever put a piece of fish in the Free Soup, or the flavor will take over the entire meal.)

Unhealthy, repetitive food for dinner. Over-priced, low-to-middle-quality food for lunch.

OR

We plan our meals right and have inexpensive, healthy food that doesn’t get boring for every meal.

It seems to be a no-brainer. Except, I don’t have lunch today because we didn’t plan our meals and used the last of the leftover hamburger helper for dinner last night.

Update: This post has been included in the Carnival of Personal Finance.

Dreams

Ever since she was a little girl, my wife has wanted to be a horse. Err, work with horses.

The problem is that most jobs working with horses pay horse-crap. It’s hard to raise a family on a stablehand’s income.

Her alternative was to own horses. This comes with a different set of problems. The biggest problem is that we live on 1/8 of an acre in a first-ring suburb. That’s not a lot of room to graze, though I would be willing to give up my spot in the garage.

I rock like that.

Boarding a horse costs a minimum of $200 per month. Two girls means two horses, otherwise, they won’t both be able to score in the saddle club. For the math challenged, that’s $400 per month, plus about $300 in preventative vet care per year.

$5100 for a year of boarding an extremely obsolete car.

Then, you need a trailer to get the horse to shows. You need saddles and reins and and short-legged stirrups and feedbags and muck-rakes and brushes and combs and hoof-cleaning-thingies and other stuff that will catch me by surprise for years to come.

Expensive.

My rough estimate is that it costs at least $10,000 to get into horse ownership, and that’s not counting the horse itself.

You can buy a horse for well under $1000 if you aren’t concerned about registration or speed. A 15 year old horse can last 10-15 more years, so it’s not money down the drain.

That’s $12,000 to get in and $5100 per year to stay in. Minimum.

Never let it be said that I’m not a pushover. Last month, we bought an SUV that can pull a horse trailer. Last weekend, we bought the trailer. That’s two major steps towards making my wife’s dreams come true. The rest of the plan culminates in a hobby farm in the sticks.

There are several steps in between.

I just need to put the brakes on every other step. We’ve been offered the free use of one pony next season, and we may be able to get another for the same price. Beyond that, we need to be patient. There will be no ponies purchased until the new truck and old mortgage are paid.

Period.

Healthcare.gov: Is this failure a warning of what’s to come?

The official launch of online registration for government healthcare has been rife with disastrous glitches from the very beginning. This cataclysmic failure has spurred severe service outages across the country, and this chronically dysfunctional interface serves as foreshadowing for an epidemic of systematic organizational deficiencies. Healthcare.gov is only the first in a series of planned bureaucratic catastrophes.

The Internet Errors

The requirement of preemptive registration resulted in a complete system crash. The ability to input health data was also starkly limited. Security issues also seemed evident as certificates failed to show updated validations, and there was no indication of where confidential information would be stored.

Lack of Foresight and Oversight

The decision to mandate initial registration was a hastily made last-minute change that failed to consider the magnitude of public interest. This unfortunately coincided with a government shutdown, which left limited federal resources available to respond to claims of malfunctioning servers. The biggest mistake made by the Department of Health and Human Services was underestimating the massive influx of uninsured applicants.

To further complicate woes, a chief contractor behind the layout of healthcare.gov is expected to testify that additional time and money could not have salvaged the doomed enlistment effort. His official testimony will shed light on administrative laziness, and the legislative committee is expected to issue serious reprimands, but nothing will recompense the thousands of individuals deprived access to healthcare registration on the date promised to them years in advance. These problems were completely avoidable, but the team in place refused to promptly pay attention.

Proposed Solutions

The Obama Administration has conveniently remained mum on the topic of minor adjustments to the healthcare law, but Congressional Democrats have proposed implementing small delays to the overall roll-out. The dates for enforcing the individual mandate have become a focal point of discussions to modify Obamacare. Because citizens were not given feasible access to the online enrollment system, it would be unconstitutional to levy fines for their lack of registration.

The Foreboding Warning

If politicians cannot even tackle basic website programming, then they should not be trusted to manage the well-being of millions of Americans. Partisan divisions have made two factions that are fully noncoalescent, which means all future fixes will be the result of an incomplete compromise between two warring parties. Real health concerns have been forgotten by the incessant squabbling of politicians in their ivory towers. This means that every new initiative will only cause further societal strife and struggle. Members of Congress have expanded the breadth of their authority without grasping the technological realm. As a consequence, these politicians will continue overextending the limits of their power, and the public will be left to pick up the pieces.

Rental Property Update

As I’ve mentioned before, we are fixing up the house we inherited in April to rent it out.

We already have renters lined up starting in February. My wife has known the couple for several years, so we’re not worried about strangers wrecking the place. We will be doing a lease, because skipping that is dumb, even if you know the tenants. They will be paying $1200 per month, plus electric, water, and garbage. We’ll be covering gas and–of course–property taxes. We’re paying the gas bill because we’re going to have most of the appliances on the repair plan through the gas company so we won’t have to worry about appliances breaking.

Those expenses will run about $325 per month, leaving $875 as profit. We’ll probably save another $200 of that to cover future vacancies and for property issues that I’m not foreseeing, leaving $675 to save and invest.

Over the summer, we have spent quite a bit of money fixing the place up.

- Dumpsters x3, $1200. Did I mention my mother-in-law was a hoarder?

- New boiler, $4500.

- Electrical repair, including running power to the garage, $1400.

- Plumbing & gas repair, $900.

- New stove & refrigerator, $1000.

- Landscaping, $2500.

- Other repairs, $8000.

So far, we have spent about $19,500 fixing this place up. There is still a bit of work left to do.

Are we done?

Crap, no.

- We have two rooms of stuff that we need to research and price individually before we sell. This includes some old cameras, typewriters, and collectibles.

- We need to buff and polish the hardwood floors that are in surprisingly good shape.

- We have to scrub the entire house. Cobwebs and mouse crap show up in interesting places when 90% of your house is buried for most of 30 years.

- We have to clean the last of the debris out of the basement. This, and some other stuff, will mean yet another dumpster.

- We have to paint walls and ceilings all over the house and the basement floor.

The to-do list will come with a price tag somewhere between $1000 and $1500.

That comes out to about $21,000 spent to make $675 per month. In just 3 years, the property will be turning a profit, then it becomes an actual profit center for us, hopefully forever. The expenses are all tax deductible, but only as depreciation, which means the cost has to get deducted a bit at a time over the course of the next 5 to 30 years.

On the other hand, we could probably sell the place for $200,000. It’s going to take 25 years of renting to make up that difference.