- RT @ramseyshow: RT @E_C_S_T_E_R_I_: "Stupid has a gravitational pull." -D Ramsey as heard n NPR. I know many who have not escaped its orbit. #

- @BudgetsAreSexy KISS is playing the MINUTE state fair in August. in reply to BudgetsAreSexy #

- 3 year old is "reading" to her sister: Goldilocks, complete with the voices I use. #

- RT @marcandangel: 40 Useful Sites To Learn New Skills http://bit.ly/b1tseW #

- Babies bounce! https://liverealnow.net/hKmc #

- While trying to pay for dinner recently, I was asked if other businesses accepted my $2 bills. #

- Lol RT @zappos: Art. on front page of USA Today is titled "Twitter Power". I diligently read the first 140 characters. http://bit.ly/9csCIG #

- Sweet! I am the number 1 hit on Ask.com for "I hate birthday parties" #

- RT @FinEngr: Money Hackers Carnival #117 Wedding & Marriage Edition http://bit.ly/cTO4FU #

- Nobody, but nobody walks sexy wearing flipflops. #

- @MonroeOnABudget Sandals are ok. Flipflops ruin a good sway. 🙂 in reply to MonroeOnABudget #

- RT @untemplater: RT @zappos: "Do one thing every day that scares you." -Eleanor Roosevelt #

Birthday Parties are Evil

This is a post from my archives.

I hate birthday parties. Well, not all birthday parties. Not even most parties. Just the expensive-for-the-sake-of-expensive parties. The bar-raising parties. The status-boosting parties. I’m done.

My son is seven years older than my first daughter. In those seven years, with only one kid, we managed to spoil him regarding birthday parties. Every party was big and there were a lot of presents. That’s an expensive way to run a birthday and it is a lot of stress. We even moved the parties home, but still invited all of our friends and family. It was much too stressful.

A good friend used the pizza and game place, buying tokens for everyone at the party. That’s incredibly expensive. Even if I wanted to, I couldn’t afford that for three kids. There’s an element of keeping up with everyone around me, but I just can’t make myself care about that anymore. They aren’t paying my debt or cleaning my house. They don’t get a vote.

My plan this year was to have a sleepover for my son. He had five friends spend the night, playing games and watching movies. They giggled and squealed for eighteen hours, all for the cost of some take-and-bake pizzas and snacks. It was a hit for everyone involved. The other parents got a night off and all of the kids had a blast.

My girls are one and two. We’re done with parties for them, too. They got big parties for their first birthdays. Those are parties for the adults; the kids don’t care. In a few years–even a few months–they won’t remember the party. My older daughter’s birthday will be a trip to the apple orchard, followed by cake and ice cream. She’ll get presents. She’ll get “her day”. She’ll remember that her birthday is special, without costing a lot of money.

We want them to have fun. We want them all to feel special. We also want to manage their expectations and keep the parties from breaking the budget. So far this year, it is working.

How do you run a birthday party on a budget?

Budget Lesson, Part 4

Part 4 of the Budget Lesson series. Please see Part 1, Part 2, and Part 3 to catch up. The Google Doc of this example is here.

The final category in my budget is “Set-aside funds”. These are the categories that don’t have specific payout amounts and happen at irregular intervals. When my car is paid off, there will be a car fund added to the list, instead of a new car payment.

- Parties – We throw two parties each year; a Halloween party and a summer barbecue. We also have three children who have varying expectations and needs for their birthday parties.

- Gifts – I don’t buy presents for my friends, and the number of relatives I buy gifts for has decreased dramatically over the years. I do, however, buy birthday and Christmas presents for my wife and kids and I participate in some form of gift exchange with my brothers and their wives. Combined, we set aside about $100 per month for parties and presents.

- Pet Care – We have four cats and a dog. This is to cover cat litter and food the bunch. We have too many pets, but we can’t give them away. They are family. However, there is a moratorium on new animals for a few years. Two cats and a dog are our hard limit.

- Car Repair – Cars break. Tires wear out. This isn’t a surprise, and it certainly isn’t an emergency.

- Warranty Fund – We are building up our own “Warranty Fund“, to replace appliances when they break. I’d rather have the interest accruing than see this as a line-item fee on any of my bills.

- Medicine/Medical – Kids get sick and prescriptions need to be filled. We figure our monthly prescriptions plus one office visit per month, but the money accrues in this fund. On low months, we have more, so we can cover the visits during flu season.

- In The Hole – This isn’t actually a fund we set aside. If, for some reason, we go over budget one month, it gets entered here to immediately pay ourselves back for the over-spend. This month, this number is $170, which is how high we went over for Christmas. Since we have all of the “Set asides” and non-monthly bills stored in the same account, there was no actual debt, just this “paper” debt to ourselves. This serves the combined purposes of a mild punishment for overspending and a method to get back on track.

That is my entire budget laid out. As the series continues, I’ll be examining how I have lowered the bills, how I could lower them more, and how I’ve screwed them up.

Checking Account for Punk

Punk is 13. He’s a good kid. He’s bright, well-mannered, hooked on MineCrack.

We just opened his first checking account.

It started when a friend called. He works at a bank and owed a banker a favor, so he asked me to open a new checking account. I’m overbanked, so we decided to open an account for Punk. He wouldn’t even have to know.

After we filled out the paperwork, I started thinking about it.

He’s been money-conscious since he figured out basic math. We’d offer to buy a $5 toy and he’d scour the toy aisles looking for the best deals, weighing the pros and cons of all of his options.

When he wants to buy something now, he doesn’t come to me without a compelling argument why I should let him.

He gets himself to school in the morning, and almost always does his homework without prompting.

He’s a pretty responsible kid. Teenagers are–by definition–stupid, but I generally trust his judgment.

We decided to let him have access to the account, then promptly forgot about the whole thing.

Last night, he asked if he could buy some package for some MineCraft server. That handy reminder made me actually take the steps to activate his debit card and have “the talk”. Money, not sex.

I taught him how to use a checkbook register and told him that if the balance on the bank’s site ever disagrees with his register, I was taking the card away.

I explained the pain of overdraft fees.

I taught him a bit about credit card fraud and how to avoid it.

I handed him the packet of documents and told him he has to read them all. All of them. My roommate laughed at me over that requirement.

From there, he opened a Paypal account, attached his card to it, and has free rein.

It’s his money, he can make these decisions. It’s low stakes, so there’s no need to stick my nose into it unless he asks. Even if he totally messes up, it can’t hurt too bad at this point, and he’ll learn an important lesson when his next meal isn’t on the line.

Next, we’ll take him down to get a state ID, so he won’t have a problem using the card in a store.

Welcome to adult finances, Punk.

What do you think is the right age for a checking account?

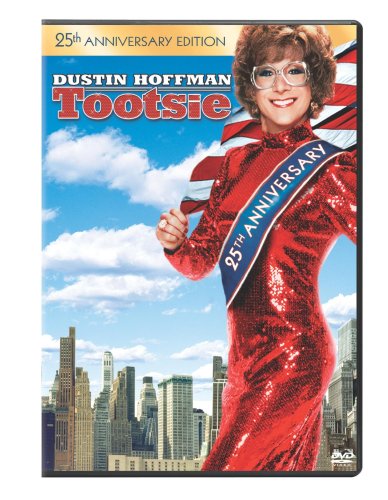

Tootsie – Does Beauty Have to be Expensive?

Many remember Dustin Hoffman dressed in drag in the classic film Tootsie, a movie that he now says made him realize how many women he’s missed out on meeting in life simply because he judged them by their looks. Every year women spend thousands of dollars on beauty products and cosmetics, hoping to increase their appearance and become attractive enough to the outside world. Although there are various degrees of beauty, it undoubtedly is usually determined by the amount of money spent to enhance features and upkeep the overall look.

The length of a woman’s hair often creates a more attractive look in the U.S., which is difficult to achieve with flat irons and curlers that create breakage and brittle hair from the heat. Women are now resorting to having hair extensions installed every three to five months to achieve beautiful hair that has a fuller texture and longer length, costing an average of $700. They can resort to shorter hair that saves a large amount of money, but they’re ultimately compromising a large part of their looks.

There’s a reason that celebrities appear more beautiful than the rest of the population, as their high school photos often show them to look like typical people. By spending thousands of dollars on personal trainers, stylists, and makeup artists, their appearance is immediately enhanced with the finest tools and products on the market. They are also able to have help with experts who have more knowledge on what creates the best look for their features.

Although beauty does not have to be expensive (just look at exotic women in Columbia and Brazil who are anything but high maintenance), it unfortunately is a requirement in the U.S. where rich housewives rule the reality shows and runways. True beauty is often defined by breast and waist sized, which few women can live up to, resulting in thousands of dollars spent on breast implants and liposuction, often impossible to attain otherwise.

Beauty may be in the eye of the beholder, but few men will argue that Angelina Jolie is unattractive or that Heidi Klum looks homely. The majority of men can agree when a woman is beautiful, and few women catch attention with a homemade manicure and dyed hair that came from a box. Perhaps going au natural will become a new trend in the coming years, but for now it’s expensive to be a woman, and even more costly to be a beautiful one.

Related articles

Net Worth Update

Now that my taxes are done and paid for, I thought it would be nice to update my net worth.

In January, I had:

Assets

- House: $252,900

- Cars: $20,789

- Checking accounts: $3,220

- Savings accounts: $6,254

- CDs: $1,105

- IRAs: $12,001

- Investment Accounts: $1,155

- Total: $297,424

Liabilities

- Mortgage: $29,982

- Credit card: $18,725

- Total: $48,707

Overall: $249,717.00

Here is my current status:

Assets

- House: $240,100 (-12,800) Estimated market value according to the county tax assessor. This will be going down in a few months when the estimates are finalized for the year. I don’t care much about this number. We’re not moving any time soon, so the lower the value, the lower the tax assessment.

- Cars: $15,857 (-4,932) Kelly Blue Book suggested retail value for both of our vehicles and my motorcycle.

- Checking accounts: $4,817 (+1,597) I have accounts spread across three banks. I don’t keep much operating cash here, so this fluctuates based on how far away my next paycheck is.

- Savings accounts: $6,418 (+164) I have savings accounts spread across a few banks. This does not include my kids’ accounts, even though they are in my name. This includes every savings goal I have at the moment. I swept a chunk of this into an IRA to lower my tax bill, which is also why my IRA balance is up as much as it is.

- CDs: $1,107 (+2) I consider this a part of my emergency fund.

- IRAs: $16,398 (+4,397) I have finally started to contribute automatically. It’s only $200 at the moment, but it’s something.

- Investment Accounts: $308 (-847) I pulled most of this out and threw it at a credit card.

- Total: $285,005 (-12,419)

Liabilities

- Mortgage: $28,162 (-1,820)

- Credit card: $16,038 (-2,687) This is the current target of my debt snowball. This has actually grown a bit over the last week. I did a balance transfer that cost $400, but it gives me 0% for a year, versus the 9% I was paying. That will pay for itself in 3 months, while simplifying my payments a bit and saving me almost a thousand dollars in payments this year.

- Total: $44,200 (-4,507)

Overall: $240,805 (-8,912)

Well, I lost some net worth over the last quarter, but it’s still a good report. If I disregard the change in value of my house and cars–two thing I have no control over–my overall total would have gone up almost $9,000.

All in all, it’s been a good year for me, so far, though paying off that credit card by fall is going to be a challenge.