- Guide to finding cheap airfare: http://su.pr/2pyOIq #

- As part of my effort to improve every part of my life, I have decided to get back in shape. Twelve years ago, I wor… http://su.pr/6HO81g #

- While jogging with my wife a few days ago, we had a conversation that we haven’t had in years. We discussed ou… http://su.pr/2n9hjj #

- In April, my wife and I decided that debt was done. We have hopefully closed that chapter in our lives. I borrowed… http://su.pr/19j98f #

- Arrrgh! Double-posts irritate me. Especially separated by 6 hours. #

- My problem lies in reconciling my gross habits with my net income. ~Errol Flynn #

- RT: @ScottATaylor: 11 Ways to Protect Yourself from Identity Theft | Business Pundit http://j.mp/5F7UNq #

- They who are of the opinion that Money will do everything, may very well be suspected to do everything for Money. ~George Savile #

- It is an unfortunate human failing that a full pocketbook often groans more loudly than an empty stomach. ~Franklin Delano Roosevelt #

- The real measure of your wealth is how much you'd be worth if you lost all your money. ~Author Unknown #

- The only reason [many] American families don't own an elephant is that they have never been offered an elephant for [a dollar down]~Mad Mag. #

- I'd like to live as a poor man with lots of money. ~Pablo Picasso #

- Waste your money and you're only out of money, but waste your time and you've lost a part of your life. ~Michael Leboeuf #

- We can tell our values by looking at our checkbook stubs. ~Gloria Steinem #

- There are people who have money and people who are rich. ~Coco Chanel #

- It's good to have [things that money can buy], but…[make] sure that you haven't lost the things that money can't buy. ~George Lorimer #

- The only thing that can console one for being poor is extravagance. ~Oscar Wilde #

- Money will buy you a pretty good dog, but it won't buy the wag of his tail. ~Henry Wheeler Shaw #

- I wish I'd said it first, and I don't even know who did: The only problems that money can solve are money problems. ~Mignon McLaughlin #

- Mnemonic tricks. #

- The Wilbur and Orville Wright Papers http://su.pr/4GAc52 #

- Champagne primer: http://su.pr/1elMS9 #

- Bank of Mom and Dad starts in 15 minutes. The only thing worth watching on SoapNet. http://su.pr/29OX7y #

- @prosperousfool That's normal this time of year, all around the country. Tis the season for violence. Sad. in reply to prosperousfool #

- In the old days a man who saved money was a miser; nowadays he's a wonder. ~Author Unknown #

- Empty pockets never held anyone back. Only empty heads and empty hearts can do that. ~Norman Vincent Peale #

- RT @MattJabs: RT @fcn: What do the FTC disclosure rules mean for bloggers? And what constitutes an endorsement? – http://bit.ly/70DLkE #

- Ordinary riches can be stolen; real riches cannot. In your soul are infinitely precious things that cannot be taken from you. ~Oscar Wilde #

- Today's quotes courtesy of the Quote Garden http://su.pr/7LK8aW #

- RT: @ChristianPF: 5 Ways to Show Love to Your Kids Without Spending a Dollar http://bit.ly/6sNaPF #

- FTC tips for buying, giving, and using gift cards. http://su.pr/1Yqu0S #

- .gov insulation primer. Insulation is one of the easiest ways to save money in a house. http://su.pr/9ow4yX #

- @krystalatwork It's primarily just chat and collaborative writing. I'm waiting for someone more innovative than I to make some stellar. in reply to krystalatwork #

- What a worthless tweet that was. How to tie the perfect tie: http://su.pr/1GcTcB #

- @WellHeeledBlog is giving away 5 copies of Get Financially Naked here http://bit.ly/5kRu44 #

- RT: @BSimple: RT @arohan The 3 Most Neglected Aspects of Preparing for Retirement http://su.pr/2qj4dK #

- RT: @bargainr: Unemployment FELL… 10.2% -> 10% http://bit.ly/5iGUdf #

- RT: @moolanomy: How to Break Bad Money Habits http://bit.ly/7sNYvo (via @InvestorGuide) #

- @ChristianPF is giving away a Lifetime Membership to Dave Ramsey’s Financial Peace University! RT to enter to win… http://su.pr/2lEXIT #

- @The_Weakonomist At $1173, it's only lost 2 weeks. I'd call it popped when it drops back under $1k. in reply to The_Weakonomist #

- @mymoneyshrugged It's worse than it looks. Less than 10% of Obama's Cabinet has ever been in the private sector. http://su.pr/93hspJ in reply to mymoneyshrugged #

- RT: @ScottATaylor: 43 Things Actually Said in Job Interviews http://ff.im/-crKxp #

- @ScottATaylor I'm following you and not being followed back. 🙁 in reply to ScottATaylor #

Daytrading Bitcoin and Cryptocurrency

For the past 6 weeks, I’ve been playing with Bitcoin and Litecoin.

I can hear you from across the internet. You’re asking, “What the hell is Bitcoin?”

I’m glad you asked. It’s a cryptocurrency.

And now you know as much as you did before.

Cryptocurrencies are anonymous internet-based money. You spend it just like money, though granted, there are fewer places that accept cryptocurrency.

The big name in cryptocurrency is Bitcoin. In second place, trying to play silver to Bitcoin’s gold, is Litecoin.

So what do I mean by “playing with” Bitcoin and Litecoin?

I’ve been daytrading, which is generally a horrible idea…when you’re doing it with stocks. Daytrading is gambling. It’s the art of doing short-term flips on a stock. You buy it today to sell tomorrow, hoping it goes up. With stocks, I play a long game. I buy and hold. I buy a stock that I believe has long-term value, and I hold it for months or years.

That’s not the game I play with BTC and LTC. I play a short game, rarely longer than a week. When the coins are at a low price, I buy, then I immediately sell when they price is higher. When it’s high, I short the coin, essentially selling coins I don’t own to trade back when the dollar-price is lower. When I’m paying attention, I make money as the coins go up and I make money when the coins go down.

Why is this a good strategy for cryptocoins?

Because they are extremely volatile. As I’m writing this, Litecoin has had a 10% swing today, from $4.03 at midnight, to a current price of $4.16, with a peak of $4.36. On Thursday, it was floating around $4.60 all day. In the last 30 days, it’s been as high as $8.65 and as low as $3.18. Go back to May and the low is $1.29.

Traditional wisdom says that volatile investments are bad. In traditional investments, that’s true. But when a stock is this volatile, nearly every bet is a good one, as long as you’re patient. If I buy LTC at $4.20 and it drops to $3.90, that’s bad. I lost money. But, if I wait a couple of days, it’s almost definitely going to climb back up. Except for large-scale sell-offs, it’s usually going to bounce 10% in a given day. You can buy in the dips and sell at the peaks all day long, turning 5-10% profits with each time. If you’re brave or stupid, you can short at the peaks and make 5-10% on every downturn, too.

For example, today started at $4.03. Buy. Today’s peak was at 7:15AM at $4.36. When the graphs start swinging down, sell short. Two hours later, it bottomed out at $4.20 for a 4% return. Then, buy while it’s low. Ninety minutes later, it was at $4.31, another 3% return. Short it again, then close the position at 7PM for $4.13.

Let’s walk through this.

Buy $10 worth of Litecoin at midnight, sell at 7:15AM. You have $10.81.

Turn around and short the same amount until 9AM. You have $11.22.

Buy that same amount to sell at 10:30AM. You have $11.51.

Short it again before closing out at 7PM and going to bed. You have 12.01. That’s almost a 12% return in 12 hours, assuming you guessed all of the major swings right. If you guessed some wrong, you’d just have to wait until the next time it swung your way, and it will. Did I do that well? No. I bought in at $4.008 yesterday and sold today-once-for $4.32. I will not complain at an 8% return over 12 hours.

The only exception to that is during major buying and selling streaks. On July 5th, a major buying run started. By July 8th, the price was run up to $8.65. A huge sell-off happened then, dropping the price to $4.36 on July 9th.

If you bought at $8.65 you’d be hosed.

The lesson there is, don’t buy at the peak. I’ve had a number of trades that could have been huge scores if I would have held onto them longer, but I’m a wimp. I sell as soon as I’ve gotten enough money to make me smile, then I refuse to regret the decision. That also prevents me from holding on to my positions too long. I avoid all of the crashes that way. That giant buy-in happened while I was on vacation, so I wasn’t paying attention. When I’m not paying attention, I leave my money in US dollars, so there’s no risk…and also no reward.

Also, an important caveat: while I am learning the cryptocurrency ropes, I’m playing with a non-critical amount of money. I put $75 into the exchange in June. Not enough to cry over losing, but enough I can play with all of the different investment options. As I said, I’m a wimp, although a 30% return in 7 weeks is pretty sweet.

Next up, I’ll show you how to get started investing/gambling with Bitcoin.

I Smell a Scam

I hate scammers. Whether it’s the garage-sale shoplifter, telemarketing “charities” with 99% overhead, 3-card-monte

dealers, or the guy who begs Grandma for cash every week, they all need to be strung up. Since vigilante justice is generally illegal and occasionally immoral, it’s best to just avoid the problems from the start. Here are some scams to watch out for.

Pyramid Scams – All of the little parties people throw to earn free items at the expense of their friends are pyramid schemes. Most of those are legitimate money-sinks. A few, however, exist solely to get their “consultants” to bring in more consultants. The sales aren’t the actual way to make money. If you don’t have anyone “downstream” you won’t make any money. If the focus isn’t on selling an actual product or service, but is instead on bringing in people under you, you have entered the world of pyramid scams. Generally illegal and always immoral. Don’t sign up and, if you do, don’t ask me to participate.

Advance Fees and Expensive Prizes – If you win a contest and you are expected to send money to claim your prize, it is a scam. You don’t have to pay sales tax in advance. You don’t have to pay transfer fees. Real prizes are delivered free, accompanied by a 1099, because prizes are income. No prize requires pre-payment. No loan service requires “finder’s fees”. If it doesn’t sound right, don’t pay it and certainly don’t give your bank information to anyone you can’t verify.

Work at Home – The most common work-at-home job I’ve found is stuffing envelopes. You see the signs on telephone poles all over the city. “Make $10/hour stuffing envelopes from the comfort of your own home! Just send $50 to….” When you get the instructions, you are told to hand up signs telling people to send you $50 for instructions on how to make $10/hour stuffing envelopes. Everybody is feeding off of everybody else.

Charity – Never give money to a charity over the phone. Always take the time to verify where you are sending your money. Some freak may call to tug on your heartstrings with a sob story, but you don’t have to give them money. At least ask them to send it in writing so you can do some checking, first.

Phishing – Simply put, don’t click on any link in any email, unless you know where it is going. If it is a link to a financial institution, go enter the address into the address bar yourself. If you find yourself on a site you don’t recognize, don’t give them your personal information and don’t ever reuse your usernames and passwords. If you do, one bad site could get access to everything you do online.

[ad name=”inlineleft”]Foreign Lottery – To be clear, Spain did not just hold a international lottery and randomly draw your email address. No lottery in the world works that way. If you didn’t enter the lottery while you were in Spain, you aren’t going to win it. The scam is that you need to provide your bank information, including a number of release forms so the scammers can transfer money to you. In reality, you are signing over control of your account and will be wiped out.

Nigerian/419 Emails – Ex-Prince WhateverHisNameIs wants your help to get his fortune out of WhereverHeIsFrom. The New Widow Ima F. Raud has an inheritence that she won’t live long enough to spend. They’ve both been given your name as a trustworthy person to handle the transactions in exchange for a mere $10 million. What friends do you have that would make this seem legitimate? Once again, they will get your bank information and take your money. At a minimum, they will try to get you to pay a few thousand dollars for “Transfer fees”. Don’t do it.

Overpayment by Wire – I had this one attempted on my last week. You sell something online. A potential buyer agrees to purchase the item, sight-unseen. They’ll send a cashier’s check and, after it clears, one of their agents will pick it up. Unfortunately, the buyer’s secretary screwed up and added a zero to the check. Would you mind wiring the overpayment back, minus a small fee for the hassle? The check is bogus and there is no way to verify it. You’ll deposit the check and it will be assumed to be real. The bank will make the funds available well before it comes back as fraud. You’ll see the available funds and send the money by non-refundable Western Union and some thug in Nigeria gets a new iPhone.

Foreclosure Scams – Some scammers try to prey on the vulnerable because they are, well, vulnerable. If you are facing foreclosure, be very careful about where you turn for help. One scam is to get you to sign over your home “temporarily” to clear the title. That doesn’t work, but you won’t find that out until you are handed an eviction notice and told you still owe the money.

Stranded Friends – You get an email from a friend saying he’s in London/Moscow/Sydney/Wherever, and he’s been mugged. He’s got nothing and needs $2500 to get home. Can you help? Do you really have friends close enough to ask for a $2500 international bailout, but not so close they tell you about the vacation ahead of time? Would they really be too timid to call you collect instead of begging for change to use an internet cafe?

Decision Making Made Easy

Have you ever had to make a difficult decision? Not necessarily a decision that’s difficult because it’s life-changing, but a decision that’s difficult because there are two phenomenally wonderful, yet mutually exclusive options?

For example:

- Should you put caramel or strawberry sauce on your ice cream?

- Should you go to Disney Land or Disney World?

- Should you subscribe to Live Real, Now by email or RSS?

- Should you take the job with the stellar benefits package or the higher salary?

These are all real decisions that you may be called on to make.

For most decisions, there are some alternatives that are easy to discard.

MadDog 20/20 isn’t a good alternative to caramel sauce on your ice cream. The local BDSM museum probably isn’t a great choice for a family vacation. Sending me hate mail is obviously worse than subscribing.

Then you’ve got some choices that are both okay, but one is clearly better. You’ve got free airfare and hotel. Do you go to Topeka, or Paris? Neither is horribly, but I think the choice is obvious. You’re going out to dinner. McDonald’s or…nevermind, this fits the first category.

After you’ve discarded the obvious bad choices and the okay-but-not-great choices, how can you decide between what’s left?

This is the point that starts to cause stress. What if you make the wrong choice? What if you regret it forever? What if you’re still not happy? Gridlock.

The reason your stuck is because it’s not apparent which is the better choice. All of your experiences and knowledge are telling you–on some level–that the options are identical in terms of your life, happiness, and goals. It truly does not matter which one you choose. You will probably be equally happy, either way.

Given that it doesn’t matter, you have two choices for making the final decision:

- Pick the one you want. The rational decision is a tie, so make it an emotional one. Does one job match your dreams, but with a bit more risk? Has one vacation destination been a goal since you were little? Do it!

- Flip a coin. If the decision doesn’t matter, leave it to fate. That way, if it doesn’t work out, you can always blame the quarter.

The one thing you don’t want to do is wait. Failing to decide is still a decision and one that is guaranteed to keep you from being satisfied with your choice. Don’t wait until you have all of the possible information, because that kind of perfect world doesn’t exist. Get to about 85% of fully informed and run with it. You’ll usually be happier making a decision–even the wrong one–than sitting back wondering “What if I had done that?”

How do you make hard decisions?

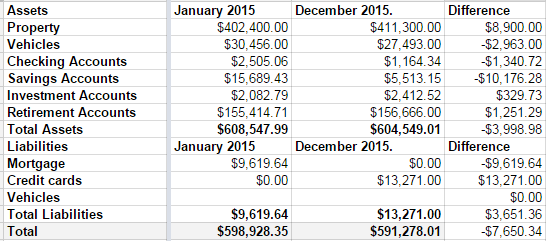

Net Worth and other stuff

This was not a good year for our net worth.

Over the summer, we remodeled both of our bathrooms. At the same time.

1 out of 10: Don’t recommend.

We love the bathrooms, but–as with any project–it went over budget. Sucks to be us.

Then, towards the end of the year, we decided to push hard and pay off our mortgage in 2015. Part of doing that meant paying the credit card off slower than we’d like. It wasn’t the best long-term decision, but we’re mortgage-free now.

Those decision, coupled with a small slump in our investment accounts means we are worth $7650 going into 2016 than we were at the start of 2015.

Disappointing.

I’m also disappointed that our credit card discipline slipped last year.

New plan: No debt before tax day. Every cent of Linda’s paycheck, every cent of my monthly bonus checks, and every cent of any extra money we make is going into the remaining credit card debt. My math says that last debt will die on April 1st.

Then we get to talk about what to do with out money when there’s no debt. But never fear, I have a plan. A boring, boring plan.

- We’re going to save for college at a rate we should have started 10 years ago.

- We’re going to max out both of our retirement plans.

- We’re going to take some nicer family vacations.

- We’re going to buy a pony.

So not that boring.

And when our kids all decide to become certified sign-spinners, we’ll have a huge nest-egg in the college fund savings account to spend on lottery tickets.

Cutting Healthcare Costs

It’s not a secret that health care can be expensive. Many people pay two and three digit bills for their prescriptions. A visit to the doctor’s office can hurt the budget. Glasses cost hundreds of dollars? How can you cut this cost?

Drugs

If possible, go generic*. There is no difference between Trazorel and trazadone, aside from the cost. Wal-mart, Target, and many other stores offer common generic prescriptions for $4-5. When you are talking to your doctor, ask if there is an drug option that has an available generic. When you are talking to your pharmacist, ask if there is a generic alternative available.

Get the price match. The Cub Foods pharmacy near me matches the Target generic drug price, giving us $4 generics for the asking. This is often an unpublicized deal, so make sure you ask. If your pharmacy will not match nearby prices, consider going elsewhere.

See if there is a 90 day plan. Many insurance companies sponsor a 90 day prescription plan that gives you a 90 supply of drugs for the 60 costs as long as you are willing to accept the drugs by mail. For expensive prescriptions, this 33% discount can be a substantial savings.

Physician

Does your clinic offer online consultations with your doctor or nurses? Some clinics offer a chat or email option to talk to your doctor without requiring a visit that will add fees and copays to your expense sheet. Most clinics and hospitals have a free nurse line for basic questions, like “When is my baby‘s fever dangerous?” It’s a great chance to save some money. I know, from personal experience, that they won’t be shy if they feel you need to come in, but they generally won’t try to convince you to come in if aspirin will fix the problem.

Stay in-network. Check with your insurance company to make sure the doctor you want to see if in your network and therefore, available at the cheapest out-of-pocket price. If not, and you really want that doctor, ask your insurance company if they accept nominations for the network and ask your doctor if he’d be interested in being nominated.

Stay home for your cold. Don’t go to the doctor for every minor problem. The best remedy a doctor can give your for your cold will reduce it to a seven day malady. On the other hand, if you do nothing, it will go away in about a week. Why waste the money? This counts double for the emergency room and urgent care. Strep throat is not an emergency. Wait until morning and go to the clinic, paying the lower fees instead of the large ER costs. Make an appointment for a doctor visit, if possible. Urgent care is billed the same as a regular visit, but most insurance plans double or triple the copay for urgent care visits.

Cash Flow

A Health Savings Account(HSA) is a pre-tax account to save for qualifying medical expenses similar to a Flexible Savings Account(FSA). The main differences are that HSAs are only available for people with high-deductible insurance plans and do not have to be spent on medical expenses. Non-qualifying expenses move from pre-tax to post-tax, meaning you will be charged federal income tax for non-qualifying withdrawals. FSAs are “use it or lose it” plans. If you don’t use it, it will go away, usually at the end of the year. That makes December a great time to stock up on over-the-counter medicines and possibly replace your eyeglasses, as both of those are qualifying expenses. Find out if you have either option available. If you use either one, set aside a place to store every imaginable medical receipt, so you can be reimbursed. Make sure you understand the FSA-eligible expenses.

An Ounce of Prevention

Get routine checkups. The earlier you find a problem, the more options you have. This goes for everything from cancer screenings to blood tests. Get a physical every year and know what is happening with your body. We may be living in the future, but replacement parts are still hard to come by.

Maintain Your Health

It’s cheaper to be healthy. Eat right, exercise, quit smoking.

I enjoy a good meal. It’s one of my favorite things. I won’t cut rich foods out of my diet, so we reduced portions. Beyond the first few bites, the flavor isn’t nearly as enjoyable or even noticeable. There’s no more enjoyment for huge servings than small ones.

Get more exercise, even if it’s just a 2o minute walks twice a week parking on the far side of the parking lot, or taking the stairs instead of the elevator.

Vision

Go online. This one is worth a write-up all by itself. I have 6 pairs of prescription glasses–all varieties of frames and coatings–that have cost a grand total of about $150. There is no noticeable difference between my cheapies and the designer alternatives. While I work on the write-up, the best site to introduce you to the concept of online glasses is GlassyEyes. Reviews, coupons, and discount likes. They have step-by-step instructions on turning an intimidating idea into a simple and cheap solution to an expensive problem.

How do you save money on health care?

* There are no generics available on new drugs until the initial patent expires. This gives the pharmaceutical companies a change to recoup their research and development costs. Without this patent period, new private drug research would evaporate. Don’t hate the brand names, but don’t show undue loyalty.