- Dora the Explorer is singing about cocaine. Is that why my kids have so much energy? #

- RT @prosperousfool: Be the Friendly Financial “Stop” Sign http://bit.ly/67NZFH #

- RT @tferriss: Aldous Huxley’s ‘Brave New World’ in a one-page cartoon: http://su.pr/2PAuup #

- RT @BSimple: Shallow men believe in Luck, Strong men believe in cause and effect. Ralph Waldo Emerson #

- 5am finally pays off. 800 word post finished. Reading to the kids has been more consistent,too. Not req’ing bedtime, just reading daily. #

- Titty Mouse and Tatty Mouse: morbid story from my childhood. Still enthralling. #

- RT @MoneyCrashers: Money Crashers 2010 New Year Giveaway Bash – $7,400 in Cash and Amazing Prizes http://bt.io/DDPy #

- [Read more…] about Twitter Weekly Updates for 2010-01-16

Saving Money: The Warranty Fund

Last weekend, my DVD player died.

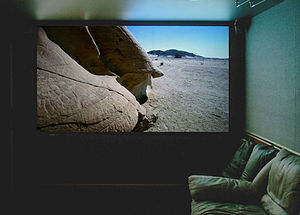

No big deal, right? We watch a lot of movies. We get a lot of enjoyment out of watching a lot of movies. Movies are fun for us. We’ve got a projector and a movie screen in our living room. Movies are our biggest pastime. Naturally, losing the movie machine hurts.

The thing that hurts the most is that this hasn’t been a good month for us, financially. My wife gets paid hourly, with semi-monthly paychecks. This means that, in a short month(like February!), her second paycheck is small by a few hundred dollars. When her company switched to that nonsensical plan, I watched for a few months, then set our budget to match the smallest paycheck she received. They haven’t been using this ridiculous plan for a full year, yet.

February caught me by surprise.

I know, it shouldn’t have. According to my research, there has been a February in every single year since well before I was born. I should have been expecting it. Oops.

So, to recap: our favorite pastime was dead and money was a little bit tight. There was no money to shake out of the budget to cover a new DVD player and there was no way we’d hit our emergency fund for something as frivolous—if enjoyable—as movies.

What to do?

About a year ago, I decided to start a warranty fund. There are things we can’t easily afford to replace, so we pay for warranties on some of them. For example, our cell phones have a repair plan, and that plan has saved us more than it has cost us. We have a repair plan for some of our appliances, and that, too, has saved more than it has cost us. My goal was to self-warranty my stuff. I wanted an account that had money that served no purpoase but to help me avoid paying for warranties.

I set up another ING Direct savings account and scheduled an automatic deposit. It’s only set to deposit $25 per month, but over a year, it was enough to replace our home theater system, with some left over. It is, quite simply, money to use when our stuff breaks.

With no warning, and no time to prepare, we still had enough money socked aside to handle one of life’s little surprises, without wrecking our plans.

How do you prepare to replace the things that are going to break?

3 Habits Every Soon-to-be-Successful Debtor Needs to Cultivate

Getting out of debt is primarily a matter of changing your habits. We’ve all heard people swear by skipping your morning cup of coffee to get rich, but that’s just a small habit. Much more important are the big habits, the lifestyle habits. Here are 5 habits to cultivate for financial success.

Frugality

“Beware of little expenses; a small leak will sink a great ship”– Benjamin Franklin

As Chris Farrel wrote in “The New Frugality“, being frugal is not about being cheap, but finding the best value for your money. When my wife and I had our second baby, we couldn’t justify spending $170 on a breast pump, so we bought the $30 model. It was quite a bit slower than the expensive model, and was only a “single action”, but for $140 of savings, it seemed worth the trade. Six weeks later, it burned out so we bought a new one, still afraid to justify $170 on quality. This thing took at least 45 minutes to do its job. When it burned out 6 weeks later, we decided to go with the high-end model. This beauty had dual pumps, “baby-mouth simulation” and it was fast. The time was cut from a minimum of 45 minutes to a maximum of 15. That’s 3 hours of life reclaimed each day fro $140. Six months of breastfeeding for each of two kids means my wife regained 45 days of her life in exchange for that small amount of money. At the rate of 6 weeks per burnout, we would have gone through 8 cheap pumps, costing $240. The high-end unit was still going strong when we weaned baby #3. Buying quality saved us both time and money. I wish we would have gone with the good one from the start. Sometimes, the expensive option is also the cheap option.

Maturity

- Image via Wikipedia

- Image via Wikipedia

“Maturity is achieved when a person postpones immediate pleasures for long-term values.” -Joshua Loth Liebman

Being a mature, rational adult is hard. It means accepting delayed gratification over the more enjoyable instant variety. We save for retirement instead of charging a vacation. It takes a lot of restraint to put off buying the latest toys, clothes, gadgets, cars or whatever else is currently turning your crank until you actually have the money to actually afford it. It means planning your future instead of looking like a surprised bunny caught in a spotlight every time your property taxes come due. (Who knew that the year changed every year? Do they really expect annual payments annually? Geez! There’s so much to learn!) It means thinking about your purchases and buying what you actually need, actually want, and will actually use instead of resorting to retail therapy whenever you feel like a sad panda. The only benefit to mature, rational management of your finances is that, given time, you will have the security of knowing that, no matter what happens, you will be okay. That’s a huge benefit.

Pleasure

[ad name=”inlineleft”]

“Do not bite at the bait of pleasure, till you know there is no hook beneath it.” – Thomas Jefferson

If it hurts, you won’t do it. You have to learn to take pleasure from from things that won’t make you broke and you have to learn not to hate putting off the things you can’t afford. Take pleasure in the little things. Enjoy the time with your family. Presence means so much more than presents. So many people never learn how to enjoy themselves. Take the time to experience life and enjoy doing it.

Update: This post has been included in the Carnival of Debt Reduction.

Why do you need a trailer?

As I mentioned before, we recently bought a Chevy Tahoe. When we bought it, we had a Ford F150 and a Dodge Caliber that we could have traded in, but decided to sell on our own, instead.

About a month ago, we sold the truck. If you’ve never owned a truck, you probably don’t realize how handy they are to have. From hauling brush to moving furniture to donating large amount of crap to Goodwill, we used our truck.

We’ve also been on a mission to replace all of our old crappy stuff with nicer things, without spending a ton to make that happen. We’ve been selling stuff on Craigslist, then taking that money to buy other stuff we’re finding good deals on.

We found a 4×8 utility trailer for $300. It came home with us. The first thing I heard was “Why do you need a trailer?”

Now, we could have made do with delivery fees or rental trucks, but that seemed silly to me.

- We recently replaced our living room couches. One of our cats had mistaken one of them for a litter box. No amount of enzyme cleaner gets that smell out of a couch cushion. Shortly after that, my fat a** popped two of the springs out of the bottom. Bad couch. We found a good deal on brand new replacements, but the delivery fee would have been $80.

- My wife found a beautiful entertainment center last week that matched the corner entertainment center we already have. We don’t need another entertainment center, but after convincing the seller to sell us the side units without the center unit, we have glass-doored bookshelves that exactly match the largest piece of furniture we own. Without the trailer, we would have had to rent a truck to get them home.

- Tomorrow, we’ll be taking the last load of stuff out of my mother-in-law’s house. Without the trailer, that would be several trips in the car.

We’ve had the thing for 3 weeks and it has almost paid for itself in time and money. I think that makes for a good investment. I don’t expect to buy a new living room set every month, but it’s nice to be able to deal with large things when the need arises.

Quit Smoking: My First Frugal Move…Ever

- Image via Wikipedia

It’s nearly the 5 year anniversary of my last cigarette, so I though I’d bring this post back to the front page.

A bit over three years ago, we found out that my wife was pregnant with baby #3. When we decided to have #2, it took us two years of trying. Naturally, we assumed we’d have the same issues with #3. Imagine our surprise when it only took 2 weeks. At that point, we were getting ready to celebrate brat #2’s first birthday.

That mean’s 2 kids under 2. Two kids in diapers. Three kids in daycare. Baby formula again.

We weren’t making ends meet with two kids, how were we going to manage three? I dropped my pack-or-two-a-day smoking habit.

But, I’ve gone over that before.

This post is about how I actually quit.

Some Facts About Me

I don’t do things by halves; I tend to do things all the way or not at all. For years, my wife would ask me to cut back, to just smoke a little less, but that never worked. If I had cigarettes, I smoked them. I always had cigarettes. When I eat, I eat. I’ve never managed smaller portions. I used to drink a case of soda each week, just because it was there. Moderation has never been my friend.

As a corollary, I don’t cheat. At anything. Ever. Because of the above fact about myself. I don’t moderate myself when I give myself rules either. If I draw a line, I obsessively avoid crossing it.

The problem comes when I try to give myself a “gray area” rule. “Smoke less” always leaves room for “just one more”, which easily leads to “I only cut out one cigarette yesterday, so what’s the use?” I had to be done.

After smoking for fifteen years–more than a pack a day for at least 12 of those–that’s an intimidating thought.

The Plan

The first thing I did was set a day to quit. I chose the day after my Halloween party. Before that would have been setting myself up for failure. Booze, food, and long conversations in a smoking-friendly environment were just 3 of my many triggers. I always smoked more at my parties, so the day after, I didn’t feel up to smoking much, anyway. I’d just ride that wave of “I don’t feel like it” to to holy city of “I quit”.

I didn’t quit smoking the next day, I just quit buying cigarettes. That left me half a pack to curb my cravings.

I also knew that nicotine cravings are about the most distracting thing I’ve ever had to deal with. That doesn’t make for a productive computer programmer, so I bought a box of the generic patch that Target carries. I started with Phase 2, because I wasn’t interested in prolonging the process. I just didn’t want to spend my work days thinking about smoking instead of designing software. I needed something to take the edge off, without actually smoking.

My plan was to have the patch at work, so I’d be able to work and to stretch those last 10 cigarettes out, as long as possible.

The Result

It worked. The pack lasted 4 days, I think. I smoked during my commute and after dinner. I used the patch only when the cravings got to the point that I couldn’t concentrate. After a week, I stopped using it at all. A few days later, I had a particularly stressful day and cheated. I took 3 puffs of that cigarette and threw it away, because it tasted like crap and I wasn’t enjoying it. That’s when I knew I was successfully done smoking. It was a 10 day variation of “cold turkey”. More than 3 years later, I have an occasional cigar, but never due to a craving. The day I experience a nicotine craving is the day I burn my humidor.

That’s how I quite smoking, strictly to try to get my finances in line. That has saved me at least $10,000 over the last 3 years.

Corporate Bankruptcy Hurts Employee’s Most

This is a guest post from Hunter Montgomery. He writes for Financially Consumed on every-day personal finance issues. He is married to a Navy meteorologist, proud father of 3, a mad cyclist, and recently graduated with a Master’s degree in Family Financial Planning. Read his blog at financiallyconsumed.com.

Bankruptcy has evolved from something that people and businesses were deeply ashamed of a few decades ago, to a seemingly acceptable path to restructuring; towards a more sustainable future. Bankruptcy is so common in corporate America that it is referred to by some as an acceptable and necessary business tool.

This bothers me on a number of levels, but mainly because corporate bankruptcies hurt the humble employee the most. The laws are supposedly designed to help the company stay in business, and continue to provide jobs. But at what cost to those employees?

When a company declares bankruptcy, they are essentially admitting to the world that they failed to compete. Their business model was flawed, they were poorly managed, and they simply did not organize their resources appropriately to meet their consumer needs.

Given this failure, it shocks me, that bankruptcy laws are designed to allow management to get together with their bankers. They essentially protect each other. Management is obsessed with holding on to power. The bankers are obsessed with avoiding a loss.

The bankruptcy produces a document called first-day-orders. This is a blueprint for guiding the organization towards future prosperity. But this is essentially drafted by the existing company management, and their bankers. Do you see any conflict of interest emerging here?

Bankers are given super-priority claims to the money they have loaned the company. Even before employee pension fund obligations. This is absurd. Surely if they loaned money to an enterprise that failed, they deserve to lose their money.

Management generally rewards itself with large bonuses, after declaring failure, paying off their bankers, shafting the employees, and finally re-emerging with a vastly smaller company. This is ridiculous.

The humble employee pays the highest price. Assuming there is even a job to return to after restructuring they have likely given up pay, working conditions, healthcare benefits, and pension benefits.

This is exactly what happened at United Airlines in 2002 after they filed for chapter 11 bankruptcy protections. The CEO received bonuses, and was entitled to the full retirement package. The banker’s enjoyed super-priority claims over company assets to cover their loans. Meanwhile, the employees lost wages, working conditions, healthcare benefits, and a 30% reduction in pension benefits.

An adjustment like this would force a serious re-evaluation of retirement plans. For most people, it would require additional years in the workforce before retirement could even be considered a real possibility.

Employees of General Motors, which recently went through bankruptcy proceedings, also had to give up significant healthcare benefits, and life insurance benefits. Entering bankruptcy, it was the objective to reduce retiree obligations by two-thirds. That’s a massive cut.

The warning to all of us here is that we must do everything possible not to fall victim to corporate restructuring. Save all you can, outside of your expected pension plan, because you never know when poor management, or a terrible economy, will force your employer to file bankruptcy. Always plan for the worst possible outcome.

It’s a competitive world and it’s quite possible that the traditional American system of benefits is uncompetitive, and unsustainable in the global market place. The tragedy of adjusting to a more sustainable system is that the employee suffers the most.