- RT @ScottATaylor: Get a Daily Summary of Your Friends’ Twitter Activity [FREE INVITES] http://bit.ly/4v9o7b #

- Woo! Class is over and the girls are making me cookies. Life is good. #

- RT @susantiner: RT @LenPenzo Tip of the Day: Never, under any circumstances, take a sleeping pill and a laxative on the same night. #

- RT @ScottATaylor: Some of the United States’ most surprising statistics http://ff.im/-cPzMD #

- RT @glassyeyes: 39DollarGlasses extends/EXPANDS disc. to $20/pair for the REST OF THE YEAR! http://is.gd/5lvmLThis is big news! Please RT! #

- @LenPenzo @SusanTiner I couldn’t help it. That kicked over the giggle box. in reply to LenPenzo #

- RT @copyblogger: You’ll never get there, because “there” keeps moving. Appreciate where you’re at, right now. #

- Why am I expected to answer the phone, strictly because it’s ringing? #

- RT: @WellHeeledBlog: Carnival of Personal Finance #235: Cinderella Edition http://bit.ly/7p4GNe #

- 10 Things to do on a Cheap Vacation. https://liverealnow.net/aOEW #

- RT this for chance to win $250 @WiseBread http://bit.ly/4t0sDu #

- [Read more…] about Twitter Weekly Updates for 2009-12-19

My Financial Life

My financial life right now is boooring.

And that’s a good thing.

When I started this site I was $90,000 in debt, and considering bankruptcy. I’d just started on the Dave Ramsey plan and was looking for every possible way to scrape up any extra money I could.

Now, the debt is nearly gone.

- I’m looking at the last $8000 on my mortgage. I have enough in savings to pay it off today, without draining my savings completely dry.

- My IRA gets maxed out every year, and this year, my wife’s will be, too.

- We save or invest about 30% of our income.

- My credit score according to CreditKarma.com is 826.

Our credit card is almost paid off every month. There’s occasionally some overlap between our auto-payment and our charges. And sometimes the budgeted auto-payment doesn’t match the reality of our spending and I don’t notice for a week or two. Except for the end of last year, but that’s a post for another day.

The short version is: We’re doing well, and we’re nearing the end of our financial problems.

Our scheduled mortgage over-payments will have it completely paid off in October. Then we are debt-free and can hopefully manage to live the rest of our lives without paying interest on money that isn’t earning us more than we are paying. For example, I’m willing to take out a mortgage to buy another rental property, but I’m going to wait to do that until our current mortgage is paid and we have a substantial down payment ready.

No debt.

I’m not kidding when I say it’s been a long 6 years of fighting our debt. Counting a car loan we got and paid early, we’ve paid more than $110,000 of debt in six years.

I’ve run side businesses, aggressively negotiated raises, and left companies(voluntarily and otherwise) for better pay & benefits.

I’ve watched friends and family take vacations around the world.

I’ve turned my kids down for so many things that I would love to buy them, but couldn’t because being financially secure is a much higher priority than spoiling children. Try explaining that to a 6 year old.

And now, the debt-ridden part of our financial journey is almost over. Finally.

So what’s next?

I have no idea. I’d like to travel more. Linda and the girls want us to move to a hobby farm and get horses. We want more rental properties.

Whatever “next” is, it will be done from a position of strength that won’t destroy our financial world or put out futures at risk.

Things to teach your kids about money

As parents, it is our job to teach our kids about a lot of things: driving, reading, manners, sex, ethics, and much, much more. How many of us spend the time and effort to teach our kids about money? A basic financial education would make money in early(and even late) adulthood easier to deal with. Unfortunately, money is considered taboo, even among the people we are closest to.

It’s time to shatter the taboo, at least at home. Our kids need a financial education at least as much as they need a sex education, and—properly done—both educations take place at home.

How do you know what to teach? One method is to look back at all of the things you’ve struggled with and make sure your kids know more than you did. If that won’t work, you can use this list.

- Balance a checkbook. This is the most basic of financial skills. The easiest way to teach this is to help him open a checking account and demand he keeps the register current and reconciled. Make him use a paper register. Quicken or an alternative may handle the work, but your kid will never learn the underlying principles if he doesn’t have to sit down with a pen and calculator to do the work. The cheat can come later, when he is capable of handling the task himself. It’s the same reason schools don’t let kids use calculators until the basics are thoroughly mastered.

- Calculate paid interest. Understanding how much something costs after accounting for interest should be enough to scare anyone away from credit cards. I believe that the reason it doesn’t is because most people don’t understand how to figure out what interest is costing them. In case you don’t know yourself, the math is simple: balance X interest rate(as a decimal) / 12. That will show you how much you are paying each month for the privilege of borrowing money.

- Use your money to make money, not to pay interest. The flip side of interest is earned interest. It’s always best to let your money work for you, building your wealth than to struggle to finance a bank’s payroll liabilities.

- Save 25%. My son is required to put a quarter of everything he earns in his bank account. He gets $20 for shoveling the neighbor’s driveway, so $5 goes in the bank. The money he gets for gifts is handled the same way. Everything he gets, whether it be from a gift, his allowance, or work he does—gets divided the same way. If I can establish that habit for him, and impress upon him the value of saving 25% enough that he continues into adulthood, he will never have money problems.

- Always contribute to retirement. At every opportunity, from every paycheck, make a contribution to retirement. At a minimum, a 401k contribution should be made at a level that takes full advantage of any company match. If there is no match, even $25 per paycheck will add up over time. Teach them to work towards the 401k contribution limits.

- Spend less than you earn. This is the shining, glorious foundational principle of successful finances. Not just individuals, but businesses and even governments should learn this lesson. If–at all times–you are spending less than you earn, you will have more options to handle the remaining bits. If you live on the wrong side of this equation, you will never be able to get ahead, no matter how hard you work.

Those are the lessons that I am working to instill in my children, a little at a time. Am I missing any?

Make Extra Money Part 2: Niche Selection

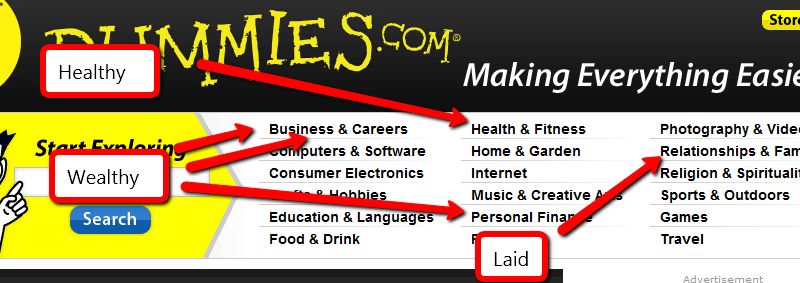

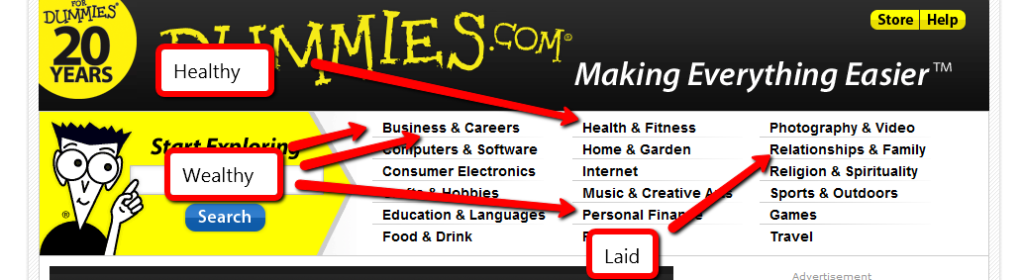

If you want to make money, help someone get healthy, wealthy or laid.

This section was quick.

Seriously, those three topics have been making people rich since the invention of rich. Knowing that isn’t enough. If you want to make some money in the health niche, are you going to help people lose weight, add muscle, relieve stress, or reduce the symptoms of some unpleasant medical condition? Those are called “sub-niches”. (Side question: Viagra is a sub-niche of which topic?)

Still not enough.

If you’re going to offer a product to help lose weight, does it revolve around diet, exercise, or both? For medical conditions, is it a way to soothe eczema, instructions for a diabetic diet, a cure for boils, or help with acne? Those are micro-niches.

That’s where you want to be. The “make money” niche is far too broad for anyone to effectively compete. The “make money online” sub-niche is still crazy. When you get to the “make money buying and selling websites” micro-niche, you’re in a territory that leaves room for competition, without costing thousands of dollars to get involved.

Remember that: The more narrowly you define your niche market, the easier it is to compete. You can take that too far. The “lose weight by eating nothing but onions, alfalfa, and imitation caramel sauce” micro-niche is probably too narrowly defined to have a market worth pursuing. You need a micro-niche with buyers, preferably a lot of them.

Now the hard part.

How do you find a niche with a lot of potential customers? Big companies pay millions of dollars every year to do that kind of market research.

Naturally, I recommend you spend millions of dollars on market research.

No?

Here’s the part where I make this entire series worth every penny you’ve paid. Times 10.

Steal the research.

My favorite source of niche market research to steal is http://www.dummies.com/. Click the link and notice all of the wonderful niches at the top of the page. Jon Wiley & Sons, Inc. spends millions of dollars to know what topics will be good sellers. They’ve been doing this a long time. Trust their work.

You don’t have to concentrate on the topics I’ve helpfully highlighted, but they will make it easier for you. Other niches can be profitable, too.

Golf is a great example. Golfers spend money to play the game. You don’t become a golfer without having some discretionary money to spend on it. I’d recommend against consumer electronics. There is a lot of competition for anything popular, and most of that is available for free. If you choose to promote some high-end gear using your Amazon affiliate link, you’re still only looking at a 3% commission.

I like to stick to topics that people “need” an answer for, and can find that answer in ebook form, since I will be promoting a specific product.

With that in mind, pick a topic, then click one of the links to the actual titles for sale. The “best selling titles” links are a gold mine. You can jump straight to the dummies store, if you’d like.

Of the topics above, here’s how I would narrow it down:

1. Business and Careers. The bestsellers here are Quickbooks and home buying. I’m not interested in either topic, so I’ll go into “More titles”. Here, the “urgent” niches look like job hunting and dealing with horrible coworkers. I’m also going to throw “writing copy” into the list because it’s something I have a hard time with.

2. Health and Fitness. My first thought was to do a site on diabetic cooking, but the cooking niche is too competitive. Childhood obesity, detox diets and back pain remedies strike me as worth pursuing. I’m leaning towards back pain, because I have a bad back. When you’ve thrown your back out, you’ve got nothing to do but lie on the couch and look for ways to make the pain stop. That’s urgency.

3. Personal Finance. The topics that look like good bets are foreclosures and bankruptcies. These are topics that can cost thousands of dollars if you get them wrong. I hate to promote a bankruptcy, but some people are out of choices. Foreclosure defense seems like a good choice. Losing your home comes with a sense of urgency, and helping people stay in their home makes me feel good.

4. Relationships and Family. Of these topics, divorce is probably a good seller. Dating advice definitely is. I’m not going to detail either one of those niches here. Divorce is depressing and sex, while fun, isn’t a topic I’m going to get into here. I try to be family friendly, most of the time. Weddings are great topic. Brides are planning to spend money and there’s no shortage of resources to promote.

So, the niches I’ve chosen are:

- Back pain

- Bankruptcy

- Conflict resolution at work

- Detox diets

- Fat kids

- Foreclosure avoidance

- Job hunting

- Weddings

- Writing copy

I won’t be building 9 niche sites in this series. From here, I’m going to explore effective keywords/search terms and good products to support. There’s no guarantee I’ll find a good product with an affiliate program for a niche I’ve chosen that has keywords that are both highly searched and low competition, so I’m giving myself alternatives.

For those of you following along at home, take some time to find 5-10 niches you’d be willing to promote.

The important things to consider are:

1. Does it make me feel dirty to promote it?

2. Will there be customers willing to spend money on it?

3. Will those customers have an urgent need to solve a problem?

I’ve built sites that ignore #3, and they don’t perform nearly as well as those that consider it. When I do niche sites, I promote a specific product. It’s pure affiliate marketing, so customers willing to spend money are necessarily my target audience.

Christmas Magic

When I was little, the world was amazing. The first snowfall was among the best days of the year. Everything was worth exploring, in hopes of discovering something new and fascinating, and everything was fascinating.

Stepping on a crack had serious implications. The wishbone in a turkey earned its name. Blowing out all of the candles on a birthday cake could change your life. The idea of some dude half a world away, watching you, then sneaking into your house to dish our rewards and punishments wasn’t pervy and sick, it was wonderful.

Then, one day, it all changes.

Somebody–a classmate, a older brother, a neighbor–let’s it slip that Santa isn’t real, and the implications snowball. That day, the magic dies.

Wishing on a star? Over.

The Easter Bunny? Hasenpfeffer.

Growing up to be Superman? Welcome to the rat race.

It’s a sad day when kids stop believing in magic.

I don’t believe in lying to my children, but I also don’t believe in destroying their magic. It’s a balancing act.

When my son was 6, an older boy at daycare tried to kill Santa for him. He was upset.

“Dad, is Santa real?”

“What do you think?”

“I don’t believe in Santa.”

“Okay, I’ll let him know.”

“Nonononononono! Don’t tell him!”

Was it lying? Probably, but he obviously wasn’t ready to stop believing, so I let him continue. A year later, we had the same conversation, but the results were quite different.

“Dad, you’ve always said that you hate lying, so why did you let me believe in Santa?”

So I told him the truth. Magic is a frail thing that’s nearly impossible to reclaim and I wanted him to have that treasure for as long as possible. And, “Now that you know, you are in on the conspiracy. You’ve been drafted. Don’t kill the magic for anyone else.”

It was weird having him help me stuff stockings.

If you’ve got kids(and celebrate Christmas), how do you handle the Santa problem?

Fixing Your Credit Report

Sometimes, negative things appear on your credit report. Usually, they do a good job of maintaining

Credit card (Photo credit: Wikipedia)accuracy, but mistakes do happen. The creditor or the reporting agency may screw up, or you may have your identity stolen. If either of these situations are true, you’ll want to correct your credit report, making yourself eligible for lower rates on future credit and, occasionally, lowering the cost of things like auto insurance.

If you throw “credit repair” into Google, you get 18 million hits. Most of those are either outright scams or hopelessly optimistic about what they can accomplish. As I said once before:

Credit Repair is almost always a scam. There are ways to get correct bad information removed from your credit report. If the information is correct, those methods are illegal. There are two legal methods to repair your credit. First, stop generating bad credit. Make your payments on time and eventually, the bad items will fall off. Second, write letters disputing the actual incorrect items on your credit report. There are no quick fixes, and anybody telling you different is flirting with a jail sentence, possibly yours.

There are ways to avoid the scammers.

- Avoid advance-fee credit repair. If they are any good, you will pay for results, not intentions. If they charge beforehand, they are already breaking the law.

- If they insist they can erase the accurate, but negative information, run away.

- If they tell you to dispute everything negative, even the accurate information, run away.

- If they tell you to create a new credit identity, don’t just run, report them. It’s a felony.

Legally, you cannot get valid information removed from your credit report. Anyone who tells you differently is advocating a crime. However, according to the Fair Credit Reporting Act (FCRA), you are entitled dispute incorrect records.

To verify the accuracy of your credit report, you need to see it. You can get a free report if your credit is used to deny you for something. This is known as an “adverse action” . You have 60 days from the denial to request the report. You can also get one free report from each of the major credit bureaus each year. I space out these requests so I see my credit report every 4 months.

If there is inaccurate information on your report, dispute it in writing. Send a letter to the credit bureau that is reporting the error. Explain the problem and politely demand an investigation. They will contact the creditor, who usually has 30 days to respond. In the meantime, send a dispute letter to the creditor, along with proof of the inaccuracy. If the investigation does not go your way, the creditor will have to report the dispute status to the credit bureaus in the future.

If the negative items are accurate, there is only one way to get it off of your report legally: Wait. Most negative information can only be reported for 7 years, while a bankruptcy will be reported for 10.

Another way to build your credit in the face of negative credit is to start building good credit to overshadow the bad. Get a credit card. Your first credit card from the bottom of the debt-barrel will probably be a gas card or a store-branded credit card. That’s fine. The main consideration is are low or nonexistent fees. Don’t accept application fees, activation fees, fees for carrying a balance or fees for not carrying a balance. Annual fees are becoming a fact of life, so look for low fees. The interest rate does not matter. You will be paying this card off immediately, meaning no less often that every two weeks. Make sure every penny is paid during the grace period, and make sure your card comes with a grace period. Some don’t. Those are bad cards to get.

There are no quick fixes for bad credit, just good new habits and time.