- RT @bargainr: Life in North Korea is absolutely dreadful http://nyti.ms/dAcL26 #

- RT @bitfs: Weekly Favorites and Gratitude!: My Favorite Posts this Week Jeff at Deliver Away Debt threw together the .. http://bit.ly/9J0gGo #

- @LiveRealNow is giving away a copy of Delivering Happiness(@dhbook). Follow and RT to enter. http://bit.ly/czd31X # #

- Baseless claims, biased assumptions, poor understanding of history. Don't bother. #AnimalSpirits #KeynesianCult #

- RT @zappos: Super exciting! "Delivering Happiness" hit #1 on NY Times Bestseller list! Thanks everyone! Details: http://bit.ly/96vEfF #

- @ericabiz Funny, we found a kitten in a box last week. Unfortunately, it was abandoned there, not playing. Now, we have a 5th cat. in reply to ericabiz #

Saturday Roundup

- Image via Wikipedia

I’ve got a birthday party today and a class to teach tomorrow. Sometimes I think I take on too much, but it’s hard to roll that back when the side-hustles are all making a bit of money. What I need to do is make the side-hustles profitable enough that my straight job is optional.

In other news, I’m 10 days away from my first blogging anniversary(here). I’ll have to come up with a way to celebrate that.

Favorite posts this week:

GOOG-411 is shutting down, but there are alternatives. My favorites are Google SMS and Bing-411.

I’m a Zimbabwean quadrillionaire due to their version of “quantitative easing”. If you’re not pushing an agenda, QE is also known as devaluing the dollar.

I’m happy to be living in the future. When I told my wife this story, she was ready to cry at the beginning, but had to see the pictures by the end. Yay, technology!

And finally, thanks to Chris, here’s a primer on the absurdities of the security theater known as TSA:

Carnivals I’ve rocked:

Experiences v Stuff was included in the Carnival of Debt Reduction.

Thank you!

If I’ve missed anyone, please let me know.

Inadvertent BOGO

I refuse to buy my kid more expensive video game systems. He’s got a friend who’s got one of each, going back 15 years.

We don’t do that, so he’s spent the last 6 months saving to buy his own XBox 360. After his birthday this month, he finally had enough, so we ordered it a few days ago.

Wednesday was the Great Unboxing.

I was making dinner in the kitchen while the punk and his friend unpacked the box from Amazon.

The squeals were normal. The shouts of “Dad, why did you buy two XBoxes?” were a surprise.

Two?

No.

Actually, yes. There were two of the things in the box. Did I order two? Did I accidentally pay for two?

Nope. The packing slip only listed one, my order history only showed one, and my credit card was only charged for one.

Yet, there were two in the box. Free XBox! Woot!

That means an XBox in the bedroom for Grand Theft Auto and Red Dead Redemption, and an XBox in the basement for Madden and Star Wars. No fighting. No turns to take. And it didn’t cost us an extra $200.

That’s all win.

If there’s nothing on the packing slip, then Amazon didn’t know I had it. Even if they did, I didn’t do anything to make them send it. There was no fraud. Legally, I had no obligation of any kind to do anything other than enjoy my new prize.

Lots of win.

The kids were excited. Everyone gets a turn. Multiplayer games.

The parents were excited. We get a turn. M-rated games.

So much freaking win in that box.

But….

There’s always a but.

We didn’t order it. We didn’t pay for it. It wasn’t ours.

A friend told me to sell it. She knows how hard we’re working to pay off debt.

A coworker said, “Screw them. They’re just a big corporation who’d be happy to screw you first.”

But it wasn’t ours.

I spent 12 hours trying to rationalize a way to keep it that wouldn’t be unethical, make me feel guilty, or–most important–send a horrible message to my kids.

I couldn’t do it.

It wasn’t ours.

I had a talk with my son. It was his money that got this little prize into our house, after all. He wanted to keep it, naturally. He’s got a lot to learn about persuasion. He acknowledged that sending it back was the right thing to do. He agreed that it would suck if the roles were reversed. His only argument in favor of keeping it was “I want it.”

Even he admitted that was completely lame.

It’s going back. I let him think that was his decision.

I talked to Amazon. They apologized for the inconvenience and gave me a UPS label to send it back at no cost. It didn’t cover pickup, but I’ve got a drop box in my office building, so I can deal with that.

My wife was pissed. The customer service rep never bothered to say thank you. She called Amazon to complain to a manager. After reminding him that we had no duty to return the free XBox, he gave us a $25 gift card to say thank you.

I love my wife.

My son, for deciding to to the right thing, gets to spend the gift card. My wife, for being awesome, gets to be with me. I miss my free XBox.

What would you do? Would you keep the free XBox, sell it, or send it back?

Why I chose a prepaid credit card

This is a guest post.

You can’t get credit without a credit card, and you can’t get a credit card without good credit. This is a dilemma that many people find themselves facing, whether they are trying to re-establish their credit or build credit for the first time. In fact, this is the dilemma that I found myself in. My solution was to get a prepaid card, and here’s why.

The Real Deal with Prepaid

Prepaid credit cards have earned a mixed reputation over the years. While it’s true that they usually have more fees than a regular credit card, they also offer a financial solution for people who don’t have good credit. And you should also keep in mind that they don’t charge interest because the cash that you are using is yours to begin with. The important thing to remember about prepaid cards is that they are a means to an end; once you rebuild your credit, you’ll find it much easier to apply for a card with better rates and fewer fees.

In addition, prepaid cards offer several advantages. The most important one for me was the convenience of having a card that I could use to make purchases. Prepaid cards look and work exactly like regular credit cards (you don’t have to enter a personal identification number to use them), so the only one who knows it is prepaid is me. And while I use cash for everyday purchases, there’s no avoiding the need for a card when you have to shop online or pay for gasoline at the pump, for example. Most digital merchants only accept payments from cards linked to large financial brands like Mastercard and Visa, and my card gives me a way to buy what I need from whoever has it in stock. In addition, my prepaid card offers me a way to keep track of all of my purchases electronically, which is helpful since I am trying to keep a closer eye on my budget.

Prepaid cards also offer security. Cash can easily be lost or stolen, but if you lose a prepaid card, you can easily get a replacement. More importantly, your balance is protected by a replacement guarantee from your bank, which comes in handy if you ever have to dispute fraudulent charges.

Perhaps the most convenient factor of a prepaid card, though, is how easy it is to get one. You don’t have to have a bank account in your name to receive a prepaid card. However, if you do have an account, you can easily link it to your prepaid card.

Changing my spending habits and getting out of debt hasn’t been easy for me, but one way for me to show creditors that I am getting better at managing finances is to build my credit with my prepaid card. It’s also a way for me to eventually be able to make big purchases that are necessary, such as a car, and hopefully one day, a home. Prepaid isn’t for everyone, but if you find yourself considering this option, it’s worth a second look.

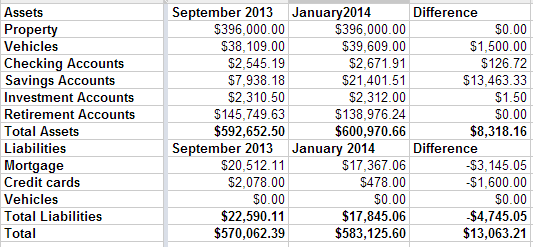

Net Worth Update – January 2014

This may be the most boring type of post I write, but it’s important to me to track my net worth so I can see my progress. We are sliding smoothly from debt payoff mode to wealth building mode.

Our highlights right now are nothing to speak of. We did let our credit card grow a little bit over the last couple of months, but paid it off completely at the end of December. It grew mostly as a matter of not paying attention while we were doing our holiday shopping and dealing with some car repairs.

That’s it. We haven’t remodeled our bathrooms yet, but we have the money sitting in a savings account, waiting for the contractor. We haven’t bought a pony yet, but we did decide that a hobby farm wouldn’t be the right move for us. We’ll be boarding the pony instead of moving, at least for the foreseeable future.

Our net worth is up $13,000 since September. Our savings are up and our retirement accounts are down because there are two inherited IRAs that we need to slowly cash out and convert to regular IRAs.

Twinkies: A Failure of Unionization

Twinkies may survive nuclear warfare, but the iconic sweet treat ultimately couldn’t withstand the might of the unionized workforce. Faced with mounting losses and overwhelming debt, due in no small part to the relentless demands of the various unions representing the nearly 19,000 employees, Hostess Brands filed bankruptcy for the second time in January 2012 and ultimately requested permission to liquidate it’s assets in November of last year when a buyer failed to materialize. While many factors played a part in the demise of the maker of such all-American snacks as Ding Dongs and Ring Dings, as well as childhood favorite Wonderbread, there is no denying the fact that costs imposed by union contracts were a major factor in the shuttering of this once-beloved company.

Certainly America’s changing eating habits, increased competition from such companies as McKee Foods, makers of Little Debbie snack cakes, and rising commodity costs all contributed to the ultimate demise of Twinkies. There is no doubt, though, that union contracts inhibited the company’s ability to adapt and make the necessary changes to remain profitable. Not only were employee costs out of control, ridiculous union rules made it nearly impossible for the company to make money. These are just a few of the rules that hampered Hostess’ management:

- Twinkies and Wonder Bread could not be delivered on the same truck.

- Drivers could only deliver one product, even if they did not have a load and a load of another product was waiting to go out.

- Drivers could only drive. They had to wait for loaders to fill their trucks.

- Likewise, loaders could only handle one product. Their contract prohibited a Twinkie loader from helping out if the Wonder Bread loaders were shorthanded.

Yes, management agreed to these terms, but often they were forced to do so in order to prevent a costly strike. In fact, it was a labor strike that lead to the decision to liquidate.

Unions are meant to protect workers from dangerous working conditions, overbearing management and unfair labor practices. Ensuring a living wage and decent benefits is another of their responsibilities. However, it is evident that in this case, the unions became as much an enemy of the Hostess employees as of the company’s management. As a result of their unwillingness to compromise and make wage and benefit concessions, almost 20,000 people no longer have a job that needs to be protected. In the end, the unions drove not only the company but themselves out of business.

Not to fear, however. Two private equity firms acquired Hostess’ assets last fall and are beginning to turn the company around. Production of Twinkies began again in June, and the gooey sponge cakes returned to store shelves on July 15. The workforce has been dramatically reduced and will not be unionized. In the end, probably the only winner in this battle is America’s sweet tooth.