- RT @Dave_Champion Obama asks DOJ to look at whether AZ immigration law is constitutional. Odd that he never did that with #Healthcare #tcot #

- RT @wilw: You know, kids, when I was your age, the internet was 80 columns wide and built entirely out of text. #

- RT @BudgetsAreSexy: RT @FinanciallyPoor "The real measure of your wealth is how much you'd be worth if you lost all your money." ~ Unknown #

- Official review of the double-down: Unimpressive. Not enough bacon and soggy breading on the chicken. #

- @FARNOOSH Try Ubertwitter. I haven't found a reason to complain. in reply to FARNOOSH #

- Personal inbox zero! #

- Work email inbox zero! #

- StepUp3D: Lame dancing flick using VomitCam instead or choreography. #

- I approve of the Nightmare remake. #Krueger #

Corporate Bankruptcy Hurts Employee’s Most

This is a guest post from Hunter Montgomery. He writes for Financially Consumed on every-day personal finance issues. He is married to a Navy meteorologist, proud father of 3, a mad cyclist, and recently graduated with a Master’s degree in Family Financial Planning. Read his blog at financiallyconsumed.com.

Bankruptcy has evolved from something that people and businesses were deeply ashamed of a few decades ago, to a seemingly acceptable path to restructuring; towards a more sustainable future. Bankruptcy is so common in corporate America that it is referred to by some as an acceptable and necessary business tool.

This bothers me on a number of levels, but mainly because corporate bankruptcies hurt the humble employee the most. The laws are supposedly designed to help the company stay in business, and continue to provide jobs. But at what cost to those employees?

When a company declares bankruptcy, they are essentially admitting to the world that they failed to compete. Their business model was flawed, they were poorly managed, and they simply did not organize their resources appropriately to meet their consumer needs.

Given this failure, it shocks me, that bankruptcy laws are designed to allow management to get together with their bankers. They essentially protect each other. Management is obsessed with holding on to power. The bankers are obsessed with avoiding a loss.

The bankruptcy produces a document called first-day-orders. This is a blueprint for guiding the organization towards future prosperity. But this is essentially drafted by the existing company management, and their bankers. Do you see any conflict of interest emerging here?

Bankers are given super-priority claims to the money they have loaned the company. Even before employee pension fund obligations. This is absurd. Surely if they loaned money to an enterprise that failed, they deserve to lose their money.

Management generally rewards itself with large bonuses, after declaring failure, paying off their bankers, shafting the employees, and finally re-emerging with a vastly smaller company. This is ridiculous.

The humble employee pays the highest price. Assuming there is even a job to return to after restructuring they have likely given up pay, working conditions, healthcare benefits, and pension benefits.

This is exactly what happened at United Airlines in 2002 after they filed for chapter 11 bankruptcy protections. The CEO received bonuses, and was entitled to the full retirement package. The banker’s enjoyed super-priority claims over company assets to cover their loans. Meanwhile, the employees lost wages, working conditions, healthcare benefits, and a 30% reduction in pension benefits.

An adjustment like this would force a serious re-evaluation of retirement plans. For most people, it would require additional years in the workforce before retirement could even be considered a real possibility.

Employees of General Motors, which recently went through bankruptcy proceedings, also had to give up significant healthcare benefits, and life insurance benefits. Entering bankruptcy, it was the objective to reduce retiree obligations by two-thirds. That’s a massive cut.

The warning to all of us here is that we must do everything possible not to fall victim to corporate restructuring. Save all you can, outside of your expected pension plan, because you never know when poor management, or a terrible economy, will force your employer to file bankruptcy. Always plan for the worst possible outcome.

It’s a competitive world and it’s quite possible that the traditional American system of benefits is uncompetitive, and unsustainable in the global market place. The tragedy of adjusting to a more sustainable system is that the employee suffers the most.

Megan Fox’s Little One: The First Year Costs of Having a Baby

If you can’t get enough of Megan Fox like everybody else, you probably already know that paparazzi has spotted her with a new and conspicuous belly bump. The steamy star already gave birth to a beautiful baby boy named Noah in 2012, but she also expressed a desire to have more children in the future. We just didn’t think that it would happen this soon. Luckily, Megan is blessed with celebrity wealth, so funding another newborn shouldn’t be too much of a problem. Unfortunately, most new mothers aren’t celebs. If you are a new or expecting mother, prepare yourself for your bundle of joy by familiarizing yourself with first year expenses and ways to save money.

What are the first year costs of caring for a baby?

Babies are expensive. How expensive, you ask? Well, that depends on your standard of living. It’s a pretty good bet that Megan Fox will dish out more dough on her newborn than most people have the ability to. Baby Gucci just isn’t on the shopping list for mothers who live from paycheck to paycheck. However, the essentials are already expensive enough to make most moms have a panic attack. A 2010 USDA report suggests that a typical American family spends about $12,000 during the first year on a baby. These days, that number is probably closer to $15,000.

What will most of the money go towards?

There are two major items that are an absolute must for a baby: formula/baby food and diapers. Expect to shell out about $50 per week on these things alone. That’s nearly $2,500 per year. Another big portion of your baby expenses will comprise of pricier one-time purchases including a baby stroller, crib, car seat, etc. The rest of the funds will likely go to baby clothes, childcare, and medical expenses.

How can I save money?

There are countless ways to cut the costs of having a baby, but you need to get creative to maximize your savings. If you want to have a fatter wallet at the end of that first year, here are some of the easiest and most effective ways to do so.

Take free samples during the initial hospital stay

Many baby product manufacturers supply maternity wards with free samples, but nurses sometimes forget to hand them out. Remember to ask about these samples after giving birth, and bring home as much as they will allow. You can snag useful items like: diapers, diaper bags, baby lotion, swaddling cloths, disposable bottle nipples, alcohol swabs, a thermometer, a nasal aspirator and more.

Breastfeed

A mother’s milk is the healthiest food option for a growing baby because it contains nutrients not found in many baby formulas. Since formula can be very expensive, you will save a ton of money and give your child the best nutrition possible by breastfeeding.

Get oversized baby clothes or use hand-me-downs

Babies grow at an amazingly fast rate, so always buy clothes of a bigger size. If you have close friends or family members who’ve already had a child, ask if you can use their old baby clothes.

Buy diapers, formula, and other commonly used supplies in bulk

Like with most consumer goods, you will pay less if you buy more. Stock up on the essentials early on if you don’t want to waste your money in the long run.

Related articles

Brown Bagging Your Way to Savings

Today’s post is written by Mike Collins of http://savingmoneytoday.net as part of the Yakezie Blog Swap in which bloggers were asked to share their best day to day money saving tip.

Do you buy lunch at work every day? Have you ever actually sat down and added up how much money you’re spending?

I did once…and I almost fell out of my chair when I saw how much I was spending!

Back in the day I used to buy lunch at the office almost every single day. It certainly didn’t seem like I was spending much. A chef salad here, a cheese steak and fries there. But every day I was spending about 7 dollars and change. That’s $35 a week, which adds up to a whopping $1820 over the course of a year!

I started thinking about all the things I could do with that extra $1820, like paying off some of our debt, increasing my 401k contributions(ed: but staying with your 401k contribution limits, of course!), picking out a new big-screen tv, or enjoying an extended family vacation at Walley World.

I immediately starting bringing my lunch to work 4 days a week (I do treat myself once a week) and I’ve been saving money ever since.

Now I know what you’re thinking. It costs money to bring lunch from home too right?

Yes, of course it does…but nowhere near as much as eating out every day. Let’s do some basic math to prove the point. Say you swing by the grocery store to buy some ham and cheese so you can make sandwiches for the week. You pick up a half pound of ham for $3 and a half pound of cheese for $2. A loaf of bread on sale runs you another $2. That means you just spent $7 for a week’s worth of lunches. Even if you only bring lunch 4 days a week you’ve still saved yourself $21. That’s over $1000 a year!

And here’s a tip to save even more: If you have extra food from dinner, just bring the leftovers for lunch the next day. We always try to make just a little bit extra so I can have free lunch the next day.

So the next time you’re sitting around complaining that you don’t have enough money for so and so, think about how much money you are spending every day on lunch, or coffee, or cigarettes, etc. You might just find that you have plenty of money after all if you just shift your priorities a bit.

The Obligatory Thanksgiving Post

Tomorrow is Thanksgiving. Tomorrow is also Thursday, and I don’t post on Thursdays, so I’ll be posting about Thanksgiving today.

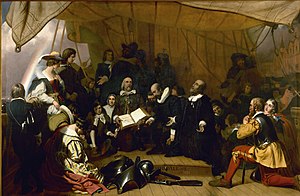

Thanksgiving is a day to be thankful for–first and foremost–capitalism.

When the Pilgrims first landed, they set up a communal farming arrangement, figuring that a good Christian community could take care of its own. From each according to his ability, to each according to his need, and all that. Everyone worked for the good of everyone else, so everyone benefited, right?

The Pilgrims, like every other group that has ever advocated communism, neglected to consider human nature. If you have no incentive to work, you don’t. If sleeping in and making babies still gets you fed and clothed, why work?

On the other side, if you work hard, only to see your hard work go to benefit your lazy neighbor, sleeping in and rattling the headboard, but never doing anything productive, why bother?

It didn’t take long for the Pilgrims to notice this tragedy of government wasn’t working.

The strong, or man of parts, had no more in devission of victails and cloaths, then he that was weake and not able to doe a quarter the other could; this was thought injuestice. The aged and graver men to be ranked and equalised in labours, and victails, cloaths, etc., with the meaner and yonger sorte, thought it some indignite and disrespect unto them. And for mens wives to be commanded to doe servise for other men, as dresing their meate, washing their cloaths, etc., they deemd it a kind of slaverie, neither could many husbands well brooke it. Upon the poynte all being to have alike, and all to doe alike, they thought them selves in the like condition, and ove as good as another; and so, if it did not cut of those relations that God hath set amongest men, yet it did at least much diminish and take of the mutuall respects that should be preserved amongst them.

It didn’t take long before nobody was working. Neighbors resented each other, because everyone had a right to the work of the other, with no need to compensate each other. That’s a case of “I’m starving because you aren’t working hard enough, but it’s not my fault you’re starving.”

At one point, the production of the colony was down so much that the colonists’ ration of corn was just 4 kernels per day. That’s how you kill a colony.

But they learned from their mistakes before they all died.

Yet notwithstanding all those reasons, which were not mine, but other mens wiser then my selfe, without answer to any one of them, here cometh over many quirimonies, and complaints against me, of lording it over my brethern, and making conditions fitter for theeves and bondslaves then honest men, and that of my owne head I did what I list. And at last a paper of reasons, framed against that clause in the conditions, which as they were delivered me open, so my answer is open to you all. And first, as they are no other but inconvenientes, such as a man might frame 20. as great on the other side, and yet prove nor disprove nothing by them, so they misse and mistake both the very ground of the article and nature of the project. For, first, it is said, that if ther had been no divission of houses and Lands, it had been better for the poore. True, and that showeth the inequalitie of the condition; we should more respecte him that ventureth both his money and his person, then him that ventureth but his person only.

The slavery of working for the benefit of others didn’t work, unless you were “theeves and bondslaves”. Then, it was great, living off of the sweat of others.

To make a long story short, the starvation ended when the Pilgrims were given parcels of land and told they could keep what they built from it. They went from the edge of extinction to being prosperous in a short time. The old and weak were cared for, not by the governor’s decree, but by the generosity of their neighbors.

Everybody in the colony won.

How to Save

Saving is hard. For years, we would either not save at all, or we’d save a bit, then rush to spend it. That didn’t get us very far. Years of pretending to save like this left us with nothing in reserve. Finally, we’ve figured out the strategy to save money.

First and foremost, make more than you spend. This holds true at any level of income. If you don’t make much money, then you need to not spend much, either. Sometimes, this isn’t possible under current circumstances. In those cases, you need to either increase your income or decrease your expenses. Cut the luxuries and pick up a side hustle. The wider the gap between your bottom line and your top line, the easier it is to save.

Next, make a budget and stick to it. There is no better way to track both your income and your expenses. I’ve discussed budgets before, so I won’t address that in detail today. Short version: Make a budget. Use any software you like. Use paper if you want. Make it and use it.

Pay yourself first. The first expense listed on your budget should be you. Save first. If you can’t afford to save, you can’t afford some of the other items in your budget. Cut the cable or take the bus, but save your money. Without an emergency fund, your budget is just a empty dream when something unexpected comes up. And something unexpected always comes up.

Automate that payment to yourself. Don’t leave yourself any excuse not to make that payment. Set up an automated transfer to another bank and forget about it. Schedule the transfer to happen on payday, every payday.

Now comes the hard part: Forget about the money. Don’t check your balance. Don’t think about it in any way. Just ignore it. For the first month or two, this will be difficult. After that, you’ll forget it exists for a few months and come back amazed at how much you’ve saved.

If you don’t forget about it, and you decide to dip into the account, you are undoing everything you’ve worked so hard to save. Do yourself a favor and leave the money alone.